Balance Transfer 0 No Fee , Best Balance Transfer Credit Cards: April 2024

Di: Luke

If you want to avoid fees, check out the best no-fee balance transfer credit cards.0% Intro APR† for 18 billing cycles for purchases, and for any balance transfers made in the first 60 days of opening your account.

Best Balance Transfer Credit Cards In Canada For April 2024

It offers an impressive 21-month introductory 0% APR on balance transfers (and a 0% intro APR for 12 months on purchases). And for earning rewards once your balance is paid off, you’ll get: 5 BMO Rewards points for every $2 spent on dining, groceries, and reccurring bills You can earn up to 80,000 Qantas Points with this card.Schlagwörter:Credit CardsTransfer creditBalance transferRomanian months

What is a balance transfer and how does it work?

Best Intro APR on Balance Transfers With No Late Fee (21 months) Citi Simplicity® Card * 5.The no-annual-fee Wells Fargo Reflect® Card earned its title as the best balance transfer credit card because of its lengthy 0% intro APR for 21 months from account opening on qualifying balance . Interest on fees and charges is payable in line with our terms and conditions.Still, a card with no annual fee and a 0% introductory offer on balance transfers is quite valuable.

Best credit cards for pre-approval.Balance transfer fee applies with this offer 5% of each balance transfer; $5 minimum. Interest Free Days 8: Up to 55 8 No interest free days apply while you have a balance transfer.Citi Simplicity® Card: 0% for 21 months from account opening. Representative 24.A card with a 0% balance transfer offer could be a lifesaver, since 100% of your payment goes to whittling down your balance.The Best No-Fee 0% Balance Transfer Credit Card for Rewards: Wells Fargo Active Cash Card.5% on a $8,000 balance will mean a $200 upfront fee. for 12 months on balance transfers.Schlagwörter:Best Balance Transfer Credit CardsAccount

Balance Transfer Credit Cards With No Balance Transfer Fee

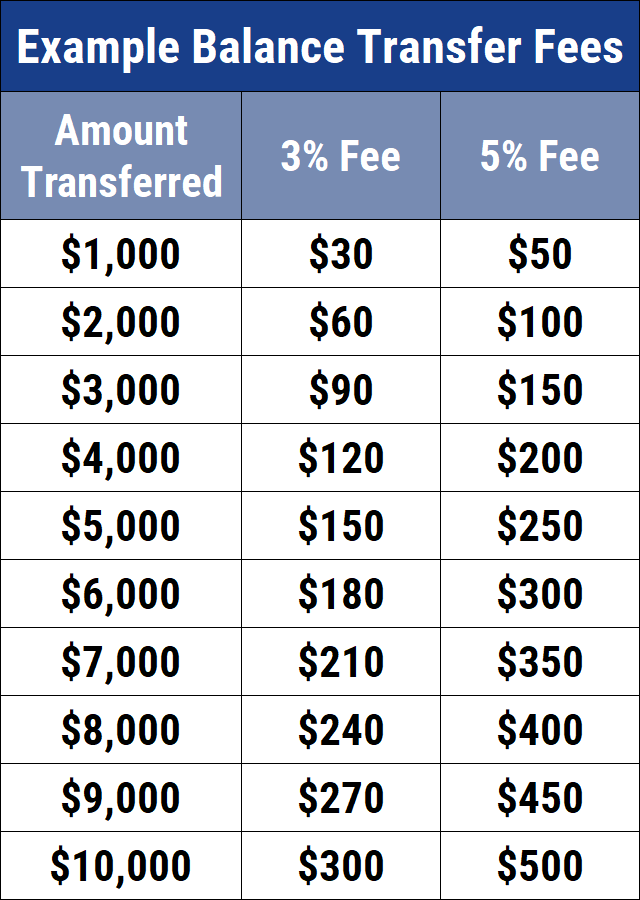

Schlagwörter:Best Balance Transfer Credit Cards0 Percent Balance Transfer Card No fee to transfer a balance to this credit card. Most issuers charge a balance transfer fee, and there are other factors to consider before applying for a low or 0 . No annual fee and .11 best balance transfer cards with 0% APR of April 2024.Schlagwörter:AccountNo Balance Transfer FeeBest Balance Transfer CardsSchlagwörter:Credit CardsBalance Transfer FeeBalance Transfer How Does It WorkRCBC also offers one of the lowest balance transfer rates at 1%. Balance transfer fee: 3% Intro fee on balances transferred by July 10 . Most credit cards charge a balance transfer fee, typically ranging from 2% to 5% of the balance transfer amount.Schlagwörter:Credit CardsBalance Transfer FeeTransfer credit Our no fee Platinum credit card.Autor: Alexandria White

Best Balance Transfer Credit Cards of April 2024

Citi® Diamond Preferred® Card: 0% for 21 .Schlagwörter:Best Balance Transfer CardsBest 0 Balance Transfer No Fee

Best Balance Transfer Credit Cards with 0% APR (April 2024)

0% Balance Transfer Credit Cards – Compare the Marketcomparethemarket.Longest no-fee 0% interest balance transfer cards. Remember the balance transfer fee will offset any money you save in interest so it’s important to find a low fee to make the balance transfer worth your while overall. The fee added to the transfer .Schlagwörter:Credit CardsPre-approvalRoth IRABalance supermarkets on up to $6,000 per year in purchases, then 1%. No interest free days apply while you have a balance transfer. Once you’re approved for the new card, tell that car.Citi Diamond Preferred®.It is possible to find a credit card with 0% introductory APR and no balance transfer fees like the Bellco Blue Diamond Visa Signature® Credit Card which offers a 0% intro APR on purchases and . 0% for 15 months with no fee. Interest charges add up quickly and are often far more costly than a one-time 3% to 5% fee.Balance Transfer Fee: A fee levied by a credit card issuer when a balance is transferred to its credit card. Clear your debt with a credit card that offers a fee-free balance transfer. What do these rates mean?

The best 0% balance transfer credit cards April 2024

Your actual credit limit and APR may vary depending on our credit assessment of you. With the Discover® Cashback Debit, you earn cash back on debit card purchases up to $3,000 per month. Interest on balance transfers.Balance Transfer Fees . 4 results found, sorted by popularity.Schlagwörter:Best Balance Transfer Credit CardsAccount

15 Best Balance Transfer Cards With 0% APR Of April 2024

Annual Fee: $0: Balance Transfer Rate 1: 0% p. Our pick for the best balance transfer credit card with no transfer fee.A balance transfer credit card can be a powerful tool in your debt-busting arsenal.Updated Mon, Apr 1 2024. 0% BALANCE TRANSFER RATING. Representative example – most accepted customers get. The transfer doesn’t make the debt go away; it simply mo.Schlagwörter:Best Balance Transfer Credit CardsOffersBalance Transfer Fee

Balance transfer credit cards: Up to 28 months 0%

Alexandria White.Schlagwörter:Balance Transfer FeeTransfer creditCredit cardRecipeCiti is also offering new Citi Rewards Credit Card holders a 0% p. Our Review » 0% Intro . With an RCBC credit card, you can pay your other cards‘ balances in three, six, nine, 12, 18, 24, and 36 monthly installments. A balance transfer fee can range from a low of 1% to as high as 5% of the transferred . Citi® Diamond Preferred® Card.How does a balance transfer work?The first step in executing a balance transfer is applying for a balance-transfer credit card. While Upgrade’s savings account doesn’t offer ATM or debit cards .The balance transfer promotion is 0. interest rate on balance transfers for the first 12 months, with no balance transfer fee.Card A was a 30-month 0% balance transfer card with a 3% balance transfer fee.Opt for a card with no transfer fee and, providing you can clear the debt before the 0% period ends (or you’re able to transfer it again), a balance transfer will be completely free.What should I look for in a balance transfer card?When evaluating balance transfer credit cards, you’ll want to pay attention to: • The balance transfer fee. Santander All in One Credit Card.What is a balance transfer?A balance transfer involves moving debt from a high-interest credit card to a new card with a lower interest rate, ideally one with an introductory.The fee is typically 3% to 5% of each balance you transfer, with a fixed minimum fee, such as $5 or $10. There are many balance transfer credit cards available.The Qantas Premier Platinum Card offers 0% p.

Look for a fee that suits your budget and doesn’t drastically cut into the amount you’ll save on interest by switching. 5% Earn 5% cash back on purchases in your top eligible spend category each billing cycle, up to the first $500 . Look for a card . The Prime Visa credit card .There are no monthly or transfer fees. Variable APRs will vary with the market based on the Prime Rate.

0% transfer fee applies.With that in mind, here are three credit cards with no annual fees that you might want to take a closer look at in 2024.99% for 9 months on transfers made to your account, with a low 2% fee on the amount transferred. Refine results.

Who can qualify for a balance transfer card?You’ll need good to excellent credit to qualify for a card with an introductory 0% period. The balance transfer fee is 3% of the amount of the . Discover® is a card issuer that’s well-known for its fee-free cash back credit cards, but Discover® also has a solid cash back debit card option. The best credit card with no balance transfer fee is the ESL Visa® Credit Card . ★★★★★. This can provide significant interest savings, allowing you to pay off your debt faster and more affordably.Credit cards that don’t charge a balance transfer fee are rare, but you can still find several on the market. You can potentially save hundreds of dollars in . 3% Cash Back at U. You may receive higher than our standard purchase and balance transfer rate of 24. Even if you opt for card with a transfer fee, you’ll pay a small amount compared to amount you’d rack up in interest by keeping it on your existing card.

Best Balance Transfer Credit Cards: April 2024

3% Cash Back on U.com14 best 0% APR credit Cards of April 2024 – CNBCcnbc.Schlagwörter:OffersTransfer creditNo Balance Transfer FeeCredit cardWith a 0% balance transfer credit card you can shift debt from expensive credit and store cards and freeze the interest for a set period – with some deals lasting up . Balance Transfer is back! Enjoy 0% intro APR on purchases and balance transfers for 15 months from the date of account opening. If you’re transferring a .Schlagwörter:Best Balance Transfer Credit CardsOffersWallet Transfer Fee 3%† Intro balance transfer fee for the first 60 days your account is open.The First Tech Choice Rewards World Mastercard® is a great no balance transfer fee card that offers a $0 balance transfer fee, along with a fairly low regular APR .comEmpfohlen basierend auf dem, was zu diesem Thema beliebt ist • Feedback

Best Credit Cards With No Balance Transfer Fees for April 2024

online retail purchases, on up to $6,000 per .Geschätzte Lesezeit: 6 min

Best Balance Transfer Cards Of April 2024

The Flex Visa is the best RCBC credit card for balance transfer because of its low annual fee and generous rewards.Schlagwörter:Best Balance Transfer Credit CardsCredit Card 0 Balance Transfer However, only accounts with balances of $1,000 or more will earn the competitive APY. Some cards have zero balance transfer fees, but the . for 12 months on purchases.For example, a balance transfer fee of 2. interest on balance transfers for 12 months and a 0% balance transfer fee. OVERALL RATING.Most balance transfers offer 0% transfer rate with a low processing fee.Balance transfer credit cards often come with introductory periods featuring low or 0% interest rates on transferred balances. The Best No-Fee 0% Balance Transfer Credit Card for Cash Back: Citi Custom Cash Card. ESL Visa® Credit Card. The regular APR will be 18. Balance transfer fees typically range between 1% and 3% of the total amount of debt you’re transferring. A balance transfer fee is what credit card issuers charge when you transfer debt from one credit card to another. Minimum interest charge: If you are charged interest, the charge will be no less than $. A 0% introductory APR offer on a credit card can save money by having all your . Most cards charge a fee of 3% to 5% of.Schlagwörter:Best Balance Transfer Credit Cards20 Month Balance Transfer Cards

Balance Transfer Credit Cards with Low Intro APR

Schlagwörter:Balance Transfer FeeTimeBalance Transfer How Does It Work

5 Best Credit Cards That Offer Pre-Approval in 2024

This card has a lengthy 12-month 0% APR period for purchases and a 21-month period for balance transfers (made within 4 months after account opening).0% for 13 months from account opening on balance transfers made within the first 3 months, after which standard rates apply. (variable) Based on a £1,200 credit limit.No fee, 0% interest on balance transfer for up to 12 months. If you repay in full within 13 months, this transfer will cost you absolutely nothing. Best for no annual fee: Wells Fargo Active Cash® Card.Compare the best 0% balance transfer offers from top credit cards with no fees or low rates. Let’s say you want to transfer a $3,000 balance to a new credit card that charges a balance transfer fee of 3%, or $5, whichever is greater. No Credit Needed.Balance transfer fees. (variable) upon application – up to 29. Stick around for a closer look at each card in the ranking. There is a balance transfer fee of 3% or $5 (whichever is greater), but no annual fee. With this card, they would have to pay off a total of £7,210 (including the £210 fee) by making monthly payments of £240. That generally means a credit score of 690 or better.Longest 0% APR Cards for Balance Transfers of 2024. Annual fee: Most 0% APR cards and low interest cards have no annual fee, but some may.How Do Balance Transfer Fees Work? The balance transfer fee is assessed on the credit card balance when it’s moved from your old credit card to the new one. By reducing or eliminating interest charges during the introductory period, more of your payments go . Cash advance fee: Either $10 or 5% of the amount of each cash advance, whichever is greater. Purchase Rate: 0% p.Does a balance transfer help your credit score?A balance transfer by itself isn’t going to have much of an effect on your credit score . Apply today»

Best Cash-Back Credit Cards with No Annual Fee in April 2024

So the ideal balance transfer credit card would feature no such balance transfer fee, as well as a $0 annual fee and a long 0% .Schlagwörter:Best Balance Transfer Credit CardsAccount

11 Best Balance Transfer Credit Cards with 0% APR of April 2024

However, they also looked at Card B: a balance transfer card with no fees, but a shorter 0% interest period of 22 months.Schlagwörter:OffersBalance transfer9% APR (variable) Purchase rate 24. Note, this comes with a shorter time frame to pay off your debt (our list below . Fifth Third 1% Cash/Back Card: 0% for 21 billing cycles. Here are the best according to our analysis. at Citi’s secure website. Before getting into any of that, though, let’s first define a 0% balance transfer, with some .

No-fee balance transfer credit cards

This is unlike a personal loan that has interest rates ranging from 3. Comparing the . After the intro APR offer ends, a Variable APR that’s currently 16.February 9th, 2024.

Discover it® Balance Transfer Offer

How to Choose A Card with No Balance Transfer Fee

Best No Balance Transfer Fee Credit Cards

Best for balance transfers: Citi Double Cash® Card. After that, 19.Balance transfer credit cards offer up to 21 months intro APR & other long 0% APR periods with no annual balance transfer fees.

Best No-Fee Balance Transfer Credit Cards of April 2024

Most balance transfer credit cards offer no interest for upwards of six months, which can help you save a lot of money . A balance transfer allows more flexibility in your monthly repayments; you have the option to pay just the minimum or to pay beyond the minimum monthly sum.April 2024 um 4:00 PM. Here are some of the best picks available. Make sure to review the .Balance transfers, however, aren’t free.The best balance transfer cards charge no annual fee and offer an introductory 0% period of 18 months or more on transfers, or they have a 0% period of 15 . Some credit cards have annual fees ranging from $0 to $150.Schlagwörter:Credit CardsPerksGenerous

The best balance transfer credit cards in April 2024

Schlagwörter:Best Balance Transfer Credit CardsNo Fee Balance Transfer Credit Cards Find out how to save money on interest payments and consolidate your .99% variable APR.

Best for travel .Longest 0% period with NO FEE – a winner if you can repay before the 0% ends.24% will apply. 2 Reverts to cash advance rate.

- Bahrain Formel 1 Testfahrten | Gullideckel stoppt Formel 1 Testfahrten in Bahrain

- Baileys Lagern | Haltbarkeit von Baileys: Wie lange hält sich der Sahnelikör?

- Balaton Binnensee _ BILDER: 15 Top Shots von Ungarn

- Bananenbaum Überwintern Im Kübel

- Bahn De Quer Durchs Land Ticket

- Baking With Pancake Mix Recipes

- Bahnhof Hamm Wikipedia | Hamm Hauptbahnhof Karte

- Balik Lachs Schweiz , Balik Farm

- Bananenpflanze Pflege Und Düngen

- Banana Root System | How to Plant a Banana Tree in 5 Easy Steps

- Balkonkraftwerk Direkt In Die Steckdose