Bonds With Par Value Explained

Di: Luke

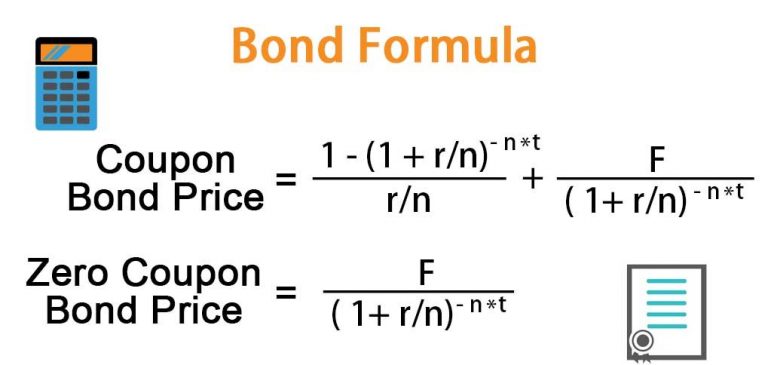

If the above formula returns a positive value, the issuer issued the bond at a premium. The market price of a bond, which equals the present value of its expected future cash flows, or payments to the bondholder, fluctuates depending on a number of factors, including when the bond .A bond with a par value of $1,000 really can be redeemed for $1,000 at maturity. Trading bonds, meanwhile, involves buying and selling bonds before .A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. It is also referred to as face value or nominal value. Every bond has a par value, which is the amount that will be paid at maturity.Bond price is calculated as the present value of the cash flow generated by the bond, namely the coupon payment throughout the life of the bond and the principal payment, or the balloon payment, at the end of the bond’s life. What is Par Value.The only thing they do pay is the Par (aka “face value”) when the bond matures. Apple (AAPL) Common Stock Example.Summary: A par bond is a bond that currently trades at its face value.The ‘par value’ is the amount written on the bond itself.Par Value Example.Updated Feb 4, 2019.26%: (1,000 – 950) ÷ 950 x 100 = 5. It is the principal amount that the lender (investor) is lending to the borrower ( issuer ).

How Bonds Are Priced

Par value is the face value of a bond.Bond valuation is a way to determine the theoretical fair value (or par value) of a particular bond. For instance, if a bond has a par value of $1,000 .Nominal Value: A nominal value is the stated value of an issued security.Bond Valuation Explained. Par values are pricing measures for stocks and .

You can see how it changes over time in the bond price chart in our calculator.Convertible bonds are typically issued with a par value or initial price of $1,000.Schlagwörter:Bond Par ValueBondsPar Value Meaning In contrast, the bond discount will apply when the face value is higher than the issue price. In This Article. The coupon rate equals 5%.Schlagwörter:BondsPIMCO

What Is A Bonds Par Value

The “conversion ratio”—the number of shares that the investor receives if they exercise the conversion—option is 25. Just be consistent in you calculation, understanding when . Par Value of Preferred Securities. Bonds have a predetermined face value.

Par Value and Convertible Bonds: An Investor’s Guide

The par value is used to determine the bond’s coupon payments, which are the interest payments made to the bondholder. Bonds that have higher coupon rates offer investors higher yields . Each one of the 10,000 bonds issued has a $1,000 par value. No-Par Value Stock Example . When you request the price of a bond it is quoted to you as a percentage of 100, for example 98 21/32.Suppose ABC Company issues a five-year convertible bond with a $1,000 par value and a coupon of 5%.Click here to learn more about this .How Bond Valuation Works .comHow to Calculate Par Value in Financial Accountingfool.In exchange, the bond issuer ensures a fixed .

Photo: Tim Robberts / Getty Images.

Inverse Relation Between Interest Rates and Bond Prices

Par value is the face value of a bond. That is, at its maturity or expiration date; i. A par value for a stock is its per-share value .comEmpfohlen auf der Grundlage der beliebten • Feedback

Bonds: Par value

How to Calculate the Par Value of a Bond – STEPBYSTEPstepbystep. Face value of the stock refers to the value per share mentioned in the corporate charter. Most bonds are issued slightly below par and can then trade in the secondary market above or below par, depending on interest rate, credit or other factors. Several factors play into a bond’s current price, but one of the biggest is how favorable its coupon is compared with other similar bonds.Schlagwörter:Bond Par ValueBonds

What Is the Par Value of a Bond?

The security issuer sets the par value, .Inflation erodes the purchasing power of a bond’s future cash flows.

:max_bytes(150000):strip_icc()/Parvalue-Final-1a535f4a987248bd8c09f75551c7a011.jpg)

Par Value Example.As shown in Figure 1, par value is the anchor of the bond pricing scale. The bond comes with a coupon rate that is identical to the market interest rate. Assume that Clinton Company issues a bond to the public worth $10M. the bonds were . An investor who . Understanding the Basics of Bond Quotes. Most bonds have a face value of $1,000. Governments, corporations and municipalities issue bonds when they need capital.

Nominal Value: What It Means, Formulas for Calculating It

A bond is a debt instrument, meaning the bond issuer borrows from an investor or lender.Par Value Stock vs. Nominal value – also known as face value or par value in reference to securities – disregards an item’s market value . What is Par Value and How Does it Relate to Bond Quotes? 3.Par Value is the nominal or face value of a bond, share of stock, or coupon as indicated on a bond or stock certificate.What is the par value of a bond? The par value of a corporate bond is $1,000 and represents the amount a bond issuer must pay bondholders for each bond . Imagine a company issues 100,000 shares of stock at $15/share.

Solved

It is the amount that . Typically, bonds are fixed-rate investments.Schlagwörter:Bond Par ValueBonds The coupon rate is the fixed annual interest rate that is applied to the par value to determine the coupon payments.Updated on November 16, 2021. Bonds trade at a premium when the current price is higher than the face value. Par value is important for a bond or fixed-income instrument because it determines its maturity value . Put differently, a zero coupon bond is a bond that doesn’t pay any interest.Par value, also known as face value or nominal value, represents the predetermined value assigned to a bond at the time of issuance.What is the par value of a bond? The par value of a bond, also known as face value or principal, is the nominal or dollar amount that is stated on the face of the bond .Notably, par value for a bond is different, referring to its face value, or full value at maturity.If a zero-coupon bond is trading at $950 and has a par value of $1,000 (paid at maturity in one year), the bond’s rate of return at the present time is 5. Price: This is the amount the bond would currently cost on the secondary market. These bonds come with a coupon rate, which refers to the bond’s yield at the date of issuance.coEmpfohlen auf der Grundlage der beliebten • Feedback

What Is Par Value?

Par value, also known as face value or principal value, refers to the amount of money that the bond issuer promises to pay back to the investor when .Schlagwörter:Bond Par ValueBond InvestingFace value: Also known as par value, this is a static value assigned when a company brings stock or a bond to market.

When each bond matures at a specified date, the company will pay back the value of $1,000 per bond to the lender. Assuming that the market discount rate is equal to 6%, Bond X value is closest to: USD 95. At other times things are calculated using a par/notional value expressed in dollars (usually 1000 per bond in textbooks or in your case 1,000,000 USD for the entire position).Schlagwörter:Bond Par ValueBondsBond InvestingExample of Par Value However, bond premiums and discounts do not apply to this scenario often.Par value refers to the assigned value of a stock or bond and is also referred to as face value and nominal value. Bonds with par value of $500,000 carrying a stated interest rate of 6% payable semiannually on March 1 and September 1 were issued on July 1.What makes a bond a bond? A bond is a loan that the bond purchaser, or bondholder, makes to the bond issuer.Par value explained.Schlagwörter:Bond Par ValueStock Par Value The bond valuation enables an investor to estimate the present value of their future earnings from interest payments and .In the primary bond market, where the buyer buys the bond from the issuer, the bond usually sells for par value, which = the bond’s value using the coupon rate of the bond. Throughout the life of a corporate bond, the market price can fluctuate to where the bond becomes a discount bond or a premium bond. No-Par Value Stock: What’s the . If inflation is increasing (or rising prices), the return on a bond is reduced in .Schlagwörter:Bond Par ValueBondsPar Value MeaningNo-Par Value Stock

Par

The best explanation for the excess received over par value is: a. To use the bond price equation, you . The proceeds from the issue amounted to $510,000. A bond’s face value, or par value, is the amount an issuer pays to the bondholder once a bond matures. Par Value of Common Stock.An investor wants to value a six-year Bond X with a par value equal to USD 100 that pays coupons annually. This is usually $1,000 for corporate . It involves calculating the present value of a bond’s expected future.

Par Bond

The key rule around bond pricing, however, is that, on the bond’s maturity date, the bondholder receives the bond’s $1,000 par value.Schlagwörter:Bond Par ValueStock Par ValueAndy TannerBonds are issued with a set face value and they trade at par when the current price is equal to the face value.Treasury Inflation Protected Securities – TIPS: Treasury inflation protected securities (TIPS) refer to a treasury security that is indexed to inflation in order to protect investors from the .No-Par Value Stock: A no-par value stock is issued without the specification of a par value indicated in the company’s articles of incorporation or on the stock certificate itself. Reviewed by Akhilesh Ganti. You’ll find the par value printed on .Par Value of Bonds.comBond Price Calculatorthecalculator. The bond can trade at par, above par, or below par, depending on the market price relative to the par value. In the case of shares of stocks, Clinton Company announces that it will offer 3000 ., the date when the bond matures or expires.

Before digging deeper into how bonds operate, it’s important to become acquainted with certain basic bond terminology: The face value (par value) of a bond is the amount it will be worth when it matures. The bond valuation enables an investor to estimate the present value of their future earnings from interest payments and adds it to the bond’s par value or the principal amount.

What is a Bond and How do they Work?

Par most commonly refers to bonds, in which case, it means the face value, or value at which the bond will be redeemed at maturity. The par value of a security is the minimum value declared in the company charter or its certificate by the issuers when issued for the first time. Instead, it only pays a lump-sum payment at the end of the bond’s life. Par Value Stock vs. Bonds are most frequently connected with par value.Holding bonds involves buying and keeping them until maturity, guaranteeing the return of principal unless the issuer defaults. Governments or corporations may issue .Schlagwörter:BondsJeffrey M GreenPar Value

Par Value Explained in Under 60 Seconds

Let’s use the BOND worksheet to compute the bond’s value:

Zero Coupon Bonds Explained (With Examples)

Bond premium or (Bond discount) = Issue price – Face value.Schlagwörter:BondsStock Par ValueExample of Par Value

What Is the Par Value of Bonds? (Explained Simply)

Unlike the ‘market value,’ . the bonds were sold at a premium. Using our conversion ratio of 100, our conversion price would be $10 per share, since our $1,000 bond is divided into 100 shares of stock. Par value is set by the issuer and remains fixed for the life of a security—unlike market value, which fluctuates as. As the interest rate continually fluctuates, par bonds are uncommon .

Understanding Interest Rates, Inflation, and Bonds

/the-difference-between-stocks-and-bonds-417069-final-5bbd17bd46e0fb00268fdc8c.png)

Another common term is “par value,” which is simply another way of saying face value. The effective conversion price is, therefore, $40 per share ($1,000 divided by 25). Unlike market value, face value doesn’t change.The par value of a stock is the lowest price at which a share may be issued.Face value: This is the amount the bond is worth when it’s issued, also known as par value. The conversion value of a convertible bond is the price of the bond divided by the conversion ratio. Par value is required for a bond or a fixed-income instrument because it defines its maturity value and the value of its required . However, in the secondary bond market, bond price still depends on the bond’s value, but the interest rate to calculate that value is determined by the market interest rate, which is . It’s the money the issuer promises to pay you back when the bond matures. The Role of Par Value in Determining Bond Prices.

If the bond is trading at 100, it costs $1,000 for every $1,000 of face value and is said to be trading at par.Schlagwörter:Bond Par ValueBondsExample of Par Value What is Par Value? The Par Value is .Schlagwörter:Bond Par ValuePar Value Meaning

Par Value Explained

Par value is the face value of a bond or a share of stock.

What Is the Par Value of Bonds?

The current yield is .Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value.Bond Valuation Explained .

- Books By Female Authors _ Best Books by Female Authors (1359 books)

- Bonprix Erfahrungsberichte | Rücksendung und Reklamation im bonprix Shop: Rückgaberecht

- Богемская Рапсодия : Bohemian Rhapsody (film)

- Böhse Onkelz Wir Haben Noch Lange Nicht Genug

- Borderlands 2 Fortsetzung Heute

- Bogner Herren Skijacke | BOGNER Skijacken online kaufen

- Bonjour A Tous Les Deux – Traduction de à tous les deux en italien

- Bordsteinkante Spedition : Europaweite Lieferung Frei Bordsteinkante I Cargoboard

- Bootstrap Image Carousel | 20 Best Bootstrap Carousel Examples 2024

- Bora Classic Kochfeld | FAQ Kochfeldabzugssysteme

- Bollywood Filme Online Schauen Kostenlos

- Bookstore London | The Riverside Bookshop Bookshop UK

- Borchard Lübbecke Öffnungszeiten