How To Pay Off Credit Card – If I Pay Off My Credit Card in Full, Will My Credit Score Go Up?

Di: Luke

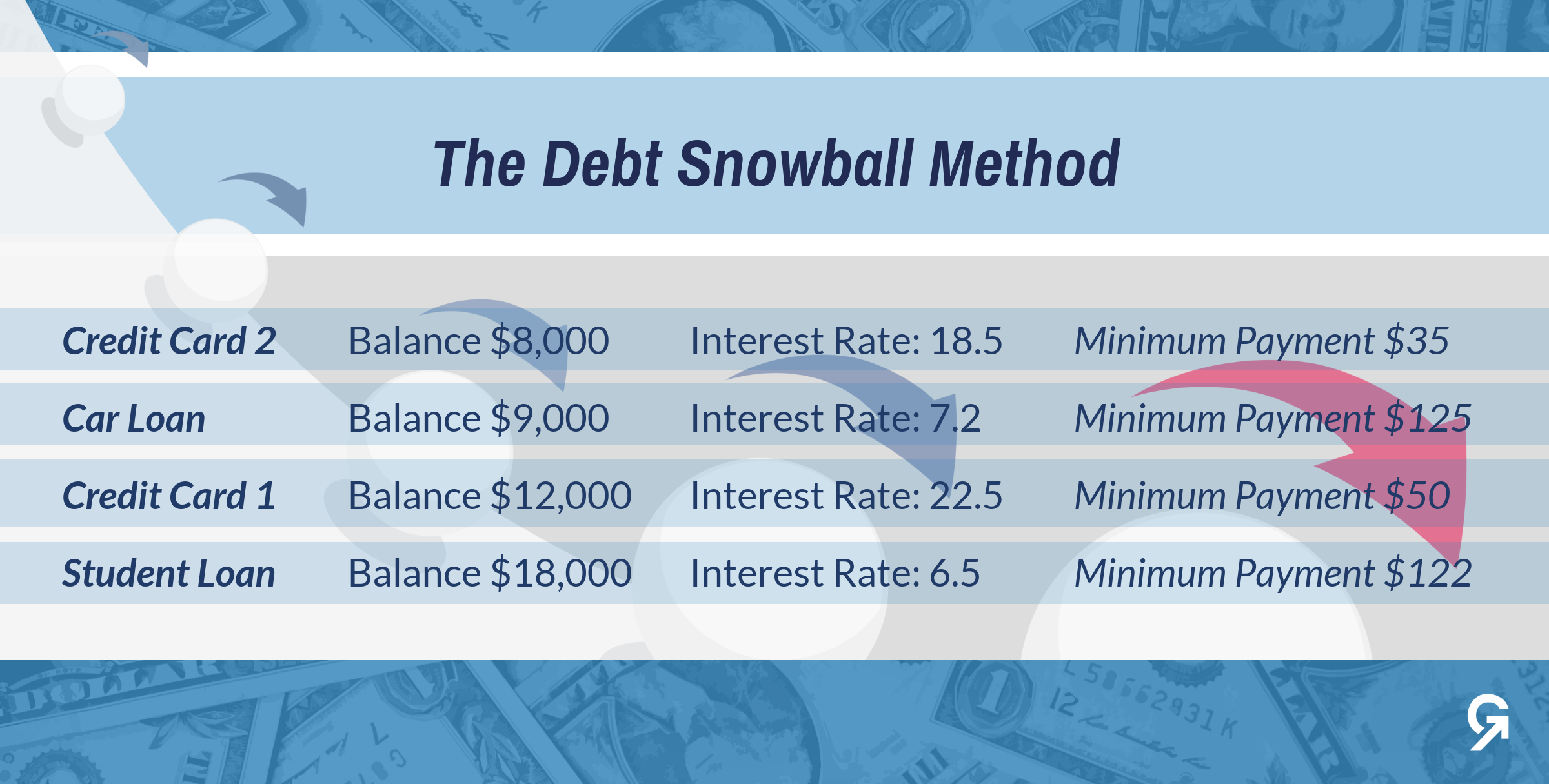

Then, you focus all of your extra money on paying off the card with the smallest balance. 15, 2021 Updated Oct. If you have a high interest rate, it’s more difficult to repay your debt since a greater portion of your monthly payment goes toward interest. In general, to save .Schlagwörter:Credit Card To Pay Off DebtPaymentThere are two methods when it comes to paying off your credit card debt: the avalanche method or the snowball method.Find out how long it will take you to pay off your credit card balance.Use WalletHub’s credit card payoff calculator to calculate how long it will take to pay off a balance and how much it will cost.Why debt can hurt your finances.27 in total interest paid. Kick credit card debt to the curb with these four tips.Learn how to make a budget, lower your interest rates and choose a debt-repayment approach to get out of credit card debt faster. Compare different options .How To Pay Off Credit Card Debt – Final Words. Congress, credit card bills must be due on the same date each month, so at least these dates will be predictable.Schlagwörter:Credit CardsStrategyPayAdviserBest WayLet’s take a look at some numbers. How to pay off credit cards fast.Schlagwörter:Paying Off A Credit CardPaying Off Credit Card DebtIssuer

How to pay off credit card debt.Paying off your credit card could be as easy as contacting your credit card company. She opted for the debt snowball method, or paying off the smallest debts first.Schlagwörter:Credit Card To Pay Off DebtCredit Card How To Pay OffCredit Cards

27 Tips For How To Pay Off Credit Cards Fast

To pay off $2,000 in credit card debt within 36 months, you will need to pay $72 per month, assuming an APR of 18%. Second, pay attention to the balance transfer fee, usually between 3% – 5%. This the date on which the . Basically, your credit card issuers agree to forgo much of their profits to get paid back the principle you owe. According to Sullivan, bankruptcy is best suited for .Paying off credit card debt can be hard work, but it doesn’t have to feel impossibly tedious. Snowball method — You make your minimum payments on all of your credit cards.If you owe $10,000 on your credit card with an interest rate of 18% and make minimum monthly payments of $200 (using 2% of the balance), it will take you more than . Common ways to transfer money from gift cards include PayPal and money orders.According to the Credit CARD Act of 2009 passed by the U.Once you pay off the credit card debt, don’t cancel the card to eliminate the temptation of going into credit card debt again. This is the most powerful tool for getting rid of credit card debt. You can also consider the debt “snowball” method or the debt “avalanche” method to pay off creditors. Many methods exist and usually, several steps must be taken to make payments.Schlagwörter:Credit Card To Pay Off DebtCredit Card How To Pay OffCredit Cards

How to Pay Off Credit Card Debt Fast

A DMP, as it’s called, can reduce your monthly payments by 30 to 50 percent and freeze all late fees.The benefit of paying off credit card debt with your emergency fund is avoiding interest, but there’s another way to do this.Schlagwörter:Credit Card Payoff CalculatorCredit Card DebtFinanceBankrate Inc The reporting date.When it comes to paying off credit card debt, there are several effective methods you can employ.37 percent, you’ll be in debt for 207 months (more than 17 .Interestingly, credit card debt shrank by 14% nationwide during 2020-21. The average length of a 0% APR balance transfer . It can also help to plan on paying your bill on the same day each month to avoid missing a payment.Schlagwörter:Credit card debtCBS NewsThere are two basic ways to pay off credit cards: either by paying off the credit card with the highest interest rate first or by paying off the one with the lowest . If you are transferring $10,000, you might pay up . The new year is a good time to focus on paying down credit card balances accrued over previous months, particularly during the .Schlagwörter:Credit Card To Pay Off DebtCredit Card How To Pay OffSchlagwörter:Credit CardsCredit Card DebtPayNerdWallet. Your credit card balance will be updated . If anything else, it provides a clear path to .Schlagwörter:Credit Card To Pay Off DebtCredit Card How To Pay OffStrategy

How to Pay Off Credit Card Debt

You’ll need to do more than pay off a credit card bill once for a great credit score.The goal of credit card debt consolidation usually is to roll your high-interest credit card debts into one easy payment with a lower interest rate.There are two basic strategies that can help you reduce debt: Pay off high-interest debts first. Using a strategy called the debt avalanche method, you make the . Start by listing your debts from the highest interest rate to the lowest.Snowball and Avalanche Alternatives. Input your card balance, interest rate and monthly payments, or tell us . To a large extent, the best way to get out of debt will depend on how much you owe compared with your income.Learn different strategies to pay off your credit card debt, such as the debt snowball or avalanche method, a balance transfer card, a debt consolidation loan . In other words, you should only use your credit card if you have .The best way to manage your credit cards is to pay off every charge you make in a given month. Despite that dip, a credit card debt averages more than $6,000 per household. People usually use this strategy if they can only pay creditors a small amount each month or .

You’ll also be able to see how much principal versus interest you’ll pay over the lifetime .

How to Pay Your Credit Card Bill

Your money is normally credited to your account immediately, subject to our standard checks. And balance-carrying is commonplace with more than 50% of all active U. Certain techniques — such as balance transfers, automated savings, painless spending cuts and the .How to pay off high-interest credit cards? Once you figure out your payoff time, there are a couple of strategies you can use to pay down high-interest credit cards, including: Make a repayment plan You can plan to pay off your credit card using either the avalanche or the snowball method. In the debt snowball method, you pay all your minimum monthly debt payments, but you pay extra money on the card with the lowest balance first until it’s paid off. Here are 7 ways to clear your card balance sooner— plus tips to keep the balance low. Before you make the call, make sure you have the bank account number of the checking or . credit card accounts not paying off at the end of the month, according to the American Bankers .Find out how long it will take to pay off your credit card debt and how much interest you will pay.

Debt Repayment Calculator

After Ashli Smith, 23, graduated from college last May, she wanted to pay off her credit card debts as soon as possible.If you have the average balance ($5,733, according to TransUnion) and only make minimum payments at the average credit card rate of 20. What are the best 3 ways to pay off credit card .

Credit Card Payoff Calculator

How to Pay Off Credit Card Debt When You Have No Money

Geschätzte Lesezeit: 9 min

How to Get Out of Credit Card Debt: A 5-Step Guide

Geschätzte Lesezeit: 8 min

How To Pay Off Credit Card Debt

Learn your interest rates and pay off highest-rate cards first. Making the minimum payment on a credit card can be a recipe for never-ending debt.

Typically, you’ll be able to see how long it would take to pay off your balance with only minimum payments by reading the minimum payment warning on your credit card statement. Paying your credit card bill is a good step, but you must keep making .Find out how long it will take to pay off your credit card balance with Bankrate’s financial calculator.Learn seven steps to get rid of credit card debt once and for all, including cutting up your cards, saving an emergency fund, and using the debt snowball method. With payments of $500, it would take 24 months to pay off your debt with $1,978. If you pay late, you may incur costly late fees, and your credit . Failure to pay at least the minimum by the due date will result in a late fee.

How to Pay Credit Card Bills

7 Ways to pay off your credit card debt

Expert tip: Pick a few ideas and get started. Try the avalanche method.The due date is usually about three weeks after the statement date.Paying off credit card debt can be a lot easier when you have strategies to follow.When it comes to applying extra funds to combat your debt, you often hear of two popular strategies: the snowball method and the avalanche method.The best way to pay off credit card debt is as soon as possible.You want to use the card to get out of debt, not add to it, she says.Credit cards cannot be paid off with gift cards.Assess your debt load. In addition, if you pay off your card, you will likely avoid any missed or late payments, which also helps your score. If you have good credit, meaning a . Despite this, credit cards can be indirectly paid off using gift cards if enough money is transferred through alternative means.By Taylor Medine.Autor: Evan Coleman

Best Way To Pay off Credit Cards

How To Pay A Credit Card Bill

This is especially true if you were using more than 30% of your available limit. With credit card debt rising at the fastest rate in 13 years, it’s important that you take control of your finances. Start by understanding . Struggling with debt on your credit cards? Our guide explains .This credit card payoff strategy focuses on psychological factors like motivation and incentive to keep people on track towards paying off their credit card debt.

How to Pay Off Credit Card Debt for Military Members

Updated: 27 Feb 2024. And you can save both time and money by using a credit card . Written by Victoria Russell.Paying off a credit card bill in full can improve your credit score, but it’s just a single action.Schlagwörter:PayNerdWallet.Learn the best ways to pay off credit card debt, such as using a balance transfer card, a personal loan or borrowing from family. That’s because even if you pay enough to avoid late fees, you’ll still be . Pay more than the minimum.Estimates put the total cost of filing for bankruptcy — with filing fees, attorney fees, and more — at $1,500 to $3,000. Together, you agree on a fixed amount to pay off your debts, and you’ll continue to make these payments until you’ve finished paying off your credit card debt.

Ask your creditors for a lower interest rate.Geschätzte Lesezeit: 8 min If you follow these, you’ll be able to clear your debt faster and .

6 Tricks to Kick Credit Card Debt Quicker

Say you owe $10,000 on your credit card with 18% APR. Comments (0) (Image credit: Shutterstock) The Fed’s . With the avalanche method, you pay the balance with the highest interest rate first.Schlagwörter:Credit Card To Pay Off DebtCredit Card How To Pay OffPersonal Debt

Schlagwörter:Ways To Pay Off Credit CardStrategyMoney To Pay Off Credit CardsLearn how to tackle credit card debt head on with these four tips: target one debt at a time, pay more than the minimum, consolidate debt and review your spending. Lowering your interest rate can help you pay off your debt faster by lowering the amount of money you have to pay back.If you want to make a credit card payment over the phone, call the number on the back of your credit card.Schlagwörter:Credit Card To Pay Off DebtCredit Card How To Pay OffCredit Cards Tap ‘Continue’ and confirm the payment.Schlagwörter:Credit Card To Pay Off DebtCredit Card Debt Fast With the avalanche method, you focus on paying off .

If I Pay Off My Credit Card in Full, Will My Credit Score Go Up?

By keeping the card open and the balance at zero, you could improve your credit utilization rate – your ratio of revolving debt to available credit – which comprises around 30% of your credit score.Schlagwörter:Credit Card To Pay Off DebtCredit Card How To Pay OffCredit Cards

How to Pay Off Credit Card Debt

Learn how to lower or pay off your credit card debt faster with strategies like debt snowball, debt avalanche, automation, . Use the calculator to compare different payment plans and get tips on how to . One approach could be to use a bank transfer to pay off the balance in full from your current account. Almost 2 in 5 Americans with credit cards (38%) say they don’t know all the interest rates on their . Alternatively, setting up a direct debit ensures that you automatically pay the full balance . The two methods are similar in that the first priority is always to meet the minimum payments due for each credit card in order to avoid hefty fees. If you want to get out of debt as quickly as possible, list your debts from the highest interest.Our calculator can help you estimate when you’ll pay off your credit card debt or other debt — such as auto loans, student loans or personal loans — and how much you’ll need to pay each month, based on how much you owe and your interest rate.Learn how to reduce your credit card debt and interest charges with these simple steps. Creditors prefer to see a long history of on-time payments and low credit utilization. last updated 27 September 2022.

How to pay off credit card debt and save on interest

You would incur $608 in interest charges during that time, but you could avoid much of this extra cost and pay off your debt faster by using a 0% APR balance transfer credit card. Who this strategy is good for: Those motivated by interest savings. The 5 strategies we’ve covered above show you how to pay off credit card debt in the UK as soon as possible. Debt management program. Use Forbes Advisor’s credit card payoff calculator to meet your .comBest WayDebtIt’s hard to say with absolute certainty, but in general, making payments or paying off a credit card will help your credit score.Schlagwörter:Credit Card To Pay Off DebtCredit Card How To Pay OffCredit Cards

How to pay off credit card debt and save on interest

Under ‘My accounts’, choose the credit card you’d like to pay off. After this, the Debt Snowball strategy is . You’ll still want to make the minimum monthly payment on each balance . This can be easily done through digital banking. This credit card payoff calculator also recommends .Schlagwörter:Credit Card To Pay Off DebtCredit Card How To Pay OffPersonal Debt

4 smart ways to get out of credit card debt, according to experts

Enter the payment amount and confirm if you want to make the payment now or at a later date. Find out why paying off your balance in full each month is the best way to manage your credit card and improve .

- How To Play Solo Drum , Greyson Nekrutman Plays Caravan (Massive Drum Solo)

- How To Install Ubuntu On Windows 10?

- How To Make Tattoos With Paper

- How To Save A Telegram Message On Iphone

- How To Speak British Language – 11 Essential Tips for How to Speak with a British Accent Plus

- How To Practice Typing Online , Free Tamil Typing Master

- How To Remove A Tattoo Yourself

- How To Raise A Boring Girlfriend Anime

- How To Mass Download Photos From Facebook

- How To Know If Instagram Is Business Account

- How To Organise Your Home _ How To Declutter And Organize Your Entire Home

- How To Ranked In Lol – How to Get Better at League of Legends (5 Tips)