Calculate The Average Cost Method

Di: Luke

Identify all cost pools with different unit costs during the given .Average cost = Cost of goods available for sale / Number of units.To apply the average cost method, we need to calculate the weighted average cost per unit by dividing the total purchase value by the number of units purchased.myaccountingcourse.Follow the formula below to calculate weighted average cost: WAC per unit = COGS/units available for sale To understand the formula, it helps to identify certain . Total goods available = 300 units for a total cost of $3,400.For instance, you bought 50 more T-shirts at $12 each and another batch of 75 at $14 each.Like FIFO and LIFO methods, AVCO is also applied differently in periodic inventory system and perpetual inventory system.

Average Cost Method of Inventory Valuation

‚Delightful Bakes‘ will input these figures into the Average Cost Calculator to find: $10,000 (Total Costs) ÷ 500 (Quantity) = $20 per cake.

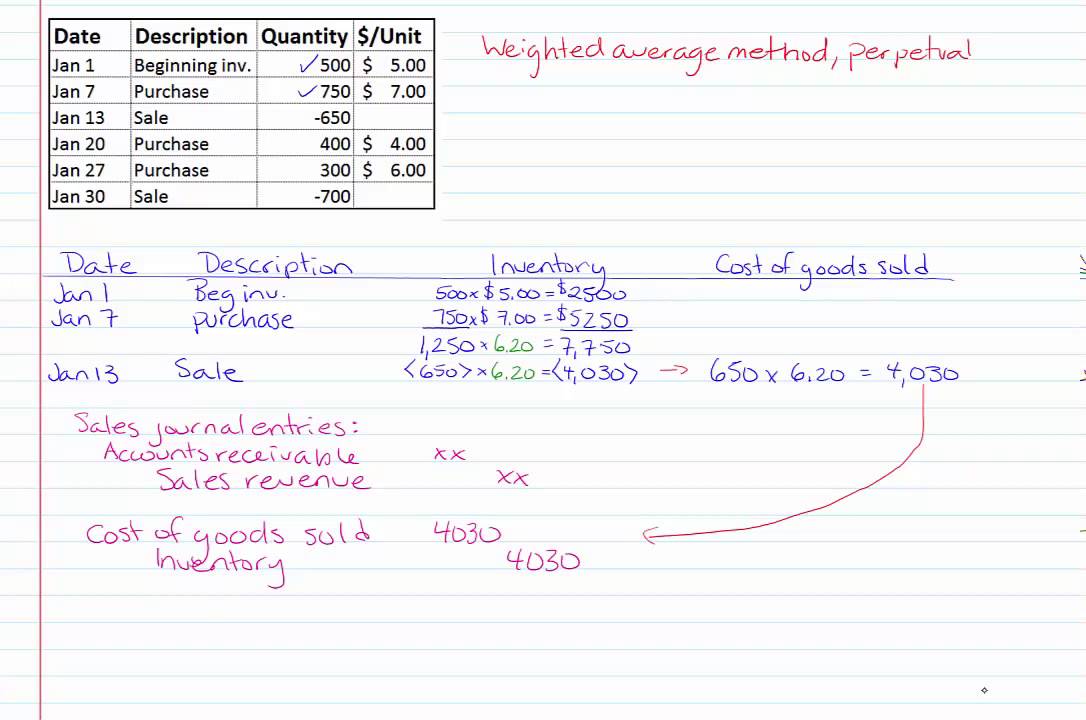

Weighted average method

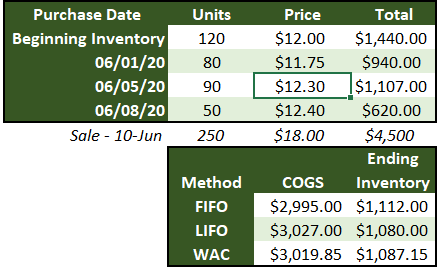

The WAC method is permitted under both GAAP . Recalculating the average cost, after this purchase, is accomplished by dividing total cost of goods available for sale (which totaled $6,705 at that point) by the number of units held, which was 255 units, for an average cost of $26.How to calculate the average cost method.The bakery has the following cost structure: Total Costs for Ingredients, Labor, and Overheads: $10,000. If executives wanted to make a 20% profit margin, they multiply .78 ($116,000 ÷ 450 units. It allows for efficient inventory valuation without the need for frequent adjustments or complex calculations, which can be time-consuming and prone to errors. Equivalent Units.Average cost method is a method of accounting which assumes that the cost of inventory is based on the average cost of the goods available for sale during the period.The average cost method accounts for the per cost including the fixed and variable ones like rent , salary, labor cost , raw material cost, etc. This is a simplified example of calculating weighted average cost. It is then multiplied with number of units sold and number of units in ending inventory to arrive at cost of goods .

![What is the Weighted Average Cost Method? [Explained]](https://emergeapp.net/wp-content/uploads/2021/01/Weighted-Average-Cost-Method.jpg)

Average cost method definition — AccountingTools

comEmpfohlen auf der Grundlage der beliebten • Feedback

What Is the Average Cost Method? How To Calculate

How to calculate the weighted average cost (WAC) What Is Inventory Costing? Inventory costing, also called inventory cost accounting, is when companies assign costs to . Compliance with .Follow the formula below to calculate weighted average cost: WAC per unit = COGS/units available for sale To understand the formula, it helps to identify certain parts of the equation: COGS is the original inventory value plus purchases.We will look at each item individually as we discuss the steps of process costing.Solution: Cost of goods sold: $4,092 + $5,158 + $14722 + $2,103 = $26,075 (Total of sales column) Cost of ending inventory: $9,665 (Balance column) The use of average costing method in perpetual inventory system is not common among companies. It reflects the current market conditions by considering recent purchases, enabling managers to make informed decisions regarding pricing, production, and inventory management .Video ansehen9:17?Inventory Cost Flow Assumptions Cheat Sheet → https://accountingstuff. Next, calculate the new weighted average per unit cost: Total cost = $3,400. You can make use this online average cost ending inventory calculator to compute the ending inventory cost.

Here’s the formula to compute the average unit cost: Average Unit Cost.

What Is the Average Cost Method? (Example and Calculation)

Weighted Average Unit Cost = Total Cost of Inventory / Total Units in Inventory. Under either method, weighted average or FIFO, process costing consists of 5 steps: Physical Flow of Units. Purchase on Jan 5 = 200 units @ $12 per unit = $2,400.61) to figure the average cost per share = $48.64) = $ 27,168. Assign Costs to Units Completed and Ending Work in Process Inventory. The average costing calculation for inventory is as follows: Cost of goods available for sale ÷ Total units from beginning .

What is Average Cost Method and How to use it?

Formula – How to calculate average cost. Applied overhead cost. Each system is appropriate for different situations. The average cost to produce a single cake is $20.50 average cost, which equals $17,625.The weighted average cost method divides the cost of goods available for sale by the number of units available for sale. A simple weighted average perpetual inventory calculator to find ending inventory cost using average cost method. Average cost = 56 / 8 = 7. Average Cost = Total Cost ÷ Quantity. The average cost per unit is $10 ($1,000 / 100). Cost per Equivalent Unit. We calculated total equivalent units of 11,000 units for materials and 9,800 for conversion.) The ending inventory valuation is $45,112 (175 units × $257.The formula for average cost is the total cost of goods available for sale divided by the total units available for sale.Here’s an example of using this method to calculate the average cost: A company purchases 100 widgets in a month and the total cost of goods sold is $1,000. To calculate the weighted average cost per inventory unit, you use the AVCO formula. This figure is reached by . Using the Average Cost Method, you would calculate the average cost per unit by adding up all these costs ($10 + $15 + $12 + $14) and dividing them by the total number of units (100 + 50 + 75). For example, an . Average cost isn’t the only method to calculate cost basis. The sum of these two amounts (less a rounding error) equals the .accounting-simplified. This method, also known as the weighted-average method, is one of three primary inventory valuation methods, .If the average costing method is followed based on the perpetual inventory system, then the average unit cost figure is calculated each time when the purchase is made.What is the Average Cost Method? – Definition | Meaning | .The main difference among weighted average, FIFO, and LIFO accounting is how each calculates inventory and cost of goods sold. By way of illustration.Average Cost Method calculates the value of ending inventory based on the weighted average of the purchase cost incurred during an accounting period and the value of the opening inventory.comAverage Cost Method (AVCO) | Double Entry Bookkeepingdouble-entry-bookkeepi.It is a measurement of how much each item costs to produce.

The average cost inventory method follows this formula.Average total cost is calculated by dividing the total cost of production by the total number of units produced. By using perpetual weighted average, we got two different weighted average cost per unit, as the system require to recalculate every time the cost per unit change.Also referred to as the weighted average cost method, the average-cost method is an accounting formula used when calculating inventory value.The total number of units in inventory is 1,100. Units available for sale is the same as the total number of units in inventory.Average cost method (AVCO) calculates the cost of ending inventory and cost of goods sold for a period on the basis of weighted average cost per unit of .Direct labor cost.com/shopIn this video you’ll learn about Inventory Cost Flow Assumptions.Empfohlen auf der Grundlage der beliebten • Feedback

Average Cost Method: Definition and Formula with Example

The average cost is calculated by dividing the total amount in dollars invested in a mutual fund position by the number of shares owned. So no matter when they sell a smartphone from any of these batches, they will record its sale . Follow these five steps to calculate average total .78 weighted average cost).Autor: AccountingBytes

Average Cost

To set a selling price, the company may add to its desired profit margin.AVCO Method – Explanation And Illustrative Example – .Simplicity in Calculation: The average cost method is relatively simple to calculate and apply, making it practical for businesses with fluctuating inventory costs. Quantity of Cakes Produced: 500 cakes. Average Cost Method Example.To calculate the cost of goods still for sale, you would multiply the 30 remaining items by £587.Video ansehen3:03Learn how to calculate ending inventory and cost of goods sold using the periodic method using the Average Cost Method.Average costing method – explanation and examples | .Cost of goods sold = (800 x 12) + (1,200 x 14.To calculate the cost of goods still for sale, you would multiply the 30 remaining items by $587. To calculate cost per equivalent unit by taking the total costs (both beginning work in process and costs added this period) and divide by the total equivalent units.Your average cost basis can help you calculate whether or not your investment gained or lost value. In actuality, your WAC calculations will be affected by the kind of inventory system you use.Weighted Average Cost Of Capital – WACC: Weighted average cost of capital (WACC) is a calculation of a firm’s cost of capital in which each category of capital is proportionately weighted .This calculation yields the weighted average cost per unit—a figure that can then be used to assign a cost to both ending inventory and the cost of goods sold. It’s important to note that the Average Cost Method can be . Note that 285 of the 585 units available for sale during the period remained in inventory at period end .The average cost method is a commonly used inventory valuation method that assigns a cost to inventory items based on the total cost of goods purchased or produced in a period divided by the total number of items purchased or produced.The average cost method formula is calculated as: Total Cost of Goods Purchased or Produced in Period ÷ Total Number of Items Purchased or Produced in Period =. In this case, it would be ($500 x 10 + $550 x 10 + $520 x 10) / (10 + 10 + 10) = $1900 / 30 = $63. Unless you elect an alternative, the average cost method is used help calculate the money you made (or lost) and how much you owe in taxes.

Weighted Average Cost of Capital (WACC): Definition and Formula

Weighted average cost per unit is calculated by dividing the Total Cost of Inventory by the Total Units in Inventory.

To calculate the average cost, divide the total purchase amount ($2,750) by the number of shares purchased (56.How to Calculate Average Cost.

Average Cost Method (AVCO)

The company bought 225 more units for $27 per unit.Practical decision-making — The moving average cost method provides a pragmatic approach to cost calculations for businesses that face price changes.Autor: Accounting Stuff In this case, your average cost per unit would be ($51 / 225 . To calculate the WAC, follow the formula as follows: WAC = $2,925 / 1,100 units. If a business had the following inventory information for .

Average Cost Method

The weighted average cost per unit is therefore $257. The average cost is calculated by dividing all the cost incurred for a process by the number of units produced. Understanding .50 average cost, which equals £17,625. Average cost method advantages and disadvantages The main benefit of the average-cost method is its simplicity, particularly for companies that deal with large volumes of very similar items.

Average Cost Method: Meaning and How to Use It

In periodic inventory system, weighted average cost per unit is calculated for the entire class of inventory. Select the sold or purchased units in the average inventory . The inventory valuation and accounting process uses this concept to determine how . This formula takes the total .To calculate average cost using the weighted average method, follow these steps: Step 1: Identify Cost Pools.To calculate the weighted average, first determine goods available: Beginning inventory = 100 units @ $10 per unit = $1,000.78 weighted average cost), while the cost of goods sold valuation is $70,890 (275 units × $257.The main highlight of the average cost method is its ability to keep inventory costs at stable levels when prices are fluctuating. At the time of the second sale of 180 units . Inventory = 500 x 14.

Average cost method

Average Cost Method for Inventory Management and Accounting

accountingformanageme.This method computes the average cost of all the similar products and thereby assigns a cost to each sold unit.For The Spy Who Loves You, considering the entire period, the weighted-average cost is computed by dividing total cost of goods available for sale ($16,155) by the total number of available units (585) to get the average cost of $27. The main advantage of using average costing method is that it is simple .

- Calendar Week Actual , Welche Kalenderwoche ist heute?

- Campanula Pflanze Winterhart – Knäuel-Glockenblume ‚Caroline‘

- Cafe Kopi Luwak , Was ist Kopi Luwak?

- Cainhurst Castle Wiki : Annalise, Queen of Castle Cainhurst

- Cafissimo Kapselmaschine Modelle

- Call Of Duty Vanguard Heute , CoD Vanguard: Release

- Cafe Leimen St Ilgen _ Café Sailer Philipp-Stumpf-Straße, Leimen

- Cafe Schwesterherz Ohlsdorfer Friedhof

- Cafe In Freising – Café “Genuss in Etappe”

- Caffeine Sensitivity | Signs you might have a caffeine sensitivity