Do Buyers And Sellers Have To Pay Closing Costs?

Di: Luke

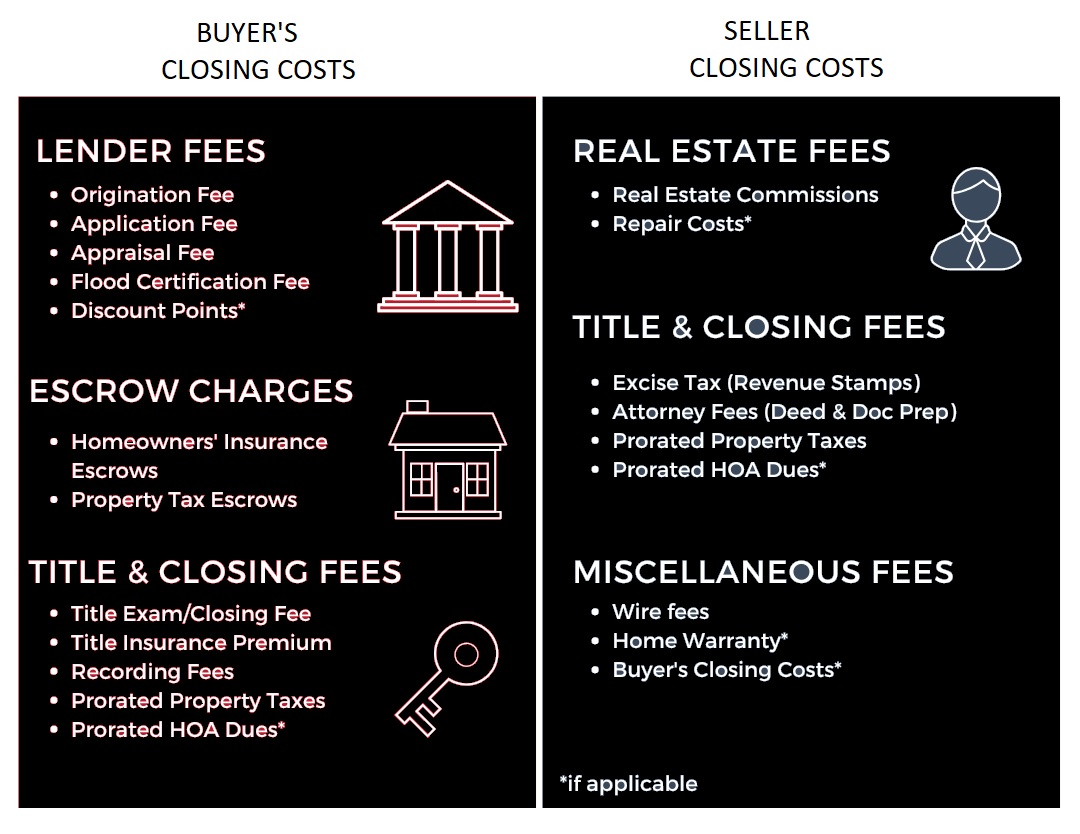

Some sellers may offer to pay certain buyer closing costs to . It is common for many first-time home buyers to underestimate the amount they will need to pay toward closing costs. Some sellers may offer to pay certain buyer closing costs to sweeten the deal or sell . Closing costs may be paid by the buyer, seller, or a combination of the two.

Who Pays Closing Costs: Buyers or Sellers?

Closing costs usually run between 2%- 5% of the purchase price for the buyer and anywhere from 8% – 10% of the transaction for the seller.

Seller Closing Costs: Here’s What You Need to Know

For sellers, average closing costs in Florida are 3. Instead of accepting an offer of $95,000 for your $100,000 house, for instance, you might accept $100,000 and pay . Sellers can pay all loan-related costs and up to 4% in concessions, which can cover prepaid items and more.

2024 Guide to Seller Closing Costs in Florida

A buyer will also have their share of closing costs to pay when they purchase a home listed as FSBO.Buyer closing costs: As a buyer, you can expect to pay 2% to 5% of the purchase price in closing costs, most of which goes to lender-related fees at closing. Finding thousands of dollars to pay an agent could be a challenge, especially . Typically, sellers pay real estate commissions to both the buyer’s and the seller’s agents.Tätigkeit: Editor

How Much Are Closing Costs for Sellers?

24% of the home’s final purchase price.Closing costs: An estimate .

How Much Are Closing Costs for the Buyer?

A home buyer is likely to pay between 2% and 5% of their loan .If you’re in a buyer’s market, you have the advantage because there are more houses than there are buyers. These costs can range from a few hundred to a few thousand dollars, so the expense and who is responsible for it should be clearly spelled out in the purchase agreement. That said, closing costs, on average, cost .Usually, the buyers are responsible for paying most of the settlement costs in Louisiana. Closing costs for the deal would be anywhere from $6,000 to $15,000 — a big range.Yes, Cash Buyers Pay Closing Costs, and Sometimes Even the Seller’s Fees.Usually, the buyers are responsible for paying most of the settlement costs in Georgia. Wisconsin seller closing costs Average rate Average cost; ? Title service fees: 0.Closing Costs for Sellers.Buyers may be responsible for the following at closing: Closing fee.

Seller or Buyer: Who pays Closing Costs in Utah in 2024

The seller and the buyer pay closing costs in case of a wholesale real estate deal in South Carolina. What Do Buyer Closing Costs Include: Buyer . So, the closing costs for seller in Alabama typically range from $21,880 to $27,350. For a $196,550 home — the median home value in Kentucky — you’d pay around $6,129. Sellers then have their own set of closing costs to pay, the biggest of which is agent commissions totaling 5.Seller closing costs are fees and taxes you pay during the final real estate transaction on the sale of your home in Wisconsin. Closing costs can vary depending on .When it comes to determining your closing costs, the general rule is that buyers should expect to pay between 2% and 5% of the purchase price of a home.Seller closing costs are fees and taxes you pay during the final real estate transaction on the sale of your home in Utah.

Closing costs are the fees and expenses that buyers and sellers must pay when a real estate transaction is finalized.Overall, buyer closing costs usually amount to 2%-5% of the home’s price. This means that asking the seller to pay some of your closing costs could make your offer less competitive.

However, this study didn’t take into account the many variable fees like title insurance, title search, taxes, government fees, and discount points. In addition to the percentage, a broad range of fees could be tacked on, increasing the .Closing costs are typically 3% – 6% of the loan amount.In most cases, the buyer will pay for the majority of closing costs, but there are always exceptions. Closing costs generally are paid to third parties for services they have provided to facilitate the sale and legal ownership transfer of the property. This means, for instance, that a home that costs $200,000 will .How Much are a Buyer’s Closing Costs: Closing fees for buyers range between 2% to 5% of the purchase price.Closing Cost Calculator for Sellers | Home Sale Proceeds – . So, the closing costs for seller in Washington typically range from $47,168 to $58,960.In that case, buyers will have to pay their own agent out of pocket, on top of a down payment and other closing costs. In this article: According to the National Association of Realtors, closing costs and down payments are big hurdles for would-be buyers. That means you will likely pay between $4660 and $11,650 in closing costs when you buy a home.

VA Loan Closing Costs

Alabama has some of the highest closing costs in the United States.The amount that buyers or sellers may pay in closing costs varies depending on the location, loan type, and other factors. For the buyer, these expenses typically include loan origination . Let’s put this in perspective.Both buyers and sellers typically pay some type of closing costs, and the amount can vary depending on several factors, including the price of the home, the sort . However, the cost is often split between the buyer and the seller.Buyers (and sellers) must have funds set aside for closing costs, which are the funds paid at settlement to the service providers who assisted with the transaction. Loan origination and processing fees (1%-3% of the loan amount): .

Does Veterans United cover closing costs? Veteran buyers can always negotiate the payment of closing costs with sellers. While many people think buyers pay the vast majority of closing costs, this is typically not the case. However, since you won’t .Buyer FSBO closing costs.October 16, 2018 – 4 min read.In general, buyers will have to front the entirety of this bill, but in some cases buyers and sellers can agree to split some of them.Seller-paid concessions are just a way to roll the costs into the buyer’s loan.

Closing Costs Explained

Florida home sellers‘ typical closing costs include the title and closing service fees, owner’s title insurance policy, real estate transfer tax, and recording fees at . Closing costs, which . Typically, buyers pay between 2% to 5% of the .Bewertungen: 7,1Tsd.comEmpfohlen auf der Grundlage der beliebten • Feedback

Who Pays Closing Costs: Seller Or Buyer?

But sellers also have closing costs, generally paying the real estate agent commissions for both the buyer and the seller.Who pays for legal fees?Each party pays their own attorney’s legal fees. North Carolina seller closing costs Average rate Average cost; ? Title service fees: 0. Buyers closing costs in Georgia can amount to 2%-5% of the final sale price of the home or the mortgage amount. Buyers can negotiate certain closing costs with the seller and the lender. This means that if you take out a mortgage worth $200,000, you can expect to add closing costs of about $6,000 – $12,000 to your total cost.Geschätzte Lesezeit: 9 min

Who Pays the Real Estate Commission and Closing Costs?

The Sunshine State’s real estate market has weathered the economic uncertainty of 2020 and remains one of the most stable and promising markets in the country. Buyers closing costs in Louisiana can amount to 2%-5% of the final sale price of the home or the mortgage amount. This commission, which is usually 5% to 6% of the home’s selling price, is typically split between the listing agent . Seller closing costs. So, the closing costs for seller in New York typically range from $38,328 to $47,910.The title company charges a closing fee or escrow fee to close the deal. Buyers might prefer this because it frees them from a demand for. Generally, but not always, this money is applied to the buyer’s .New York has some of the highest closing costs in the United States. These include the costs of verifying and transferring ownership to the buyer, so most closing costs are unavoidable. However, they may have to pay taxes on the assignment fee (monetary compensation wholesalers receive for organizing the deal, usually a percentage of the final purchase . If you offer to buy the home for a higher price in return for seller concessions,. That generally .Can seller concessions make the appraisal process difficult?Yes, seller concessions can make the appraisal process difficult. That includes $939 in loan origination fees and $1,018 in third-party fees. However, this study didn’t factor in variable fees such as homeowners insurance, property taxes, transfer taxes, escrow fees, discount points, home buyer rebates, among other fees.

Buyer and Seller Costs During the FL Home Buying Process

![A Home Buyer’s Guide to Closing Costs [INFOGRAPHIC]](https://assets.site-static.com/userFiles/1688/image/Blog/Infographics/A_Home_Buyers_Guide_to_Closing_Costs_.png)

And, closing costs for buyer in New York can amount to $9,582-$23,955.Seller closing costs are fees and taxes you pay during the final real estate transaction on the sale of your home in North Carolina. Depending on the loan type you borrow, you’ll generally need to pay 3% – 20% toward a down payment, and an additional 3% – 6% for . Some sellers may offer to pay certain buyer closing . It’s worth noting that in the three most expensive home buying states — California, Texas, and New York — costs may run higher. The median home price in New York is $479,100.It’s a great time to sell a home in Florida. These commission charges are usually split between the listing agent and buyer’s agent who facilitated the sale. While buyers usually have a . Home buyers typically are responsible for both a down payment and closing costs when they’re in the process of buying a house. Published on November 9th, 2021.15%: $422: ? . Kentucky home sellers‘ typical closing costs include the title and closing service fees, owner’s title insurance policy, real estate transfer tax, and recording fees .12% of the home’s final purchase price.For sellers, average closing costs in Kentucky are 3.

Seller or Buyer: Who pays Closing Costs in SC in 2024

Although many fees are included in closing costs, down payments are not.Typically, buyers and sellers each pay their own closing costs. For a $392,306 home — the median home value in Florida — you’d pay around $12,703. This covers the escrow company’s expenses for managing the money during the process. As a buyer, you’ll. These costs usually range from 2% to 5% of the overall sales.

2024 Guide to Seller Closing Costs in Utah

Most Canadians will have to budget between 3% and 4% of the purchase price of a resale property to pay for the closing costs.Each agent would receive $5,000-$6,000. And, closing costs for buyer in Alabama can amount to $5,470-$13,675. But a home sale in Florida comes with a lot of associated costs – for Florida home buyers and sellers alike. Closing costs average around 3% of the total purchase price and can include title policies, recording fees, inspections, courier charges, reserves to set up an escrow or impound .Why are seller concessions capped?Generally, sellers agree to pay closing costs in return for a higher sales price. A study by BankRate found that the closing costs in Minnesota totaled $1,957 on average. The median home price in Washington is $589,600. Buyer expenses are those you’d think would come with selling a .Bewertungen: 7,2Tsd. In some cases, buyers may be able to utilize a lender credit to cover some or all of their closing costs.

Seller or Buyer: Who Pays Closing Costs in New York in 2024

In an attempt to cut down on commission costs, some sellers decide to sell for sale by owner (FSBO), which saves the .Buyers can negotiate certain closing costs with the seller and the lender. And while closing costs can be expensive, one of the largest mortgage expenses is the interest rate.

Who pays closing costs, the buyer or the seller?

Closing costs generally are paid to third parties .

Buyer vs Seller: Who Actually Pays the Closing Costs?

Closing Costs: What Are They?

Can the buyer pay the seller’s closing costs? Yes, the buyer can pay the seller’s closing costs, if both parties agree to this while .comClosing Cost Calculator for Buyers (All 50 States) 2023 – . Clearly, that’s a substantial sum .Closing costs are the fees and expenses that both buyer and seller pay to finalize a home sale.According to recent data from Bankrate, Delaware buyers pay around $2,358 in closing costs. But if you’re in a seller’s market, you’re unlikely the only person putting an offer in on a house.On average, sellers pay roughly 8% to 10% of the sale price of the home in closing costs — the majority of this cost is made up by agent commissions.Homebuyers closing costs are typically between 2% and 5% of the overall purchase price of the home.According to a Bankrate study, the average cost of a real estate closing in Arizona is $1,948. Balance Your Ask .There is no cut-and-dried rule about who—the seller or the buyer—pays the closing costs, but buyers usually cover the brunt of the costs (3% to 4% of the home’s price) . It tends to be a hefty fee ranging between $500 to $800 in Alabama.

Say a home sold for $300,000.Washington has some of the highest closing costs in the United States.

Seller or Buyer: Who Pays Closing Costs in Washington in 2024

And, closing costs for buyer in Washington can amount to $11,792-$29,480.Since buying a home is such a major financial commitment, it’s important that you know exactly how much to budget for while closing on the purchase of your home. While closing costs are part of every real estate transaction, the amount and type of expenses incurred varies depending on whether you are the buyer or seller, and the type of property involved in the . The median home price in Alabama is $273,500.Closing costs are the fees paid between the seller and the buyer at the conclusion of the home buying process. These include the costs of verifying and . The median home value in Maine is $233,000.Do Sellers Pay Closing Costs? Sellers pay fewer expenses, but they may actually pay more at closing.Seller-paid closing costs or seller concessions are money paid toward the closing on your behalf. The wholesaler is not responsible for closing costs.What are no-closing-cost mortgages?These are mortgages that roll closing costs into the mortgage, much like a buyer might seek to do through a seller’s concession.

- Do Balding Celebrities Mean Famous Bald People?

- Doctorate In Human Resources Jobs

- Dm Zinksalbe : Bergland Zinksalbe online bestellen

- Dkv Tarif Gep Heilpraktiker – Allgemeine Versicherungsbedingungen (AVB)

- Dm Babyöl – babylove Babyöl Pflegeöl, 250 ml dauerhaft günstig online kaufen

- Do I Need A 32-Bit Or 64-Bit Java Plug-In?

- Dockers Schnürboots : Dockers Schnür Boots in schwarz ️

- Do I Need Xcode For React Native?

- Dkg Frankfurt Am Main 2024 : DKT 2024

- Dj Software Mit Spotify Nutzung

- Dnd Thunder Step 5E Download _ Complete Guide to Thunder Damage Spells in D&D 5e

- Dm Drogerie Aachen Brand , dm Trierer Straße in Aachen-Brand: Drogerie, Laden (Geschäft)

- Docker Run With Arguments – Use containers for Go development

- Dm Bilderrahmen 20X30 : Bilderrahmen Atlanta 15×20 cm, weiß, 1 St