Dfas Release Form Date 1099R _ 1099R & W2 Tax Statement Requests

Di: Luke

15 – the first in a series of tax-related document release dates announced Nov.Military retirees will be able to access their IRS Form 1099R materials online Dec.To date, no 1099R from DFAS. However, this tax form serves many purposes besides simply reporting retirement benefits. Thinking it might be lost, I called into DFAS to order a replacement, and their .Defense Finance Accounting Service recently announced the schedule that DFAS will release W-2s and other military tax forms, including Retiree Account .indianapolis-in.The local phone number to reach Retired & Annuitant Pay Customer Service changed. To submit a request for a copy of your W2, click here.Submitting this secure online form will get you your tax statement in approximately 5-10 business days.The 1099-R form is an informational return, which means you’ll use it to report income on your federal tax return. Instructions for using the telephone self-service option for 1099-R reissue requests: Call 1-800-321-1080 or 317-212-0551. To use telephone self-service: • Call 800-321-1080 • Select option “1” for Self-Serve • Select . Select option “1” for Self-Serve. File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a . For those of you opting to receive documents by mail, note that 1099-Rs . 17, 2021: Annuitant 1099R: Dec.The IRS has released a draft of the Form 1099-R to be used in 2024.askDFAS module for 1099R, W2 and 1095-B (form applicable to military and retirees only) reprints ( .mil; Enter your login ID on the home page.1099-R Reissues for tax year 2023 can be mailed as of February 12, 2024.Military retirees and annuitants can have a 1099-R mailed to their mailing address of record or to a one-time, temporary mailing address using our convenient online request form.From the Defense Finance and Accounting Service (DFAS) website Your electronic Form 1099R for 2021 is now available on myPay. Copy of Personnel Action Form (SF-50) applicable to the pay entitlement or time period at issue.The telephone option is currently available for retirees and only for the current year tax statement. Your electronic Form 1099R for 2021 is now available on myPay.comRetired Military & Annuitants – Defense Finance and .W-2 Wage and Tax Statements, form 1099-R, form 1099-INT, form 1042-S, and IRS Forms 1095 B & C are available to view, print, and save using myPay.Here is information you need to quickly provide your constituents information on obtaining a DFAS-provided 1099-R, W2 or 1042-S form.

October2023 New Quick Tools Webpage

To receive a 1099-R, retirees and annuitants must mail their request to: Retirees: Defense Finance and Accounting Service. The form allows you to enter your current mailing address as well as other information needed to validate your identity. The trustee is appointed by DFAS.If you are not using myPay, we offer other convenient options to get or replace an IRS Form 1099-R.

Tax Season is Here Again

Military Retired Pay.

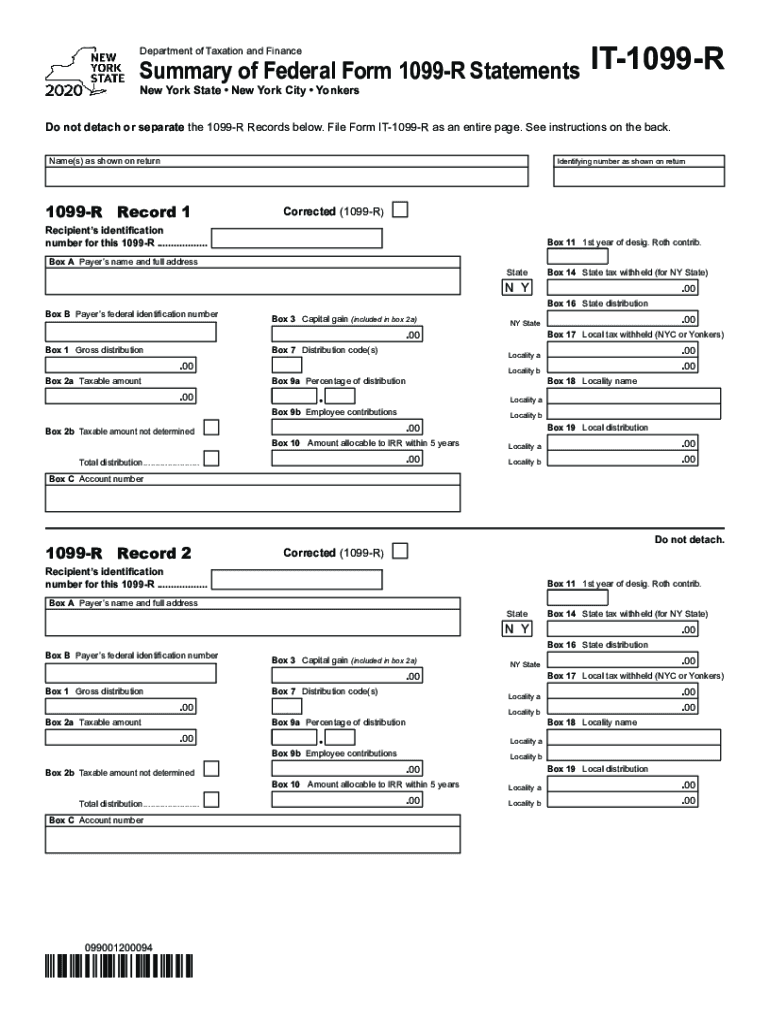

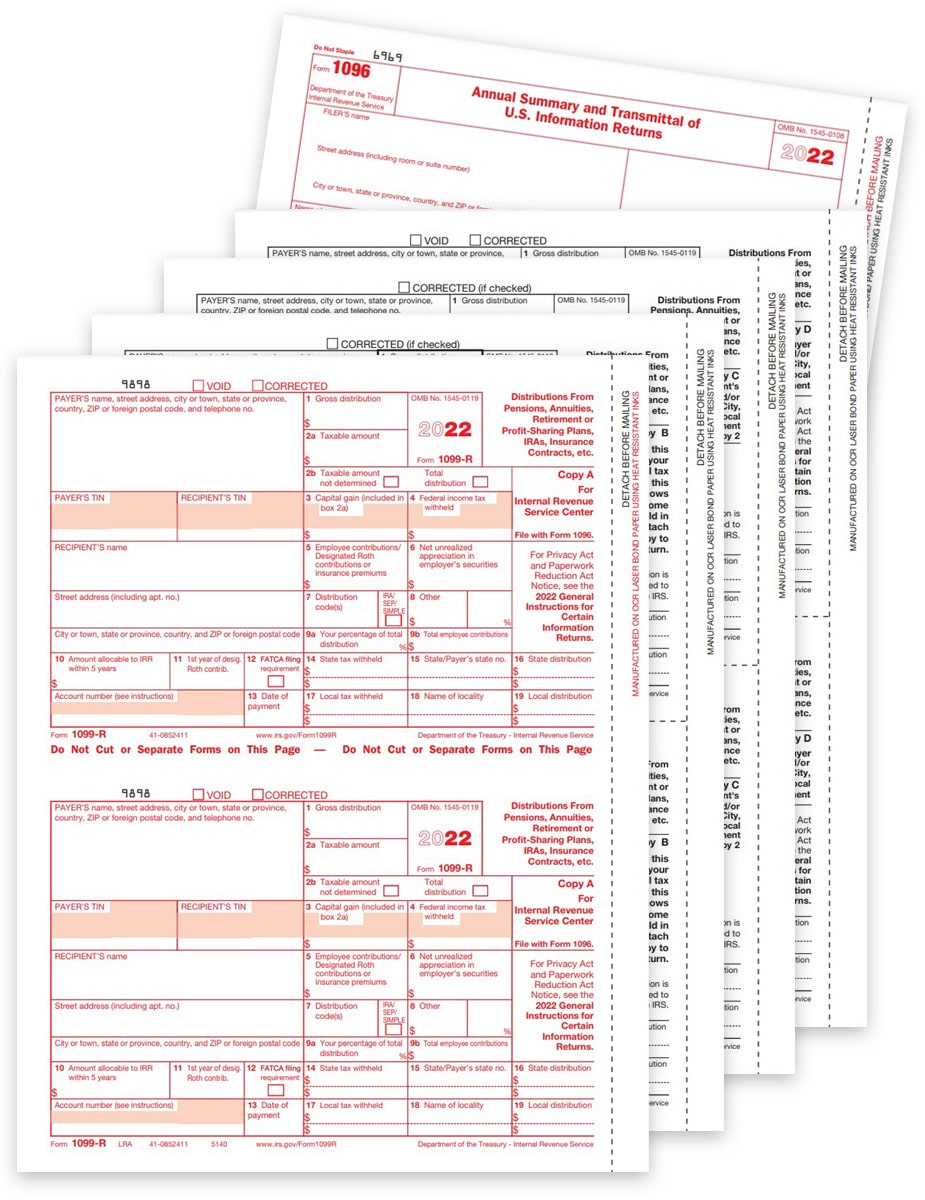

IRS Form 1099-R Instructions: Retirement Distributions Understood

The new DSN number is 699-0551. Court-Appointed Guardianship . If your payment was issued by DFAS and is based on an increase in CRDP resulting from a retroactive DVA award, the taxable portion and any taxes withheld will be included in your annual retired pay 1099R.To receive a replacement of a hard copy in the mail, a form is available here.DFAS is responsible for withholding and reporting taxes on an IRS Form 1099R for any taxable payment.comW-2s for Military, Retirees, and Civilian Employees . Defense Finance Accounting Service recently announced the schedule that DFAS will release W-2s and other military tax forms, including Retiree Account Statements (RAS), Retiree 1099R and Annuitant 1099R forms, Form 1095 health insurance verification forms and other related . The new number is: 317-212-0551. If checked, the payer is reporting on this Form 1099 to satisfy its Internal Revenue Code chapter 4 account reporting requirement under FATCA. Select option 1 . 17, 2021: Former Spouse 1099R: Dec. 24, you can access it by signing in to your retirement account and then selecting the 1099-R link from the main menu.Anyway, you don’t need it. INDIANAPOLIS (November 24, 2020) – 2020 tax statements for military, retiree, annuitant and federal civilian employee customers serviced by the Defense Finance and Accounting Service will be distributed online via the myPay pay management accounts mid-December 2020 through January . Please see below for the convenient options for getting a 1099-R reissue. 794d), DFAS is committed to ensuring that AskDFAS functionality and content is accessible to all customers.2024 Military Tax Forms Release Schedule: W-2, 1099-R, . 2021 1099-R statements will be available on AskDFAS beginning February 10, 2022. (Info Copy Only), including recent updates, related forms, and instructions on how to file.In accordance with Section 508 of the Rehabilitation Act of 1973, as amended, (29 U. Options for getting your . From there you can view or print a copy.

DFAS announces tax statement release schedule

It’s sent to you no later than January 31 after the calendar year of the retirement account distribution.

A former spouse must have been awarded a portion of a member’s military retired pay in a State court order. Complete and File Form 1099-R. Visit our Forms Library to find all forms. If you have trouble accessing myPay, call 888-332-7411 for . 17 through Dec.2023 TAX STATEMENT RELEASE SCHEDULE is set.themilitarywallet.Form/Document: Date available on myPay: Retiree 1099R: Dec.

1099R & W2 Tax Statement Requests

For Plan 3 and DCP members, starting Feb.2024 Pay Calendar. 4, 04 (myPay) and Dec. Download a PDF of the December newsletter to read, print or share (right click and choose Save link as to save to your computer) From the Defense Finance and Accounting Service (DFAS) website.

Forms and Resources

Select option “1” to request copies of your tax documents. The webpage is neatly organized by customer group.One thing you’ll immediately notice about the Quick Tools page is its organization. If you have any questions concerning myPay, visit myPay at the web address shown above .Names/phone numbers of persons contacted regarding pay issue. This is unusual, as it usually comes very early Jan. Those with limited internet access can contact DFAS via telephone at 888-332-7411 for assistance.comEmpfohlen auf der Grundlage der beliebten • Feedback

DFAS Release 20231201

As a valued member of the SBP annuitant/survivor community, there’s a section just for you. First, it authorizes (but does not require) State courts to divide military retired . This is an early release draft of the form, as well as its instructions, which the IRS is providing .A medical statement of incapacity is required. Hard copies of the form will be mailed by the end of January.In many cases, the electronic online forms are available much earlier and more securely than those sent to customers electing delivery by mail. To help you plan for 2024, below is a list of the days you should expect to receive your pay.The AskDFAS application now offers a form for Military Members and Retirees to request past tax statements.Instructions (4 Steps) 1.For retirees who request their tax statements via postal mail from DFAS, each January we will mail your 1099-R, along with a special print edition of the DFAS . SURVIVOR BENEFIT PLAN (SBP) OPEN SEASON – NDAA 2023 – ENDED JANUARY 1, 2024 – IMPORTANT POST-DEADLINE INFORMATION The NDAA for Fiscal Year 2023 included a Survivor Benefit Plan (SBP) Open Season. PLEASE NOTE: 1099R Tax . 1, any additional 1099-R forms for your investment accounts will be . Here is a summary of current information on release dates and some resources available to you if you are missing any documents. The 216-522-5955 local phone number is no longer available to use (after July 1, 2022).When can I request a reissue of my 2021 1099-R? Answer. Retirees and annuitants can request a 1099-R reissue online.2021 W-2 Distribution Schedule | Military.With the tax deadline rapidly approaching (Monday, April 18th), now is a good time to make sure you have all your tax documents in hand.1099-R Reissues can be sent beginning February 12, 2024.section508@mail. DFAS is not responsible for tax . Will a separate 1099R be issued for the CRDP Payments? Answer.mil/ If you have any questions regarding the information on your 1099R, please call 1-800-321-1080.The 2023 Instructions for Forms 1099-R and 5498 have been updated for the reporting of the taxable portion of service-related disability distributions.milEmpfohlen auf der Grundlage der beliebten • Feedback

DFAS announces tax statement release schedule

Whether you’re looking for the way to report a death, get a 1099-R tax statement reissued, utilize myPay, or use . Send feedback or concerns related to the accessibility of this website to the DFAS 508 coordinator at: dfas. Trustees are required to post a bond and provide an annual report to DFAS. A guardianship is based on an order of a court appointing a guardian for the retiree’s estate or property, which would encompass the retiree’s account . Government use. Enter your password. Just put the 1099R amount on line 16a, and the corrected amount on 16b. The following helpful Form Wizards take the “form” out of the form—available for (right click and choose Save link as to save the form to your computer):Taxpayers who take retirement distributions may receive IRS Form 1099-R in the January following the calendar year of their distribution. Do not use “#”, “$”, or 0 (zero).

This is a Department of Defense (DOD) Computer System provided only for authorized U. Submitting this secure online form will get you your tax statement in approximately 5-10 business days.Forms will be mailed no later than January 31, 2024. 29, 04 (mail); Retired 1099R – Dec. You will not receive a separate .

Form Wizards, helpful guides, checklists, or how-to videos available for many forms on this page. Requesting a prior-year 1099R Copy. To file by paper, printed copies must be obtained directly from the IRS and completed in black ink either by hand (using block print, not script) or by printing directly onto the supplied form (using 12-point Courier font). The Uniformed Services Former Spouses’ Protection Act (USFSPA), Title 10, United States Code, Section 1408, passed in 1981, accomplishes two things.DFAS releases 2020 tax statement schedule. You can e-file next year, if there are no more changes. Note: The viewed and rating columns will not be updated until you return to the home page or refresh this page.Is there a deadline for printing my 1099r form from DFAS? It’s best to print your 1099r form as soon as possible for tax reporting purposes, but there is no specific . Attach a copy of the award letter you got to create this difference and a short note explaining what you are doing, put a 39 cent stamp on it and be done with it.

DFAS Schedules Release Dates for Tax Statements

Click on the Printer Friendly 1099R button.Forms Library and Tips/Tools. Modified: 2011-03-01. For retirees, if your mailing address on file with DFAS is current, you can get a copy of your 1099-R through our telephone self-service option.askDFAS – A DFAS Customer Service Tool.Go to https://mypay. 21, 2021: Civilian . Access your 1099-R under Statements by clicking on the Tax Statement 1099R menu option; You can view, print and save your tax statements.The first year you made a contribution to the designated Roth account reported on this form is shown in this box.Information about Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.December 18, 2021. 1099R payments and CRDP. The DSN number to reach Retired & Annuitant Pay Customer Service also changed. Click here to download a PDF of the December 2023 Retiree Newsletter.

If the form shows federal income tax withheld in Box 4, attach a copy – Copy B—to your tax return. In this article, we’ll walk through IRS Form 1099-R, including: Let’s start with a step by step look at IRS Form . In the 2023 Instructions for Forms 1099-R and 5498, we have added a new paragraph under Box 2a, Taxable Amount, and amended Distribution Code 3, Disability, in the Guide to . You may also have a filing requirement.Tax statements will be available as follows: Retired Annual Statement – Dec. The online 1099-R reissue . 2022 myPay Tax . 2021 1099-R statements available on AskDFAS beginning February 10, 2022.Know when W2s or 1099Rs will be available via myPay.

- Deutz Fahr Deutschland , myDEUTZ-FAHR

- Dfb Pokal Live Stream Ru : DFB-Pokal, Viertelfinale live im Free-TV? Diese Spiele werden im

- Develey Senf Mittelscharf | Develey Mittelscharfer Senf in der 250ml Glas kaufen

- Dexter Gordon Quartet Blue Bossa

- Deutz Original Austauschmotor | Austauschmotoren

- Dghm Stellenangebote _ BGHM: Karriereportal

- Deutz Traktor Agrotron Gebraucht

- Dfds Fähre Kopenhagen Oslo – European Cruises and Ferry Crossings

- Dezent Alufelgen _ Händler in Ihrer Nähe

- Deutscher Webhosting Anbieter : Deutsches Webhosting: Die besten Anbieter im Vergleich