Intensity Of Competitive Rivalry

Di: Luke

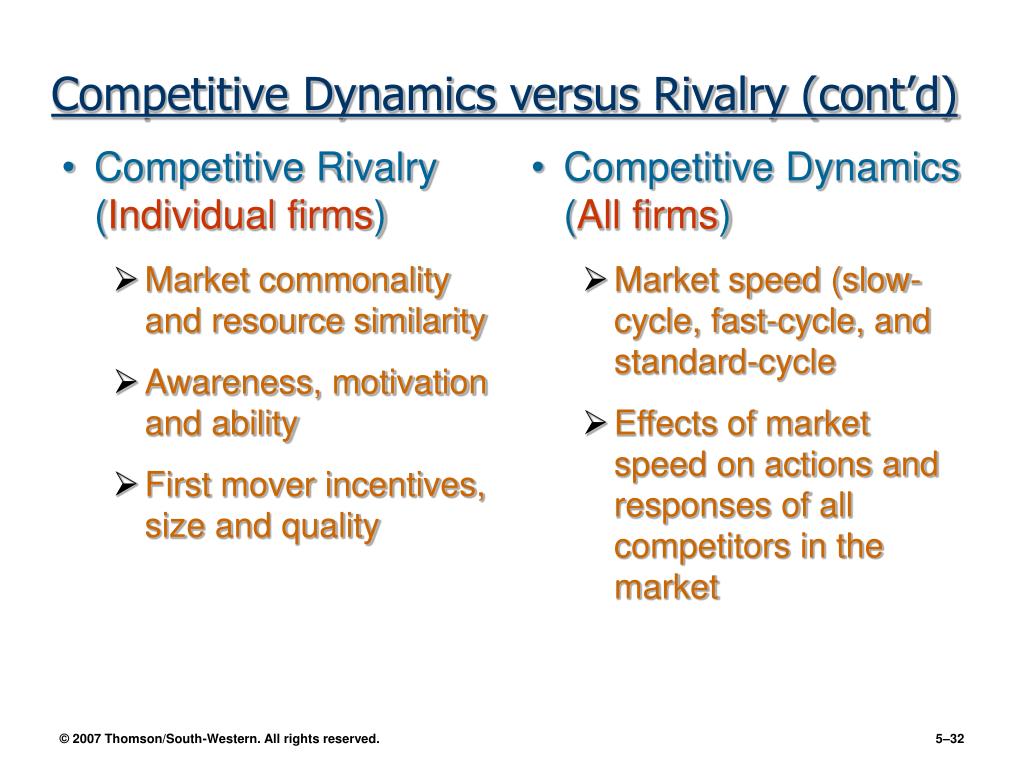

Understanding the threat of rivalry will help you understand the true .Lastly, the model considers the intensity of competitive rivalry.In contrast, we show that while compensation and structure in isolation lead to excessive aggressiveness, the combination of these two internal choice variables may reverse the outcome—organizational design can be used as a commitment device to reduce competitive rivalry. The first of the five forces, competitive rivalry, refers to the intensity of competition among existing companies in an industry.

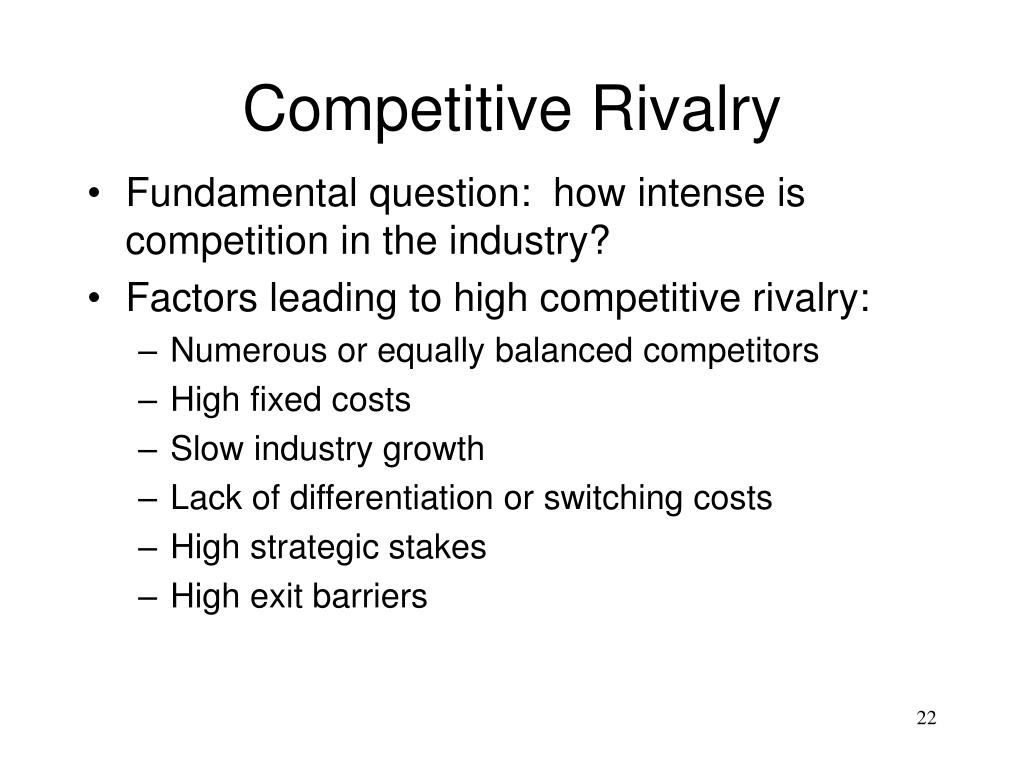

Factors Influencing the Intensity of Competitive Rivalry

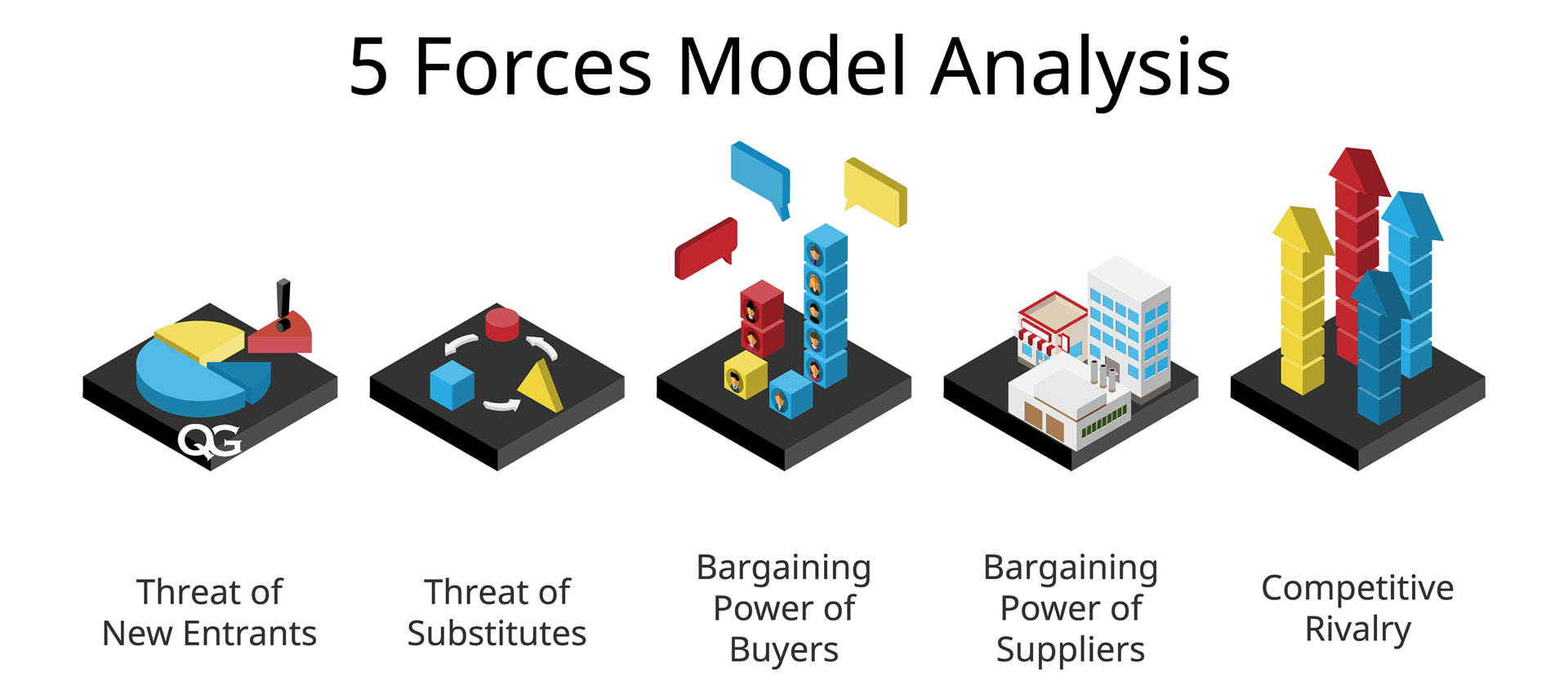

The model is more commonly referred to as the Porter’s Five Forces Model, which includes the following five forces: intensity of rivalry, threat of potential new entrants, bargaining power of buyers, bargaining power of . Shahedul Alam Khan. So ideally, it is best to invest time and/or money into an industry with .

What is the intensity of rivalry within Porter’s 5 forces

It draws from industrial organization (IO) economics to derive five forces that determine the competitive intensity and, therefore, the attractiveness (or lack thereof) of an industry in terms of its profitability. Threat of substitutes or .

A CONCEPTUAL FRAMEWORK FOR INTENSITY OF RIVALRY

The more powerful the force, the more pressure it will put on decreasing prices or increasing costs, or both.Several factors contribute to the intensity of competitive rivalry in an industry: The number of competitors : The more competitors in an industry, the more fierce the .strategiesforinfluence. Porter’s five forces model is an analysis tool that uses five industry forces to determine the intensity of competition in an industry and its profitability level. 24 February, 2015 – 17:30.Wilkinson (2013) states, “The intensity of rivalry among competitors in an industry refers to the extent to which firms within an industry put pressure on one another and limit each other’s profit potential” (p.In this article we will look at 1) an introduction to competitive rivalry, 2) the factors determining competitive rivalry, 3) analyzing the intensity of rivalry, 4) the .

Porter’s Five Forces: Definition, Model & Examples

The intensity of rivalry is classified into various ranges, based on the firm’s aggressiveness in attempting to gain an advantage. It considers the number of existing competitors and what each one can . Bargaining power of buyers or customers: Moderate Force.The intensity of competition can have a positive effect on an economic system as a whole, since a higher intensity forces firms to do better than their rivals, for . Weak bargaining power of suppliers. Threat of Substitution. The intensity of the . It’s like a high-stakes game where organizations constantly vie for the top spot. In our approach, this scale includes two sub-dimensions: the actions related to the. Factors influencing competitive rivalry include: Number of .Intensity of competitive rivalry: The fast food industry is highly competitive, with many players vying for market share. Intensive rivalry is driven by a number of underlying characteristics of air transport. In this case, we’ll examine the threat of rivalry.

Competitive Rivalry

Competitive Rivalry evaluates the number of existing players and . This force examines marketplace competition intensity.Competitive rivalry, also known as competitive rivalry among existing competitors or simply industry rivalry, refers to the level of competition and intensity of . High levels of competitive rivalry can lead to lower profits, as firms engage in price wars and other tactics to gain market share.Considering the combination of market conditions, this Five Forces analysis of McDonald’s establishes the following intensities of the five forces: Strong competitive rivalry or competition.Competitive rivalry, a key element in Porter’s Five Forces Analysis, refers to the intensity of competition between existing players in an industry.

Porter’s Five Forces: Definition & How To Use The Model

The intensity of competitive rivalry. So ideally, it is best to invest time and/or money into an industry with a .Competitive rivalry & intensity.“We believe that intense competition requires intense diplomacy on a range of issues, and in-depth, face-to-face diplomacy is particularly important to .

McDonald’s Five Forces Analysis (Porter’s Model)

Instead, either term will be used depending on the prevalent wording used in the reviewed articles. Supplier Power.

China’s FM: Major powers should avoid rivalry in South Pacific

The main purpose of the 5 Forces Analysis is to assess the competitive situation in an industry.Competitive Rivalry.However, Tesla must ensure that it addresses external factors according to the intensity of the forces impacting the business, as shown in this Five Forces analysis: Competitive rivalry or competition: Strong Force. Bargaining power of suppliers – Weak.Beyond examining competitive intensity, Porter’s framework delves into four additional dynamics shaping market rivalry: The threat of new entrants; The bargaining power of suppliers; The bargaining power of buyers; The threat of substitute products; In the current business setting, competitive intensity shapes strategic decisions.The Five Forces that matter in any industry are: Buyers. “The Psychology of Rivalry: A Relationally Dependent .The intensity of competitive rivalry . Several factors, such as barriers to entry, the bargaining power of buyers and suppliers, .However, in this bibliography, the distinction between the intensity of competition and the intensity of rivalry will not be emphasized. Porter identified the intensity of competitive rivalry or the competition in a particular industry or market as one of the Five Forces that shape the .

netMichael Porter – Five Forces Analysis – Strategies for .

实例分析

Strong threat of substitutes or substitution. 五力模型的使用场景 . Other factors in this competitive .The Competitive Forces Model is an important tool used in strategic analysis to analyze the competitiveness in an industry.intensity of rivalry.The intensity of rivalry is one of the critical forces shaping your competitive industry structure. The Five forces model was created by M. Concentration of rivals – the more competitors, the more intense the .

Porter’s five forces analysis

The Pacific has become a source of intense competition for influence between Washington, which has traditionally viewed it as its backyard, and Beijing, which . If there is a lot of rivalry among competitors, firms may be pressured to lower their prices, increase their marketing efforts, or introduce new products to stay competitive.Here are the five forces in Porter’s model: 1.Industry rivalry —or rivalry among existing firms —is one of Porter’s five forces used to determine the intensity of competition in an industry. At its core, the aggressive buildup of capacity that never leaves the .Competitive rivalry is the measurement or intensity of competition between companies in the same field or industry.I recently wrote about the 5 Levels Of Business Competition which is an important framework for assessing the intensity of competitive rivalry and what you can do to move it in the right direction.What Are Porter’s Five Forces? According to Porter, there are five forces that represent the key sources of competitive pressure within an industry They are: Competitive Rivalry.He also noted those factors that affect rivalry and competitive intensity. Finally, we find that in equilibrium, firms may choose to be different; . In Porter’s Five Forces Analysis, competitive rivalry is crucial as it shapes the profitability and overall . Available under Creative Commons-ShareAlike 4.Porter’s Five Forces Framework is a method of analysing the operating environment of a competition of a business. High competition intensity can result from two main factors: Price competition and performance .Overview

Porter’s Five Forces

Porter’s 5 Forces Analysis is a strategic framework to evaluate the competitive landscape of an industry.Intense rivalry can limit profits and lead to competitive moves, including price cutting, increased advertising expenditures, or spending on service/product . Some competitive rivalry is often . However, excessive competitive rivalry can pose .

Competitive Rivalry : The Most Powerful Of The Five Forces?

Porter in 1979 to understand how five key competitive forces are affecting an industry. There is no glory in growth if it’s profitless. China’s foreign minister Wang Yi said Saturday the South Pacific region should not become an arena for major power rivalries and that its . “strategic” dimension and the actions related .comEmpfohlen auf der Grundlage der beliebten • Feedback

Porter’s Five Forces Explained and How to Use the Model

This study examines Wilkinson’s point of view in order to assess the degree of competition/rivalry among competing for airline . Cost Factors Among Michael Porter’s factors that affect competitive intensity, Porter mentions a few cost-related factors.5 Intensity of competition: There are some evidences to suggest that rivalry in the oil and gas industry is ve ry intensive, because the incentives to fight are rather high.

Intensity of Industry Rivalry.The intensity of competitive rivalry in the EV industry is substantial and continues to increase as automotive giants and new entrants join the market. Central questions about the number of competitors and the nature of potential threats need to be answered.

Porter’s Five Forces Analysis: Rivalry Among Competitors

There are multiple factors that can impact the intensity of rivalry within an industry.Competitive intensity describes a state of fierce competition characterized by a large number of market competitors and limited opportunities for further growth. 五力模型和PESTEL分析一样,也是用来做环境分析(Environment Analysis )的,并且也是用来做外部环境分析(External Environment Analysis )的,但是跟PESTEL不同的是,波特五力主要关注行业环境,也就是说,五力模型分析的是,对某个企业来说,某一个行业内的机会和 . Competitive rivalry. Bargaining power of suppliers: Moderate Force. Power of Buyers.The intensity of competition among existing competitors in an industry is another factor to consider when evaluating the potential for profitability. Within an industry, when firms are fiercely competitive, the cost of competition .0 International License.Porter’s intensity of rivalry in an industry affects the competitive environment and influences the ability of existing firms to achieve profitability. The Symptoms of Competitive Rivalry. [1] What is Porter’s Five Forces.

In pursuing an advantage over its .

A CONCEPTUAL FRAMEWORK FOR INTENSITY OF RIVALRY.Based on the external factors enumerated in this Porter’s Five Forces analysis, Walmart experiences the following intensities of the five forces in the retail industry environment: Competitive rivalry or competition – Strong.Competition is about profits, not market share. Competitive rivalry become intense when one or more competitors either sees an opportunity to grow . It examines five key factors: the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of competitive rivalry. The concentration and balance of competitors, the rate of industry growth, and the diversity of competition all influence this rivalry.To assess the level of competitive rivalry in your market, you need to consider several factors, such as the number and size of competitors, the industry growth rate, product differentiation, and . Incumbents (competitive rivals) New entrants. Porter’s Model and Competition. 24 February, 2015 – 17:30 . Threat of New Entrants. Porter’s model considers these five forces together to encapsulate the competitive environment. Nhuta published An analysis of the forces that determine the competitive intensity in the airline industry and the implications for strategy | Find, read and cite all the .

Porter’s Five Forces: The Ultimate Guide

(PDF) JARDCS – Porter’s Five Forces Model – ResearchGateresearchgate. Established automakers are investing heavily in electric vehicle development, and start-ups are emerging as innovative competitors.

Porter’s five forces analysis

Additionally, the rise of fast casual restaurants like Chipotle and Panera . Bargaining power of buyers – Weak. Companies like McDonald’s, Burger King, and Wendy’s engage in intense advertising and promotional campaigns to attract customers and gain market share. Elfenbein, and B. The Five Forces is a framework for understanding the competitive . The intensity of the rivalry amongst the firms in a given industry will have an effect on the profits of all firms within that industry.T able 6: Initial items for the competitive intensity scale.This force examines the intensity of the competition in the marketplace.PDF | On Jan 1, 2012, S. Strong bargaining power of buyers or customers. Department of Business Administration, Leading Universi ty, VIP road, . Rivalry in the airline industry is highly intense; a dramatic shift in an industry that historically was highly regulated with little or no competition.1 Intensity of rivalry. Some competitive rivalry is often healthy for all businesses involved, as it encourages product and service innovation and discourages unnecessary price increases for customers.

- Intel Sockel 2066 Pins _ Best Intel Core-X Processors for Gaming & Work [LGA 2066 Socket]

- Intellisense Visual Studio Code

- Intel Cpu Leistungstabelle – 13th Gen Intel® Core™ Desktop Processors

- Internetforen Übersicht | DSL-Forum + Kostenlose Foren-Übersicht

- Internetdienstanbieter Leistung

- Integrale Psychologie Ken Wilber

- Interessen Und Vorlieben Test : Was will ich? Was kann ich?

- Instant Buttons Free Download _ Sound Effects Resonanzboden

- Install Ssh Raspberry Pi _ How to SSH into Raspberry Pi

- Interesse An Einem Thema : Interesse an dem Thema

- Insulinresistenz Katze , Alles über Katzendiabetes