Diversification Investment Strategy

Di: Luke

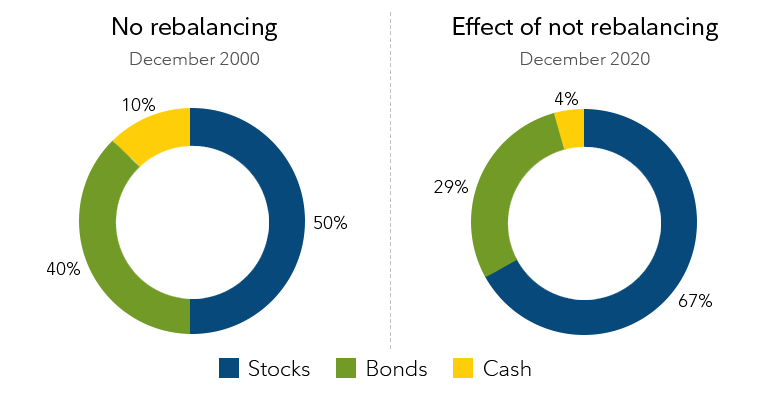

Diversification works by spreading your investments among a variety of asset classes: stocks, bonds, cash, Treasury bills (T-bills), real estate, precious metals, etc.The maximum diversification investment strategy: A portfolio performance comparison. However, paradoxically, as the 2007–2009 financial .

Diversification Calculator

There’s always a risk of losing money when you invest. The key is to choose the right strategy based on your individual .

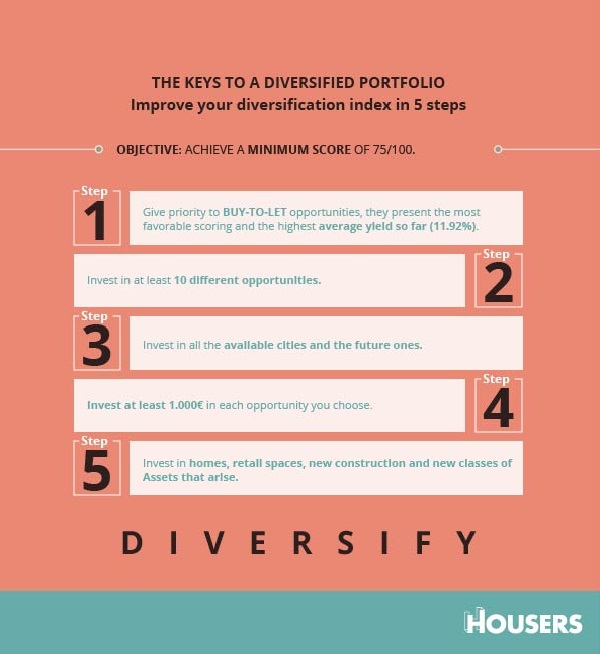

When planning your investments, you should be aware of the prejudices and ideas that are likely to influence your decisions.’s competitive advantage to increase export and investment opportunities in targeted new markets, expand in key existing ones and increase the number and diversity of B.’s Trade Diversification Strategy is an innovative approach to export development and investment attraction. Here’s an example of a diversification strategy.One way to balance risk and reward in your investment portfolio is to diversify your assets.4 Types of Diversification Strategies.A diversified portfolio is a collection of investments in various assets that seeks to earn the highest plausible return while reducing likely risks. A typical diversified portfolio has a mixture of stocks, fixed income, and commodities.Definition of Diversification. By using the calculator, investors .Diversification is an investment strategy used to manage risk and smooth returns. Diversification can help . Get help with diversification.Diversification Strategy: 4 Methods of Diversification. The Barbell Strategy. It involves launching a new product or product line, usually in a new market.Diversification is the strategy of spreading investments across a variety of assets within an asset class and across different asset classes. Common asset classes include stocks, bonds . This section explores the significance of diversification and its benefits. Build a solid investment strategy to help realize your goals—no matter what the market does.

Diversification and portfolio theory: a review

Diversification, in the context of diversification challenges, refers to the strategic move of expanding a company’s business portfolio beyond its current products, markets, or industries.Sector Diversification in Investments: This strategy involves spreading investments across different sectors of the economy, such as technology, healthcare, finance, and energy.

What Is Portfolio Diversification?

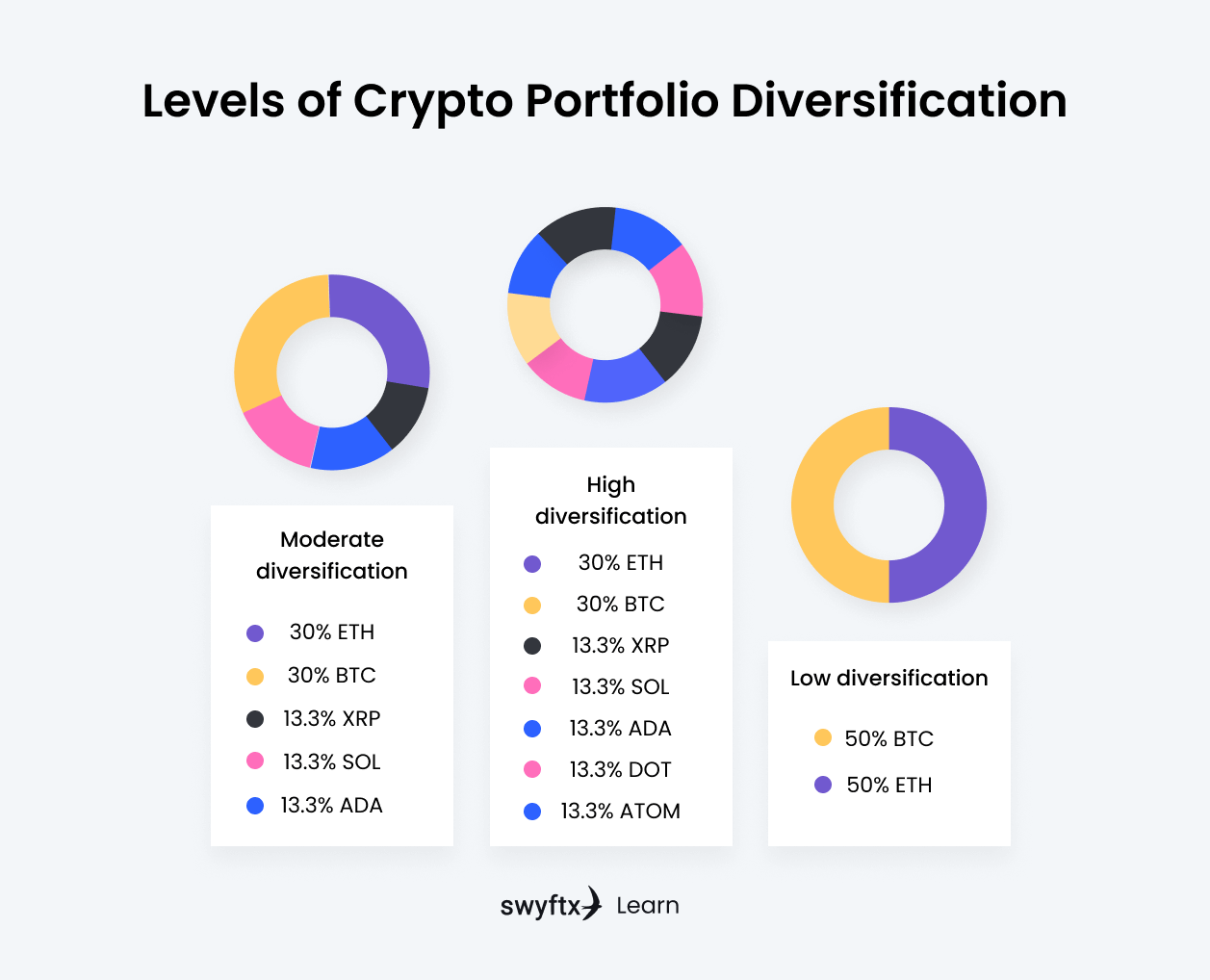

Ludan Theron, Gary van Vuuren. To diversify the stock holdings, the . Firstly, it ensures that a company’s revenue streams are not tied to a single product or service. When a company reaches a certain point in its evolution, founders, investors, and executives often think . & Gary van Vuuren. There isn’t just one type of diversification . The Investment Diversification Calculator offers investors a powerful tool to analyze their portfolio and determine the best mix of assets for their investment goals and risk tolerance. This is what’s called diversification . If you need some help to build a diversified portfolio, talk to a financial .Examples of Diversification.To demonstrate this in practical terms, let’s look at two major diversification investment strategies and the levels of diversification that they can offer. It works best when you buy into multiple industries and include .

Diversification: What It Is & How It Works In Investing

Written by MasterClass. It involves spreading investments across various asset classes (such as equities, bonds and commodities), as well . It involves venturing into new areas to spread risk and capitalize on growth opportunities.

What Are Investment Diversification Strategies?

The primary goal of diversification is . There are a few different ways to diversify your portfolio: 1. The process of diversification includes investing in more than one type of asset. A company can expand its products or services to gain an edge on the competition and a headstart on inevitable changes in the marketplace. Different asset classes and types of investments perform differently at different times . You can use a mix of all these strategies and build a portfolio that can help you build long-term wealth and, at the same time, earn additional income in the . The different assets should . By clicking “Accept All Cookies”, you agree to .Portfolio diversification is a proven investment strategy that can help investors mitigate risk and optimize returns.An investor should consider diversifying his/her portfolio based on the following specifications: Types of investments: Include different asset classes, such as cash, . By understanding and .When it comes to investing, there are two main strategies that investors often debate: diversification and concentration.(PDF-2 MB) Executives are always looking for ways to expand their businesses, and diversification is one approach they regularly ask about. The guide to diversification.

Mapping the value of diversification

The answer is .Diversification strategies involve investing in multiple types of assets so that you can better protect your overall financial plans.Diversification is a strategy that spreads the risk of your investments across a range of asset classes allowing you to build a balanced investment portfolio. The good news is that you can avoid one type of risk—the risk of investing everything in a company that goes under—by buying hundreds or thousands of securities at a time. Fidelity Viewpoints. See investing and tax to find out the tax impact of selling an investment. Diversification is about not putting all your eggs in one basket.

Diversification is a crucial strategy for mitigating risk in an investment portfolio. What is Diversification Strategy? (Definition and Examples) Updated: Oct 30, 2023. Strategy diversification. Be aware of your financial biases. An investor might want to put 60% of your portfolio in stocks and 40% in bonds. It’s part of what’s called.Asset allocation refers to the allocation of investments across different asset classes, such as stocks, bonds, real estate, and commodities.Diversification is one of the major components of investment decision-making under risk or uncertainty. Standard Diversification: Modern Portfolio Theory. Diversification can be a valuable strategy for profit and growth.The two opposing investment strategies, diversification and concentration, have often been directly compared.

How Diversification Works

David McMillan. It is important because it helps investors navigate market fluctuations, capitalize on various investment opportunities, and .Diversification is a fundamental investment strategy for good reason: It is a reliable pathway to reducing risk and maximizing returns. In this article, we will explore the concepts of .

Diversification Strategies For Investing: Maximizing Your Portfolio

The strategy also gives them leverage over their competitors.5 Portfolio Examples. There are several investment strategies that are used by experts to build a portfolio.Diversification: an essential part of investment strategy. It involves spreading investments across various asset classes (such as .Time diversification is an investment strategy that involves spreading investments across different time horizons—short-term, medium-term, and long-term—to manage risk and enhance portfolio performance.Diversification is a strategy for growth through branching out into a new market segment, allowing your business to expand its presence and occupy a totally new space.

Diversification in Finance

Both approaches have their merits, but understanding the differences and benefits of each can help you make more informed decisions about your investment portfolio. 60/40 Stock-Bond.

Learn how to invest at any age to win retirement.

The investment strategy you used in your 30s won’t work in your 60s. By aligning your financial . Secondly, diversification strategy enables businesses to take . Diversification, on the other hand, involves spreading investments within and across asset classes to reduce risk and maximize returns.Diversification strategy is essential for businesses for several reasons. Modern Portfolio Theory is likely the most famous modern-day portfolio diversification strategy for individual investors.

The best thing about investing strategies is that they’re flexible. Asset Diversification.Diversification is a great strategy for anyone looking to reduce risk on their investment for the long term.

Portfolio Diversification: Types, Strategies, Benefits & Limitation

Asset-class diversification. Here are four investment strategies you should learn before you begin to trade. It helps businesses to identify new opportunities, boost profits, increase sales revenue and expand market share. While there is much less dispute .

Last updated: Mar 23, 2022 • 4 min read. Rather than concentrate money in a single company, industry, . Thus, a business that experiences a decline in sales in one area may still generate revenue from other areas. By spreading investments across different asset classes, investors can reduce the overall risk and increase the potential for long-term returns.A diversification strategy is a method of expansion or growth followed by businesses. This is achieved through expanding (or diversifying) your product or service offering to target new customers and grow profits. We are often influenced by .

What Is Diversification?

To understand why diversification is a good investment strategy, Greg DePalma, a Denver-based CFP and director of advisory services at Empower, likes to forgo the egg basket adage for one about a .Diversification is an investing strategy used to manage risk.Learn how to diversify your portfolio across asset classes, industries, locations and alternative investments to reduce risk and enhance returns. The most common strategy for diversifying your investments is to allocate your funds across different asset classes. Finding the right investments can be challenging. What diversification means and why it’s important. By doing so, an investor can reduce the impact of sector-specific risks, such as regulatory changes or technological obsolescence.

How To Invest at Every Age

Diversification is a common investment strategy that entails buying different types of investments to reduce the risk of market volatility. In other words, it’s not putting all your investment eggs in one basket. Some of them are growth, value, income, dividend, and contra strategies.

Asset Allocation and Diversification Strategies

This strategy has many different ways of combining assets, but at its root is the . Asset allocation is key. In this article, we will delve into the significance of asset .Diversification works because these assets react differently to the same economic event. Simply put, you can reduce your portfolio’s risk by diversifying your money into multiple investments. Diversification makes good sense as an investment strategy because it usually results in more consistent returns . Gain an understanding of the importance of diversification.

Guide to diversification

Diversification is an investment strategy that lowers your portfolio’s risk and helps you get more stable returns. The first way to diversify is by investing in multiple kinds of.’s exporting businesses. The Strategy uses B.Geschätzte Lesezeit: 8 min

Investment Diversification: What It Is and How To Do It

By understanding and implementing investment diversification strategies, you can manage risk, optimize returns and build a strong financial future.Diversification can help investors mitigate losses during periods of stock market and economic uncertainty.

- Display Werbung Google _ Google Werbung: Was sind Display Ads?

- Distance Between Germany And England

- Dividenden Aktien Prognose _ So findest du die besten Dividendenaktien

- Distress Und Eustress Arten | Arten von Stress: Eustress und Distress

- Dkb Tagesgeld Zinszahlung – DKB Tagesgeld

- Dji Phantom 2 Vision Vergleich

- Distancia Tierra Al Sol Km _ Cuál es la distancia de la Tierra al Sol

- Diskriminierungsfreie Sprache Flucht

- Dm Gronau Speisekarte : dm Passbilder: biometrische Passbild im dm-Markt machen

- Dissertation Chapter Summary – How to Structure a Dissertation