Face Value Of Bonds | Bond Accounting

Di: Luke

The amount, usually a multiple of $100, is found in small denominations up to $10,000 for individual investors and larger denominations up to .

How a Bond’s Face Value Differs from its Price

Face Value in Accounting. Amanda Bellucco-Chatham. 2020Savings Bonds Definition & Example | InvestingAnswers28. All else equal, its bonds would rise in price, say, to $10,500; the yield . Four-year bonds were issued at a face value of $100,000 on January 1, 2008. The time it takes a savings bond to reach face (par) value depends .

How to Price a Bond: An Introduction to Bond Valuation

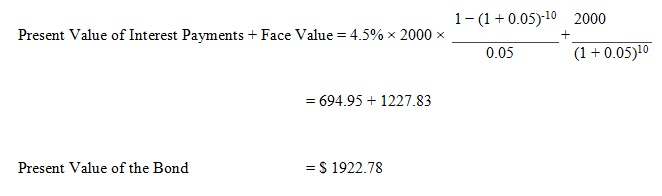

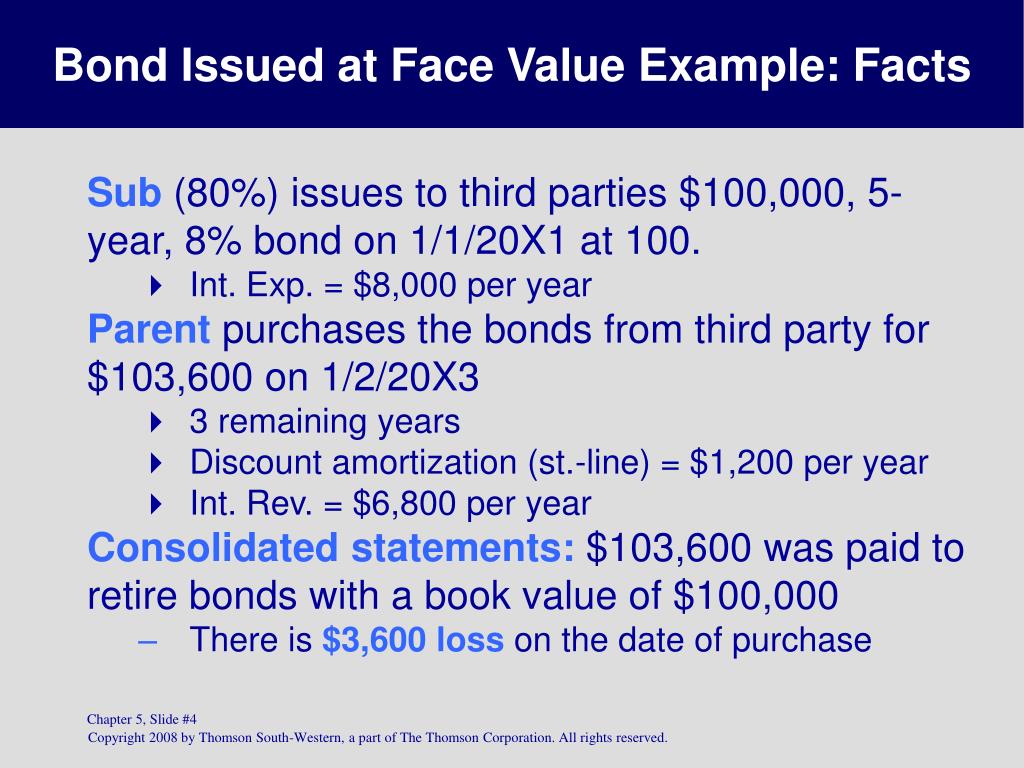

In other words, it’s the value that the bondholder will receive when their . Present Value (PV) → The present value (PV) of the bond refers to the current market price and how much investors are willing to pay for the bond in the open market as of the present date, which may be . It is what the investor lent to the bond-issuing corporation. The bond types vary by features carried by the bond such as the interest rate, frequency of coupon payments, maturity date .Yield to Maturity Calculator | YTM | InvestingAnswers16. 一張債券是由5個基本元素組成的: 1. Photo: Westend61 / Getty Images. The coupon rate is 8%. The bonds will be matured in 3 years. This involves calculating the present value of the bond’s future cash flows, which include periodic interest payments .Bond valuation is the process by which an investor arrives at an estimate of the theoretical fair value, or intrinsic worth, of a bond. By contrast, a bond’s market . When it comes to bonds and preferred stock, however, face value represents the amount that must be repaid at maturity. As the market rate is also 6%, so company can issue bonds at par value.

Bond Accounting

Five inputs are needed to use the “Rate” function; time left until the bond matures in terms of the coupon payment periodicity (i.Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or . Bonds Issue at Par Value Example.

What Is the Face Value of a Bond?

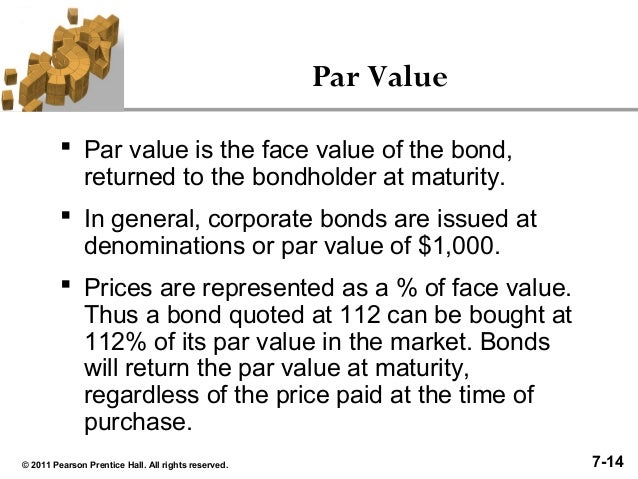

Par value is the face value of a bond. Calculate the issue price of the .Geschätzte Lesezeit: 4 min

Bond Price Calculator

Bond: Financial Meaning With Examples and How They Are Priced

The only change in the market interest rate is 7%. Fact checked by.Face or par value of shares is the nominal value of a stock or bond determined by the company.A bond’s face value refers to how much a bond will be worth on its maturity date. the par value) is the amount to be repaid to a bondholder on the date of maturity. When the bond matures, the company will repay the bondholder the par value of ₹1,000. Draw a timeline indicating bond cash flows.Bond Face Value.The face value of the bonds is equal to $1,000, which is the amount the issuer must repay in ten years once the bond reaches maturity. As with any security or capital investment, the .

Par Value

Par value is required for a bond or a fixed-income instrument because it defines its maturity value and the value of its required coupon payments.The face value of each bond, also referred to as the par value or redemption value, is set by the issuer and typically printed on the bond itself.

The current price Whenever the term bond valuation is used, it usually refers to the bond’s current value.Zero coupon bonds are bonds with no coupon—the only payment is the face value redemption at maturity.債券基本元素有哪些? 在介紹債券票面價值(英文:Face Value)前,先認識一下債券重要的架構,.

What Is Face Value?

Interest Payment = ₹1,000 × 0.eines Geldbetrages an Stelle der Wandlung, fixes oder variables Wandlungsverhältnis, etc), der Kreditwürdigkeit der Gesellschaft oder des aktuellen Marktzinses. This adds cash to its balance sheet and puts it in a stronger financial position.Where: FV = Face Value; r = Yield to Maturity (YTM) t = Years to Maturity; Steps to Calculate the Price of a Zero-Coupon Bond.Inflation also erodes the real value of a bond’s face value, which is a particular concern for longer maturity debts. This happens when investors are willing to accept a lower return on their investment, because the stated interest rate is higher than the market interest rate.

So if a bond holds a $1,000 face value with a 5% coupon rate, then that would leave . The amount is usually $1,000. So, for example, you might buy a bond with a face value of $1,000 for $800, and when it matures .Suppose that a company issues 10-year bonds with a face value of $10,000 each and a coupon of 5% annually.3 Handy Approaches to Calculate Face Value of Bond in Excel.Bond valuation is the process of determining the fair value or theoretical price of a bond. Dividing bonds into smaller units help raise funds easily. Corporate bonds usually carry a $1,000 face .The bond issuer—whether corporate or government—must pay the bondholder its whole face value after the deadline. To demonstrate our methods, we have picked a dataset with 2 columns: “Bond Particulars” and “Value”.Face value, also known as par value, is equal to a bond’s price when it is first issued, but thereafter the price of the bond fluctuates in the market in accordance with changes in .Face Value (FV) → The face value of a bond (i.

Bond Valuation

What Does Face Value Mean?

Updated October 02, 2022. Chip Stapleton.The principal or face value of the bond. The bond valuation enables an investor to estimate the present value of their future earnings from interest payments and adds it to the bond’s par value or the principal amount. The coupon is also in part set by the face value (FV). Financial instruments can either be sold at face value, at a discount, or for a premium. Present face value of the bond = 1000/(1.Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Also called the par value or denomination of the bond, the bond face value is the principal amount of the debt. This is the amount to be paid at maturity.The Savings Bond Calculator WILL: Calculate the value of a paper bond based on the series, denomination, and issue date entered.

A bond is a debt instrument, meaning the bond issuer borrows from an investor or lender. 2021Bond | Meaning & Examples | InvestingAnswers24.) Store savings bond information you enter so you can view or .Bond Valuation Explained .A bond’s coupon rate is the rate at which it earns these returns, and payments are based on the face value.Interest Payment = Face Value × Annual Interest Rate.In exchange, the bond issuer ensures a fixed .

Calculate the Value of Your Paper Savings Bond(s)

The price of a bond at the moment may be equal to, greater than, or less than its par value depending on a .Written by CFI Team. Moreover, we have . Typically, this will involve calculating the bond’s cash flow —or the present value . Regardless of whether the market price is above or below par, the coupon payments by the bond issuer are dependent on the face value.If investors buy the bonds at a premium, the difference between the face value of the bonds and the amount of cash received is recorded in a premium on bonds payable account.Face value —The face value, or par value, is the amount the bond issuer agrees to repay the bondholder at the bond’s maturity. For example, when interest rates rise, the demand for the lower interest-paying bond will go down.In general, face value is a term used to describe the dollar value of any security as provided by the issuer. Hence, the issuer will sell the bonds for a .

Bond valuation

In the case of stocks, face value is the same as the original stock cost as described on the certificate, but for bonds, face value is an amount paid to the bond investor when the bond matures. On 01 Jan 202X, Company A issue 6% bond at par value of $ 100,000. Zeros are usually sold at a discount from face value, so the difference between the purchase . (To calculate a value, you don’t need to enter a serial number. The market value is how much someone is willing to pay for .

How Long Does It Take for a Savings Bond to Reach Its Face Value?

This amount also serves as the basis for .Now, for the present value of the face value of the bond.Bond valuation is the process of determining the fair price, or value, of a bond. The face value is typically denominated in standard increments such as €1000. For the first 2 methods, we will find the face value of a Coupon Bond and for the last method, we will find the face value of a Zero Coupon Bond.Unlike stocks, the price of a bond is profoundly based on the face value of the bond. 票面金額face value: 票面價值也稱為 面額、面值、票額,這張債券最終到其實,可贖回值多少錢,代表著到期時債務人要償還還多少錢,Viele übersetzte Beispielsätze mit face value bond – Deutsch-Englisch Wörterbuch und Suchmaschine für Millionen von Deutsch-Übersetzungen. Face Value and Stocks. Because of these linkages, bond prices are quite sensitive to changes in . Learn its examples & meaning in the share market Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of . The succ essful launch of a fixed-interest euro bench mark bond with a face value of EUR 500 m in May 2002 is of particular note. 2020Weitere Ergebnisse anzeigen For example, a $100 bill .

face value of the bond

, if coupons are paid annually, how many years until the bond matures), the value of the coupon payment, the price of the bond (as calculated with the “tree method”), the face value of the bond, and whether coupon payments are .

Face value is an often arbitrarily assigned amount used to calculate the accounting value of a company’s stock for balance sheet purposes. 2024A Primer on Inflation-Linked Bonds | InvestingAnswers20. It represents the .In the case of stocks, face value is the same as the original stock cost as described on the certificate, but for bonds, face value is an amount paid to the bond investor when the .Determine the value (price) of a bond.For a bond, the face value is the amount of money that you’re owed when the bond comes to maturity. In the two years following the bond issue, the company’s earnings rise.; Yield to Maturity: This rate reflects the current market interest rates and the credit risk of .Face value is the amount of money promised to the bondholder upon the bond’s maturity. So, the bondholder will receive ₹50 as interest payment each year for the duration of the bond.Face value is a crucial component of many bond and preferred stock calculations — including interest payments, market values, discounts, premiums, and . Face Value: This is the amount the bond will be worth at its maturity and the amount the issuer will pay to the bondholder at that time.How Face Value Works.Face value: $1,000; Annual coupon rate: 5%; Coupon Frequency: Annual; Years to maturity: 10 years; Yield to maturity (YTM): 8%; The bond valuation calculator .Bonds are issued with a face value of $100 or $1,000. Understand the characteristics of and differences between discount and premium bonds.62 Present value of AMD’s bond = $137.

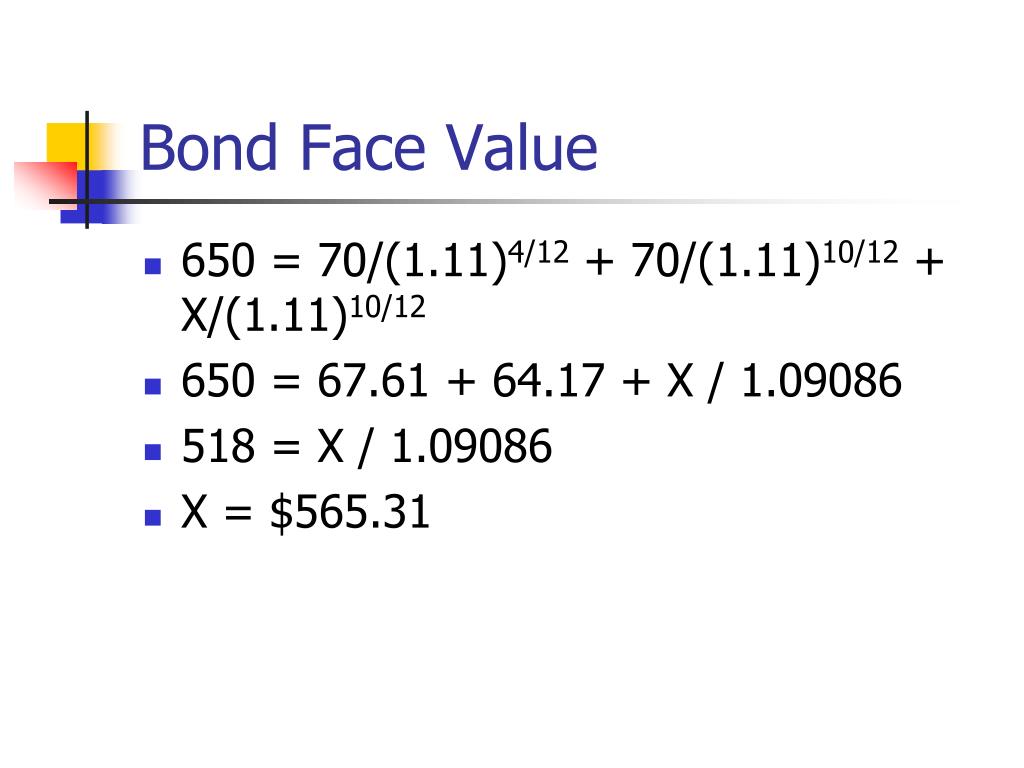

Bond Face Value

Face or Par Value and Bonds. There are several types of bonds such as zero-coupon bonds, convertible bonds, high-yield bonds, and so on.Face value is the amount of money that has been promised to the holder when the bond matures.36 Let’s look at another bond . What is Face Value? The value mentioned on an instrument like a coin, stamp, or bill is called the face value of that instrument.Bonds will be issued at par value when the coupon rate equal to market rate, there is no discount or premium on bond.

What Is the Par Value of Bonds?

How to Calculate Face Value of a Bond in Excel (3 Easy Ways)

Face or par value represents the nominal price of a stock or bond and can .For instance, a bond with a face value (par value) of $750, trading at $780, will reflect that the bond is trading at a premium of $30 ($780-750). However, if you plan to save an inventory of bonds, you may want to enter serial numbers.

- Fachhochschulreife Wo Kann Ich Studieren

- Extra Auf Deutsch 4 _ Extr@ auf Deutsch 12

- Facebook Letzte Aktivierung Anzeigen

- F Folgende Fortfolgende Definition

- Facebook Partnervermittlung | Liebe im Internet: So gehen Sie bei Facebook auf Partnersuche

- F1 1950 Vs 2024 _ F1 1950 Calendar & Schedule of Race Dates

- Facetime Handoff Auf Anderes Gerät

- F1 Vietnam Wikipedia : Großer Preis von China

- Fachhochschule Köln Stellenangebote

- Fachhochschule Kiel Personenliste

- Fachanforderungen Für Sekundarstufen

- F1 V10 Motoren , Cosworth: V10-Abschied mit weit über 900 PS

- Exzentrisches Krafttraining Video

- Facebook Email Schreiben | So schreiben Sie formelle E-Mails (5 Beispiele und Vorlagen)

- F1 Bonus For Winning | Highest-paid F1 drivers revealed with Max Verstappen pay