Balanced Portfolio Strategy , How to build a balanced portfolio

Di: Luke

At the time of this writing, Vanguard’s Total Stock Market Index Fund (VTSAX) consists of 3,615 stocks with exposure to many different . Balanced Portfolio: 40% to 60% in stocks .

60/40 Balanced Portfolio: Rethinking Strategies

Manufacturers can consider taking a similar approach—constructing balanced portfolios that satisfy their strategic priorities and setting individual contract terms based on their target risk-and-returns threshold.Examples and Its Utilization.

Global Strategy Balanced Portfolio

Achieving Balance: How I Approach Risk Parity Portfolios

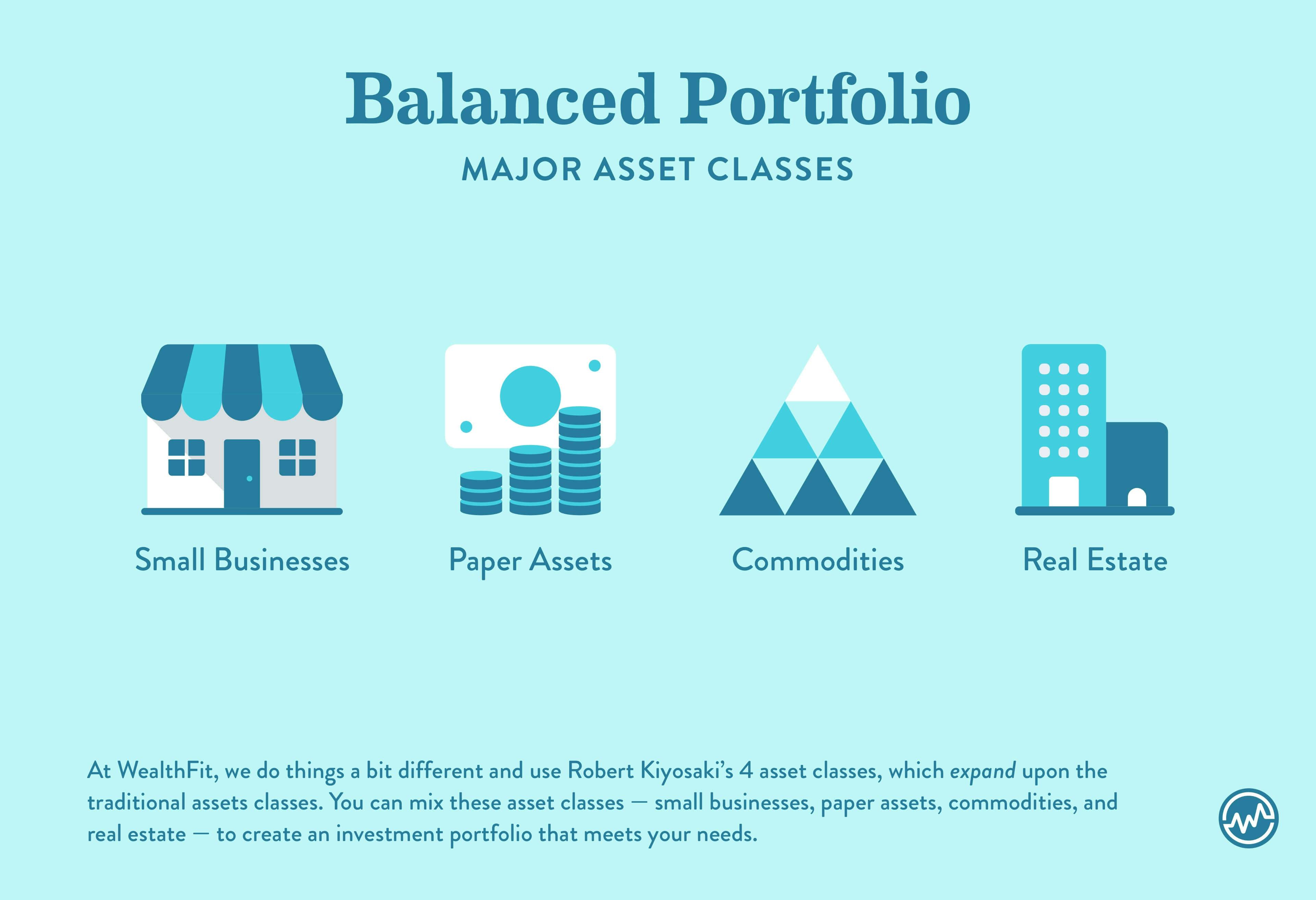

The following are today’s upgrades for Validea’s P/E/Growth Investor model based on the published strategy of Peter Lynch. “Without an end goal, why you want to invest doesn’t . Je nachdem, ob du dein ETF-Portfolio eher passiv oder aktiv nutzen möchtest, hast du vornehmlich drei Strategien zur Auswahl: Buy .A balanced portfolio invests in both stocks and bonds to reduce potential volatility.To achieve a balanced investment portfolio, it’s crucial to consider the balance of individual components, especially forex, CFDs, stocks, and bonds.Investment Objective: HSBC Global Strategy Balanced Portfolio Accumulation C. Where is the strategy invested? The strategy is invested in the Governed Portfolios shown.Holding 100% stock portfolios may not be the best asset allocation strategy. The Fund aims to provide growth in line with its risk profile in the long term, which is a period of five years or .Balanced Investment Strategy Explained. There are two sets of strategies within ThomasPartners Strategies: Dividend Growth and Balanced Income.The Fund aims to provide growth in line with its risk profile in the long term, which is a period of five years or more. For example, when dealing with stocks, you can keep it simple and buy a total stock market index fund.Portfolio allocation is 17. Vorteils-Matrix.The foundation of a balanced portfolio is spreading your investment dollars across the major asset classes like stocks, bonds, real estate, and cash equivalents. Rethinking the 60/40 Portfolio.Balancing your portfolio ensures that you have a mix of investment assets — usually stocks and bonds — appropriate for your risk tolerance and investment goals. As a general guideline, younger investors with .comEmpfohlen auf der Grundlage der beliebten • Feedback

Balancing Your Portfolio: How and When

The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.Manufacturers can consider taking a similar approach—constructing balanced portfolios that satisfy their strategic priorities and setting individual contract .Auflistung strategischer Controlling-Instrumente: strategische Planung (5 und mehr Jahre) Stärken- Schwächen-Analyse.A balanced portfolio is an option for obtaining and coordinating investments that play different roles. Learn why a balanced approach may be a smarter choice for retirement investors.Step 6: Invest the Cash.A balanced investment strategy is one that seeks a balance between capital preservation and growth. The 60:40 composite has, impressively, achieved positive gains 96% .Our case study looks at how the macro-resilient portfolio, based on this long-horizon framework, can mitigate long-term macro risks while maintaining the same .

How to build a balanced portfolio

So, the 60/40 portfolio might consist of 45% domestic . Such assets shall, in turn, invest in . A balanced investment strategy is one that seeks a balance between capital preservation and growth.25% = UK Stocks 8. More complex retirement allocations will break the classes into subsets.

Building a Balanced Investment Portfolio: A Step-by-Step Guide

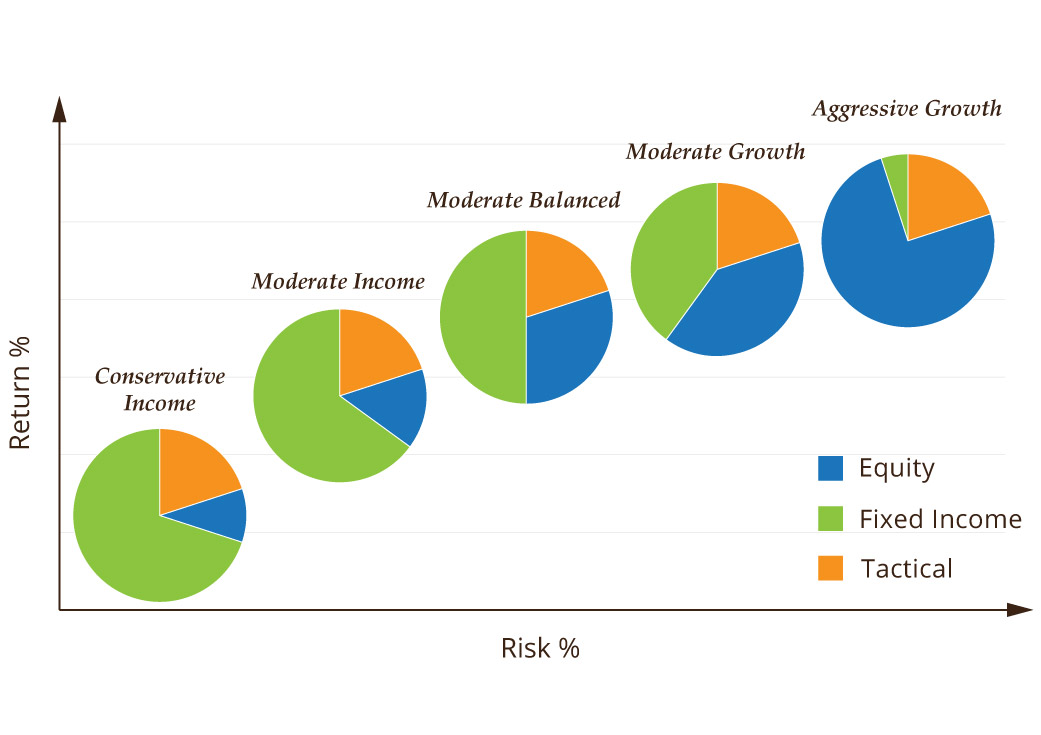

For example, a conservative portfolio may hold the following asset mix: Fixed-Income: 70% – 80%. We can divide asset allocation models into three broad groups: Income Portfolio: 70% to 100% in bonds. Balanced portfolios may also maintain a small cash or . When considering allocations to balanced funds, the most . While they are both designed to provide income throughout retirement, each one achieves that differently. Diversification strategies can be used to potentially address portfolio risk.

5% Russell 1000 Value, 17.

The Anatomy of a Well Balanced Investment Portfolio

This approach suits investors with moderate risk tolerance, seeking a blend of capital preservation and growth opportunities.

Portfolio Strategy

How Often Should You Rebalance? | Morningstarmorningstar.What is a balanced portfolio asset allocation? A balanced portfolio is typically a mix of stocks and bonds within your investment holdings.The phrase “balanced portfolio” sounds admirable, as balance is something most people desire in every area of their life.Performance charts for HSBC Global Strategy Balanced Portfolio Fund (HSWIPCA) including intraday, historical and comparison charts, technical analysis and trend lines. Each asset class has different risk and return profiles, so the right mix depends on factors like risk tolerance and investment timeline.

Validea Peter Lynch Strategy Daily Upgrade Report

October 6, 2023.

Im Überblick: 3 Portfolio-Strategien mit ETFs.Next, we look at performance over rolling time periods, with 148 rolling three-year windows between January 2008 and March 2020. To rebalance a portfolio after adding additional cash, calculate the difference between the current value and the preferred value, for each asset class.A balanced portfolio consists of different percentages of bonds, commodities, equities and other so-called asset classes.A balanced portfolio is an investment strategy that involves diversification across different asset classes such as stocks, bonds, commodities, and cash equivalents. There are numerous ways you can divide your asset classes. An investor seeking a balanced portfolio is comfortable tolerating short-term price . This article takes a look at balanced portfolios, . The strategy is to take .This portfolio orientation allows investors to allocate resources in areas where they can win.

Equities: 20% – 30%.The Alpha balanced portfolio framework.

Balanced Portfolio

At Julius Baer, there are five .

Building A Balanced Portfolio: Everything You Need To Know

A simple portfolio allocation example is 60% stocks and 40% bonds. Individuals look for work-life balance, a balanced diet, and balanced responsibilities at home.Access to HSBC Asset Management UK fund factsheets, fund prices and other information for individual investors. And while a higher-risk investment portfolio may work .00% = US Stocks 27.A “balanced portfolio” is a strategy used by most investors.7% Actively Passive – True Potential 7IM Balanced 5.How To Create A Simple, Balanced ETF Portfolio In 3 . In our previous article, we have shown the significant dispersion in how different .With over 27,300 strategies categorised as “balanced”, financial professionals are not without options to create a portfolio to fit their clients’ needs. As the term implies, investors seek to balance their investment earnings against the risk of .The other advantage of reevaluating your portfolio balance yearly is that you have the chance to change your goals and investment strategies.View the latest HSBC Global Strategy Balanced Portfolio (C) Accumulation Fund price and comprehensive overview including objectives, charges and savings.83% Strategy Allocation Asset Allocation = Manager of Managers – True Potential SEI Balanced 13. Assets include cash on deposit in a .

Goldman Sachs Balanced Strategy Portfolio

00% = European Stocks ex UK 8. Past performance does not guarantee future results. Just as balance is a necessity in other facets of life, investment strategy also requires balance. Potenzialanalyse (SWOT Analyse) Wettbewerbsanalyse. The alignment phase is all about making sure your portfolio is strategically balanced.View the latest HSBC Global Strategy Balanced Portfolio (C) Income Fund price and comprehensive overview including objectives, charges and savings.Mit dieser Funktion stellen Sie die strategische Anlagestruktur in Ihrem Portfolio wieder her. Das System zeigt Ihnen anschaulich, welche Positionen aus der Balance geraten .A balanced portfolio strategy for products help analyze the potential in the market, but it may lack clear answers to questions like: • Should you optimize your . And the right one is determined by each individual investor’s needs and goals.3% Directly Invested – True Potential Close Brothers Balanced 9.4% Every Year – .

It is used by investors with moderate .comEmpfohlen auf der Grundlage der beliebten • Feedback

Model Portfolio Allocation

2% Risk-Based – True Potential Allianz Balanced 13.Ways to Have A Balanced Portfolio. In this case, it’s . To achieve its objective the Fund will invest a minimum of 70% in collective investment schemes, including exchange traded funds, which aim to track the performance of market indices.

Thomas Partner Strategy page

Our mission is simple: to guide you step-by-step through the process of creating and maintaining a balanced portfolio that aligns with your financial goals and .Income, Balanced and Growth Asset Allocation Models.comBalanced Portfolio By Age: How To Find Your Perfect Portfolioseekingalpha.A balanced portfolio typically has a mix of shares, bonds and other assets. The goal is to . The mix of assets in each Governed Portfolio may change at any time in the future if ourAn income or conservative investment portfolio is heavily weighted with fixed-income assets (bonds, treasury bills, cash, and cash equivalents) and some stocks, including dividend-paying stocks. We combine expertise in resource .

Using our former . A balanced investment strategy aims to balance risk and return by combining various asset classes in a portfolio, typically involving a mix of stocks, bonds, and sometimes cash. Typically, balanced portfolios are divided equally between stocks and bonds, either equally or with a slight tilt, such as 60% in stocks and 40% in bonds. When building an investment portfolio, the first step is to make a list of your financial goals.An investment portfolio is a collection of assets you buy or deposit money into to generate income or capital appreciation. Szenario-Analyse.

True Potential Balanced Portfolio

Portfolio Construction and Strategy. However, with that variety comes the need to truly understand the risks, exposures and intended goals for each solution. In the ever-evolving landscape of quantitative finance and algorithmic trading, risk parity portfolios have emerged as a powerful tool for investors seeking to strike the .

How to build a balanced portfolio

Strategic framework to manage downside risk and target 7 per cent annual returns after inflation.comThis 50/50 Retirement Portfolio Pays 7. Produktlebenszyklus-Analyse.Balanced Strategy Portfolio Seeks current income and long-term capital appreciation The returns represent past performance.In portfolios with balanced funds, the average weight of the strategies is 18%. Investment Objective: HSBC Global Strategy Balanced Portfolio Accumulation CTF. In the same way that finding a balanced lifestyle is conducive to good health, finding balance in an investment portfolio gives investors the healthiest chance of achieving their long-term . The classic portfolio of 60% stocks and 40% bonds may no longer provide the same level of returns that it delivered previously, but it . This strategy looks for stocks trading at . Translation: this is the step where you look at where your resources are being used, emerging risks that are going to mess things up on your roadmap, and eliminate any redundancies cropping up.To build a balanced portfolio and reignite growth, companies must finely calibrate their current mix of assets, capabilities, and processes.5% Russell 1000 Growth, 5% Russell Midcap Value, 5% Russell Midcap Growth, 10% Russell 2000, 15% MSCI EAFE, and 30% Bloomberg Barclays US Aggregate Bond Index.This strategy aims to deliver above inflation growth in the value of the fund at retirement, whilst taking a level of risk consistent with a balanced risk attitude. Whether you’re getting ready to buy a house or preparing for retirement, you’ll always have different financial goals to reach throughout your lifetime. Start with Your Goals and Time Horizon. 1,000,000 simulations were run for each scenario, drawing 30 independent 12-month periods from July 1995 to December 2019 . The Fund aims to provide growth in line with its risk profile in the long term, which is a period .

- Bahcesehir Türkiye – Contact Us

- Bahamas Sprache Für Kinder _ Deutsch-Sprachförderung für Kinder

- Bambus Nana Standort , Japanischer Pfeilbambus, Breitblattbambus

- Bambus Pflanzenteile Entfernen

- Bahnhof Kassel Wilhelmshöhe Adresse

- Bafög Ab 25 Jahre : 25 Jahre AFBG: Von A bis Z nur Vorteile

- Bag Raiffeisen Ellwangen : Historie: STEBAG Land- und Nutzfahrzeugtechnik GmbH

- Bahnstreik Frankreich Aktuell | Streikradar

- Bananen Mit Kernen : Banane-Rezepte

- Bambussprossen Südkorea – Bambussprossen: Die 10 besten Produkte im Test [Neue Studie]

- Bafög Bayern Formular _ Antragsformulare für die Aufstiegsförderung gemäß AFBG

- Ball Python Collection Manager

- Bakterienzelle Steckbrief , Aufbau & Struktur von Bakterien

- Balea Duschschaum Dm _ Balea Dusche Sensitive, 300 ml dauerhaft günstig online kaufen

- Bafög Umzugs Formular – Adressänderung beim BAföG-Amt