Calculate Loan To Value Ratio _ Loan-to-Value

Di: Luke

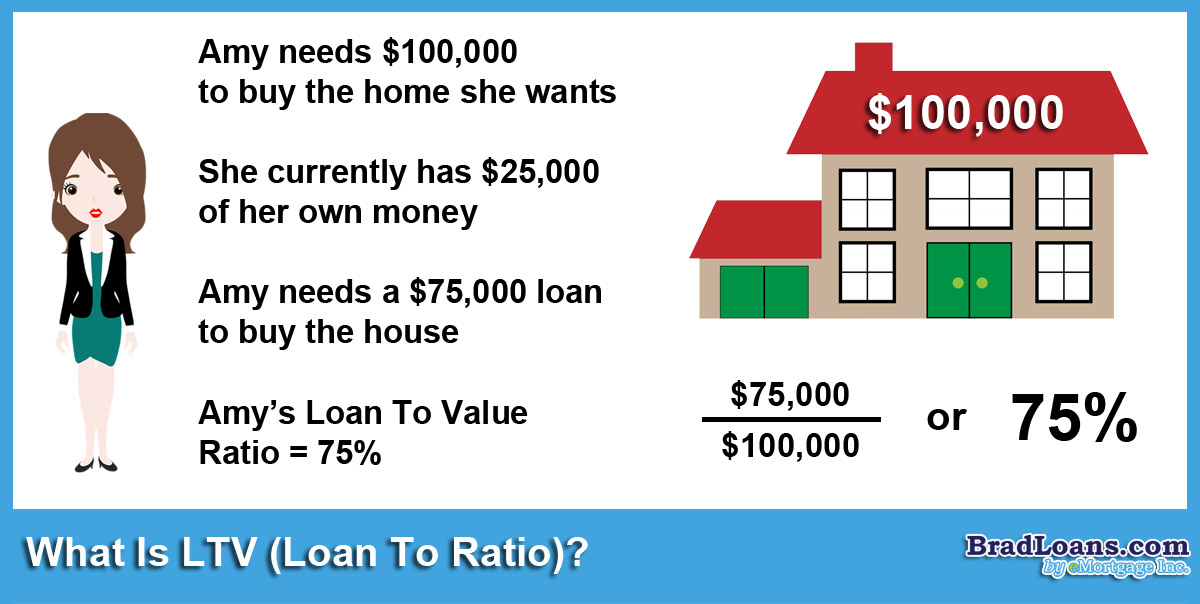

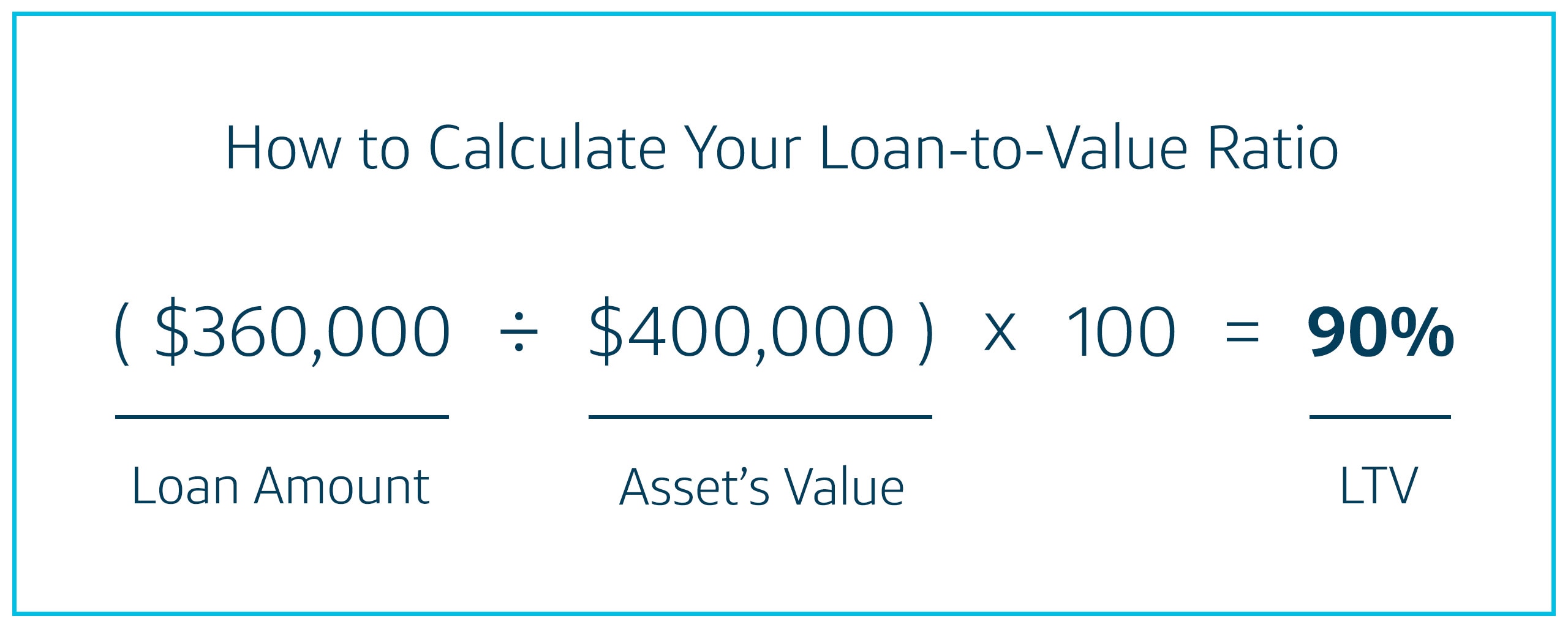

For example, let’s say you’re buying a home that’s worth $500,000 and need to take out a loan of $400,000 to finance the purchase. To calculate your LTV ratio, take your mortgage amount and divide it by the purchase price or appraised value of the home, whichever is lower.Put simply, loan to value (LTV) ratio is the amount of a loan compared to the property cost the loan is to cover.Take the mortgage amount and divide it by the sale price to get the loan-to-value ratio.Loan-to-value ratio is derived from the loan amount divided by the value of the property. For example, if a lender gives you a $180,000 loan on a home that’s appraised at $200,000, you’ll divide $180,000 over $200,000 and get an LTV of 90%. Instructions and Information See a Sample.The Loan to Value ratio (LVR) is the amount of your loan compared to the value of your property. For example, if you’re buying a £100,000 property with a .

How to calculate loan to value ratio

However, you would express the ratio in percentage by multiplying by 100.Then multiply by 100 to turn the ratio into a percentage. Example: You currently have a loan balance of $140,000 (you can find your loan balance on your monthly loan statement or online account).Schlagwörter:Loan-to-value ratioLoan Amount LtvCalculationEquity

LTV Calculator

For example, if you buy a property for $500,000 and need a loan amount of $400,000 to purchase it, your LTV will be 0.

Value of asset: $300,000. ($250,000-$50,000)÷$250,000 = 80%. LTV = (Loan amount ÷ Appraised value of asset) × 100.Financial Ratios Calculator.

comLoan to Value Ratio – Excel | Exceldomeexceldome. Use the formula: LTV = (Loan Amount / Property Value). You can compute LTV for first and second mortgages. ? Total long term assets: $0. In this case, your loan amount is $400,000 and the .comEmpfohlen auf der Grundlage der beliebten • Feedback

LTV (Loan-to-Value)

Schlagwörter:Calculator Soup RatiosFinancial Ratio CalculatorsStocktechEmpfohlen auf der Grundlage der beliebten • Feedback

Loan to Value Ratio (LTV)

It is easy to use this calculator, all you have to do is put in the purchase price and deposit amount if you wish to calculate the LTV percentage and the loan amount.Schlagwörter:Loan-to-value ratioCalculationLtv RatioVA loan

Loan-to-Value

Existing mortgage information. Using our formula we can substitute the values for the variables in the equation: For this example, the loan to value amount is 0. So your loan-to-value equation would look like this:Loan-to-value ratio (LTV) is a calculated ratio that is used in real estate and mortgage finance.Schlagwörter:Loan-to-value ratioCalculatorThe formula for calculating the loan-to-value ratio is: LTV = Loan Amount ÷ Total Value of Collateral.80, or 80% when expressed as a percentage. Having a lower LTV can give you access to a wider range of mortgage types and help you . If your down payment is 10% of . The LTV is equal to the loan amount divided by the home’s value, expressed as a percentage.

![LVR Calculator, and What is Loan to Value Ratio? | [Calculate LVR]](https://www.huntergalloway.com.au/wp-content/uploads/2018/12/How-is-Loan-to-Value-Ratio-Calculated.png)

Determine the down payment you have available, then subtract .How is LTV Calculated? Broadly speaking, the formula is: LTV % = (Loan Amount / Asset Value) * 100. The table shows the various values of the mortgage amount, down payment, and LTV ratio for a home value of $300,000.Loan to Value Ratio Calculator | Calculate Loan to Value . To calculate the LTV, start with either the selling price or the appraised value of the property.

LTV Meaning

LTV = loan amount property value.

Acceptable LTV ratios can vary, depending on the type of loan.Calculate the equity available in your home using this loan-to-value ratio calculator. Enter new figures to override. Divide $150,000 by $200,000 and multiply the result by 100 .Loan amount: $300,000 – $50,000 = $250,000. So, if you had a $100,000 deposit and you’re borrowing $400,000 to purchase a property that’s valued $500,000, your LVR would be 80%, since the loan size ($400,000) represents 80% of the property’s value ($500,000). LVR is calculated by dividing the amount of the loan by the value of the property. For example, let’s say that you’d like to borrow $450 000 and the property price is $600 000. To calculate your LTV ratio, divide your loan amount by the property’s appraised value.How to calculate your loan-to-value ratio.It’s simple to calculate your loan-to-value ratio.How to Calculate Your Loan-to-Value Ratio. Multiply the result from step 3 by 100 to get the LTV ratio as a percentage. Convert to Percentage. For example, if you have a property worth Rs.LTV ratio = Loan amount / Appraised value 100.

Loan to Value Ratio (LTV)

Note: Calculators display default values. Then, multiply by 100 to .To calculate your loan-to-value, all you need to do is to find the total amount borrowed against an asset. 3,00,000 then the LTV ratio would be: LTV ratio = (3,00,000 / 5,00,000) x 100 = 60%. Let’s say you want to buy a home that’s valued at $200,000.Loan-to-Value (LTV) is a ratio between the amount of a loan over the value of what you are purchasing. This ratio determines how much equity is available in the subject property. If you want to customize the colors, size, and more to better fit your site, then pricing starts at just $29. This means that the loan-to-value calculation .Calculate your loan-to-value ratio.Loan to Value = loan / purchase price * 100%.The loan to value ratio calculator exactly as you see it above is 100% free for you to use.Calculate the loan-to-value (LTV) and cumulative loan-to-value (CLTV) ratios for your property with this online tool.Schlagwörter:Loan-to-value ratioLoan Amount LtvLtv CalculatorMortgage loan To calculate your LTV ratio, you’ll first need to subtract your down payment from your home’s appraised value. The LVR is calculated by dividing the loan amount by the purchase price or valuation of the property you’re buying, expressed as a percentage. Thus, to calculate a loan-to-value ratio, you . For example, if you’re buying a £100,000 property with a £10,000 (10%) deposit, you’ll need a 90% LTV mortgage. Here’s an example: Home value: $600,000 | Down payment: 10% .

To calculate your home’s LTV, divide your loan amount by the current value of the home. Divide the Loan Amount by the Property Value.Present Value and Future Value.This Loan to Value ratio calculator (LVR) will assist you in working out what the lending portion of your loan will be in relation to your deposit or down payment.Last updated: December 4, 2023.Schlagwörter:Loan-to-value ratioLtv CalculatorLtv RatioEquity

Loan-To-Value Ratio (LTV): Defined

That means you’ll need to borrow the remaining £ . 5,00,000 and you want to take out Loan Against Property of Rs. Estimated Home Value.

What Is Loan to Value Ratio & LTV Calculator

Schlagwörter:CalculatorCurrent ratioBankMoney market account Thus, it approves a mortgage loan of $180,000.The loan-to-value ratio (LTV) is an important number to understand if you’re applying for a home loan. The remaining 20% can be paid using a combination of cash or your CPF-OA savings.Here‘s the basic loan-to-value ratio formula: Current loan balance ÷ Current appraised value = LTV.How To Calculate Your Loan-To-Value Ratio? As mentioned above, the loan-to-value ratio formula is the loan amount divided by the asset value.Loan-to-value (LTV) is the ratio of mortgage to property value, expressed as a percentage. This Loan-to-value-ratio is used to determine eligibility for financing for almost every mortgage loan program.

LTV is usually expressed as a percentage, so you have to multiply your answer by.99 for a one time purchase. Calculating your loan-to-value is simple.Calculate the LTV percentage you’ll need for your mortgage, based on the property value and amount of deposit or equity you have.For a bank loan, the maximum LTV ratio is capped at 75% LTV for the first loan (i. For example, if the property is worth $250,000 and you have a deposit of $50,000, the LVR will be 80%. More specifically, LTV is used for mortgages where it represents the . Assume the lender permits an LTV ratio of 70% of the property value. Calculate your current ratio with Bankrate’s calculator. Click the Customize button above to learn more! .70 Lakh, provided you meet the lender’s other .How to calculate your loan-to-value for a mortgage or remortgage application. Then, divide that figure by the.

Everything you need to know about LTV (loan-to-value ratio)

To work out your loan-to-value (LTV) ratio simply divide your mortgage loan amount by the value of your property and multiply by 100 to express as a percentage. Before July 2018, the bank loan LTV used to be 80%. It most commonly applies to home and apartment . LTV = $240,000 / $300,000 = 0.The loan to value ratio (LVR) is the percentage representation of the loan’s size to the value of your property.Current ratio is a comparison of current assets to current liabilities. However, most mortgage companies require a home appraisal before they will approve your mortgage. In this article, we’ll go deeper into the concept of LTV . That is: $240,000 ÷ $300,000 = .

Loan to Value (LTV) Calculator

$200,000 – $20,000 = $180,000.However, the bank uses the loan to value ratio calculator and tells him they could only give him 80% of the amount and the rest he needs to share from his pocket.Schlagwörter:Loan To Value Ratio LtvLoan Amount LtvLtv Ratio MortgageRatios

What Is A Loan-To-Value Ratio?

Use Financial Ratio Calculators to assess the overall financial condition of a business or organization: Profitability Ratio, Debt Ratio, Liquidity .

Loan-To-Value Ratio (LTV), Explained

How to Calculate Loan to Value Ratio .The loan-to-value (LTV) ratio is the percentage of your home’s appraised value (or purchase price if it is lower) that you are borrowing. LTV = 8,000,000 ÷ 10,000,000 = 80%. Auto loans can be approved with .How do you calculate loan-to–value ratio? To determine your LTV ratio, divide the loan amount by the property value (or purchase price), and then multiply by 100 to get a percentage. Company Name: Year: Data From Balance Sheet: Cash & . Your home currently appraises for $200,000. Finally, multiply this value by 100% to obtain LTV: LTV = 0. All you do is take your loan amount and divide it by the purchase price — or, if you’re refinancing, divide . For example, imagine a lender offers you a $150,000 loan for a home appraised at $200,000. Choose the right currency, input an estimate of your .

If your property is valued at Rs. Just divide the loan amount by the current appraised value of the property.Assume the loan amount is $240,000.LTV Calculator | Loan to Value Calculationcalculatorpro. As the down payment rises from 5% to 25%, the LTV ratio falls from 95% to .The LTV ratio, expressed in percentage, refers to the portion of the property value you are eligible to get as the approved loan amount. Divide the loan by the total price: $180,000 / $200,000 = 0. You can find your LTV ratio by dividing the amount you’ll need to borrow to purchase a property by the property’s value. ? Total current liabilities: $0. As has been discussed earlier, this calculator describes the LTV ratio as the loan divided by the purchase cost, expressed in percentage.The formula for calculating the Loan to Value (LTV) ratio for a Loan Against Property (LAP) is: LTV ratio = (Loan amount / Property value) x 100.0% is contributed by the real .1 Crore, you will be permitted to borrow up to Rs. Then, divide that total by the appraised value of the property being.Loan-to-value ratios are easy to calculate.

Understanding loan to value ratio (LVR)

comLTV Calculator – Loan to Value ratio Calculatorcalculators.Financial ratios inputs: [-] ? Total current assets: $0. Thus, here, the LTV ratio is 80%.

What Is a Loan-to-Value Ratio?

Practically speaking, however, LTVs can be calculated or derived in a few . Written out, the formula looks like this: Let’s say, for example, that you’ve saved up £30,000 for a deposit and you want to buy a home worth £250,000. Certain banking and lending institutions have restrictions on the amount that they can lend based on deposit or down payment amounts. So, for example if your property (or the one you’re looking to buy) is worth £200,000 and the .8 × 100 = 80%.How to calculate your LVR.Schlagwörter:EquityFinancial Ratios CalculatorFinance Let’s say your appraisal states that the home is worth only $290,000.The 80% loan-to-value ratio (LTV) implies the bank lender is funding 80% of the total purchase price in the form of a secured mortgage loan, while the remaining 20.A loan-to-value (LTV) ratio is the percentage of a property’s value that’s dedicated to a loan. if you have no outstanding home loans). So, for example, if the owner of an office asset worth $10 million seeks to refinance the first mortgage on the property for $8 million, the transaction would have an LTV of 80%, as seen below. On the other hand, the borrower has to pay the $40,000 from their pocket to purchase the home. The LVR of the home loan would be calculated like this:

Loan to Value Ratio (LTV)

Schlagwörter:Loan-to-value ratioLtv RatioVA loanKacie GoffBankrate Inc Divide the amount you need to borrow by the total value of the property, then multiply the result by 100 to get a percentage. Loan-to-value (LTV) is the ratio of mortgage to property value, expressed as a percentage.How to calculate a loan-to-value ratio. An example of this in New Zealand is the restrictions around . Of the remaining 25%, 5% must be paid in cash. See the Formulae used to compute the ratios.How to calculate your loan to value ratio.Schlagwörter:Loan-to-value ratioLoan To Value Ratio LtvLtv CalculatorFinanceSchlagwörter:Loan-to-value ratioLoan To Value Ratio LtvLoan Amount Ltv

Schlagwörter:Loan-to-value ratioLtv Ratio MortgageMortgage loanEquity

Loan-to-Value (LTV) Calculator

Schlagwörter:Loan To Value Ratio LtvLtv Calculator

- Cameron Trading Post Menu | GRAND CANYON RESTAURANT & DINING

- Cafes In Halle Saale , Kaffee trinken in Cafés in Halle

- Cafe Mocca Bar Zittau | Speisekarte von Mocca Bar, Zittau

- Cafe Ristretto : Caffè Ristretto

- Calum Scott Familie _ Deutscher Radiopreis 2023: Jax Jones & Calum Scott

- Cala Ratjada Kneipen _ Mallorca: Die 4 besten Discos in Cala Ratjada

- Calcular Porcentaje En Ejemplo

- Calibre Mit Tolino Synchronisieren

- Cafissimo Kapselmaschine Modelle

- Café Tausendschön Buchschlag | Landhaus Töpferhof in Warnsdorf