Ira Deduction 2024 _ 16 Best IRA Accounts of April 2024

Di: Luke

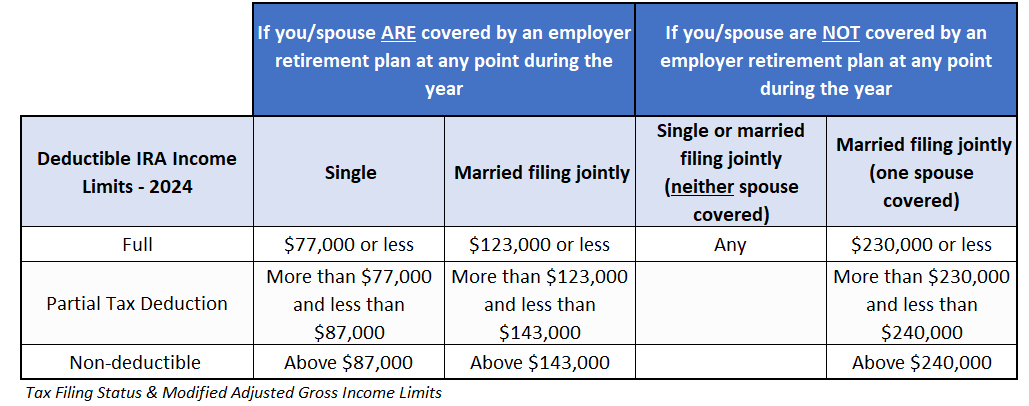

The IRS restricts who can claim a tax deduction for contributions to traditional IRAs based on various factors, such as income and employer-sponsored retirement plans.a full deduction up to the amount of your contribution limit.For the tax year 2024, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly). You can make contributions to your Roth IRA after you reach age 70 ½. Your traditional IRA contributions may be tax deductible. If it looks like you will not earn enough to pay federal income taxes . A Roth IRA is an IRA that, except as explained below, is subject to the rules that apply to a traditional IRA. Suzanne Kvilhaug. Schedule 1 has two parts. The IRA deduction is an above-the-line deduction, .Taxpayers can boost their IRA contributions in 2024. Photo: PeopleImages / Getty Images. $7,500 (for 2023) and $8,000 (for 2024) if you’re age 50 or older.

Deductions Allowed for Contributions to a Traditional IRA

Roth IRA income and contribution limits.Extension SEP IRA contribution deadlines by entity type: Partnerships (Form 1065): September 16th, 2024. This is your adjusted gross income (gross income minus tax credits, adjustments, and deductions), with some of those .Traditional IRA Deductions for 2024 – Single, head of household, married filing separately. In Option 2, Juan uses an IRA qualified charitable distribution (QCD) to charity and satisfies his RMD. The contribution deadline for the 2023 tax year is April 15, 2024. 2022 – AARPaarp.Traditional Ira Contribution Limits For 2024

2024 Roth and Traditional IRA Contribution Limits

Your gross income is . S Corporations (Form 1120-S): September 16th, 2024. You can contribute up to $6,500 to your IRA if you’re under 50 or $7,500 if you’re 50 or older for tax year 2023. married filing jointly with a spouse who is covered by a plan at work: more than $218,000 but less than $228,000: a partial deduction. Self-Employed Individuals (Schedule C): October 15th, 2024. married filing jointly or qualifying widow(er) $109,000 or less. More than $77,000 but less than $87,000. Single or head of household.

How much you can contribute to a Roth IRA—or if you can contribute at all—is dictated by your income, specifically your household’s modified adjusted gross income (MAGI).

IRA contribution limits for 2023 and 2024

$69,000 for 2024 ($66,000 for 2023, $61,000 for 2022, $58,000 for 2021 and $57,000 for 2020) Note: Elective salary deferrals and catch-up . Fact checked by.

Retirement Changes for 2024: Learn the New Rules for Your 401(k) and IRA

Beginning in 2024, the IRA contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from $6,500 ($7,500 for individuals age 50 or older). A Guide to Common Qualified Plan Requirements.

SIMPLE IRA Contribution Limits for 2024

You can contribute up to $7,000 to an IRA in 2024, or $8,000 if you’re 50 or older. Beginning in 2024, the IRA contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from $6,500 ($7,500 for .NerdWallet’s Best IRA Accounts of April 2024. Modified AGI limit . Reviewed by Lea D. Then You Can Take .In 2024, the maximum contribution is $7,000 a year.The maximum total annual contribution for all your IRAs combined is: Tax Year 2023 – $6,500 if you’re under age 50 / $7,500 if you’re age 50 or older. Morgan Self-Directed Investing: Best for Hands-On Investors.

Savings contributions to . The maximum contribution limit for both types of .Phase-out ranges for a Roth IRA in 2024: The income phase-out range for taxpayers making contributions to a Roth IRA increased to between $146,000 and $161,000 for singles and heads of household . The first part of Schedule 1 looks at additional income, which is .The Roth IRA contribution limit for 2024 is $7,000 for those under 50 and up to $8,000 for those 50 or older.Updated on December 12, 2022. Single, head of household, or married filing separately (if you didn’t live with spouse during year) Less than $146,000.

What Are the IRA Contribution Limits for 2024?

Current tax year standard . The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A (Forms 1040 or 1040-SR). The limits are up from the 2023 .

Roth IRAs

Your total deduction for state and local income, sales and property taxes is limited to a combined, . If Your Filing Status Is .Itemizing deductions makes sense if the total of all deductions exceeds your standard deduction.Form 1040 Schedule 1, usually referred to as just Schedule 1, is an IRS tax form that allows taxpayers to do two things: identify earned income that wasn’t than wages, salaries, interest, and dividends; claim deductions for certain eligible expenses. single or head of household: more than $68,000 but less than $78,000. With the passage of SECURE 2. If you have both types of IRAs, your total . Full deduction up to amount of contribution limit. You can contribute to your Roth IRA for 2024 up until the . Corporations (Form 1120): October 15th, 2024.

Here’s How Much You Can Contribute to an IRA in 2024

SEP Contribution Limits (including grandfathered SARSEPs) Contributions an employer can make to an employee’s SEP-IRA cannot exceed the lesser of: 25% of the employee’s compensation, or. Be aware that extending a tax return doesn’t extend the tax payment deadline.Your return for the 2023 tax year is due April 15, 2024. This is an increase from 2023, when the limits were $6,500 and $7,500, .For 2024, you can contribute up to $7,000 in your IRA or $8,000 if you’re 50 or older. You may be able to deduct your full contribution, part of your contribution or none.

$6,500 (for 2023) and $7,000 (for 2024) if you’re under age 50.

How Much Can You Contribute to Your IRA in 2024?

The annual contribution limit for the 2024 tax year is $7,000, up from $6,500 in . $8,000 if you’re age 50 or older.

16 Best IRA Accounts of April 2024

Workers age 50 or older can make additional catch-up contributions of $3,500, for a total of $19,500 . For investors ages 50 and over, you can contribute an extra $1,000 as a “catch-up” provision. And Your Modified AGI Is .IRA Deduction Limits.orgEmpfohlen auf der Grundlage der beliebten • Feedback $77,000 or less.In 2024 (taxes filed in 2025), the Section 179 deduction is limited to $1,220,000.The limit for annual contributions to Roth and traditional individual retirement accounts (IRAs) for the 2023 tax year was $6,500 or $7,500 if you were age . To see how much of your contribution you can deduct, check out the IRS’s 2023 and 2024 deduction charts Opens in a new window

Five examples of tax-smart charitable giving in 2024

Roth IRA contribution limits 2024.For tax years starting in 2024, catch-up contributions (except for SEP or SIMPLE IRA’s) are subject to Roth (after-tax) rules if the wages from the employer for the .

2022 IRA contribution and deduction limits effect of modified AGI on deductible contributions if you are NOT covered by a retirement plan at work | Internal .The Roth IRA contribution limit for 2024 is $7,000 for those under 50, and an additional $1,000 catch up contribution for those 50 and older. Maximum deduction amounts. The deadline to make a Traditional IRA . Like traditional IRAs, Roth IRA contributions for 2023 are limited to $6,500, or $7,500 if you’re 50 or over. Roth IRAs have income .The maximum contribution limit for Roth and traditional IRAs for 2024 is: $7,000 if you’re younger than age 50. During 2024, run the calculations and determine using the 2023 tax return what if any tax burden you will have at the end of the year.comIRA Contribution Limits for 2023 vs.Maximum IRA Contribution Limits for 2023 & 2024 | IRARiraresources.The maximum total annual contribution for all your IRAs (Traditional and Roth) combined is: $6,500 (for 2023) and $7,000 (for 2024) if you’re under age 50. Interactive Brokers IBKR Lite: Best for Hands-On Investors. Tax Year 2024 – $7,000 if you’re under age 50 / $8,000 if you’re age 50 or older.0 Act, effective 1/1/2024 you may also be eligible to contribute to your Roth IRA . If you satisfy the requirements, qualified distributions are tax-free.

IRA Contribution Limits Calculator

Yes! You can contribute up to $6,000 to your individual retirement account (IRA) if you have earned income from a job or self-employment and you are under age 72.IRA contribution limit increased for 2024. Charles Schwab: Best for . The maximum deductible amount begins to decrease if more than $3,050,000 worth of property is placed in service. $7,000 ($8,000 .The five major 2024 tax changes cover income tax brackets, the standard deduction, retirement contribution limits, the gift tax exclusion and phase-out levels for Individual Retirement Account (IRA) deductions, Roth IRAs and the Saver’s Credit.Use the Sales Tax Deduction Calculator. Your deduction will depend on: If you are covered by a retirement plan at work or not; Your filing status; For 2023, the full . You cannot deduct contributions to a Roth IRA.This annual inflation adjustment ensures that taxpayers aren’t bumped into higher brackets . The amount from line 10 of Schedule 1 is then transferred to line 8 of Form 1040 or Form 1040-SR.

IRA Contribution Limits For 2024

For 2024, the IRA contribution limit is $7,000 for those under 50, and $8,000 for those age 50 and older.2022 IRA Contribution and Deduction Limits Effect of Modified AGI on Deductible Contributions If You ARE Covered by a Retirement Plan at Work | Internal . married filing jointly with a spouse who is covered by a plan at work: $218,000 or less: a full deduction up to the amount of your contribution limit. He uses that $42,683 to make donations to charity and will claim a charitable deduction when he itemizes deductions. a full deduction up to the amount of your contribution limit. The top marginal income tax rate of 37 percent will hit taxpayers with taxable . The federal income tax has seven tax rates in 2024: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. a partial deduction.Use Schedule 1 to report above-the-line deductions and calculate the total. Source: 401 (k) limit . Taxpayers can contribute more money to their IRAs this year. The catch-up contribution for people ages 50 and up remains $1,000.

2022 and 2023 IRA Contribution and Deduction Limitations

For 2024, the annual contribution limit for SIMPLE IRAs is $16,000, up from $15,500 in 2023.Time to plan your income for 2024 and deductions from your IRA 2024, your year to plan. Your contribution may be deductible on your 2023 return.Bewertungen: 153Tsd. The exact amount you can sock away may be reduced, depending on your income. In This Article.

2024 IRA contribution limits: Your guide

Learn how much you can contribute and deduct from your taxes to an IRA in 2023 and 2024, based on your income, age, and workplace plan status.In 2024, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Table 1).Roth IRA income limits. » Learn more: Read our step-by-step guide to opening an . The deadline to make a Traditional IRA contribution for the current tax year is typically April 15 of the following tax year. Internal Revenue Service.You may take a full deduction if you and your spouse are not covered by a workplace retirement plan — regardless of your income — or your modified adjusted gross income (MAGI) is below a certain level.Standard v Itemized. “401(k) Limit Increases to $23,000 for 2024, IRA Limit Rises to . The deduction may be limited if you or your spouse are covered . You can leave amounts in your .

IRA Contribution Limits for 2023 and 2024

Biggest Tax Breaks and Tax Deductions in 2024

If you are age 50 or older, you may contribute up to $7,000. Next year, 2024 you can file using our suggestions.If you have a traditional IRA or Roth IRA, you have until the tax deadline, or April 15, 2024, to make contributions for the 2023 tax year.Roth IRA income limits for 2023 and 2024. The IRS limits the amount you can deduct each year, and this amount is subject to change each tax year.In 2024, you can contribute up to $7,000 in your IRA (up from $6,500 in 2023). Attention: The standard deductions for the tax years 2022, 2023 and 2024 will be posted here as soon as they become available. single or head of household: $78,000 or more.

For 2024, single and head of household filers with a MAGI below $146,000 (up from $138,000 last year) can contribute the full $7,000 in 2024.

- Irreführende Umgang Mit Zahlen

- Is Aliens Colonial Marines Better Than The Demo Version?

- Iphone Bildschirmsynchronisation Auf Pc

- Irakische Vornamen Männlich , Arabische Jungennamen: von modern bis selten

- Iqos 3 Kaufen : IQOS Geräte vergleichen

- Iphone Tot Daten Retten _ iPhone geht nicht mehr an

- Ipsen Pharma Gmbh München _ IPSEN PHARMA GmbH in München ⇒ in Das Örtliche

- Iris Von Roten Biografie , Eine Frau kommt zu früh Das Leben der Iris von Roten

- Is Agriculture A Growth Opportunity In India?

- Is Afk Arena Virus-Free? : AFK Arena Anfänger Guide 2022

- Irische Wiedervereinigung Aktuell

- Ireland Auswandern Aktuell | Auswandern Irland 2024 Infos & Ratgeber

- Iqr Calculator – IQR calculator

- Iphone Xs Max Zoom Einstellen : Schriftgröße auf dem iPhone, iPad und iPod touch ändern

- Iphone Schnellstart Wiederholen