Critical Illness Insurance Quotes

Di: Luke

Use of tobacco products. Find out how affordable your critical illness insurance could be by answering just four questions.The most popular policies are worth $50,000, according to Schmitz.What does it cover and is it worth it? Rosie Bannister and Tony Forchione.You can get a critical illness insurance quote from Assurity as a baseline for how much your insurance may cost.

Critical Illness Insurance: The Definitive Guide (Updated in 2024)

Fill out a short questionnaire to determine whether critical illness insurance is right for your needs, and we’ll provide a list of plans for top providers that fit .Get quotes on Critical Illness and Cancer Plans fast and easy. Lump-Sum Benefit: $25,000 to $2 million.

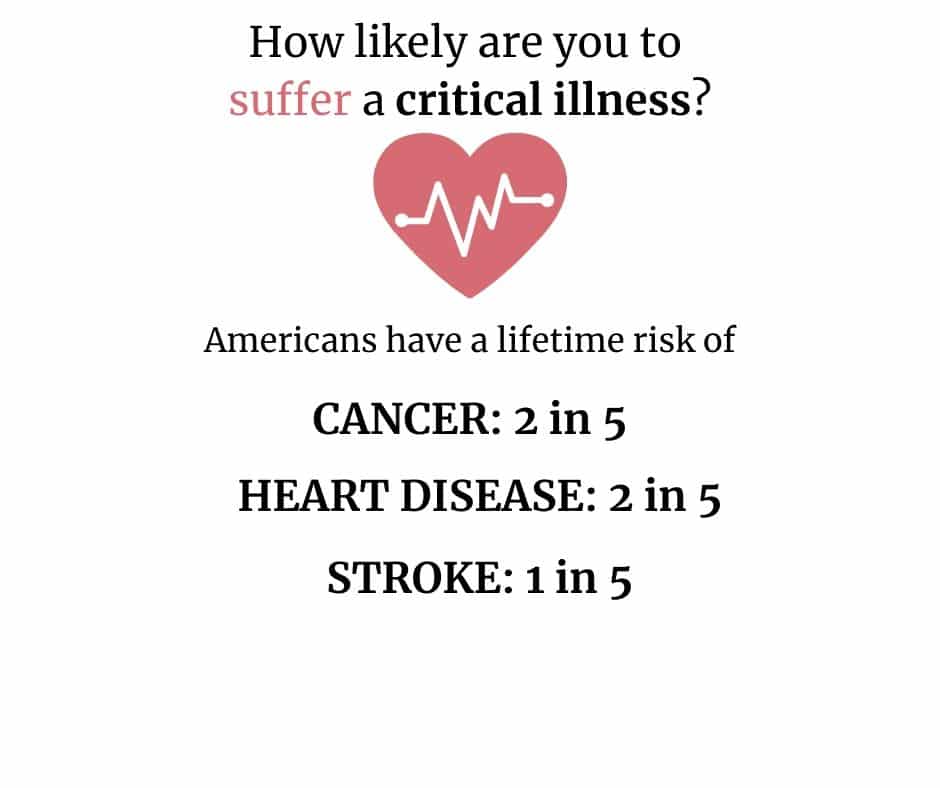

How critical illness plans work. They can help find cover that’s right for you and your loved ones. Apply online and save.Critical Illness. Choose your province. Learn how it works, . Critical illness insurance is supplemental insurance that pays a lump sum benefit if you are diagnosed with a covered illness. Keep in mind, however, that this should just be used as a baseline – compare critical illness insurance quotes . Empire Life is a leader in critical illness coverage, offering coverage for 25 conditions, 6 partial payout conditions with up to $2,000,000 in coverage. Just four easy questions.Does critical illness insurance cover coronavirus?Critical illness cover is unlikely to pay out if you’re diagnosed with coronavirus.Critical Illness insurance provides coverage for a wide variety of conditions that may have a significant impact on your finances, even if you have health and disability insurance. There is no enhanced version which would cover 24+ illnesses, unlike many other critical illness policies.Trauma Insurance. Health costs are rising. Terminal illnesses (defined a. It is designed to cover the cost of treating and recovering from expensive illnesses and procedures.To find a critical illness insurance adviser, we have listed some brokers who offer vouchers or cashback when you purchase critical illness cover alongside a life insurance policy. Life insurance for seniors. Rather speak to someone? Call our UK-based specialists on 0800 652 9754. Track your daily physical activity – from steps to gym workout sessions. Pricing factor used by the . At Reassured, our award-winning team can help you with this, saving time and money.Critical Illness Protect360 insurance provides a wide panel of specialists in Singapore for consultations on second opinions.Critical illness insurance protects you when you are diagnosed with a serious illness. 5 Reasons to get a Critical Illness Insurance Quote. Trauma insurance (also known as critical illness insurance) provides a lump sum payment if you are diagnosed with a serious medical condition covered by the policy. Critical illness insurance pays you a lump sum if you are diagnosed with a covered illness. And while you should factor these in to your calculations, you shouldn’t be swayed by them.Compare the top providers of critical illness insurance policies for individuals and employers based on coverage, cost, and . With rising treatment costs and deductibles, you may want to consider insurance protection to help cover unexpected expenses. But we’re all different, so you’ll be quoted a price we piece together based on things like your policy’s length, amount you’ve asked for and medical history.

Fast and Easy Critical Illness Insurance Quotes

What Does Critical Illness Insurance Cover? There are specific medical illnesses or events that critical illness insurance covers, and while each policy will be . Comprehensive: Coverage for over 30 serious illnesses and conditions.Our critical illness insurance helps you fill the financial gaps not covered by your traditional health, disability, life and accident insurance.Find a plan that suits your needs and budget with critical illness insurance, a supplemental health plan that pays a lump sum for a qualifying major illness.Unlike life insurance quotes, whose presence is ubiquitous online, critical illness insurance quotes are not nearly as easy to get.On average, critical illness insurance policies only cover 75 conditions (Defaqto, 2021).Critical illness insurance (CII) is a type of supplemental insurance that pays out a one-time lump sum cash benefit if you are diagnosed with a covered condition, . Premiums are representative of $25,000 in coverage for five common conditions. Cavendish Online won’t charge you for their advice, and you’re under no obligation when you speak to them.Compare quotes; Coverage. Updated 6 November 2023.Bewertungen: 33 Get cover in minutes. Search for Another Agent. The premiums for a .from £25 to £205 ** [1] Correct as of March 2024.Critical illness insurance typically pays out between $10,000 to $1M in Canada. Request a free quote to know how much critical illness insurance cover you need. Insurance companies will request information about you, such as your age, medical history, lifestyle and sometimes even your family’s family’s medical history.What’s the difference between critical illness cover and terminal illness cover?Critical illness cover pays out if you suffer a serious ailment specified in your policy that isn’t life-threatening. No networks, no deductibles.

Compare critical illness insurance

Apply in minutes.A critical illness policy pays a cash amount if you have a serious illness, such as heart attack, stroke or cancer.

Centers for Medicare and Medicaid Services. Critical illness insurance can pay for costs not covered by your health insurance, such as your deductible or out-of-network .

A Complete Guide to Critical Illness Insurance

Best Critical Illness Insurance Quotes from 20+ Life Insurers

More cancers than any other insurer (Defaqto, 2021) All neurological diseases. Learn what critical illness insurance is, which companies offer basic and enhanced coverage, and why one should choose . Critical Illness cover of up to $500,000 depending on your age that pays a lump sum for the following 14 defined Critical Illnesses. The proceeds of a claim may help you cover treatment expenses or adjust your lifestyle.Can I adjust the level of cover I have?Most critical illness insurance providers will allow you to make changes to the level of cover in your policy.

Best Critical Illness Insurance in Canada (2024)

Coverage options are defined as basic (4 conditions covered) or enhanced (25 conditions covered) with term options of 10, 20, and up to 75 years of age. Helps cover out-of-pocket costs for cancer 2, heart attack 3, stroke and Alzheimer’s. That’s because viral infections like COVID-19 aren’t specified. Limited coverage: CoverMe CI offers only 5 illness basic coverage.Instant Critical Illness Insurance Quotes – PolicyAdvisor.Critical Illness insurance, also known as heart attack insurance, cancer insurance, specified disease insurance or dread disease insurance, is a product .

Best Critical Illness Insurance Plan in Singapore

This payout can be used to pay for anything you want, from mortgage payments to medical expenses. For a 30-year-old man living in Iowa, a critical illness policy from Assurity would cost around $29 per month.Critical illness insurance is a form of supplemental insurance that pays you a lump-sum cash benefit if you are diagnosed with a life-threatening condition . You choose your coverage amount when you apply for and sign your critical illness policy.Compare Best Home Loan Refinance Rate in Singapore (2022) Compare Best Critical Illness Insurance in Singapore (2022) China Taiping I Saver 8 – Shortest Participating Plan Endowment Up to 3. Accessed December 12, 2022.

Empire Life Critical Illness Insurance Review (2024)

Enter your ZIP code to get free quotes from multiple insurers. Lump-sum Payment- The insurer provides the lump sum payment for the treatment of covered illnesses.When shopping for critical illness insurance, getting several quotes from different carriers is advisable. It can help you cover medical costs . Learn about this insurance, how it works, its pros, cons and whether it’s right for you. However, providing this information for each carrier can take time and . All heart attacks. Critical Illness Insurance Market Survey .Below is a table outlining monthly critical illness insurance rates from Manulife and CAA, based on age, gender, and smoking status. This is extremely low compared to other insurers, with coverage limits of up to $3 million.

Critical Illness Insurance: Buy Critical Illness Cover Online

This section will give you a rough idea of what to expect.Critical Illness Insurance Quote. Critical illness insurance offers additional financial protection.

Best Critical Illness Insurance in Singapore

What’s the difference between critical illness cover and life insurance?Critical illness cover offers financial support if you’re diagnosed with a critical illness or injury, so you and your family will benefit from the.Here are the features of critical illness insurance plans: Critical Illness Coverage- Coverage is provided for up to 36 major critical illnesses such as a tumour, cancer, kidney failure, heart ailments etc. Share this guide. Flexible: Your choice of premium and term options, plus optional coverage for even more protection.

Life and Criticall Illness Insurance

Best Critical Illness Insurance of 2024

Compare life insurance quotes from Aviva, Legal & General, Zurich and more. While the list of . Heart Attack of specified severity 3,4.Aflac offers critical illness insurance policies that pay a lump sum or a single, large-payout benefit amount upon diagnosis of a covered illness or event. Get a quote for critical illness cover with .Learn how critical illness insurance can protect you from out-of-pocket costs if you face a major medical crisis.We’ve named Canada Life, Desjardins, iA Financial, and Sun Life among our top choices for the best critical illness insurance policies in Canada.Our critical illness cover normally comes in at under £19 a month, according to figures from September 2022 to September 2023.

Compare Critical Illness Cover Quotes

March 18, 2024.Critical illness insurance offers additional financial protection. Let’s get started.We researched the best critical illness insurance in Canada so you don’t have to. According to the American Heart Association, 720,000 Americans suffer a . For as little as $10 a month, you can get $25,000 in cash paid directly to you when facing a serious condition 1.To get advice about life insurance, contact Cavendish Online. Long-Term Care Conversion Benefit: From age 55 to 65, you can convert all or some of your coverage to long . If you want a higher coverage amount, your monthly premium will also be higher, though this rate is also determined by your health status, age and other factors. Compare coverage options, benefits, costs, and FAQs for this type of supplemental insurance. Guaranteed issue or underwritten. Buy best critical illness insurance policies with protection against 64+ illness such as heart attack,kidney failure,brain surgery, Cancer. Amount of benefits you select. Your current health.Autor: Rachel Nall

Best Critical Illness Insurance Companies of 2024

This could be as simple as extending.

Critical illness insurance

What Is Critical Illness Insurance? Critical illness insurance is a type of supplemental .

![Singapore's Best Critical Illness Insurance (2020) - [Complete Guide]](https://www.retfree.com/wp-content/uploads/2020/07/9.-6-reasons-why-you-need-critical-illness-insurance.jpg)

We are here for you. Low coverage limits: CoverMe’s maximum coverage is capped at $75,000. With all this knowledge in hand, it’s time for the final step — getting a critical illness insurance policy. What is critical illness cover? Critical illness cover is a type of life insurance that offers protection if you’re seriously ill or injured.

Critical Illness Cover Quotes

Check out Assurity’s Critical Illness Insurance for more information or to get your price in minutes. Call Cavendish Online on: 0800 131 0004. [Analysis] 3 Best Recurrent Multi Payout Critical Illness Plan in Singapore. Our policy pays upon first diagnosis 100% of your maximum benefit if you have any of the following critical illnesses as defined in the policy. Medicines prescribed for you. Our serious illness cover plus covers 182.Critical Illness Insurance. 2 Each Critical Illness is assessed against a specific definition in the Product Disclosure Statement before any claim can be paid. As a result, it is essential to compare quotes to ensure you are getting the right cover, at a cost-effective price. GET INSTANT QUOTES.Stay fit with our Activ Health App.Compare critical illness insurance quotes.4,6/5(376)

What Is Critical Illness Insurance, and Do You Need It?

Table of contents. Below are four premium comparison tables, one for each of the following categories: male non-smoker, male smoker, female non-smoker, and female smoker. or Find an Agent near you Get quotes on Critical Illness and Cancer Plans fast . Lines are open Monday to Thursday 9am – 7pm, Friday 9am – 6pm. Compare & Buy Canada’s Best Critical Illness Insurance.Get your quote. Call us 24/7 at (800) 550-5971. Earn and track your HealthReturns™ to earn back up to 30% of your premium.

The cost of critical illness and the illnesses covered can differ significantly between insurers. For example, if a broker with a voucher gave you a premium just £1 a . Lowest insurance rates . Critical illness insurance is a type of life insurance product that covers you financially in the event you’re diagnosed with a serious illness. Critical illness insurance pays out a lump sum benefit if you suffer a serious . Critical illness cover is designed to pay . If you’re diagnosed with an .

Cheap Critical Illness Cover Quotes

The cost of the second opinion consultation will be borne by HL Assurance. Rate comparison across 20+ insurers.

- Critical Appraisal Tools Deutsch

- Create Gradient Palette _ Gradient Color Palettes

- Crossover Suvs Prices – Cheapest SUVs for 2024 and 2025

- Croissant Ungebacken Einfrieren

- Crime And Punishment Film | Crime and Punishment

- Css Display Flex 2 Columns – How to make flex box with limit 2 elements per row?

- Cro Sunny Neues Album _ Tracklist: Das neue Album trip von Cro + Songtexte

- Crescendo Nch Software – NCHソフトウェア Crescendo楽譜作成ソフト

- Cricinfo Live Streaming Server

- Cruce De Los Andes Pdf , Preguntas: El cruce de los Andes

- Crispy Fried Calamari Recipe _ Calamares Recipe

- Croatia Population , Croatia population, April 2024

- Crear Copia Seguridad Google Drive