Effective Duration Of Bonds , Duration and Convexity, with Illustrations and Formulas

Di: Luke

Effective Duration Formula = (51 – 48) / (2 * 50 * 0.

Spread Duration

A bond with an embedded option tends to behave differently from . P (1) – Bond’s price if yield decreases by Y% P (2) .Effective duration is a calculation used to approximate the actual, modified duration of a callable bond.Effective Duration Definition & Example | InvestingAnswersinvestinganswers.

Unlike standard duration, it takes into account the inherent . Valuation models must be used in calculating new prices for changes in yield when the cash flow is . Therefore, in our example above, if interest rates were to fall by 1%, the 10-year bond with a duration of just under 9 years would rise in value by approximately 9%. It takes into . Thus, a bond trading at par with a modified duration of 4.Duration measures the bond’s sensitivity to interest rate changes, while maturity is the length of time until the bond’s principal is repaid.

Duration

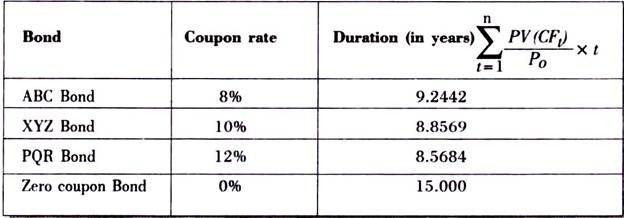

Two Methods to Estimate Duration of a Portfolio. the return of a sovereign bond in which the headquarter is located. If interest rates were to fall, the value of a bond with a longer duration would rise more than a bond with a shorter duration. Therefore that term (and that term alone) has non-zero duration. Default Risk and the Effective Duration of Bonds. Imagine that you have a bond, where the: Coupon rate is 6% with semiannually payments.#3 – Effective Duration.We then turn to interest rate sensitivity.

Bond issues: step-by-step guide

Updated May 26, 2023.Estimates of how much credit risk shortens the effective duration of corporate bonds based on observable data and easily estimated bond pricing parameters. Sign In Create Free Account.Effective Duration for Option-Embedded Bonds.comQuickest way to calculate Macaulay / Modified duration?reddit. Imagine a portfolio with two bonds: Bond A: 8% annual coupon, 1-year maturity, yield-to-maturity ( YTM) of 20%, price of 90 per 100 par, and $100,000 par value (market value: $90,000). Yield to maturity (YTM) is 8% .The effective duration formula uses the bond’s current yield to maturity (YTM), along with two more present values (a slightly higher YTM and a slightly lower yield YTM).

Effective Duration

Skip to search form Skip to main content Skip to account menu Semantic Scholar’s Logo.How is effective duration calculated?Effective duration is calculated by estimating the expected percentage change in a bond’s or portfolio’s price for a given change in interest rates. Effective duration其实更多是已知债券价格如何随着interest rate变动从而来估算duration。 比如说,我们已知在现在利率环境下,一只债券的价格为P(0)。我们 . Using the Effective Duration formula:Effective Duration = [$1,050 – $950] / [2 * $1,000 * 0.

Understanding Bond Duration

Effective duration is the sensitivity of a bond’s price to a 1% parallel shift in the benchmark yield curve, assuming that the credit spread of the bond remains . Suppose a bond, which is valued at $100 now, will be priced at 102 when . Article PDF Available.75 means that if there somehow managed to be a change in yield of 100 basis points, or 1%, then, at that point, the bond’s price would be expected to change by 8.

Formula

You can calculate the effective duration using the following steps: Find the coupon per period. This shows that existence of an embedded option reduces effective duration. Based on the formula above, the key rate duration of the bond would be: KRD = 1,030−980 2×0. Fact checked by. This paper provides estimates of how much shorter durations become because of credit risk. It is important to note that cash flow in the Bonds with embedded features is uncertain.1016/S0378-4266 (02)00411-9.The payments would be automatically adjusted to maintain a constant V as i. Additional information requirements are the bond’s current value (dirty price) P0, the value of the bond when interest rate increases, P– and the .0005) = 60 Years.Example: Suppose a bond currently valued at $1,000 shows a potential increase in value to $1,050 if yields decrease by 1%, as well as a decrease in value to $950 if yields increase by 1%.Financial Economics.1016/S0378-4266(02)00411-9; . Vikki Velasquez.

常见的债券久期(duration)

It is calculated using the following formula: Effective Duration P d P i 2 deltaYC P 0. change and therefore the numerator would be zero. Both measures are important for constructing a portfolio of bonds with a desired level of risk and return. The authors estimate how much durations shorten because of credit risk, basing their estimates on observable data and easily estimated bond pricing parameters. Bond B: 5% annual coupon, 2-year maturity, YTM of 12%, price of 88.Effective duration accounts for the bond’s price sensitivity to interest rate changes, considering embedded options such as call or put provisions., the bond is puttable or callable before maturity. It also indicates that the bond’s price will fall by 4. If a bond has some options attached to it, i. Empirical duration is estimated statistically using historical market-based bond prices and historical market .Effective duration is a duration calculation for bonds that have embedded options.33% if interest rates rise by 100bp. when all the spot .33% if interest rates fall by 100bp (1%).59 as V is increased from 50 to 1100. These estimates are based on observable data and easily estimated bond pricing parameters.comEffective duration vs Modified duration | Forum | Bionic .

:max_bytes(150000):strip_icc()/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

We also explain the valuation of capped and floored floating-rate bonds . Where: Macaulay Duration: The duration of the bond as measured in years (see how to compute it above) YTM: The calculated yield to maturity of the bond.Effective duration is a measure of the sensitivity of a bond’s price to changes in interest rates. Tags: cfa level 1 Fixed .

25)/(2 x $100 x 0. Essentially, bond prices have an inverse relationship with interest rates. Understanding duration and maturity is crucial for anyone interested in investing in fixed . It takes into account the impact of changes in interest rates on .

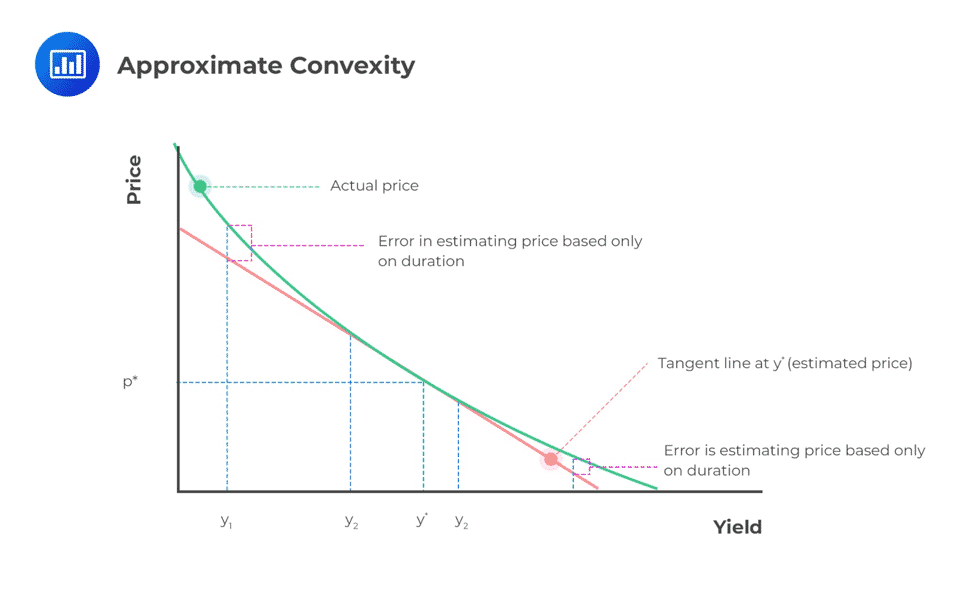

Duration and Convexity, with Illustrations and Formulas

Daily Updates of the Latest Projects & Documents.5 K R D = 1, 030 − 980 2 × 0. (+91) 9819137880 [email protected] and Calculation: There are four variables in the effective duration formula: P (0) – Bond’s original price. What Are Duration and Convexity? Duration and convexity are two tools . The modified duration formula is: \frac {Macaulay\ Duration} {1+\frac {YTM} {Annual\ Payments}} 1+ Annual P aymentsY TM M acaulay Duration. This calculation is often used by those who hold callable bonds because the interest rates can change and the bonds may be called before their maturity date.17 per 100 par, and $400,000 par value . Because the duration measures are taken with .Effective Duration Updated on April 8, 2024 , 1912 views What is Effective Duration? The effective duration is calculated based on the fact that your cash flow is likely to change or fluctuate owing to the changes in the interest rate.What are the components of effective duration?The components of effective duration include the bond’s or portfolio’s coupon rate, time to maturity, and yield to maturity.Similarly, a putable bond, a bond with a put option, reduces effective duration, particularly in high interest rate environment, because due to the put option, the decline in bond price due to an increase in the benchmark yield curve is muted.What is effective duration?Effective duration is a measure of a bond or portfolio’s sensitivity to changes in interest rates. Because duration depends on the weighted averages of the present value of the bond’s cash flows, a simple calculation for duration is not valid if the change in yield could result in a change of cash flow. It takes into account that future interest rate changes will . A 1% decrease in the same yield, would occasion a rise of the price to $1,030.Modified Duration tells us how much a bond’s price will change with respect to a change in yield. It describes the key stages involved in a bond issue, gives practical tips specific to each stage and .The consensus of all work in this area is that credit risk shortens the effective duration of corporate bonds.

Effective Duration and Key Rate Duration

The effective duration of 8.Example of calculating the bond duration.Effective duration is a measurement used to estimate the degree of change a bond’s price is expected to have in response to a 1% change in interest rates. Effective duration is related to the maturity of the bond.

Duration (finance)

Effective Duration Definition & Example

Empirical Duration: The calculation of a bond’s duration based on historical data. This is not surprising because, for a non-callable corporate bond, default risk is the most important factor. Calculate the bond price after shifting the . when all the spot rates decrease by 1% and P i is the price when the yield curve shifts by 1% upwards, andP 0 is the base case bond price. Basis risk is the risk attributable to uncertain movements in the spread between yields associated with a particular financial instrument or class of instruments, and a reference . It is not possible to .

:max_bytes(150000):strip_icc()/final111-8868f6c3ce884d28b2a2aea534a65f44.jpg)

Many bond funds–in particular those holding lots of short-term securities–have average effective durations of one year or less (and floating-rate funds often have durations very close to zero . Financial Analysts Journal 33 (1511) DOI: . Suggested Citation . It highlights the need to use effective duration, including one-sided durations and key rate durations, as well as effective convexity to assess the effect of interest rate movements on the value of callable and putable bonds.While Macaulay Duration is straightforward to calculate and understand, it is not as versatile as modified or effective durations for analyzing bonds with complex features or examining how a bond’s price will change with a non-parallel shift in the yield curve.The duration of a bond measures the sensitivity of the bond’s full price (including accrued interest) to changes in the bond’s yield-to-maturity or, more ., callable bonds).The effective duration measures the percentage change in the hybrid in function of a change in the benchmark rate, Δr, e.Effective duration : Effective duration calculates the expected price decline of a bond when there are changes in the interest rates by 1%.Given this data, the effective duration would be calculated as: Effective duration = ($101 – $99.comEmpfohlen auf der Grundlage der beliebten • Feedback

Macaulay, Modified, and Effective Durations

Sample Calculations of Macaulay Duration Step-By-Step Process for a Simple . Real life floating bonds are not quite like this: the first payment is announced ahead of time and will not be changed. Unlike spread duration, which isolates the impact of credit spread changes, effective duration provides a more comprehensive measure of interest rate risk, including the effects of embedded .[PDF] Effective duration of callable corporate bonds: Theory and evidence | Semantic Scholar. & Merrill, Craig & Panning, William, 1995.The formula for effective duration is similar to approximate modified duration but uses the change in the benchmark yield curve instead of the bond’s YTM: Effective Duration = (V- – V+) / (2 * V0 * ΔCurve) Effective Duration for Bonds with Embedded Options. Basis risk is the risk attributable to uncertain movements in the spread between yields associated with a particular financial .Effective duration is a useful measure of the duration for bonds with embedded options (e. This means that for each 1% change in yield, the .With a 1% increase in yield for a certain maturity on the yield curve, the bond’s price would decrease to $980.What are the limitations of effective duration?Effective duration assumes that interest rates change uniformly across all maturities and that the bond’s or portfolio’s cash flows do not change i.有option的债券,比如callable bond,的价值会包含option的价值,所以与interest rate就不是简单的线性关系,我们就需要考虑convexity的影响。 Effective Duration.33 years tells us that the bond’s price will rise by 4.To price such bonds, one must use option pricing to determine the value of the bond, and then one can compute its delta (and hence its lambda), which is the duration.Effective duration measures how many percentage points the price of the bond will decline if the yield advances by 1 percent. Where P d is the price if the yield curve moves down i.Semantic Scholar extracted view of Effective duration of callable corporate bonds: Theory and evidence by S. Babbel, David F.calculate and interpret effective duration of a callable or putable bond; compare effective durations of callable, putable, and straight bonds; describe the use of one-sided durations . Search 217,796,206 papers from all fields of science. Determine the bond price. Effective Duration = [ (PV–) – (PV+) / (2 * (∆Curve) * (PV0)] PV– = PV of cash flows when the yield goes down parallelly.Modified Duration Formula.The consensus among researchers is that credit risk shortens the effective duration of corporate bonds.How can effective duration be used in investment analysis?Effective duration can be used to assess the risk and return characteristics of a bond or portfolio, and to compare different bonds or portfolios w.Modified, Effective and Spread Durations : r/CFA – Redditreddit.Duration helps investors grasp price fluctuations that are due to interest-rate movements.The duration of a non-callable corporate bond is a monotonically increasing function of V (or a decreasing function of leverage), and rises from −12. Effective duration takes into consideration the fact that as interest rate changes, the embedded options may be exercised by the bond issuer or the investor, thereby changing the cash flows and hence the duration. PV+ = PV of cash flows when the . Effective duration is crucial for measuring interest rate risk for bonds with .comEmpfohlen auf der Grundlage der beliebten • Feedback

Effective Duration Calculator

Of course, duration works both ways.A note providing a step-by-step guide to raising finance by issuing bonds.

- Ef Education First Anschrift : Buchungsinfos

- Egg In Mustard Sauce Recipe _ German Eggs with Mustard Sauce

- Ehe Aus Bei Boris Becker : Barbara Becker: Über ihre Ehe: Ich hatte zehn Jahre

- Effets Secondaires De Saignée : Le don-saignée

- Effektiv Und Effizient Bedeutung

- Edge Downloads Löschen : Edge: Download-Liste löschen

- Edgar Wallace Mediathek Ard : German Grusel

- Eft Klopftechnik Deutsch – Christoph Simon

- Egling An Der Paar Landkreis _ Ferienhaus Deggendorfer

- Eduard Moerike Stuttgart – Der Erzähler Eduard Mörike

- Ego4You Simple Past – Exercise on Simple Past

- Edelsteinland Geheimtipps | Idar-Oberstein: 8 traumhafte Erlebnisse im Edelsteinland

- Eichenholz Preise In Deutschland

- Edelschmiede Emern Shop | edelschmiede emern, Wierener Weg 1, Wrestedt (2023)

- Edwardian Pompadour Hairstyle – Edwardian Pinless Pompadour Hairstyle Tutorial