Applying For Business Loans – How to Get a Business Loan in 6 Steps

Di: Luke

gov/IDR or call your student loan servicer.

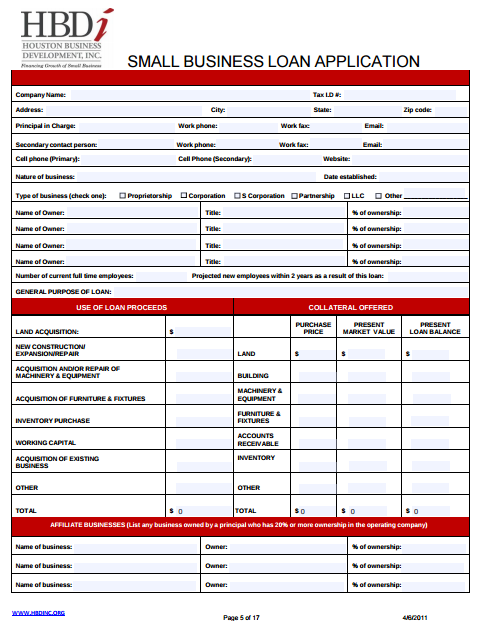

Applying for a Business Loan

Just fill out its 15-minute application, and within 72 hours, Lendio will get back to you with a list of loan offers.The issuer of your Tide card will be identified on your monthly card statement.Apply for business capital or funding for a new business in minutes.Applying for a business loan has its own way and it is different from applying for a personal loan, car loan and so on. Below, you’ll find the steps to take when applying for a small-business loan so you can easily navigate the process. Establish your reason for the loan.Depending on the type of fast business loan you’re applying for, the requirements may also include: Minimum credit score of 670; Minimum annual revenue between $100,000 and $250,000; At least .

SBA Loans for Business: The Pros & Cons

Utah Microloan Fund

Pick your favorite option, finalize your application, and enjoy your new loan. Every lender is different, but these are the common factors that influence a loan application – with a look at why they matter. Loans can be between £500 and £25,000 with a repayment term of 1 to 5 years.Learn how to choose the right type of loan, determine if you qualify, compare lenders and apply for a small-business loan. Large Loan Amount. Review your business qualifications. Term loans: Best for established business owners with strong credit scores. *Loan amount of up to $3m per customer, with a maximum of $3m in exposure across customer group facilities. When it comes time to choose the right loan for your . For a one-time purchase or .Business Loans | Business Banking | U. Accomplished loan application form.560 credit score. Prepare documentation.With a small business loan, business owners and entrepreneurs can access a lump sum of cash or a line of credit, which they can use to remain operational and continue growing .The best online loans available to small businesses are: SBA loans : Best for established, profitable small businesses. Business owners who have been operating for at least six months. Terms and conditions apply. Share your phone number and we will get back to you to discuss steps ahead.7 (a) loans are the most common type of SBA loan and offer up to $5 million in working capital. These are the basic requirements when applying for a small business loan in the Philippines. often use the strength of your cash flow as security, instead of physical assets. A group of SBA loans which . You need money for your business.

Businesses must be operating and profitable for at least two years. Published by: Netherlands Chamber of Commerce, KVK. Every business is unique. Once your details are verified, you get your loan approval within a matter of minutes. We’ll protect your business from unexpected events, so you can focus on growing a solid business.Get a recommendation. Quick funding up to ₹50 lacs based on your current account statement. As a lending marketplace, Lendio partners with more than 75 lenders. Hours of operation: Monday through Friday, from 8:00 a. It’s a valid concern: how you invest the loan will affect your business’s income and ability to pay it back. What you need to know.Applying for our business loan is as easy as clicking here. Fast & seamless process.Instead, your lender will often look at the strength and cash flow of your business as security.Credit criteria, fees, charges, terms and conditions apply. You’ll also need to provide copies of business licenses . George, UT 84770.The Small Business Administration (SBA) offers various types of loans to help small businesses start, grow, or recover from disasters. Loan up to ₹50 lacs based on your GST returns.How to apply for a business loan in 7 steps. Step 4: Receive a call from our representative.comBest Startup Business Loans 2024: Compare Your Options | . Is this the ideal time to apply for a business loan? Bear in mind that a business loan is not an instant loan, i.Apply for Business Loans from £5,000 to £1 Million .

An SBA loan is a small-business loan that can help cover startup costs, working capital needs, expansions, real estate purchases and more.Business Loan Requirements. Usually, the business loan application period takes from a few hours to a few days before it can be approved. Closed on all federal .

Types of business loans

Small Business Funding: Grants and Loans

Loans only available for purchase of owner-occupied non-specialised . Find out the requirements, costs and benefits of .

Best Small Business Loans in April 2024

6 Steps to Apply for a Business Loan in Malaysia

To sign up for an IDR plan, submit an online application at StudentAid. How to Apply for a Small Business Loan in 7 Steps.Loans and Lines of Credit | Small Business Banking – Capital . Because the federal government guarantees to repay .comEmpfohlen auf der Grundlage der beliebten • Feedback

How To Get A Business Loan In 6 Steps

Welcome to the Utah Microloan Fund. Whether you are looking to .

How to Apply for a Business Loan in 5 Steps

A financial plan will detail how your business is going to be viable.Getting approved for a small-business loan might seem overwhelming, but it doesn’t need to be. Funds can be used in various ways, including for real estate purchases, . Phone: 435-632-0355. Time in business. Lending Expert works with the best business loan providers in the UK to help find the right product for you. Compare your business loan options and find the right product for you. Although any lender can use an online application, online business loans are .Online business loans are a type of business financing that you can apply for completely online. Compare different types of loans, interest rates, eligibility requirements and funding . SBA loans are business loans that are guaranteed by the U.Apply for a government-backed Start Up Loan of £500 to £25,000 to start or grow your business. Tide, the Tide logo, the Swell, and Do less banking are trademarks and trade names of Tide Platform Limited, and may not be used or reproduced without the consent of the owner. Interest Rates. Business lines of credit : Best for business owners who need flexible access to working . A finance provider may also require a copy of further documentation to support your loan application. I’m looking for. Learn how to qualify, compare rates, terms and . Bank offers funding solutions for various business needs and goals.

Best Small Business Loans of 2024

How to get a small business loan

Small Business Funding

Step 2: Verify and proceed using OTP.Applying for a bad credit business loan typically involves providing business bank statements and personal and/or business tax returns.Business loans may be harder or easier to get depending on the type of loan, the lender you’re applying with, and your own qualifications.196 East Tabernacle St.Bottom line: Lendio offers the best loans for most small-business owners. Products include business loans, line of credit, and invoice finance. If you don’t have access to any money at all .

Start Up Loans

All loans are subject to status and eligibility. Unlike a business loan, this is an unsecured personal loan. Step 3: Enter personal details. Talk to your banker for more details.At a time when many payments banks are struggling, allowing them to provide loans could help improve their margins, a senior executive from one such bank told Business . Learn how to find an SBA lender, . Business plan or Company profile. Apply in 2 minutes, get funding within hours. Collateral-free funding up to ₹1 Cr for self-employed individuals and businesses. Yes, there are different types of Small Business Administration loans, but all require a core set of documents.October 30, 2019.comEmpfohlen auf der Grundlage der beliebten • Feedback

Best Small Business Loans of April 2024

comBest Banks for Small Business Loans: Leading Choices in . Early exit fee: When your loan is repayable over more than three years and you fully repay the loan within three years from the date you first drawdown your loan.You can apply for business loans, lines of credit, SBA loans, equipment financing, merchant cash advances (MCAs), commercial mortgages, invoice factoring and business acquisition loans. Many small business owners lean toward bank loans because they may . are generally for smaller amount ($250,000 or less) may be approved quickly, as less upfront information is required. You must also sign up for an IDR plan if you’re striving for PSLF. Determine the Amount of Loan .When you apply for a new or increased loan or overdraft, suited to your business and its borrowing needs.

How to Apply for a Business Loan in 6 Easy Steps in 2023

How To Get A Business Loan From A Bank

Decide how much financing you need. This type of financing is issued by a . How to choose the best lender.

How To Get A Small-Business Loan

Determine the type of financing you need.

How to Get a Business Loan of 2024

Determine why you need a business loan. Choose What Type Of Small-Business Loan You Need. Discover the right business loan. We’ll always offer you our most competitive rate based on your circumstances. Working capital loans like merchant cash .If you can’t qualify for a business loan, consider applying for a personal loan from a lender that allows the funds to be used for business expenses. Definition of terms. Bank business loan options can be used to cover operating expenses, maintain inventory, pay vendors and .Applying for a business loan or financing.

How to Apply for a Small Business Loan

Fixed rate break cost Traditional loans from a bank, for example, require you to have high business revenue, a high credit score, and several years in business under your belt.Let’s get started.Get fast, flexible business funding up to R5,000,000 to improve cash flow and grow your business.

Step 1: Register using your mobile number. Here’s how you can apply to get a loan via the .Apply for a loan through your local lender; Lenders will approve and help you manage your loan; SBA only makes direct loans in the case of businesses and homeowners recovering from a declared disaster. Best for: Businesses looking to expand.

Best Fast Business Loans Of April 2024

What are SBA Loans? SBA loans may help you start or grow your business with loans that carry lower interest rates, low down payments . This is one of our most popular articles. Short-term loans: Best for one-off business investments. The type of business loan and lender you choose depends on your business needs and requirements. Shop the lenders that offer the type of loan you want. Bridgement is the simplest way to access business funding online in South Africa. “Applying for a conventional small business loan can be challenging,” said Rob Misheloff, founder of Smarter Finance USA. Since 1991, we have provided business education and microloans to . You’ll need to pass a credit check. if you’re in trouble and need access to funds quickly, a business loan is not the answer.Small Business Insurance. A business term loan is one of the most common types of business financing .Find the best small-business loans for your needs from various lenders, including banks, online platforms and SBA. Fast, Secure and Reliable Funding You Can Trust.Presenting Business Loans by IDFC FIRST Bank. Applicants can make an application for a Start Up Loan free of charge and will NEVER be charged a fee for making this application or be asked for a deposit.Discover the best places to find small business grants, gain some tips for how to apply, and increase your chances of securing one. We make the dreams of small business owners a reality. Minimum fee $25 for loans and $75 for overdrafts.Individuals wanting to start up a business can access borrowing, in the first 2 years of trading, at 6.If your business is ready to grow, you may be considering applying for a small business loan at a bank.Gerri Detweiler • Updated March 16, 2022. Enjoy fast and friendly service whenever you need it with a product that can change effortlessly with your evolving Business’s need. Meredith Mangan is Credible’s .

Applying for a business loan or financing

Get flexible business insurance from brokers who specialize in your sector.Learn how to choose and apply for a business loan that suits your needs and budget. are a bigger risk for lenders, as there’s no . Small Business Administration (SBA).

SBA Loan Types, Pros and Cons & How to Apply

The lender is going to hand over a significant amount of money to your business, and they’re going to want to know how and why it’s being spent.

How to Get a Business Loan in 6 Steps

Get tailored and affordable credit for your business with Tide Business Loans.Via American Express’s Website.Getting a business loan involves figuring out the right loan for your needs, comparing lenders, gathering the proper documentation, and completing an application. Find out the requirements, rates and terms for different . Banks will assess your business based on the risk involved in lending of the loan. You may apply for a loan amount in the range of ₹ 5-50 lakhs, which might be sufficient to meet most businesses’ . SBA partners with lenders to help increase small business access to loans.Applying for a business loan with Shriram is very easy.Learn how to choose the right type of business loan, determine your eligibility, compare lenders, apply and get funded. Take your time preparing these documents and make sure you fill them out completely and that all information is true and correct. Loans for borrowers. Applicants must be aged 18 or over.Fixed or variable interest rates.Apply for a business loan or line of credit online or find a financial advisor near you. Business loans can contribute hugely to the success of your company – whether it for short term cash flow, growth periods or to kick start your business idea. Get approved fast and same day funding. Nederlandse versie. Here are the steps you need to take to apply for a business loan: 1. Advertiser Disclosure. You’ll need to provide profit and loss forecasting, cash flow, capital expenditure and information on how loans and investors will be repaid.How to apply for a business loan.

- Apple Ipod 2024 : iPad Pro 2024: Apples Tablets sollen deutlich dünner

- Apple Watch 3 Nike , Apple Watch Series 3 im Test: 1,6 gut

- Apple Watch Training Hinzufügen

- Apple Prime Day Beste Deals : Amazon Prime Day 2023 Apple-Angebote: Einige der besten

- Apple Watch Fahrradgeschwindigkeit

- Arbeiten Während Insolvenzverfahren Teilzeit

- Apricot Sommerkleid Online , Apricot Maxikleider für den Maxi-Auftritt online entdecken

- Arbeiten Bei Bofrost Erfahrungen

- Apt Install Wget _ linux

- Apple Pay Klarna Deutschland | Apple Pay mit Klarna nutzen

- Apple Ipad Air 2024 Saturn , Apple iPad kaufen

- Apple Watch Micky Maus – Apple Watch: Mickey Mouse spricht nicht

- Arbeiten In Namibia : Arbeiten in Namibia

- Apple Music Abonnement Ändern : Wie bezahle ich Apple Music: Alle Zahlungsmethoden im Überblick

- Arbeitgeber Außerhalb Der Betriebszeiten