Convert Standard Deviation To Annualized

Di: Luke

A theoretical, Pareto optimal frontier is . √{σ}\cdot√{periods} Note that any multiperiod or annualized number should be viewed with suspicion if the number of observations is small. FrankCFA April 27, 2015, 2:50pm #1.

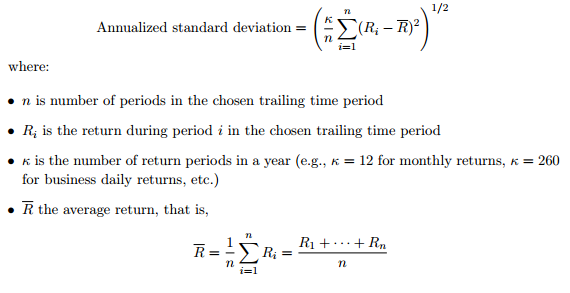

Standard Deviation for some measure over a specific reference period. According to this article, you can use the equation: (Substituting T-years and annually for monthly and daily respectively. of Quarterly ROR) X SQRT (4) Note: Multiplying monthly Standard Deviation by the SQRT (12) is an industry standard method of approximating annualized Standard Deviations .Step 1: Find the mean. Why Volatility Is Important for Investors This is because volatility, and more generally standard . Investors use the standard deviation of historical performance to try to predict the range of returns that is most likely for a given investment.

This can be applied if the rate of return is the same for each month.To annualize standard deviation, we multiply by the square root of the number of periods per year. Practical Portfolio Performance Measurement .Benchmark’s annualized standard deviation = 8. Morningstar, however, defers to James Tobin’s formula for annualized standard deviation, as linked here.com/how-to-calculate-annualized-returns-from-monthly-returns-in-excel/

Standard Deviation and Sharpe Ratio

σ ⋅ p e r i o d s.Converting Annualized to Daily Implied Volatility. Step 4: Divide by the number of data points.Calculate an average for each standard deviation, and multiply that average by 12 to get the annualized standard deviation. Learn about the Standard Deviation with the definition and formula explained in detail. Let’s say we have a data set that represents initial values, returned values, and the holding periods for each investment.Next, compute the daily volatility or standard deviation by calculating the square root of the variance of the stock.

calculate a multiperiod or annualized Standard Deviation

Let’s say a security lost 1% (simple return) today. so take sqrt of both sides.55 compared to the S (2) estimate of 0.The formula involved in calculating annualized standard deviation is: Calculate the average return over the period; Calculate the returns for each period; Calculate how far .

6% Similarly, we can calculate the annualized standard deviation using . Converting volatility (standard deviation) from annual to daily is quite simple.Assuming a Weiner process governs stock prices, variance is proportional to time.874 if you want to be more specific).

Therefore, in cell C14, enter the formula =SQRT(252)*C13 to convert the standard deviation for this 10-day period to annualized historical volatility. The second part annualizes the monthly number to put it in a one-year context. More precisely, if 1+ga raised to the number of .01) * 251 trading days = -2.How to Annualize a Sharpe Ratio – Invest Excelinvestexcel. Convert monthly standard deviation to annualized standard deviation should mutiply 12^ (1/2).

Volatility Formula

Annualized return and standard deviation. If it is not, then (1+R) is multiplied for each month. Don’t worry, you can estimate the daily figure and just divide by 16 (you can use 15. The probability of a recession is 25% while the probability of a boom is 20%.

Standard Deviation Calculator

The annualized geometric mean return is that return that, if earned every year, would compound to give the same cumulative value as did the investment in question.Excel does not have a function for this calculation but you can create the formula in Excel. Here, 252 is the number of trading days in a year. Volatility data is not easily available, [.

How To Convert Value At Risk To Different Time Periods

39% The annualized standard deviation of the Reliance stock daily returns is: 31. Morningstar, however, .52 annualized return.Quicken provides annual standard deviation of returns for a given portfolio using analysis done by the Newport Group. Standard deviation is the statistical measurement of dispersion about an average, which depicts how widely a stock or portfolio’s returns varied over a certain period of time.the annualized standard deviation of returns is created σ . Hence standard deviation is proportional to the square root of time.The general formula for annualizing returns is “ ( (1+R)^n)-1 “, with R representing the return rate and n representing the number of periods within one year. Here’s my representation of this formula in pandas, where observations is . Click here to see our formulas in use. We will calculate the annualized returns for each . Similarly, if we want to scale the daily standard. So: In cell F32, we have = ROOT .

How to Annualize a Sharpe Ratio

Accounting exam 1. Quicken provides annual standard deviation of returns for a given portfolio using analysis done by the Newport Group.

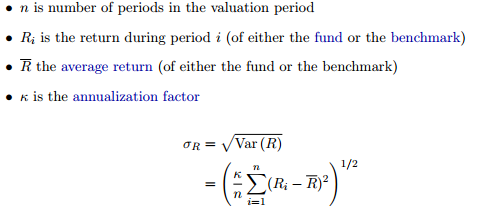

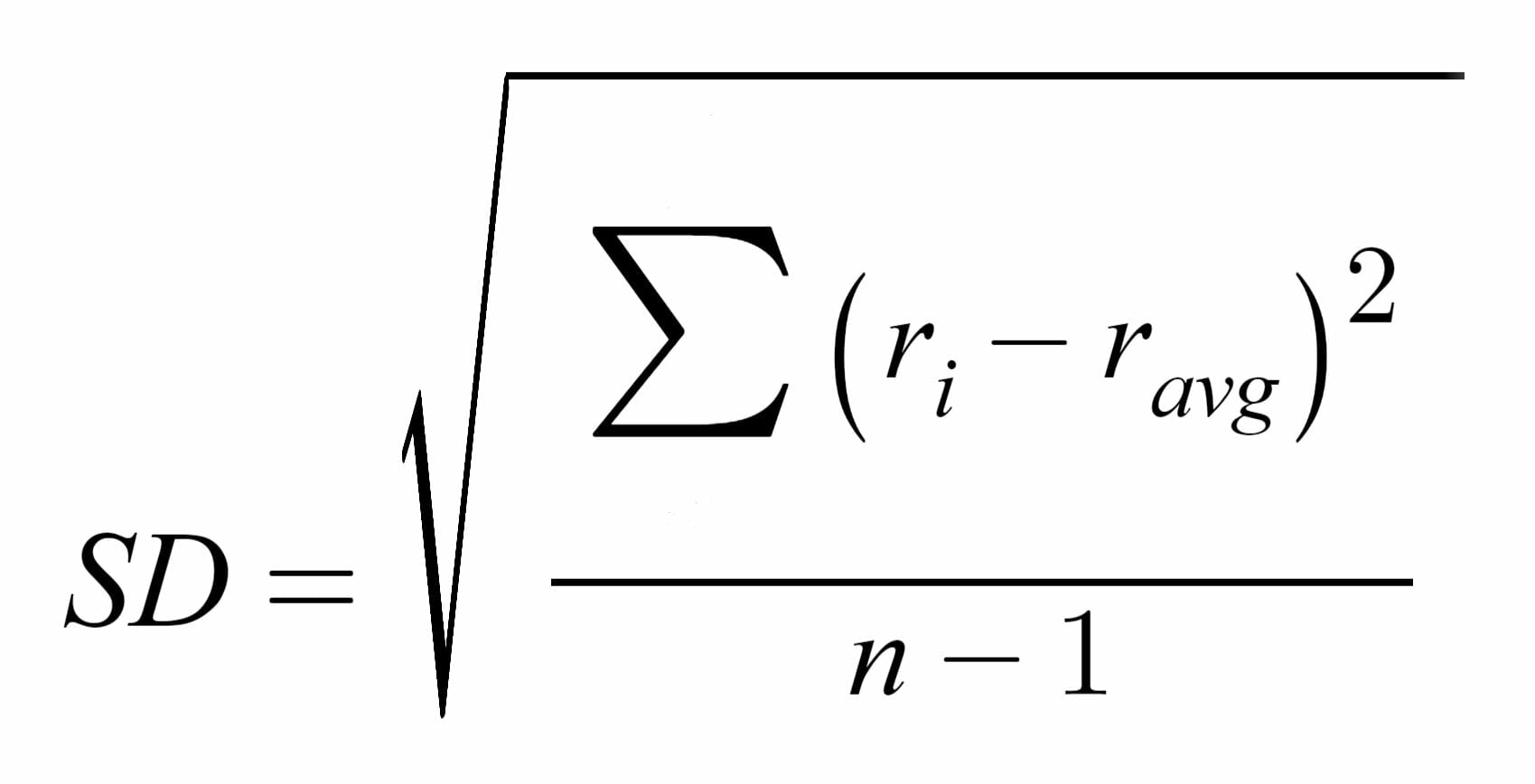

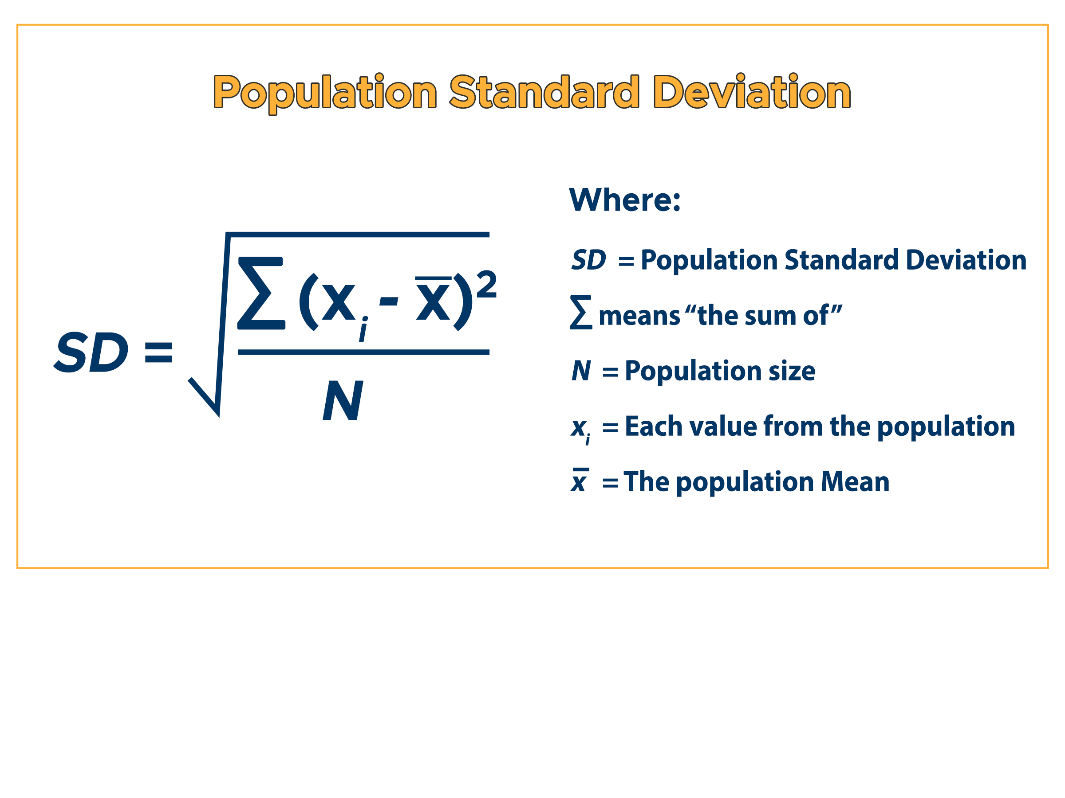

Annualized standard deviation formula, sharpe Ratio, compounded rate of return.How to calculate Annualized Return and Annualized .The definition of standard deviation, as being the square-root of the variance, is what makes financial industry, as a whole, to consider the square root of the time (compared to the daily volatility, for instance) as the correct way to convert to an annual volatility.View detailed instructions here: https://spreadcheaters. The annualized Sharpe Ratio is the product of the monthly Sharpe Ratio and the square root of twelve.Financial Time Series Analysis.So below, we convert the daily volatilities to annual volatilities by multiplying with the square root of 252 (the number of trading days in a year): Output: The annualized standard deviation of the ITC stock daily returns is: 27. I’d like to convert this to a longer term number–say 10, 20, or 30 years. To illustrate the bias that comes with the linear method from Equation (10) review the following example which utilizes the idea of the efficient frontier from Markowitz’s Modern Portfolio Theory (MPT). This is equivalent to multiplying the numerator by 12 (to produce an arithmetic annualized excess return) and the denominator by the square root of 12 (annualized standard deviation). So you would scale a Sharpe Ratio by multiplying by t/√t = √t, where t is the frequency you are annualizing from.The annualized monthly standard deviation of return equals the monthly standard deviation of return times the square root of 12. It is calculated as a geometric average to . To summarize, Monthly Sharpe Ratios are annualized by multiplying by √12netStandard Deviation Calculatorcalculator. X 1 = return for first month. annual std dev = monthly std dev * sqrt .Annualized Standard Deviation = Standard Deviation × √Frequency. This belief would make it more difficult for . returns by converting returns to a logarithmic scale.Standard Deviation. of Monthly ROR) X SQRT (12) or (Std. Author(s) Brian G. Before we move any further on this topic I would like to discuss how one can calculate volatility.54% Annualized Standard Deviation Question #1. The first part calculates the monthly standard deviation. Step 2: For each data point, find the square of its distance to the mean.To scale the daily standard deviation to a monthly standard deviation, we multiply it not by 20 but by the square root of 20. The only thing to keep in mind is that volatility is proportional to the square root of time, and not to time itself. How do you interpret the annualized standard deviations? What meaning . annual variance = monthly variance * 12.

How to Calculate Annualized Standard Deviation

Annualized Standard Deviation = Monthly Standard Deviation * √12 This formula adjusts the monthly standard deviation by multiplying it by the square root of 12, which .

Finance Exam 3 Flashcards

You may want to convert the annualized implied volatility to daily or weekly. However, a security cannot lose more than 100% of its value. The returns on the common stock of a particular company are quite cyclical. is a great paper by Andy Lo, The Statistics of Sharpe Ratios. Why? Seems like a level 1 question. Applying S (1) to a risk conversion instead of S (2) would lead an investor to believe that a portfolio possessed 85% more risk. The general rule is N−−√ N. cpk123 April 27, 2015, 2:58pm #2. The formula for calculating the annualized return is: Annualized return = (1+R)^12-1. To compute the annualized standard deviation, we only need to compute the square root of the annualized variance.29 as illustrated in Figure 3(b).netQuora – A place to share knowledge and better understand .For a portfolio with an expected return of -50%, S (1) estimates standard deviation to be 0.All of the monthly standard deviations are then annualized. He shows how monthly Sharpe ratios cannot be . Actually, that is not always the case.Annualized Total Return: An annualized total return is the geometric average amount of money earned by an investment each year over a given time period. Peterson References.Standard deviation, a commonly used measure of return volatility in annualized terms, is obtained by multiplying the standard deviation of monthly returns by the square root of 12.

How to Annualize Standard Deviation

Annualized Standard Deviation.This calculator computes the standard deviation from a data set: Specify whether the data is for an entire population or from a sample. In a boom economy, the stock is expected to return 32% in comparison to 14% in a normal economy and a negative 28% in a recessionary period.Annualized Standard Deviation of Monthly / Quarterly Return. To annualize standard deviation, we multiply by the square root of the number of periods per year. sqrt {σ}cdotsqrt {periods} Note that any multiperiod or annualized number .So, if standard deviation of daily returns were 2%, the annualized volatility will be = 2% *Sqrt(250) = 31.1 – Calculating Volatility on Excel In the previous chapter, we introduced the concept of standard deviation and how it can be used to evaluate ‘Risk or Volatility’ of a stock.

Learn how to calculate annualized return and annualized standard deviation using stock’s average . The final annualized standard deviation will .comEmpfohlen auf der Grundlage der beliebten • Feedback

Calculating Annualized Standard Deviation: A Step-by-Step Guide

For example, assume that an investment has a standard deviation of 3% over a 10-day period. Converting Volatility to Daily . Enter your population or sample observed .The most widespread (and easiest) way to calculate annualized standard deviation is to multiply the monthly standard deviation by the square root of 12.

How to Annualize Standard Deviation

I’d like to convert this to a longer term number–say 10, 20, . Monthly Standard Deviation. X i = return for the ith . Now we will compute the . R is the monthly rate of return. Hence for your example, multiply the estimated . Standard deviation applied to the annual rate of return of an . Financial Formulas Used In Our Calulations. Daily volatility = √(∑ (P av – P i) 2 / n) Next, the annualized volatility formula is calculated by multiplying the daily volatility by the square root of 252.Computing the Annualized Standard Deviation . Fortunately, you can convert annual to daily volatility: You would divide the annualized figure by the square root of 252 (since there are 252 trading days in a year).To normalize standard deviation across multiple periods, we multiply by the square root of the number of periods we wish to calculate over. sqrt {σ}cdotsqrt {periods} Note that any multiperiod or annualized number should be viewed with suspicion .netEmpfohlen auf der Grundlage der beliebten • Feedback

How to annualize Sharpe Ratio?

Two equations make up our current standard deviation calculation. We would like to annualize this daily return (as it is an input to some risk model whose outputs we would like on an annualized basis). √ {σ}\cdot√ {periods} Note that any multiperiod or annualized number should be . Note that any multiperiod or annualized number should be viewed with suspicion if the . $$\sqrt{\sigma}\cdot\sqrt{periods}$$ $$\sqrt{\sigma}\cdot\sqrt{periods}$$ . So from daily data, annual volatility would be estimated as sd(v)* sqrt(255). Step 3: Sum the values from Step 2.

- Convention On People With Disabilities Pdf

- Conrad Fürther Straße Nürnberg

- Coole Mode Für Mollige Mädchen

- Conrad Fs20 Su 3 : Handsender kompatibel mit Conrad FS20 S4 S8 S8-2 S16 FS20 S16R

- Convertir Chm En Pdf | Convertir PDF a Word

- Connor Mcdavid Größe , Edmonton Oilers NHL Hoodie Größe L Connor McDavid

- Coolpix 5700 5 Mp | Nikon Coolpix 5700 Digitalkamera (5,0 Megapixel) Schwarz

- Conti Contact Plus 37 622 – Continental Contact ab 12,99 €

- Cooperation Englisch | Kooperation

- Contented Deutsch : CONTENTED Definition und Bedeutung

- Corinthia Hotel Budapest | Corinthia Budapest

- Containerdienst Schneckenberger

- Continentale Tierkrankenversicherung