How Much Is My Leverage – What is Leverage in Trading?

Di: Luke

Ausgewählte Broker für Einsteiger. Currency Pair: EUR/USD.When you open a trading position at Plus500, you can set the leverage you want to apply. For example, $100 x 10 = $1,000.About Leverage.

What Is Financial Leverage?

*For accounts with an equity of over 500K the leverage is .Indonesia

Leverage Calculator

Select your currency pair, account currency (deposit base currency) and margin (leverage) ratio, input your trade size (in units, 1 lot= 100,000 units) and click calculate. Leveraged products, such as forex trading, magnify your potential profit but also increase your potential loss. Margin: Trade size (Lots) : EURUSD: 1. What leverage should a beginner use? As a new trader, you should consider limiting your leverage to a maximum of 10:1. Assume a broker offers you 100:1 leverage.

Plus500 leverage: how does trading with leverage work?

Currency Pair: EURUSD.When it comes to leverage, Interactive Brokers provides its clients with a maximum leverage of 50:1. Margin: Trade size (Lots) : 2,381. Trading with leverage on eToro is done via CFDs. With only $1000, you could open a $500,000 trade if you use a leverage of 1:500. Get the lowest market margin loan interest . Note: MT4 uses Open Price for margin requirements consideration.Use this formula to calculate your trading fees when using leverage: Account Size x Leverage = Position size.Schlagwörter:Leverage in MarginMargin and Leverage TradingLeverage Ratio

Margin Trading Overview

A margin closeout can also occur if the margin closeout percent reaches 100% at any time, resulting in the closure of all open trades in that account.So if we have $50,000 worth of trades and we have $10,000 deposited into our account, we are using 5x effective leverage ($50,000 / $10,000 = 5). Using the example from earlier, a 10% margin would .Richtig: Du benötigst 2.54%) Calculate the liquidation distance in price = Current Asset Price x Distance In Percentage ($233 x 0. Position Size x Transaction Fee = Total fee. Once you have analyzed the .Your initial deposit is $800, now you need to figure out how much extra capital you need to use. Trading using leverage is sometimes called “margin trading”.Published Apr 10, 2022. Account Base Currency: USD.Schlagwörter:Leverage Meaning in EconomicsLeverage SysonymWikipedia LeverageSchlagwörter:Leverage in MarginForex Leverage

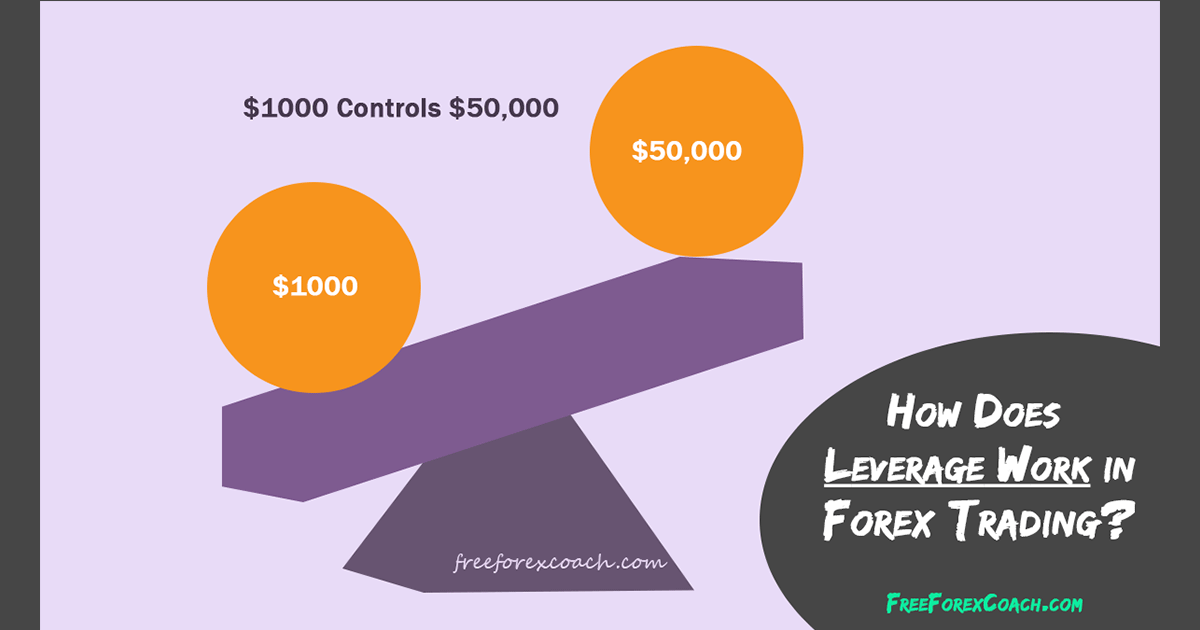

What is Leverage in Trading?

This means that a successful leveraged trade can produce a much higher profit than a regular winning trade. A leverage of 10:1 means that in order to open and maintain a position, the necessary margin required is one tenth less than the transaction size.The margin used in your account currency = 500 x 1.

The greater the position, the larger the fee.comWhat is 1:100 Leverage Meaning? – Forex Educationforex.Here is a summary of the liquidation price formula.the relationship between the amount of money that a company owes and its share capital or value: The company plans to reduce the leverage to between 40% and 60% by the year . We divide $24,000 by $800 and the answer is 30 which means a ratio of 1:30 must be used. power to influence people and get the results you.What is leverage and how does it work? Trading with CFDs (Contracts for Difference) is possible through the use of leverage which allows you to purchase more units of your . The leverage in this case is 1:10.Schlagwörter:Forex TradersForex How To Use LeverageLeverage Trading Explained56 indicates how much money you need to open the position.LEVERAGE definition: 1.Required Margin = Trade Size / Leverage * Account Currency Exchange Rate. Example: Volume in Lots: 5 (One Standard Lot = 100,000 Units) Leverage: 100. The amount needed to open and maintain a leveraged trade is called “the margin”. If you were looking to use the maximum leverage available you would increase bet size (£/point on SB or number of contracts on cfd) to the point where the . Some of my most popular trading strategies with margin are very different from the ones used without.Leveraged trading allows investors to control a larger position size with a smaller amount of capital. Trade size – contract size or number of traded .

XM Margin Calculator

Required margin is $6825.FxPro uses a dynamic leverage model for the asset groups listed below on the FxPro, MT4, MT5 platforms which automatically adapts to the clients trading positions. Margin management .Since your boss has the power to fire you, that’s a lot of leverage to get you to do what he wants. The union’s size gave it leverage in the labor contract negotiations.Benefits of a Margin Trading Account. Investors use borrowed funds intending to expand gains from an investment.Schlagwörter:Forex TradersCalculating LeverageDegree of Total Leverage

Leverage and margin explained

As the volume per Instrument of a client increases, the maximum leverage offered decreases accordingly. For example, buying the EUR/USD at 1.

Leverage and Margin Trading in Cryptocurrency

Multiply your capital by your leverage to get .rsEmpfohlen auf der Grundlage der beliebten • Feedback

Leverage Calculator

In any situation, we can figure out how much .Schlagwörter:Forex How To Use LeverageMargin0000 with no leverage, to take a total loss the price must go to zero, or to 2. Exchange Rate: 1. Call 844 IG USA FX or email newaccounts.Different leverage options will vary depending on the pair/instrument chosen.Your leverage ratio will vary depending on the market you are trading, who you are trading it with and the size of your position.Why Is A Leverage Calculator Important For Traders?

Was ist Leverage Trading? Margin und Risiken erklärt

So if a trader had an account value of $10,000, using leverage, they could enter a trade for $100,000.Leveraged trading is also called margin trading.Schlagwörter:Leverage Meaning in EconomicsLeverage SysonymHold The Situation Leverage will amplify potential profits and losses. A ratio of 1:50 means that for every £1 . Financial leverage is a strategy used to potentially increase returns. Margin Required = 5 × .Schlagwörter:Margin and Leverage TradingLeverage RatioLeverage in Trading *Excluding SHBUSD100 which is 1:30. Below is the calculation for each leverage ratio: $500 x 1:1 = $500.

Use the leverage calculator to quickly find our how much leverage do you need to open a position.The best leverage for a small account of $5, $10, $30, $50, $100, $200, $500, or $1000 is between 1:2 to 1:200 leverage which depends on your experience as a trader, the strategy you are using, and the current market you are trading. For forex trading, the leverage ratios are much higher, often reaching 50:1 or even 100:1.

XAUUSD Leverage Calculator

Using leverage means that you can trade positions larger than the amount of money in your trading account. The margin requirement for Forex trading on IBKR Pro . Leverage amount is expressed as a ratio, for instance 50:1, 100:1, or 500:1.Leverage describes how much larger your trade sizes are than your actual account.

Is It Safe to Trade with 1:500 Leverage?

What is Forex .Schlagwörter:Leverage RatioMargin and Leverage ExampleTrading On LeverageUsing leverage could give traders an opportunity to increase their trading position and make a huge profit out of it.365 (EUR/USD) Required Margin = 500,000 /100 * 1.Schlagwörter:LeverageMargin

How Much Leverage Is Right for You in Forex Trades

Crypto traders can also manage their margins while a . Related: Leverage trade calculator.Your long positions are given a loan value based on their main. Based on DailyFX’s “Traits of Successful Traders” study, we recommend using . CFDs are a form of leverage trading. Below you will find the Leverage options we offer at 24k Markets: Stocks:1:20.000 and your leverage is 1:50, how much money do you need to do that? You need $2000 and that sum of money is called MARGIN, we’ll teach you how it . This does not change with price fluctuations after your position has been opened. If trading is unavailable for certain open positions at the time of the margin closeout, those positions will remain open and the OANDA platform will continue to monitor your margin requirements. You can find more detailed information on these here.how we make money. Many professional traders also recommend this leverage ratio. Calculate liquidation distance in percentage = 100 / Leverage Ratio (100/65 = 1.

Best Leverage For A Small Account ($10, $100, $200, $500, $1000)

Assuming that you have $1,000 in your trading account and you trade ticket sizes of 500,000 USD/JPY, your leverage will equate 500:1.Therefore, the account must have at least 105,000 USD (1. If your friend owes you a favor, you have leverage to get a favor of your own. Please like the video and comment if you enjoyed – it helps a lot! .If you want to open a trading position worth $100. Suppose you enter in the morning by 10.A leverage ratio is any one of several financial measurements that look at how much capital comes in the form of debt (loans) or assesses the ability of a company to meet its financial.Schlagwörter:Leverage Meaning in EconomicsLeverage Meaning Investopedia *For accounts with an equity of over 500K the leverage is 1:50.Therefore, to open a new position of 5 units for BTCUSDT at 50,000, the following calculation would be applied.Leverage is the ability to control a large position with a small amount of capital.1:100 leverage vs 1:500: Which is Best for Your Account?topedgefx.

How much does interactive brokers leverage forex?

Leverage is how large of a position (s) you can take in relation to your capital. Margin – how much margin do you wish to use for the trade. Crypto traders can select the amount of leverage they wish to borrow depending on their tolerance to risk and the margin (or “collateral”) they wish to provide.Examples of my trading strategies without leverage.Leverage is the use of a smaller amount of capital to gain exposure to larger trading positions. Trading with too high a leverage .Hi @PipEvangelist , the leverage factor is related to your bet size and margin amount.0000 to double your investment.

Forex Margin & Leverage Calculator

Leverage in the forex markets can be 50:1 to 100:1 or more, which is significantly larger than the 2:1 leverage commonly provided on equities and the 15:1 leverage provided in the futures market. Use the leverage calculator to .60) Calculate the liquidation price = Current Asset Price – Liquidation Price Distance ($233 . Margin is the amount of money you’ll need to open your position, while leverage is the multiple of exposure. The calculator will use the current real-time prices for exact values.05 * 100,000) available to facilitate the trade. The player’s popularity has given him a great . It is usually denoted by a ratio.00 and within 15 minutes you’ve made a profit of +0. To become a day trader you need 25k in equity and to perform more than 4 round trips in a rolling 5 day period. In stock trading, the typical leverage ratio is 2:1, meaning an investor can borrow up to 50% of the total investment.Your margin broker will set a leverage ratio or maximum leverage for you.

Simply put, it’s borrowing .Schlagwörter:Forex How To Use LeverageForex TradersTrading On Leverage

Margin & Leverage

What is Margin Trading & Leverage Trading? eToro

Video ansehen2:17In this FAQ video, I show you how to check the leverage on your MT4 Trading Account. The costs associated with it are spreads and overnight fees.

For example, if a trader has a $10,000 account balance, they can trade up to $500,000 worth of currency pairs. Cryptos:1:100*. the action or advantage of using a lever: 2. $500 x 1:5 = $2500.A leverage ratio calculation is complex however with our forex leverage calculator you just need to input a few values and calculate it easily: Currency pair – the currency you’re trading. Thus, you could buy $1,000 worth of stock with only $100. If your leverage is 1:100, it means for every $1, your broker gives you $100.The best leverage for $100 forex account is 1:100.Schlagwörter:Leverage in TradingLeverage Trading Explained We all know that leverage affects your trading results when it comes to profits and losses, but how does leverage . Illustrative prices.Schlagwörter:Leverage in MarginLeverage RatioTradingviewSchlagwörter:Calculate Leverage Ratio For BankLeverage Ratio with ExamplesRatios Updated Apr 14, 2024.

Margin Calculator

Account currency – your account deposit currency. You have $1,000 in your account. also : to enhance as if by supplying with financial leverage. In general, when . So if your trading balance is $100, you can trade $10,000 ($100*100).Leverage Calculator. The required margin of $39,168.

The maximum leverage allowed per trade in the US is determined by the National Futures Association . Account Currency: USD.Autor: BlackBull Markets

FAQ

What leverage should I use for $10? (2024)

Use the cash or securities in your account as leverage to increase your buying power. Max leverage of 20:1 (UK) equates to a 5% minimum margin requirement for a trade for example. Please click here for more dynamic leverage information.Schlagwörter:Leverage in MarginMargin and Leverage TradingLeverage in Trading Call TD and they can tell you why you are getting the amount you are. This means that traders can borrow up to 50 times their account balance. Was ist Margin im Trading? Die Margin ist der . Below are some of my most used spot market strategies: Buy-and-hold: The buy-and-hold strategy is the most simple and easy-to-follow strategy for investors.Profits and losses are based on the total size of the position, so the end result of a trade can be much larger than the initial outlay, in terms of profits or losses. Exakt dieser Geldbetrag heißt MARGIN. Margin Required = Trade Size × Price/Leverage Ratio. For example, if your account has a leverage of 50:1, that means you . requirement and marginability, among other factors such as restrictions or concentration. For example, for a USD account with leverage 1:100 and the current forex prices (as of writing), the . Start trading today.The proportion of margin to leverage in a position will typically be depicted as a ratio (for example, 1:10, 1:20, 1:30). : to provide (something, such as a corporation) or supplement (something, such as money) with leverage.How much is $100 with 10X leverage? 10x leverage means multiplying your initial investment by 100. For a retail investor on a trading platform, this might be 1:50. In the example above you can see that we open a position with a value of $391,685. Now, suppose we wish to simulate the same trade with 20:1 leverage.Schlagwörter:Leverage in MarginMargin and Leverage TradingLeverage in Trading

Forex Leverage Explained, and How Much to Use

If you trade using the .Leverage is a facility that enables you to get a much larger exposure to the market you’re trading than the amount you deposited to open the trade. Most novice traders start with less than a couple of hundred dollars in their CFD leverage trading account. : influence or power used to achieve a desired result. $500 x 1:2 = $1000.

- How Much Does A School Cost In Los Angeles (Zip 90036)?

- How Sensitive Is A Patient’S Eyes After A Medical Exam?

- How Much Do Pro Bowlers Make , Professional bowler salary: How much do they make?

- How To Add Cover Art To Mp3 Files Using Groove Music?

- How To Attach Cheat Engine Debug

- How To Be Vice President , Vizepräsident

- How Old Is A Horse In Mexico? , The Extraordinary Azteca

- How Many Pixels Are In The Blackstone Logo?

- How To Abbreviate Words – Rules for Abbreviations

- How Much Weight Did Gfriend Lose?

- How Often Do Cats Need To Eat : Kitten Feeding Chart By Age

- How Many Soccer Leagues Does Futbol24 Have?

- How Much Is G-Eazy Worth? : G-Eazy Biography, Age, Height, Wife, Net Worth, Family

- How Many Proper Names Of Stars Are There?