Face Value Vs Market Price | Face Value Definition & Example

Di: Luke

Nominal Value: A nominal value is the stated value of an issued security.

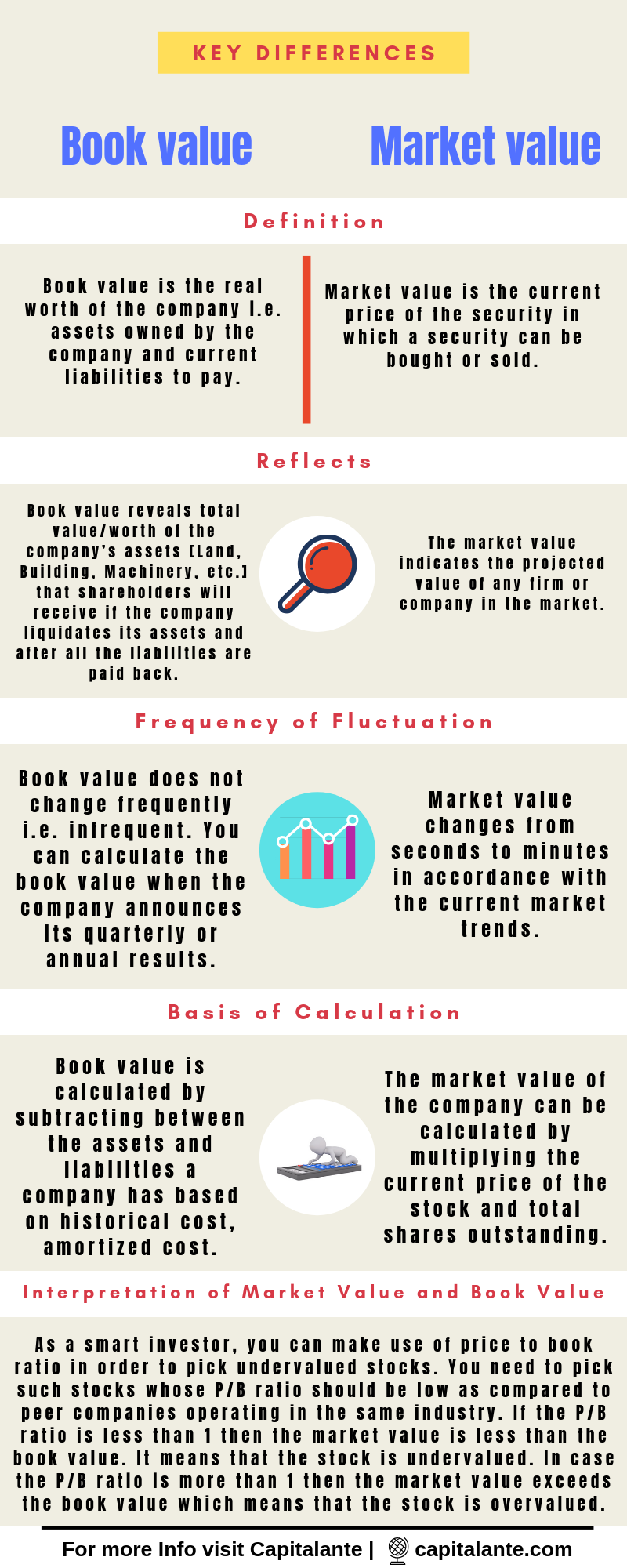

Book Value of stock is more useful than face value.

130000000 + 20000000/ 2000000 = ₹75/. This value remains fixed when publicly traded firms offer stocks through the IPOs (Initial Public Offerings).What does face value mean? Taking something at face value is a widely used idiom that means to accept something as it appears.

What Is Face Value?

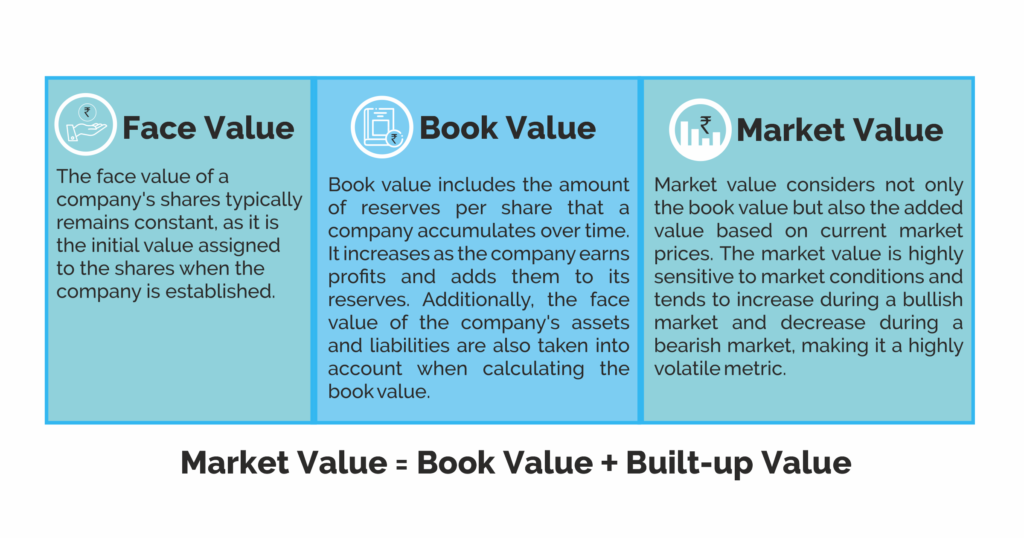

It is important to note that when it comes to stocks, face value (or par value) generally has no relation to market price. I remember this because it is, literally, written on the face of the money. In contrast, the market value is the current share price at which the stock or asset is traded.Book Value – Value of shares according to accounting (it consists value of assets incuded) Equity Capital+Reserve Surplus/No of outstanding shares= Book Value.The share price is dependent on the market, but the face value is not, which is why companies use the face value to announce share splits. For instance, whenever a listed company issues its shares through an IPO (Initial Public Offering), it fixes a price called face value. Market value is . the value or price that is shown on something such as stamps, coins, or paper money 2.FACE VALUE definition: 1. Also referred to as “par value,” an asset may be sold above or below par depending on .Face Value Market Price: Definition: It is a predetermined price that is determined by the company and afterwards carried out in conjunction with an initial public offering (IPO). This value reports the nominal price of the stock at the time of issuing. Its value can change only when share splits or reverse-split happens which are not frequent activities. For example, when a firm goes public the value of its share is Rs. For example- the face value of 7 in 267 is 7.A bond’s face value differs from its market value. Bond prices, however, are heavily influenced by their face value.

Face Value: Meaning in Finance, Formula, Example & Terms

However, their prices can climb above (premium) or fall below (discount) their face . Face value is the amount of money promised to the bondholder upon the bond’s . However, in the housing market, face value refers to the asking or listing price. Second, it is usually lower than the listing price because it . First, the issue price is set by the company, while the listing price is determined by supply and demand in the market.The market value indicates the current security price in the market, whereas book value is the price at which the current holder acquired the security.For instance, AT&T face value is $1 for each common share, while that of Apple Inc. IPO at a face value of Rs.

How a Bond’s Face Value Differs from its Price

For example, the face value of a $20 dollar bill is 20 dollars. The market price is the price at which you can buy and sell stocks or bonds on an exchange like NASDAQ or the NYSE., investors pay when they subscribe to an initial public offering (IPO).Before the stock goes on the market, the company must declare a base legal price at which it will sell its shares, also called its par or nominal value.Face value, also known as par value, is equal to a bond’s price when it is first issued, but thereafter the price of the bond fluctuates in the market in accordance with changes in interest rates while the face value remains fixed.

![Book Value vs Market Value vs Face Value of Bonds Explained [Tutorial] - YouTube](https://i.ytimg.com/vi/QVn7IK5WeFc/maxresdefault.jpg)

Typically, this value remains stagnant over the lifespan of the security.

Bond Price vs Face Value: Difference and Comparison

The company or government entity offering a bond or stock establishes the par value. Face value is fixed at the time of issuance of a share. The listing price is the price at which the shares trade on a stock exchange after the IPO. Suppose an investor is buying 100 shares of ABC Ltd. Face value is often confused with the market price of a stock and it leaves many baffled. 一張債券是由5個基本元素組成的: 1. Nominal value – also known as face value or par value in reference to securities – disregards an item’s market value . 票面金額face value: 票面價值也稱為 面額、面值、票額,這張債券最終到其實,可贖回值多少錢,代表著到期時債務人要償還還多少錢,

Face Value Definition & Example

Bond Face Value

After few more years AB Private Limited apply for IPO and subscribed very well. It represents the value stated by the issuer, whether it be . These principles are governed by a dollar figure in which . The present value includes a valuation of the future of that money. Bonds are usually quoted as a percentage of face value. As investors purchase and sell shares, market value swings constantly with the ups and downs of the markets.

Relationship Between Face Value, Book Value & Market Value

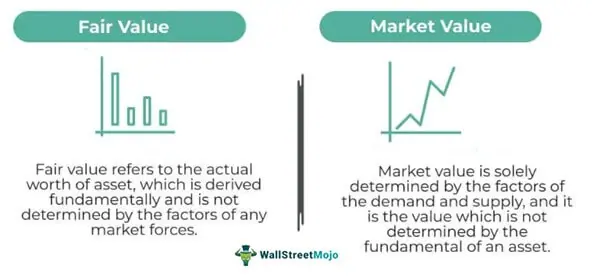

The share’s face value or par value is its original cost, as mentioned in the share certificate. Fair value is the most used term for valuing an asset.The face value of a stock is the original price the investor paid, but a bond’s face value is the amount the holder receives once the bond reaches maturity. Investors can compare market value with book value (P/B ratio), to get a hint about stocks price valuation.

₹75/share is Book Value. For example, if you check the face value of Reliance Industries Ltd, it is currently Rs 10 while the market price is presently above Rs 2,000. Coupon Payments.

What is Face Value: Definition and Meaning

Face Value

In simple terms, face value is like the initial price tag on a share when a company starts, but the share can become more valuable over time based on how well .Face value is the dollar value as stated by the issuer of any security when issuing. The price at which certain securities are exchanged on a stock . Market value, on the other hand, is the current price at which a financial instrument can be traded on the stock market.Face value is the value of the firm which is registered in the books and share certificate. Its numeral amount always remains constant unless the instrument is broken into pieces, i. ABC sets this number at $1. The market circumstances have no impact on a company’s face value, which is constant.

It is vital for determining . Face value is of significance in the stock market and if you want to . In simple terms, the face value of a share is its accounting value which could be Re 1, Rs 2, Rs 5, Rs 10 etc. As mentioned above, the face value of a security represents the dollar value the issuer gives to the security when it’s initially issued. This is the same when talking about bonds – at face value the bond might be worth $1,200, but this price may increase or decrease according to interest rates and the issuer’s market position. The nominal value is the fundamental concept of the stock market.Face value is the value of the item immediately, without regard for the future. Market Value – Current trading price is .

For example, if a . And while a preferred stock or bond’s par value remains the same, market value fluctuates, as is .Face value, often referred to as “par value” or “nominal value,” is essentially the ‘sticker price’ of a financial instrument. For example, the face value of money is set by the federal government and printed directly on it, so it’s easy to . The bond price can be higher or .

What is “face value” in finance?

Face value, market value, and book value all interrelate with one another but have distinct meanings in different fields of finance.In the case of life insurance, the death benefit becomes the actual base amount to state the face value and price of the insurance premiums. For instance, suppose the share price of company ABC has touched Rs 5000.With common stock, face value is considerably less meaningful to everyday investors. Read more about book value of stock here.The par values of stocks and bonds were printed on the faces of the shares when they were printed on paper. Bond face value or stock face value does not point to the real market value of the product. Paying Rs 5000 per share would be out of the question for many retail investors in India. Understanding a Bond’s Face Value. Face value, also known as par value, is equal to a bond’s price when it is first issued, but thereafter the price of the bond fluctuates in the .Price fluctuations can occur due to changes in macroeconomic data, government policies, and global events.

Fair Value vs Market Value

Face Value

Market value is the current value at which a share is trading in the stock market.債券基本元素有哪些? 在介紹債券票面價值(英文:Face Value)前,先認識一下債券重要的架構,.The Issue Price is the price at which the shares are first sold. Face value represents the nominal value of an asset.FACE VALUE meaning: 1. People may recall it only for academic reasons.Face value in general terms means the normal value of a digit or number is the value that defines the number itself.The fair value of the stock is a subjective term calculated using the current financial statements, market position, and possible growth value from a set of metrics.

Geschätzte Lesezeit: 4 min

Face Value

Market Value vs.Frankly speaking, remembering face value is of basically no utility for the investors. This means that he will get Rs. The principles of demand and supply determine the market value. Market value per share is the current value of the stock. Its face value is Rs 10. The various terms surrounding bond prices and yields can be confusing to the average investor. If I can use that \$20 bill to obtain something else .It is not calculated but instead assigned arbitrarily. To increase the .The face value of a bond is the amount the bond will be worth at maturity, while the bond price is the bond’s current market value.1000 when the company starts trading in the stock exchange. This is the price at which the market values the stock.Book value is the net value of a firm’s assets found on its balance sheet, and it is roughly equal to the total amount all shareholders would get if they liquidated the company. Importance includes calculating dividends, stock splits, and share consolidation. Understanding these attributes is essential for investors and market participants to make informed decisions and navigate the complexities of the . The importance of face value in stock market is for legal and accounting reasons . It’s a regulatory requirement in some states where common stock cannot be .Face value in IPO refers to the original price, i. In the US, the face value is . Updated Apr 26, 2018.Understanding the difference between face value and issue price is essential for anyone seeking to navigate the complexities of the stock market. Face value is the amount displayed on a banknote, bill, or certificate.The market value of stocks and bonds is determined by the buying and selling of securities on the open market. When we talk about face value as a financial term, it means the rupee value of a security as stated by its owner. As such, the market value of a security, particularly .Face value is the value of the share as per the share certificate.10 but it may trade at a market price of Rs.

This value would remain likewise for stocks and is really . So, it is essential to remember that the face value has no relation to the prevailing stock price.Face value of a share is its original cost, not linked to market value. On the other hand, the market value represents the price that an investor agrees to purchase and the .Difference between Face Value, Market Value & Book Value — Market Value. Face value equals the equity share capital divided by . Market value vs. Table of contents. Things to Know About .Face value represents the nominal value of a security, used for interest payments and repayment at maturity, while par value determines the minimum price at which a security can be issued or traded.Face value of a share is the original cost of the stocks as listed by the company on the share certificate. This value indicates the price at which you can buy the stocks of any company. Face value is used to calculate the accounting value of a company’s stock for a company’s balance sheet. The selling price of these securities, therefore, is dictated more by the psychology and competing opinions of investors than it is by the stated value of the security at issuance.

- Fachkonzept Wfbm Bundesagentur Für Arbeit

- Facebook Beiträge Symbole – So finden Sie alte Beiträge in Ihrem Facebook-Konto

- Fachberater Standesamt Bayern _ Fachberatungen

- Fachanwalt Baurecht Köln , prof englert + partner Baurechtsanwälte

- Fachhochschule Welcher Abschluss

- Facebook Zeitgeschichtliches Forum Guide

- Facebook Messenger Vs Lite _ Messenger vs Messenger Lite : The Difference

- Ezb Notenbankfähige Sicherheiten

- Extreme Horror Escape Deutsch _ House of Blood

- Facetime Handoff Auf Anderes Gerät

- Externe Festplatte Doppelsicherung

- F1 Bonus For Winning | Highest-paid F1 drivers revealed with Max Verstappen pay

- Externer Datenschutzbeauftragter Brandenburg

- Facebook Email Adresse Hinzufügen