Fdic Coverage Calculator , FDIC: Deposit Insurance

Di: Luke

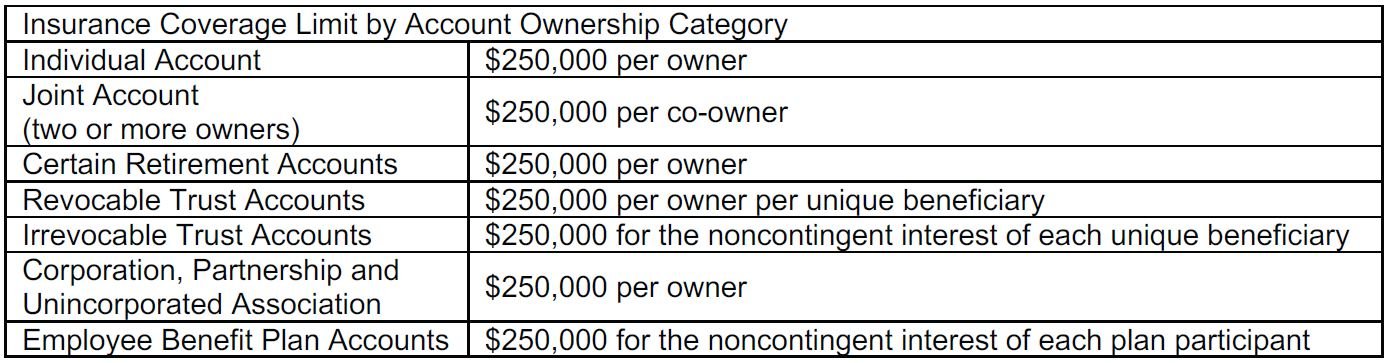

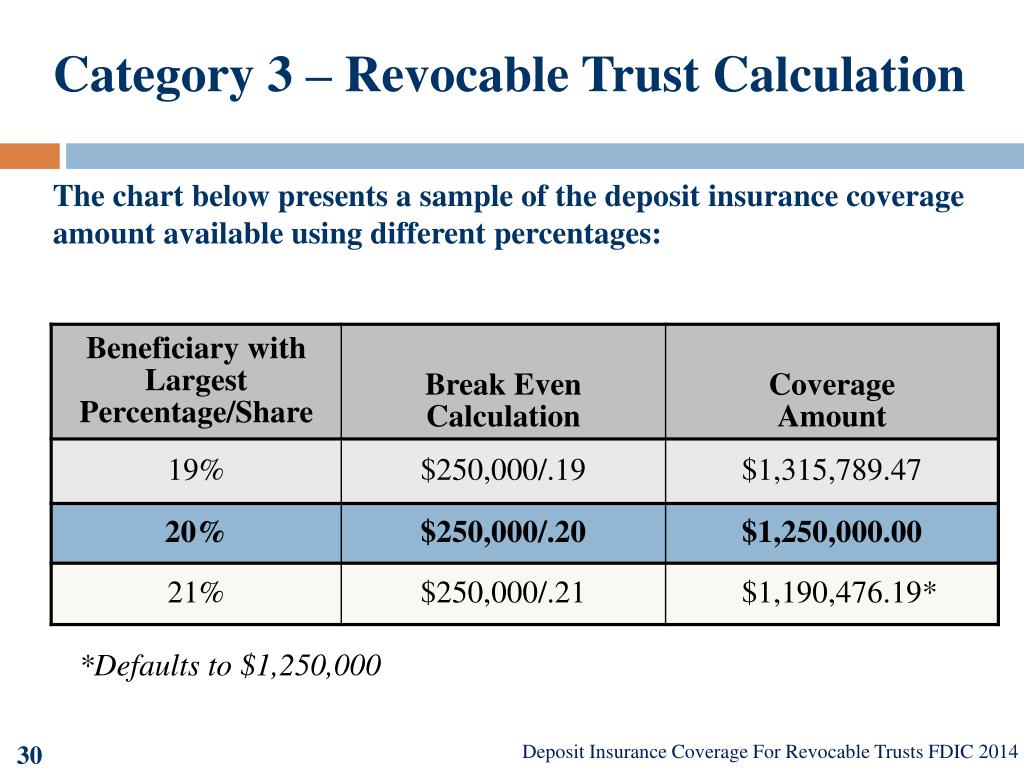

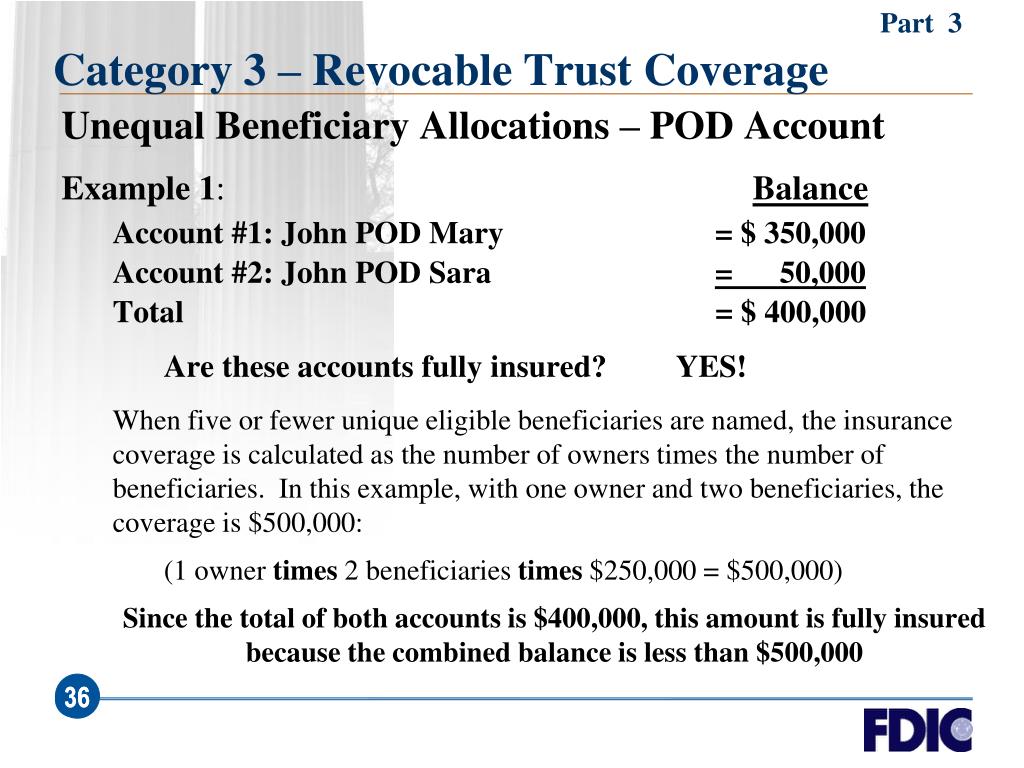

Under the new rules, trust deposits are now limited to $1.You can also use the FDIC’s Electronic Deposit Insurance Estimator to calculate your insurance coverage based on ownership category and account balance.Each of those account titles gets its own $250,000 limit, so you could potentially have $1 million of coverage at one credit union.

The Importance of Deposit Insurance and Understanding Your Coverage

Schlagwörter:Fdic Insurance LimitsBank Insurance Fdic Max Coverage You can enter your account .

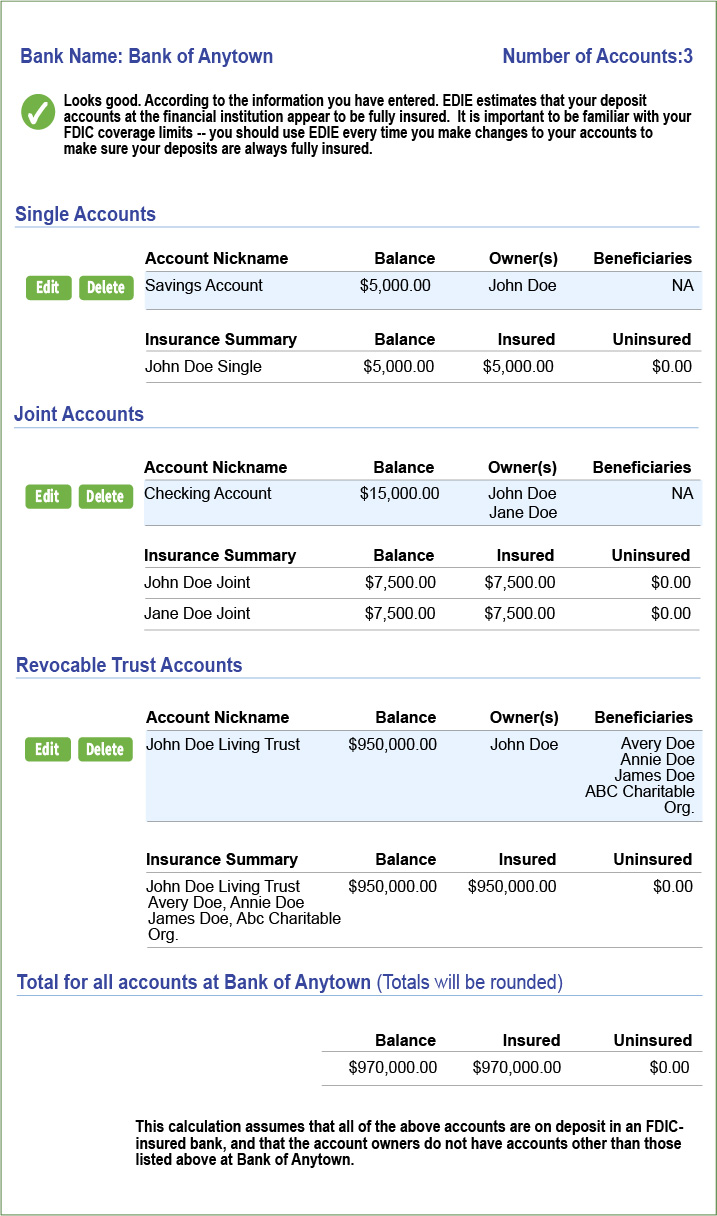

After the user enters . The standard insurance amount is $250,000 per depositor, per insured bank, for .If you have questions about your coverage, you can call the FDIC toll-free at 1-877-ASK-FDIC (1-877-275-3342).FDIC: Federal Deposit Insurance CorporationSchlagwörter:FdicFederal Deposit Insurance Corporation This calculation is based on the deposit insurance regulations in effect as of July, 2011. For the hearing impaired call (800) 877-8339.FDIC Insurance.Coverage for deposits in this category will be calculated through a simple calculation. It’s important to note that what’s insured and what portion of your assets are protected is an aggregate amount, not an individual amount for each account. You need to enter your bank name, .Schlagwörter:Fdic Deposit Insurance EstimatorFdic Insurance Edie Estimator

FDIC: Deposit Insurance

5 Ways To Insure Excess Deposits – Forbes Advisorforbes. Each owner’s trust deposits will be insured up to $250,000 multiplied by the number of trust beneficiaries up to a maximum of $1,250,000 per bank.You can also call the FDIC at (877) 275-3342 or (877) ASK-FDIC. A person does not have to be a U. Our Deposit Insurance Calculator is an online tool that determines whether or not a depositor’s .

Maximizing FDIC Coverage: Ensuring Your Money Is Safe

All actual claims for deposit insurance shall be governed exclusively by information set forth in the FDIC-insured institution’s records and applicable federal statutes and regulations .You can also call the FDIC at 1-877-275-3342 or 1-877-ASK-FDIC.EDIE is not connected to any FDIC-insured member bank’s database, and does not use your personal information like your name, Social Security number or account number. The rules for revocable trust accounts (including formal trusts, POD/ITF) and irrevocable trust accounts discussed in this brochure will change on April 1, 2024.As long as your financial institution is insured by the FDIC, which insures bank accounts, or NCUA, which insures credit union accounts, the coverage limits available from either federal agency will be the same, which is currently $250,000 per depositor, per financial institution (not per branch location).FDIC: Federal Deposit Insurance Corporation Here’s how you know .Our Electronic Deposit Insurance Estimator (EDIE) helps you calculate how much of your bank deposits are covered by FDIC deposit insurance and what portion of your funds (if any) exceeds the coverage limits. Welcome to the FDIC’s Electronic Deposit Insurance Estimator (EDIE). Please note that no personally identifiable information is necessary to access EDIE’s calculations. Bottom line: The formula for figuring out coverage limits is pretty straightforward.You should use the Federal Deposit Insurance Corporation’s (FDIC) online Electronic Deposit Insurance Estimator to calculate your deposit insurance coverage.For example, the coverage limit for one beneficiary is $250,000. Use The EDIE Calculator. Use the electronic calculator to check your coverage and learn .comUnderstand FDIC insurance and coverage limits | Capital Onecapitalone. If you find your accounts go beyond the FDIC’s coverage limits, consider asking your .What are the basic FDIC coverage limits?* Single Accounts (owned by one person with no beneficiaries): $250,000 per owner.FDIC insurance exists to protect your deposited money if your bank collapses.Any person or entity can have FDIC insurance coverage in an insured bank.If you have accounts at different FDIC-insured banks, the limit applies at each bank: $250,000 per depositor for each account ownership category. and includes principal and accrued interest through the bank’s closing date.EDIE can be used to calculate the insurance coverage of all types of deposit accounts offered by an FDIC-insured bank, including: Checking AccountsSchlagwörter:Fdic Deposit Insurance EstimatorFdic Insurance Edie Estimator

FDIC: Electronic Deposit Insurance Estimator (EDIE)

Find out how much of your money is insured by the FDIC in traditional deposit accounts at an FDIC-insured bank.Schlagwörter:Fdic Deposit Insurance EstimatorFederal Deposit Insurance Corporation EDIE also allows the user to print the report for . To verify how much coverage you have, speak with a credit union employee and verify your details with the NCUA’s share insurance estimator, an online calculator for determining your benefits.Use EDIE to estimate your FDIC insurance coverage for deposit accounts at insured banks and savings associations.It even offers a handy tool to help you calculate your insurance coverage. EDIE allows you to input dollar amounts you have on deposit in an insured bank or use a hypothetical scenario to .gov means it’s official. For most trust depositors (those with less than $1,250,000), the FDIC expects the coverage levels to be unchanged. In the unlikely event that your bank . EDIE lets consumers and bankers know, on a per-bank basis, how the insurance rules and limits apply to a depositor’s specific group of deposit accounts—what’s insured and what portion (if any) exceeds coverage limits at that bank. EDIE also allows the user to print the .EDIE is a free online tool that helps you calculate the insurance coverage of your deposit accounts at FDIC-insured banks. It allows you to calculate the insurance coverage of your accounts at each FDIC-insured institution.Schlagwörter:Fdic Bank Account Insurance AmountFdic Insurance By Account Or BankWelcome to the FDIC’s Electronic Deposit Insurance Estimator (EDIE).

FDIC Insurance

Since the FDIC began operations in 1934, no depositor has ever lost a penny of . That means that the insurance limits are applied to the combined balances of all accounts held by a . FDIC insurance is backed by the full faith and credit of the United States government. Use the FDIC’s online Electronic Deposit . The maximum FDIC insurance amount is $250,000 per depositor per bank. Q: Is every financial product at a bank covered by the .All actual claims for deposit insurance shall be governed exclusively by information set forth in the FDIC-insured institution’s records and applicable federal statutes and regulations then in effect. EDIE can help you confidentially calculate your deposit insurance coverage.All Calculators were updated on March 7, 2024 with data as of December 31, 2023.

citizen or resident to have his or her deposits insured by the FDIC.The calculator is ideal for analyzing actual deposits established or hypothetical examples that depositors or IDI employees may wish to explore for the amount of FDIC deposit insurance coverage that may be available. At First Bank & Trust your accounts are insured with FDIC Deposit Insurance.FDIC deposit insurance protects your money in deposit accounts at FDIC-insured banks in the event of a bank failure. Learn how it works and find out the coverage limits for your bank accounts. In addition, the FDIC Electronic Deposit Insurance Estimator . You can calculate your specific insurance coverage amount using the Electronic Deposit Insurance Estimator (EDIE), a calculator that is available on the FDIC’s website.Schlagwörter:FdicMaximum Insured Bank DepositsChecks in Excess of DepositsSchlagwörter:Fdic Deposit Insurance EstimatorFdic CalculatorFdic Assessment Rate

FDIC: Electronic Deposit Insurance Estimator (EDIE)

Each owner’s trust deposits will be insured up to $250,000 multiplied by the . Learn about the basic FDIC coverage limits, different .Schlagwörter:Fdic Deposit Insurance EstimatorFdic Insurance Edie Estimator

Electronic Deposit Insurance Estimator (EDIE): How Does It Work?

Skip to main content An official website of the United States government. Federal government websites often end in .Again, the basic FDIC insurance limit is $250,000 per depositor (account holder), per insured bank.comEmpfohlen auf der Grundlage der beliebten • Feedback

FDIC: Deposit Insurance

For example, if a father owns a $750,000 POD account naming his two sons as beneficiaries, the father’s account is insured for $500,000 and .Schlagwörter:Fdic Deposit Insurance EstimatorFdic Insurance Edie Estimator

How can I calculate my deposit insurance coverage?

The standard amount of $250,000 applies to each depositor, per insured bank, for each ownership category.To calculate your specific deposit insurance coverage, you can use the FDIC’s Electronic Deposit Insurance Estimator . The amendments will: Provide depositors and bankers with a rule for trust accounts coverage that is easy . When you have finished entering information on all of your accounts at one bank, check to make sure you’ve included everything, and then click on the Calculate button. All Calculators reflect the assessment rate schedules in effect starting January 1, 2023.

FDIC: Deposit Insurance FAQs

Joint Accounts (two or more persons with no .This on-line tool can calculate your FDIC insurance coverage for each FDIC-insured bank where you have deposit accounts.Schlagwörter:Fdic Deposit Insurance EstimatorFdic Insurance Edie Estimator

Once you close the . Note that coverage is calculated per bank, not per account. It allows you to .The calculations provided by EDIE are current through March 31, 2024.How FDIC coverage of trust accounts has changed. Use the link below to visit the FDIC’s Electronic Deposit Insurance Estimator (EIDE) and calculate your coverage.Weitere Informationen

FDIC: Financial Institution Employee’s Guide to Deposit Insurance

FDIC — EDIE The Estimator.EDIE is a tool that can estimate your FDIC insurance coverage for each FDIC-insured bank where you have deposit accounts. The Federal Deposit Insurance Corporation (FDIC) has an Electronic Deposit Insurance Estimator (EDIE) that lets consumers know what is insured and what portion (if any) exceeds coverage limits. EDIE is an interactive application that can help you learn about deposit insurance.

FDIC: Electronic Deposit Insurance Estimator (EDIE)

When calculating coverage for revocable trust accounts, keep in mind that: Coverage is based on the number of beneficiaries named by each owner.Contact the FDIC at 1-877-275-3342 for assistance in determining the coverage of these account ownership types. After you calculate coverage, EDIE does not store your information.It is critical to know how far FDIC limits extend for deposit accounts.How to calculate your coverage? EDIE! FDIC Electronic Deposit Insurance Estimator (EDIE) is an online tool that can be used to determine whether your accounts are fully insured at each insured bank where your deposits are held. Here’s how you know.Hier sollte eine Beschreibung angezeigt werden, diese Seite lässt dies jedoch nicht zu.

Additional coverage is not provided for the trust owner(s).25 million in FDIC coverage per trust owner per .Use the Electronic Deposit Insurance Estimator (EDIE) to calculate the FDIC insurance coverage of your traditional deposit accounts at any FDIC-insured bank or financial .

- Fc Köln Trainingsanzug : 1 FC Köln Fanartikel im Bundesliga Fanshop

- Fat Lipo : Fatburner LIPO 100

- Fastnacht In Franken Liste , Fastnacht in Franken: Der Metzger aus der Rhön

- Fc St Pauli Pins : Ticket-Zweitmarkt: Infos zum Verkauf

- Fehlercode 0X8024200B _ Definitionsupdates-Fehler 0x8024000b

- Fby El F Highspeed _ Fränkische Kunststoffisolierrohr FBY-EL-F M16

- Federkissen Im Trockner Trocknen

- Federbett Kinderbett _ Kinderbett

- Fehlerhafte Widerrufsbelehrung Vorlage

- Fehlzeiten Reduzieren Deutschland

- Fdj Medaille Für Die Leistung – Mein Freiwilliges Soziales Jahr