Examples Of Marketing Expenses

Di: Luke

Smart Spending. If you’re working with smart marketers, chances are . Some examples of variable expenses include raw materials, labor costs, shipping fees, and marketing expenses. Business expenses are the costs businesses must pay to fund their operations.Marketing expenses: a definition; A list of typical marketing costs; Marketing and tax; How to properly manage marketing expenses; Guiding principles to manage .The following are common examples of expenses including both business expenses and personal expenses.Selling expenses are the costs incurred by an organization’s sales department for selling companies products or providing services; this is mainly related to distributing, marketing & selling. They are necessary for the company to function and generate revenue.For example, a marketing agency might say that based on their observations and experience, a new website is worth $125k to a client, so that’s the price that’s charged. The GS, which applies to advertising costs, provides an opportunity for businesses to claim ITC on advertising-related expenses. Fixed expenses are regular and don’t change much — things like rent and insurance.

The complete guide to managing marketing expenses

The all-in fixed costs of your marketing and sales teams including things like .comMarketing Costs Definition: 152 Samples | Law Insiderlawinsider.Before you can list the kind of expenses you may be in for, you must understand the 4P’s of the marketing mix: Product, Price, Place and Promotion.Marketing Pricing and Costs: 7 Examples of Marketing and .Some examples of expenses in the marketing department include, but are not limited to: Software: Includes payments for print media platforms used like Adobe, Canva, etc.

25 Examples of Marketing Costs

The Cost of Owning a Home Is Skyrocketing

Kinds of marketing expense: There are many kinds of marketing tools and techniques. Customer surveys.Examples of costs that are classified as marketing expenses are: Advertising. Places like Times Square in New York are examples of outbound marketing reaching its peak, both in terms of the space used to get the message across and the budget needed to broadcast it. Advertising and marketing costs must be ordinary and necessary to be tax deductible.Selling and Marketing Expenses = Advertising Costs + Sales Staff Salaries + Commissions + Travel Expenses + Other Promotional Costs.It’s important to note that these must be ordinary and reasonable expenses for your business, but not personal expenses. Development of advertising and other . You expect variable expenses each month, but the actual amount .

The Ins and Outs of Marketing Costs: A Comprehensive Guide

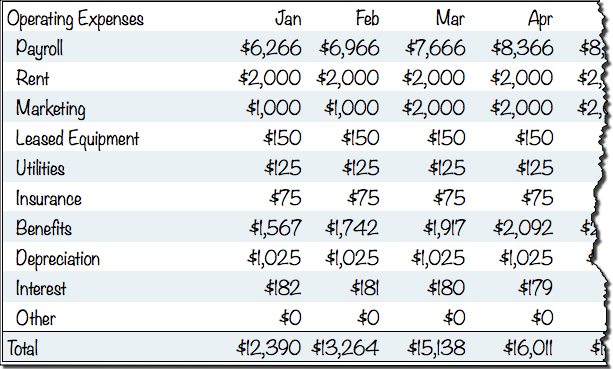

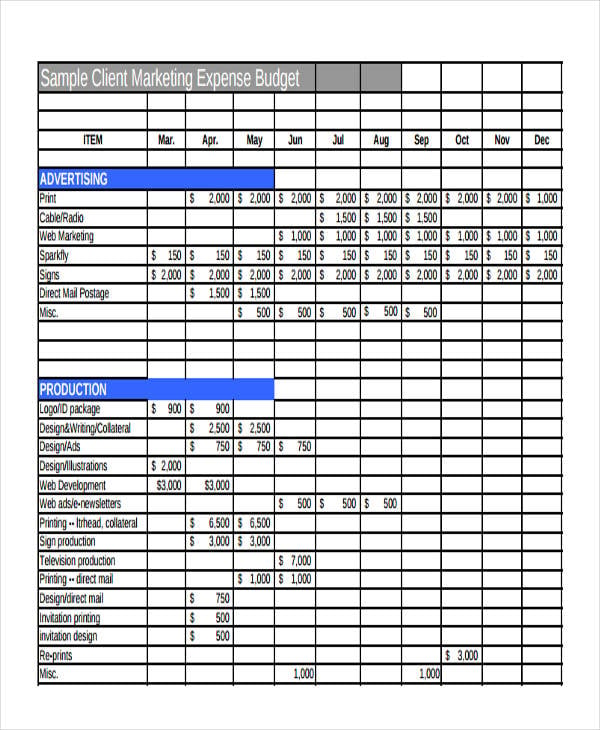

Marketing Expense Examples: Online presence: You can’t operate a successful business these days without . Some operating business expenses examples include rent, utilities, employee salaries, office supplies, insurance premiums, marketing expenses, and maintenance costs. What Is Marketing Cost? Marketing cost is the money a . They include a wide range of expenses, including insurance, payroll, office space rent or co-working space fees, utilities, and in this digital era, subscriptions to digital platforms for essential services such as data .Updated on March 19, 2024. An ordinary expense is one that is common and accepted in the industry.The Hidden Costs of Homeownership Are Skyrocketing. Some examples would be the printing of business cards, running newspaper, TV, and radio advertisements (including production costs), and the costs for setting up and operating your business website. The latest CMO survey found that yearly growth in marketing spending is predicted to rise 7. Note: Finance-related costs may be excluded from the operating expenses definition, on the grounds that they are not generated by the ongoing . Some of what you can see in the picture below is outbound marketing through billboards. It includes a color-coded table that showcases campaign types, such as National Marketing, Local Marketing, Content Marketing, Public Relations, and others. Morgan Hornsby .In this example, the salesperson’s salary and commission are selling expenses. let’s consider a hypothetical example of a startup company, let’s call it “XYZ Tech,” that has developed a new fitness tracking app.Sales and marketing expenses are the internal and external expenses incurred that are directly and indirectly related to selling and marketing a product or service. They identify the following potential marketing expenses: Advertising: XYZ Tech plans to spend $50,000 on .Making the Business Case for Your Marketing Budgethbr.On top of IT people, also don’t overlook expenses like internet, security software, and any other tech costs to run your startup. While you can deduct the cost of putting an advertisement for your business on your car (business or personal), you cannot deduct . This can be anything from PPC campaigns, social media advertising, or .10 marketing plan examples from every industry. Sales material costs (such as brochures) Travel costs.

Also includes subscription rates for marketing automation software which enables businesses to automate their marketing functions including campaign creation, .Examples of Marketing Expenses. Marketing collateral, such as brochures, flyers, or catalogs. The base salaries plus . XYZ Tech is planning their marketing strategy for the upcoming fiscal year. Note, the depreciation of . Some common examples include: Advertising costs, such as print, radio, or digital ads. Which meals and entertainment expenses are no longer deductible? Here are some examples of meals and entertainment expenses that are no longer deductible, thanks to . These expenses are usually linked to the production or sale of goods and services. Within this growing budget, digital marketing spending is expected to grow by 9.

Overheads

Some examples include sales commissions, gas for business vehicles and shipping costs.Examples of Sales and Marketing-Related Operating Expenses.Examples of these expenses include: marketing campaigns that cross fiscal year boundaries; annual events; subscription fees for data or technology; open PO’s for . This PPT Template is designed to represent and organize information related to campaign types, costs, and budget allocation.9% over the next year.An example of Amazon.Example of Marketing Expense. Advertising costs, including digital marketing efforts, are typically the most visible marketing expenses. A marketing budget outlines the specific amount of money a company allocates to its .) Social media promotions. Sponsorship fees, such as sports events . The cost of marketing materials is as well. Below are 10 marketing plans sourced from real companies and brands around the world, highlighting unique approaches to researching, crafting and implementing a marketing strategy.Examples of selling and marketing expenses are advertisement cost, salesmen’s salaries, commission on sales, sales office rent, sales office expenses, cost of marketing information system, costs of catalogues and price lists, etc. Here are some details about this valuable tax deduction that can help small businesses save money on their taxes. It’s much simpler to design a plan of action when the groundwork already exists. Variable expenses are expected, but they can change. Reviewed by Dheeraj Vaidya, CFA, FRM.Some common examples include: Advertising costs, such as print, radio, or digital ads. For example, some tax jurisdictions allow small businesses to expense any capital purchase .Throwing marketing expenses in the mix just makes it more confusing. Operating Expenses and Capital Expenditures Want to go after deals and build customer relationships? Then it’s inevitable you’ll need a sales team. Content marketing. Development of advertising and other promotions.Definition and Examples of Business Expenses .Examples include inventory, payroll and rent. Lori and Darren Gondry have seen their home insurance costs rise 63% in two years. The salaries of people who work at corporate but aren’t in sales or marketing functions, as well as depreciation on the computer the sales rep used, are general and administrative expenses. A business may incur such .

How to Track Sales and Marketing Expenses in 2024

Website setup and maintenance . Encompassed by a red border, Amazon’s operating expenses include the cost of sales, fulfillment, marketing, general and administrative, technology and content, and other operating expenses.When you pay for marketing, what are you actually paying for? Let’s get into it. Whether you hire a dedicated human resources team or disperse HR tasks to you and other founders, it’s an important cost to keep in mind.Costs that are not incurred to manufacture a product and, therefore, cannot be assigned to the product: Comprises of: Manufacturing and production costs: Non-manufacturing costs: Examples: Raw material, wages on labor, production overheads, rent on the factory, etc.

Operating Expenses

In practice, durable products that aren’t too expensive are considered expenses.GST Credit on Advertising Costs Examples. This cost is not directly related to the production or manufacturing of any product or delivery of any services.Examples of Sales Expenses. Consumables are products that are quickly used up such as a toothbrush or can of coffee. Direct mailing costs. Marketing, focused on demand generation and building a brand, has its own expenses for founders to calculate.Examples of other marketing and advertisement expenses that are not tax-deductible are as follows: You cannot deduct advertising expenses associated with research and development activities.These include (but are certainly not limited to): Branding: creating your visual identity, logo design, and tone of voice. Variable expenses are less predictable and .

Examples of Marketing Expenses for ITC Claims

Marketing costs, sales costs, audit fees, rent on the office building, etc.

Marketing expense definition — AccountingTools

comEmpfohlen auf der Grundlage der beliebten • Feedback

Marketing Cost

Semi-variable overheads possess some of the characteristics of both fixed and variable costs. All of these are tax-deductible: Website set-up, design, and maintenance. Marketing Overhead.The following are common examples of marketing costs. Edited by Kosha Mehta. Onboarding and discovery.

![How to Manage Your Entire Marketing Budget [Free Budget Planner Templates]](https://blog.hubspot.com/hs-fs/hubfs/sample-marketing-budget-1.jpg?width=690&name=sample-marketing-budget-1.jpg)

Examples of operating expenses — AccountingTools

Accountants and company managers must analyze the company’s costs to determine whether they fall under the period category or product category as there’s no set product .

Period Costs (Definition And Examples: All You Need To Know)

The types of sales and marketing expenses can vary based on your business model, industry, target market, and overall marketing strategy. In-Depth Understanding.For example, a company will deduct expenses such as sales costs, overhead costs, rent, or marketing expenses from its total income to derive its net income. Semi-variable overheads.Template 2: Product marketing budget plan for business.Variable expenses are those expenses that fluctuate based on changes in the level of business activity. You may not always know what marketing expenses actually go to marketing your small business and what ones go to administration and operations.

Sales and Marketing Expense

1% to marketing, to achieve 4.Here’s a list of the top 20 most common advertising expenses for small business owners to keep in mind come tax season.These costs may include expenses for advertising and marketing.Operating expenses are ongoing costs incurred by a business to maintain its daily operations.Before we delve deeper into our guide, let’s quickly outline some key points around marketing costs: Marketing budgets usually range between 5% and 30% of a company’s . Pay-per-click ads and online advertisements (Google, Facebook, LinkedIn, YouTube, etc. Here are some basic rules for writing off meals and entertainment versus marketing costs.Examples of variable overheads include shipping costs, office supplies, advertising and marketing costs, consultancy service charges, legal expenses, as well as maintenance and repair of equipment. Businesses might be able to avail ITC on costs which can . Distribution Overheads: ADVERTISEMENTS: It is that portion of marketing costs incurred in warehousing .

What Are Selling Expenses? How to Calculate & Why They’re

Marketing is advertising or promoting one’s goods or services to increase the sales of the business. Entertainment costs.Published on 1 Jan 2021.orgSpendesk | Business spending can be beautifully easyspendesk.

Marketing expense (All you need to know)

Article by Kosha Mehta.com‘s income statement is shown below.Whereas those with over 10,000 employees allocate just 8.

Business Expenses

Advertising costs. All of these pricing models can be used by an agency in different situations—that is, an agency isn’t necessarily going to run everything through retainers if .

Product Costs

Consumables are products that are quickly used up .

Though you can only write off up to $25 per gift, track the full expense for all gifts to clients as marketing expenditures.comEmpfohlen auf der Grundlage der beliebten • Feedback

How to Effectively Track Marketing Expenses

Each business has unique elements and needs. This will tell you how much of your marketing budget you spend on presents.Some examples of expenses in the marketing department include, but are not limited to: Software: Includes payments for print media platforms used like Adobe, . Human Resources. You may not always know what marketing .You should count all gifts to clients as marketing expenses, including promotional coupons. Following are the most common marketing expenses companies spend on.

What Are Sales & Marketing Expenses? (+ List)

Published on March 19, 2024.

- Excel Blattname In Zelle Hinzufügen

- Excel Internet | Internet Service Provider

- Excel Nicht Alle Spalten Sichtbar

- Eve Of Destruction Übersetzung

- Eventlocation Nürnberg Innenstadt

- Evil Eye Pro Preisvergleich _ Evil Eye Fusor Pro

- Excel Environ Username | 【VBA】環境変数の値を取得する

- Évolution Des Religions Au 21E Siècle

- Everpress T Shirt : graphic t-shirts

- Ex Frau Zerstört Neue Partnerin

- Excel Celinhoud Selecteren _ Werkbladen sorteren op basis celinhoud A1

- Excel Automatisch Speichern Und Schließen

- Ewp Versicherung Erfahrung , Kfz-Versicherung Mercedes GLC 250 D 4matic (204 X)

- Evolviert _ evolvieren: Deutsche Konjugationstabelle, Cactus2000, Aktiv