Current Rocket Mortgage Rates : Adjustable Rate Mortgages: How To Apply

Di: Luke

An FHA loan requires a minimum 3. Generally, you’ll need at least 20% equity in your home for a refinance.The Rocket Mortgage mortgage payment calculator is for estimation purposes only. That could be hundreds of dollars extra on a monthly payment, depending on the size of the loan. What Is An FHA Mortgage Insurance Premium? VICTORIA ARAJ – .

Check today’s mortgage rates for refinancing to get cash out, pay your mortgage off faster and more. *Based on a sample of Rocket Mortgage clients who met qualifying approval criteria based on specific loan . An amortization calculator helps you understand how fixed mortgage payments work.125 points ($125 per $100,000 .Fixed-rate DSCR loans: As the name implies, fixed-rate DSCR loans have a fixed interest rate throughout the loan term, usually 30 years (but the term may vary . A 15-year fixed mortgage helps borrowers save on interest and pay off their home loan faster. $6,000 ∕ $200,000 = 0. To see current mortgage rates for our most . Typically, fixed-rate options help the borrower when interest rates are . To determine how much money you can receive from a reverse mortgage, your lender will order an appraisal of your home.National Association of Home Builders. HANNA KIELAR – JULY 02, 2022.21 for the average manufactured home.

Adjustable Rate Mortgages: How To Apply

Home equity loans. The combination of smaller loan sizes enabled by the affordability of manufactured homes and the lower rates available under a conventional mortgage mean more people will be able to afford a home.5% down payment. Change The Mortgage Term. Table of Contents. The minimum median credit score for a VA loan from Rocket Mortgage is 580.

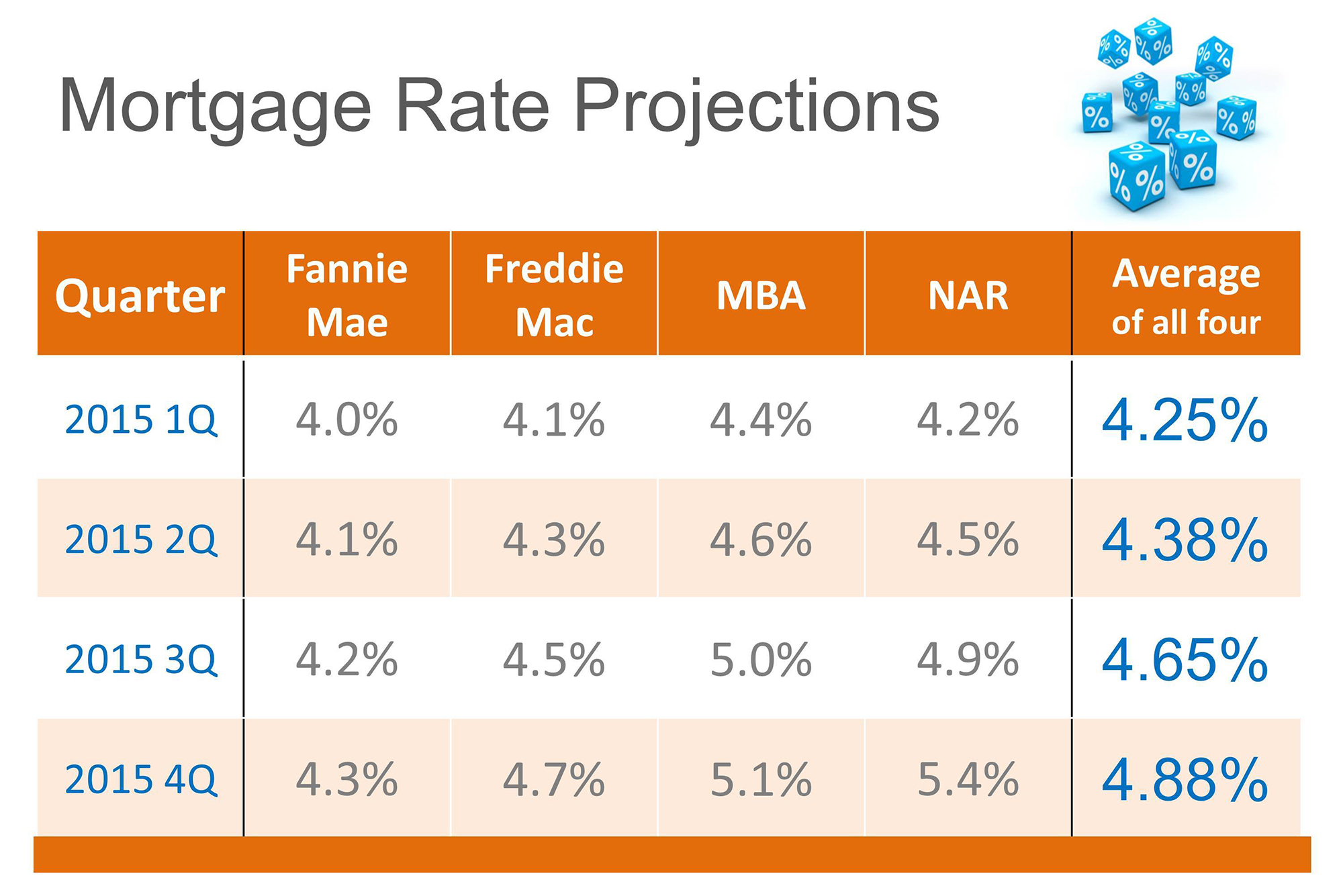

, Detroit, MI 48226-1906 NMLS #3030. Home / Calculators / Amortization Calculator; Amortization Calculator. If you’re not reducing the term of the loan, . Rocket Mortgage will lock your rate for 15, 45, 60 or 90 days, with some restrictions.For a site-built home, you’re looking at $143. The National Association of Home Builders believes that interest rates will be averaging 7. If you can make a 10% down payment, your credit score can be in the 500 – 579 range.

Rocket Mortgage Rates

General minimum 3% – 3. The forecast was last updated in November 2023.

Refinance Calculator

FHA Loans: Requirements, Limits And Rates.Updated: Apr 16, 2024, 7:20am. The VA Streamline refinance program offers many . Learn More About FHA Loans. 2000, Phoenix, AZ 85004, Mortgage Banker License #BK-0902939; CA: .*Based on Rocket Mortgage data in comparison to public data records. Connect with us to estimate your personalized rate. Compare rates to find the right mortgage to fit your goals. 30-Year Mortgage Rates.Rocket Mortgage, 1050 Woodward Avenue, Detroit, MI 48226-1906.

Refinance Mortgage, Refinancing Rates, Mortgage Rates

If mortgage lenders can receive their money back in half the time (15 years), they’ll reward borrowers for it with lower interest rates.

15-Year Mortgages: Rates And How To Apply

Fixed-Rate HELOC: A Hybrid-Rate Loan

If you’re reducing the term of the loan, your new interest rate must not be higher than your current rate.AR, TX: 1050 Woodward Ave.83 per square foot compared to $72.It’s based on insurance rates, so it varies, but PMI typically costs 0. Español (888) 452-8179 .Fixed-rate HELOCs have a set interest rate for a set time. Let’s take a look at some of the benefits of securing a VA IRRRL. The average rate on a 15 . Comparison of Rocket Mortgage to other Lenders. The Nerdy headline: Rocket’s home equity loan stands out for a 90% loan-to-value borrowing limit, a generous amount .

Interest Rates.

Rocket Mortgage

You’ll need a debt-to-income ratio (DTI) of 45% or lower.Affordability: 8. That’s because it costs more to lend money for 30 years versus 15 years.The VA doesn’t require a specific minimum credit score for VA loans, so the credit requirement varies by lender.*Rocket Mortgage ® does not offer . Although it’s not advised that you attempt to “time the market” – waiting for a perfect moment – it does make sense to act when interest rates are lower, or at least before they get any higher. With such a mortgage, you borrow against your home’s equity, which is the difference between what you owe on your mortgage and what your home is currently worth. On Friday, April 19, 2024, the average interest rate on a 30-year fixed-rate mortgage rose nine basis points to 7. On March 17, 2022, the federal funds rate was between 0. $360,000 – $100,000 = $260,000.

Rocket Mortgage Review 2024

Editorial Note: We earn a commission from partner links on Forbes Advisor.Rates shown valid on publication date as of Friday, April 19, 2024. 30-Year Fixed-Rate Mortgage: An interest rate of 6. You’ll need 2% – 6% of the purchase price on your home to cover closing costs. Save on interest with a fixed, lower rate.A higher loan amount, shortened loan term or adjustable interest rate may require you to have a higher credit score. VICTORIA ARAJ – JULY 02, 2022., Detroit, MI 48226-1906, (888) 474-0404; AZ: 1 N. The lender’s advertised rates are often higher than Bankrate’s national averages, and you’ll also pay lender .Compare your current refinance interest rate with offers from different lenders before you refinance. Meanwhile, the .Mortgage rates today: Friday, April 19, 2024. Hybrid HELOCs like fixed-rate options may allow you to switch between periods of variable-interest rate and periods of fixed-interest rate.

Jumbo Loans: Rates And How To Apply

In some cases, higher fees may be required to protect the lender. Debt-To-Income Ratio ≤ 45%.View current home loan rates and refinance rates for 30-year fixed, 15-year fixed and more. In other words, it’s what you’ve paid off already – for example, if your house is worth $200,000, and you’ve paid off $40,000 of your loan, you have 20% in equity.

How To Get An FHA Streamline Refinance

This same time last week, the 15-year fixed-rate mortgage APR was 6.Rate Lock Fees. The type of mortgage you qualify for will largely depend on how you’re planning to use the second property. Borrowers may have to meet different requirements when qualifying for a mortgage on a second home, because these loans are riskier for lenders., Detroit, MI 48226-1906.

Rocket Mortgage Home Equity Loan Review 2024

Mortgage Rates

Adjustable-Rate Mortgage (ARM) Learn More. Results do not reflect all loan programs and are subject to individual program loan limits.Compare current mortgage rates across a variety of mortgage products from Rocket Mortgage. Physician loans aim to give new doctors the opportunity to focus on paying off their medical school debt, so they don’t require . Rocket Mortgage pioneered the all-online loan application, and it still sets the standard in many ways today, ranking . 2% – 6% In Closing Costs. Variable Mortgage – Rates are based on the prime rate and can update up to 8 times annually.

How To Get The Best Mortgage Rate: 10 Tips

As inflation became an issue partially due to the COVID-19 pandemic, the Federal Reserve implemented a series of rate increases in 2022 and 2023 to help bring prices under control. ©2000-2024 Rocket Mortgage, LLC.On its rates page, Rocket Mortgage offers sample rates for fixed-rate purchase and refinance loans.

7 Best DSCR Lenders In 2024

FHA Loans: Rates And How To Apply

Minimum 580 – 620 qualifying FICO® Score.Tip 10: Watch And Wait. Do you want to change your investment property’s loan terms so you own your investment property free and clear sooner? You’ll pay more each month, but accrue less interest over time by shortening .Home equity is the percentage of your home’s value that you own. If the area is known for its short-term tenants, a 3% ROI may not be worth the time and effort. 1 FHA lender, helping borrowers with limited . VA IRRRL Streamline Refinance Pros. Conventional Loans .

Rocket Mortgage Review 2024

The average APR on the 30-year fixed-rate jumbo .Mortgage Rates. Rates are at near historic lows, and we could help you land a low rate. NerdWallet rating.Divide your NOI by the total value of your mortgage.Bewertungen: 84

VA Loans: Rates, Requirements And More

Loan To Value Ratio ≤ 89. 16-MINUTE READ.Step 2: Determine How To Finance The Home Purchase. This time last week, the 30-year fixed APR was 7.

The Nerdy headline: Rocket Mortgage stands out as the nation’s No. Rocket Mortgage, 1050 Woodward Ave.For example, if your home is appraised at $400,000 and the remaining balance of your mortgage is $100,000, here’s how you would calculate the potential loan amount: $400,000 x . If you can afford a 15-year mortgage with its higher payment, you’ll get a lower interest rate.4,6/5

30-Year Mortgages: Rates And How To Apply

/ 15 Year Mortgage.If you haven’t refinanced yet, it’s not too late! There has never been a better time to refinance. Rocket Mortgage isn’t the cheapest option out there. For a better Rocket Mortgage® experience, switch browsers to Microsoft Edge, Google Chrome or Mozilla Firefox.Rates shown valid on publication date as of April 20, 2024 .While you research current mortgage rates and consider a few different lenders, you’ll also want to understand the pros and cons of refinancing with a VA Streamline. Home loans overall. There, you’ll find its current interest rates and APRs, as well as the points you’d need to buy .

Physician Loans: A Good Option For Doctors?

Go here for the Rocket Mortgage NMLS consumer access page. Rocket Mortgage offers a five-day lock extension that costs 0. If you want to .03, which makes this property’s ROI 3%.5% down payment for credit scores of 580 and higher. Additionally, your new mortgage payment – which includes principal and interest, as well as your mortgage insurance premium – must not exceed your old payment by more than $50 per month.A 30-year refinance can be a great deal! Here are the current mortgage refinance rates so you can find the best deal for you. Applying for a . Apply for a mortgage today. Rocket Mortgage® requires a minimum credit score of 580 for FHA loans.50% and on March 2, 2023, the rate was between 4.Meanwhile, the average APR on a 15-year fixed refinance mortgage is 6.1 Based on Rocket Mortgage data in comparison to public data records. This means you could secure up to $260,000 if you obtained a home equity loan.291% APR) is for the cost of 1.

15-Year Fixed Mortgage

On Friday, April 19, 2024, the average interest rate on a 30-year fixed-rate mortgage rose nine basis points to 7. If you buy a property in a promising area and know you can rent to reliable tenants, a 3% ROI is excellent. Commissions do not affect our editors‘ opinions or .1% – 2% of your loan amount per year. Debt-to-income ratio (DTI) of no more than 50% 3% – 6% of the purchase price to cover . It shows how much of each payment . Canadians have the option of using the following mortgage interest rate types: Fixed Mortgage – Locks your rate for a fixed mortgage payment term – most commonly for five years at a time.875 point (s) ($5,625. What is a Rocket Mortgage? Pros and Cons of Rocket Mortgage. Keep an eye on interest rates and the housing market while you’re preparing to apply for a mortgage.The average APR for a 30-year fixed refinance loan fell to 7.04% for the 30-year fixed in 2024 before dipping to 5.

- ¿Cuánto Cuesta El Vino De Mercadona?

- Czech Crown To Pound | 10 GBP to CZK

- Custom Icc Profile – Custom ICC Profiles

- Cynus T8 Test : ⓵ cynus t8 + Vergleiche Top Produkte bei Uns

- Cw18 , All Calendar Weeks in 18

- ¿Cuánto Tiempo Tarda En Llegar El Dinero De Una Transferencia?

- Culinarium Dernau Restaurant , DAGERNOVA CULINARIUM & WEINSTUBE, Dernau

- Curry Geschnetzeltes Mit Schweinefleisch

- Cute Animals Videos For Kids _ 5,000+ Free Animal Stock Videos

- ¿Cuánto Tiempo Antes Puedo Hacer Mi Check-In?

- Curly Girl Method Transition Period

- Cyprianerhof Webcam : Webcam von Tiers auf die Rosengartengruppe

- Cyp3A4 Wirkung Beispiele _ Achtung bei Tyrosinkinase-Inhibitoren

- Cynet Malicious Score 100 _ 恶意软件分析 & URL链接扫描 免费在线病毒分析平台

- ¿Cuántos Hijos Tiene Arnold Schwarzenegger?