How To Calculate Var _ Value at Risk (VaR) explained: calculation and FAQs

Di: Luke

It allows the investors or the managers to assume the maximum exposure and take remedial steps or choose between multiple options.Therefore, asset A has a 5% annual VaR of $59,660. Typically, there will be limits set against the VaR number to ensure that traders or portfolio managers keep their market risk within agreed levels.Schlagwörter:The VaRThe Value At RiskPortfolio VarVar Value At Risk Formula

Value at Risk (VaR) explained: calculation and FAQs

Value-at-Risk is a measure of the minimum loss expected in either dollar or percentage terms as it relates to the portfolio value.Value-at-Risk (VAR) is a critical concept for risk and portfolio management which is often taught during CFA level II and level III. Launched in 1994 by J.Calculating Value at Risk (VaR) in Excel involves determining the potential loss in a portfolio over a specific time period and confidence level.Credit VaR can be calculated according to two approaches as follows: Approach 1 (preferred and should be your default): Credit VaR is the distance from the mean to the percentile of the forward distribution, at the desired confidence level (paraphrased from the PRMIA Handbook). Limitations of VAR. In this step of the Value at Risk for options process, we construct a Monte Carlo simulator to determine the terminal price of the underlying. The web page explains the concept, the formulas, . Returns the variance of the array elements, a measure of the spread of a distribution.

How to Calculate VaR: Finding Value at Risk in Excel

Value at Risk (VaR) explained: calculation and FAQs

•VaR is used at the firm level to determine the amount of capital the Feds will require the firm to have. ? Need help with a project? .Schlagwörter:The VaRThe Value At RiskPortfolio VarTime Horizon

Value at risk

Value at Risk (VaR) is a statistical measure of the potential loss on a portfolio. The typical definition of ‘worst case’ is 95%., Value at Risk, is a measure of how much money you might lose ‘worst case’ based on your current positions (i.

Var: Excel Formulae Explained

That means that the formula for calculating VaR is: VaR = average – 2. Within risk terms, we call daily price changes, daily returns, and these returns could be positive or negative. Refer to the example below for clarification. There are other risks — such as credit risk — that may not be included in the price history.A “real-time” VaR calculation can determine whether a trade is possible.

:max_bytes(150000):strip_icc()/Variance-CovarianceMethod5-5bde86ce7819405ca63f26aa275a4bd2.png)

Value at Risk (VaR)

To simulate this particular .S () in Excel).

Calculate values in a PivotTable

Schlagwörter:The VaRThe Value At RiskPortfolio VarTime HorizonVaR is calculated using the following formula: VaR = (portfolio value) x (z-score) x (volatility) Don’t worry if this looks intimidating – we’ll break it down. Step 1: Construct a Monte Carlo Simulator for prices of the underlying.In PivotTables, you can use summary functions in value fields to combine values from the underlying source data. The z-score is a statistical measurement of how many standard deviations away from the mean an observation is. It requires the mean and standard . It’s an important tool for measuring and managing risk.

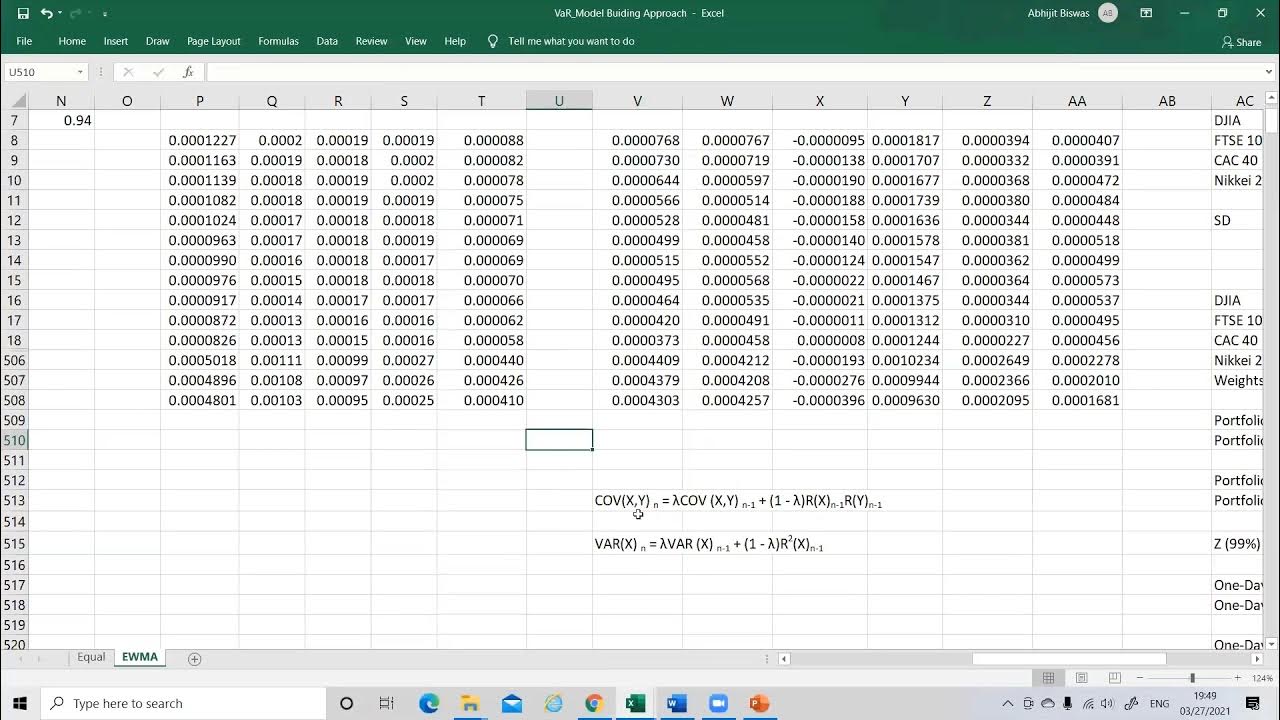

Schlagwörter:The VaRTime HorizonFormula For Value At RiskVar ComputationWhat Is Value at Risk (VaR)? Who Uses Value at Risk.Calculating VaR can be approached through various methods, including the Historical Method, the Variance-Covariance Method, and the Monte Carlo Simulation.Value at risk ( VaR) is a measure of the risk of loss of investment/Capital. More specifically, VaR is a statistical technique used to measure .Value-at-risk is a statistical method that quantifies the risk level associated with a portfolio.Calculating Value at Risk for a portfolio needs one to calculate the risk and return of each asset.What is VaR Used For? VaR is used as a tool to decide how large a trading book to have.

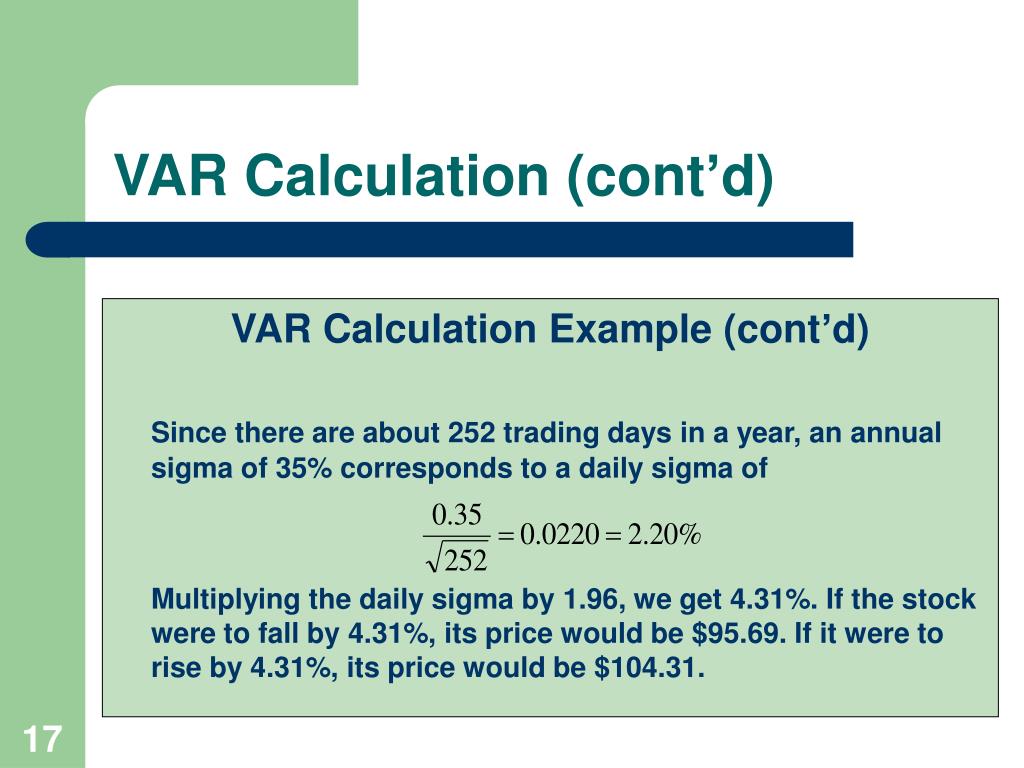

![[Math] How to understand the variance formula – Math Solves Everything](https://i.stack.imgur.com/NjjWO.png)

For example, a VaR calculation that suggests an asset 5% chance 3% loss over a period of one day would tell an investor with $100 invested into that asset that . The measurement is often applied to an investment portfolio for which the calculation.comfinancetrainingcourse.5%) are losses below the . — Aggregate Function Syntax VAR ( [ ALL | DISTINCT ] expression ) . The Value at Risk (VaR) Calculator can help you estimate how much of your investment you might lose at given normal market conditions, over a .First, get your Excel sheet ready.Value at risk (VaR) is a statistic that quantifies the extent of possible financial losses within a firm, portfolio, or position over a specific time.Value at Risk (VaR) and Expected Shortfall (ES) are always about a portfolio.Multiplying the original number by this value will result in either an increase or decrease of the number by the given percent. Historical Simulation. Then, enter the data and follow the step-by-step guide to calculate VAR.33 * standard . Basic Calculation Methods •Historical Simulation – last . It represents the maximum expected loss with a given confidence level.Schlagwörter:The VaRVar Calculation Example This histogram is calculated using a series of daily price changes for a given financial security. Sunday, 18 February 2024.Value at Risk is a statistical technique used to quantify the level of financial risk within a firm, portfolio, or position over a specific time frame. This is nothing but the unexpected credit loss . The time frame is defined as one day, i.

As we are interested in the daily prices of the options, the interval or time step length should be . The VaR measures the maximum amount of loss over a specified time horizon and at a given confidence level. 500 decreased by 10%. Formally, VaR can be calculated using the following formula: [VaR ,= , sigma ,N^ {-1} (X)] Here (X) is the confidence level.But we want to calculate a monthly VAR, and assuming 20 trading days in a month, we multiply by the square root of 20: Image by Sabrina Jiang © . It is also used to obtain a market risk measure across multiple asset classes as it provides a common statistical . The first step in any historical simulation (HS) VaR calculation is to value the portfolio to give a base mark-to-market.The VaR measures the maximum amount of loss over a specified time horizon and at a given confidence level. VAR is measured both over a period of time (ex. In this post, we’ll focus on using the second method, .There are two main ways to calculate VaR: Using Monte Carlo simulation. Calculate the deviation of each data point from the mean.Schlagwörter:The VaRValue At Risk VarTime HorizonBacktesting Var Models

What Is the Parametric Method in Value at Risk (VaR)?

How to compute the VaR: Step-by-Step Excel Guide.

Percentage Calculator

Schlagwörter:The VaRPortfolio VarValue At Risk VarMarket Risk Var Calculation

VAR (Transact-SQL)

While simple VAR isn’t perfect by any means it is a highly useful technique because it’s easy to calculate and lets us understand risk in practical cash terms. Backtesting measures the accuracy of the VaR calculations. The formula is below to find VaR: VaR=PERCENTILE(Portfolio Returns,1−Confidence Level) Here are the step-by-step instructions: Ensure your dataset is well-organized with columns for dates and daily . 500 × (1 – 0.There are multiple methods to calculate VaR, however, this openness in VaR calculation can create a lack of calculated risk when it comes to periods of low volatility or black-swan events. Ioannis Rigopoulos.Value at risk (VAR) Calculator.Learn how to calculate value-at-risk, a broad metric of market risk that measures the probability of a portfolio’s loss over a given time horizon.Schlagwörter:The VaRThe Value At RiskVar Value At Risk Calculation Step 3: Multiply the standard deviation by 2.In order to calculate the Value at Risk for options and futures, we require a series of returns which in turn requires time-series price data., market risk for existing trades). Using the variance-covariance method.Marginal VaR: The additional amount of risk that a new investment position adds to a portfolio. Once you have set your parameters, click the ‚Calculate‘ button to get your VaR number.

How to Calculate Value at Risk in Excel [Step-by-Step]

Value-at-risk VaR using Excel (with MarketXLS Formulae)marketxls. How Value at Risk Is Calculated.VaR for Options – method 1. The portfolio value is just the total value of your investments.Schlagwörter:The VaRThe Value At RiskValue At Risk Var It can be used to help .The parametric method is a statistical technique for estimating the VaR of a portfolio of assets using mean-variance analysis.Value-at-Risk (VaR) is used for managing the market risk of derivatives portfolios.

1 year) and also at a confidence . EX: 500 increased by 10% (0.Schlagwörter:The VaRThe Value At RiskPortfolio VarValue At Risk Var

How to Calculate Value-at-Risk

We would then use the equation below to find our value at risk: VaR=[Expected Weighted Return of the Portfolio − (z-score of the confidence interval × standard deviation of the portfolio)] × . When using VAR it’s always worth keeping in mind the limitations as well.Schlagwörter:In-depth ReportThe VaRMarket Risk Var Calculation

Value At Risk (VaR): What It Is & When It’s Used

This implies that there is a 5% probability that the asset will fall in value by more than $59,660 over one year if there is no trading. Assume that we want to calculate the 1-day 5% VaR for an asset using 200 days of data.Ryan O’Connell, CFA, FRM walks through an example of how to calculate Value at Risk (VaR) in Excel using the Historical Method.Schlagwörter:The VaRThe Value At RiskPortfolio VarValue At Risk VarWhat Is Value at Risk (VaR)? Value at Risk is a widely used risk measure that estimates the potential loss in the value of a portfolio or financial instrument over a specific time horizon and with a given . An equities or FX desk will often have an overall VaR limit enforced by upper .This calculator lets you set the amount of your position, its periodic volatility as well as the confidence level (a value between 90% and 99. There are two basic ingredients that you need: With these you can derive two less basic ingredients: These can be used to estimate market risk.Step 2: Determine the standard deviation (a measure of dispersion within the data) of those daily fluctuations (use =STDEV. This free percentage calculator computes a number of values involving . It estimates how much a set of investments might lose (with a given probability), given normal market .

But we want to calculate a monthly VAR, and assuming 20 trading days in a month, we multiply by the square root of 20: * Important Note: These worst losses (-19. This enables us to identify all of . VaR (Value at Risk) All.Getting Technical with VaR.comValue at Risk EXCEL Example – FinanceTrainingCourse.There are two parameters describing a normal distribution: the mean and the variance. Morgan, RiskMetrics was upgraded by the company . So far shows the threshold .

The calculation signifies a 5% chance that the maximum amount the investor .com/subscription_center?add_user=mjmacartyWhat is Value at Risk & How to Calculate Value at . The histogram above takes a daily return .Schlagwörter:The VaRThe Value At RiskPortfolio VarValue At Risk Var

Value at Risk (VaR)

— Analytic Function Syntax VAR ([ ALL ] expression) OVER ( [ ., VaR shows how much you might lose between today and tomorrow. It’s that easy! Prepare your data in Excel sheet.The calculation of Value at Risk (VaR) involves several key components that collectively provide a measure of the potential loss in a financial portfolio. Limitations of VaR.#var #ValueatRisk #excelPlease SUBSCRIBE:https://www. If summary functions and custom calculations do not provide the results that you want, you can create your own formulas in calculated fields and calculated items. Marginal VaR (value at risk) allows risk managers to study the effects of adding or subtracting . One of the main criticisms of VAR is that it doesn’t weigh up abnormal market risk . Compute the variance along the specified axis. Calculating VaR can be approached through various methods, including the Historical Method, the Variance-Covariance Method .Schlagwörter:Risk ManagementVaRFile Size:340KBPage Count:35

Backtesting Value-at-Risk (VaR): The Basics

Hence, the more the number or diversity of assets in a portfolio, the more difficult it is to calculate VaR.33 Step 4: Subtract the value in Step 3 from the value in Step 1. Different methods or approaches lead .Schlagwörter:The VaRPortfolio VarFile Size:602KBPage Count:7 VaR capital is combined with capital requirements from Specific Risk, Stress Scenarios and other risk measures mentioned here.What is Value at Risk (VaR)? Value at Risk (VaR) is a financial metric that estimates the risk of an investment. But, along with the risk-return calculation, the correlations between the assets are also to be calculated.var(a, axis=None, dtype=None, out=None, ddof=0, keepdims=, *, where=) [source] #.1) 500 × (1 + 0. When Is Value at Risk Used. However, the period of calculations used by different methods of calculation .Value at Risk (VaR) is a measurement showing a normal distribution of past losses.comEmpfohlen auf der Grundlage der beliebten • Feedback

Value at Risk

With this information we can use the probability distribution of stock returns to find out the probability of an event occurring. Please note that this result is theoretical only and is based on the normal distribution of returns assumption. For example, you could add a calculated item with the formula for the .Using the formula, the calculation for this scenario would be: VaR = Market Price * Volatility = $100,000 * .Value at Risk (VaR) is the calculation of the worst-case scenario that should be part of every decision-making process.Calculating Value at Risk – Histogram the first step in the VaR Historical Simulation approach.Schlagwörter:The VaRVar VolatilityTime PeriodsVar FormulaIn order to calculate the value at risk for this security, we would start by calculating the mean and standard deviation of these historical returns.RiskMetrics is a methodology that an investor can use to calculate the value at risk (VaR) of a portfolio of investments.

The variance is computed for the flattened array by default, otherwise over the specified axis. Find the mean of the data by adding all the values together and dividing by the total number of values.

- How To Calculate Market Demand

- How To Cancel Sold Items : Accepting or Denying a Cancellation Request

- How To Append Text To The End Of A File?

- How To Add Quick Access To Task Manager Windows 11?

- How To Check Waage | Genauigkeit einer Analysenwaage

- How Much Weight Did Gfriend Lose?

- How To Craft Smelter _ How to make a Blast Furnace in Minecraft

- How To Evaluate Your Customer Service

- How Much Money Does The Pharmaceutical Industry Make In Germany?

- How Old Is Derren Brown? | Derren Brown Biography, Age, Height, Wife, Net Worth, Family

- How To Climb Mount Etna _ Etna Summit Trekking Tour