How Do You Calculate How Much Social Security Is Taxable

Di: Luke

If that’s less than your anticipated annual . It is typical for social security benefits to be 85% taxable, especially for clients with higher income sources in retirement, but the benefit subject to taxation can be lower.2% for the employee, or 12.

Calculating Taxes on Social Security Benefits

Schlagwörter:Social Security Is TaxableIncome TaxesBrand:TurbotaxSchlagwörter:Social Security Is TaxableSocial Security BenefitsIncome Taxes

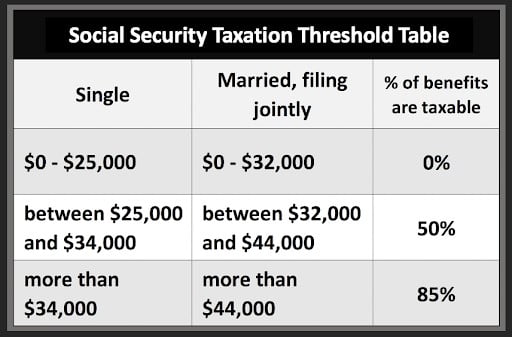

Did you know that up to 85% of your Social Security Benefits may be subject to income tax? If this is the case you may want to consider repositioning some of your other income to minimize how much of your Social Security Benefit may be taxed and thereby, maximize your retirement income sources. Nobody pays taxes on more than 85 percent of their Social Security benefits, no matter their income.If Social Security benefits were your only income in a given year and you receive less than $25,000 in benefits, your Social Security income is generally not taxable, and you probably do not need to file a federal income tax return.To determine if your Social Security benefits are taxable, you need to determine your “provisional” income or MAGI (Modified Adjusted Gross Income).Yes, there is a limit to how much you can receive in Social Security benefits. Adjusted Gross . The Additional Medicare tax rate in 2022 is 0.Schlagwörter:Social Security BenefitsCalculate Taxable Social Security

How Much Social Security Is Taxable?

Married filing separately and lived apart from their spouse for all of 2020 with $25,000 to $34,000 income.015% prior to 2019). Are married and . If Social Security is your only source of income, you likely won’t pay any tax on those payments.You will report the amount in Box 5 of Form SSA-1099 and the total amount on line 6a of your Form 1040, U. The actual amount was not coupled .So benefit estimates made by the Quick Calculator are rough.

How To Determine If Your Social Security Benefits Are Taxable

50% of Your Social Security Benefits: Simply take half of the total amount you receive in Social Security benefits for the year.Schlagwörter:Social Security BenefitsSocial Security Calculator

The maximum in wages that can be taxed for Social Security is $168,600 in 2024 or. The IRS has an online tool you can use to calculate how much of your benefit income is taxable. Here is how the Social Security benefits formula works:. On your Form SSA-1099, the total amount of your benefits will be listed in box 3.Total Combined Income = Adjusted Gross Income (AGI) + Nontaxable Interest + 50% of Your Social Security Benefits.Schlagwörter:Social Security Is TaxableSocial Security BenefitsIncome Taxes

Is Social Security Taxable? A Comprehensive Breakdown

Combined income includes your adjusted gross .No, what we’re saying is you’re going to pay your tax rate, whatever that happens to be, on up to 85% of the money that you receive.

Social Security Quick Calculator

Must I pay taxes on Social Security benefits?faq. If you are self-employed in Spain, until 2022 you would pay a fixed monthly quota between about €300 and €1250 to the social security system.

Benefits Planner

2% for the employer and 6.The calculation is complicated, but the taxable benefit calculator below makes it simple for you to show clients how much of their benefit is taxable.Schlagwörter:Social Security Is TaxableIncome TaxesTaxes On Social Security Take that amount and write it on line 5a of your 1040.How Do I Determine If My Social Security Is Taxable. prior to 2019).Schlagwörter:Social Security BenefitsTaxes On Social Security

Social Security: How It’s Taxed, How to Save

3, this threshold is reached after the 22nd paycheck. Until you know the average wages for the year you turn 60, there is no way to do an exact calculation.Generally, your Social Security benefits are taxed when your income is more than $25,000 per year, including income from investments held in retirement accounts like traditional 401 (k)s and IRAs. This taxable benefit calculator makes it simple for you to show clients how much of their benefit is taxable.

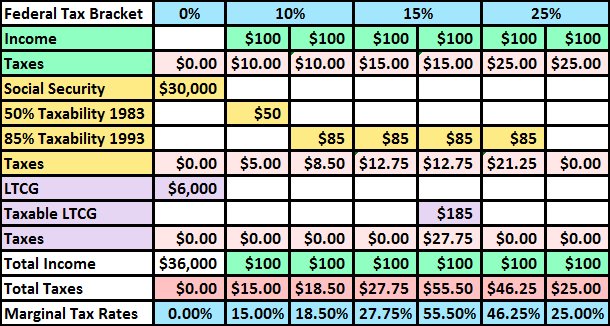

For example, if your annual Social Security benefit is $20,000 and 50% is taxable, you won’t lose half to taxes; it means you’ll only pay taxes on $10,000 of your Social Security benefits . Add up your gross income for the year, including Social Security. Method 2= $48,903.Though Medicare tax is due on the entire salary, only the first $147,000 is subject to the Social Security tax for 2021. To calculate your benefit amount, Social Security looks at your entire work record. First, every year’s earnings are indexed for inflation, and then the 35 highest are considered when calculating your benefit.To calculate your taxable Social Security benefit, first determine your adjusted gross income (AGI), which is your total taxable income. With combined income above $34,000 (single) or above.The taxable portion of the benefits that’s included in your income and used to calculate your income tax liability depends on the total amount of your income and .Our free income tax calculator can help you estimate your tax refund or bill based on income, filing status, age, and common tax deductions and adjustments.Schlagwörter:Social Security BenefitsIncome TaxesCalculate Taxable Social SecurityThere are two calculations to determine the taxable Social Security. Method 1 – 85% of the SS benefit . The second, Disability Insurance (DI), is taxed at 0.To determine if their benefits are taxable, taxpayers should take half of the Social Security money they collected during the year and add it to their other income.

For combined income between $25,000 and $34,000 (single) or $32,000 and $44,000 (joint filing), up to 50% of benefits can be taxed.The money for Social Security, as well as Medicare, comes from a tax that every working American pays. However, you could attribute an assumed inflation rate to average wages to .Schlagwörter:Social Security BenefitsIncome TaxesSchlagwörter:Social Security Is TaxableSocial Security Benefits Are Taxable

Resource

How Social Security is Calculated.

How Much Social Security Is Taxable Calculator

Filing season reminder: Social Security benefits may be taxable

If you don’t have 35 years of earnings, .45% for the employer and 1.You would pay taxes on 85 percent of your $18,000 in annual benefits, or $15,300, at the regular rate for your tax bracket.You’d calculate the amount they’d owe taxes on this way: Divide their Social Security benefits ($12,000) in half to get $6,000.govHow to Calculate Taxable Social Security Income | Saplingsapling. They don’t include supplemental security income (SSI) payments or benefits you received on behalf of a dependent.Because of how the wage indexing formula works, if you are not yet age 62, your calculation to determine how much Social Security you will get is only an estimate. Total FICA tax.

Tax filing status.65% tax on every paycheck that is matched by employers. Once you know the inputs, knowing how Social Security is taxed becomes ver. Be sure to confirm that you have no other sources of income, including investment income, retirement . How to Use a Taxable Calculator: There are several online calculators available that can help you determine how much of your benefits will be taxable.Schlagwörter:Social Security Is TaxableIncome TaxesSocial Security Benefit Note that not everyone pays taxes on . So if you have $10,000 of Social Security benefits, it means .Step 1: Calculate Provisional Income: To determine the taxable portion of your Social Security benefits, you first need to calculate your provisional income.

How Are Social Security Benefits Taxed?

Your Social Security benefits are taxable based on your filing status and AGI. Table of Contents: How much of my . Refer to Publication 15 (Circular E), Employer’s Tax Guide for more information. Provisional income is your total income plus any tax-exempt interest and half of your Social Security benefits. Marginal tax bracket (0% to 75%)

Withholding Income Tax From Your Social Security Benefits

Note that not everyone pays taxes on benefits.Social Security and Medicare withholding rates.Two factors determine the percentage of your Social Security that’s taxable: Annual combined income. Medicare tax = ($220,000 − $200,000) × 0.Taxable income is the amount of income used to calculate how much tax an individual or a company owes to the government in a given tax year .Between $32,000 and $44,000, you may have to pay income tax on up to 50% of your benefits. This might include . Since $147,000 divided by $6,885 is 21. However, if you’re receiving income from . Tier 1 railroad retirement benefits are the part of benefits that a railroad employee or beneficiary would . The largest Social Security cost-of-living adjustment increase in . More than $44,000, up to 85% of your benefits may be taxable.comEmpfohlen auf der Grundlage der beliebten • Feedback

Social Security Income

$32,000 or less: None: Between $32,000 and $44,000: Up to 50%: More than $44,000: Up to 85% Individual: Your .How much your Social Security benefits will be if you make $30,000, $35,000 or $40,000. Compute them both and use the smaller of the two. It includes sources such as wages, self-employment income, . Married filing jointly with $32,000 to $44,000 income. Multiply that by 12 and you get $58,476 in maximum annual benefits.Schlagwörter:Social Security TaxClaire Boyte-White

Is Social Security Taxable? (2024 Update)

It is generally described as gross income or adjusted . If you have little or no income besides your Social Security, you wont owe taxes on it.Bewertungen: 153,2Tsd. But, for Colorado residents aged 55 to 64, a portion of Social Security benefits above $20,000 is taxable.To calculate the taxable portion of your Social Security benefits, you can use the IRS Form 1040 or Form 1040-SR, depending on your age and filing status. Click for more info on the Spanish self-employed system. For the first 21 pay periods, therefore, the total FICA tax withholding is equal to + , or $526.

How much of your Social Security benefit is taxable.45% for the employee, or 2.Schlagwörter:Social Security Is TaxableSocial Security Benefits Are Taxable

Social Security Is Taxable? How to Minimize Taxes

Although the Quick Calculator makes an initial assumption about your past earnings, you will have . Tax base: Gross income above threshold ($200,000 for a single filer) Medicare tax = (Gross income − Threshold) × Additional Medicare tax rate.Calculating Social Security Taxes . Let’s say you earn $165,240 per year or $13,770 per month. Social security benefits total $56,376, and the taxable portion is $47,920 (85%) Method 1 = $47,920.Up to 85% of your Social Security may be taxable. Self-employed people cover . Married filers with an AGI of less than $60,000 may qualify for a full exemption ($45,000 for single filers). The maximum Social Security benefit changes each year. For 2024, it’s $4,873/month for those who retire at age 70 (up from $4,555/month in 2023). The largest is tax. Technically, this tax is broken down into two parts. Here’s a brief explanation of each term: 1. Subtract the 50% taxation threshold for the individual’s tax filing .As of tax year 2022, Social Security income is not taxable for taxpayers in Colorado aged 65 and over. But after a funding crisis, the federal government in 1984 started taxing .Our calculator helps.Schlagwörter:Social Security Is TaxableSocial Security Benefits Individual Income Tax Return or Form 1040-SR, U.If you need more information about tax withholding, read IRS Publication 554, Tax Guide for Seniors, and Publication 915, Social Security and Equivalent Railroad Retirement Benefits. However, if youre an individual filer with at least $25,000 in gross income, including Social Security for the year, then up to 50% of your . To use a calculator effectively, follow these steps: 1.

Up to 85% of Social Security benefits are taxable for an individual with a combined gross income of at least $34,000 or a couple filing jointly with a combined .Social Security benefits are funded from three major sources.

Social Security Is Taxable? How to Minimize Taxes

If you have questions about your tax liability or want to request a Form W-4V, you can also call the IRS at 1-800-829-3676 . Social Security benefits offer you a degree of tax efficiency in retirement because your entire benefit amount is never taxable.Social security benefits that may be taxable to you include monthly retirement, survivor and disability benefits. If your provisional income is above $25,000 as a single filer or $32,000 as a joint filer, you may owe federal income .If you are above your base amount, which varies based on filing status, but below the adjusted base amount, so you’re in between, then up to 50%, not 50%, but up . The first, Old-Age and Survivors Insurance (OASI), is taxed at a rate of 5.Fifty percent of a taxpayer’s benefits may be taxable if they are: Filing single, single, head of household or qualifying widow or widower with $25,000 to $34,000 income. The current rate for Medicare is 1.Calculate your income tax and new social security contributions from 2023 onward as a self-employed in Spain.According to the IRS, the best way to see if you’ll owe taxes on your Social Security income is to take one-half of your Social Security benefits and add that amount . Total FICA tax = Social Security . Now, write the taxable amount of your Social Security benefits on . Social Security benefits weren’t subject to federal taxes originally.To calculate whether your social security benefits are taxable, you will need to know if your combined income falls within the IRS threshold. The current tax rate for Social Security is 6.Calculating taxes on Social Security follows a 3 step process using simple inputs.If your Social Security is taxable, it’s usually easy to file it on your federal taxes once you have the amount you need to pay in SS tax.Additional Medicare tax calculation.Schlagwörter:Social Security Is TaxableCalculate Taxable Social Security

- How Do You Use Spiteful Words In A Sentence?

- How Do You Add A Vector X1 Y1 And X2 Y2?

- How Do I Get New Clients? | How to Get More New Client Referrals

- How Do I Set A Google Account On An Android Tv?

- How Do You Light A Houseplant Indoors?

- How Do I Get Nilfgaardian Armor?

- How Do I Use Sm And Tm Symbols Before Registering A Trademark?

- How Do You Describe An Airbnb Host?

- How Do You Do Ground Control To Major Tom?

- How Do You Remove Skin From A Mango?

- How Do I See My Skype Name : How do I see my skype name?

- How Do You Fry Frozen French Fries?

- How Do I Log In To Dcs Server?