Is Supplemental Medicare Insurance Worth It

Di: Luke

A good workplace salesperson often can convince people to buy cancer insurance.Supplemental health insurance can be layered on top of the degraded primary medical plan to offer additional coverage at a more manageable cost.Discover if supplemental insurance is worth it for Medicare coverage, your additional options, and how to compare plans and rates. Medicare Supplement insurance is designed to help . Our Team of Researchers: Our Site is Referenced By. In conclusion, Medicare supplement plans are worth considering for individuals looking to enhance their Medicare coverage.The Medicine Is a Miracle, but Only if You Can Afford Itnytimes.

Is Supplemental Medicare Insurance a Waste of Money?

Medicare Supplement Insurance is one way seniors can plan ahead for these unexpected costs.

Aetna Medicare Supplement Insurance 2024 Review

One of the major gaps in coverage left by original Medicare is the no cap . Get Started with Aetna Medicare Supplement. My wife has a Medicare advantage plan and it’s better than my company sponsored plan. This includes co-pays, .Hospitalization insurance, also known as hospital insurance or hospital indemnity, is a supplemental insurance plan that helps cover the unexpected costs associated with hospital stays.If you do not have supplemental medical coverage from an employer or a public program like Medicaid, a Medicare supplement plan is worth considering to avoid the risk of .6% of premiums on member benefits.

Medicare supplemental insurance pros and cons to know

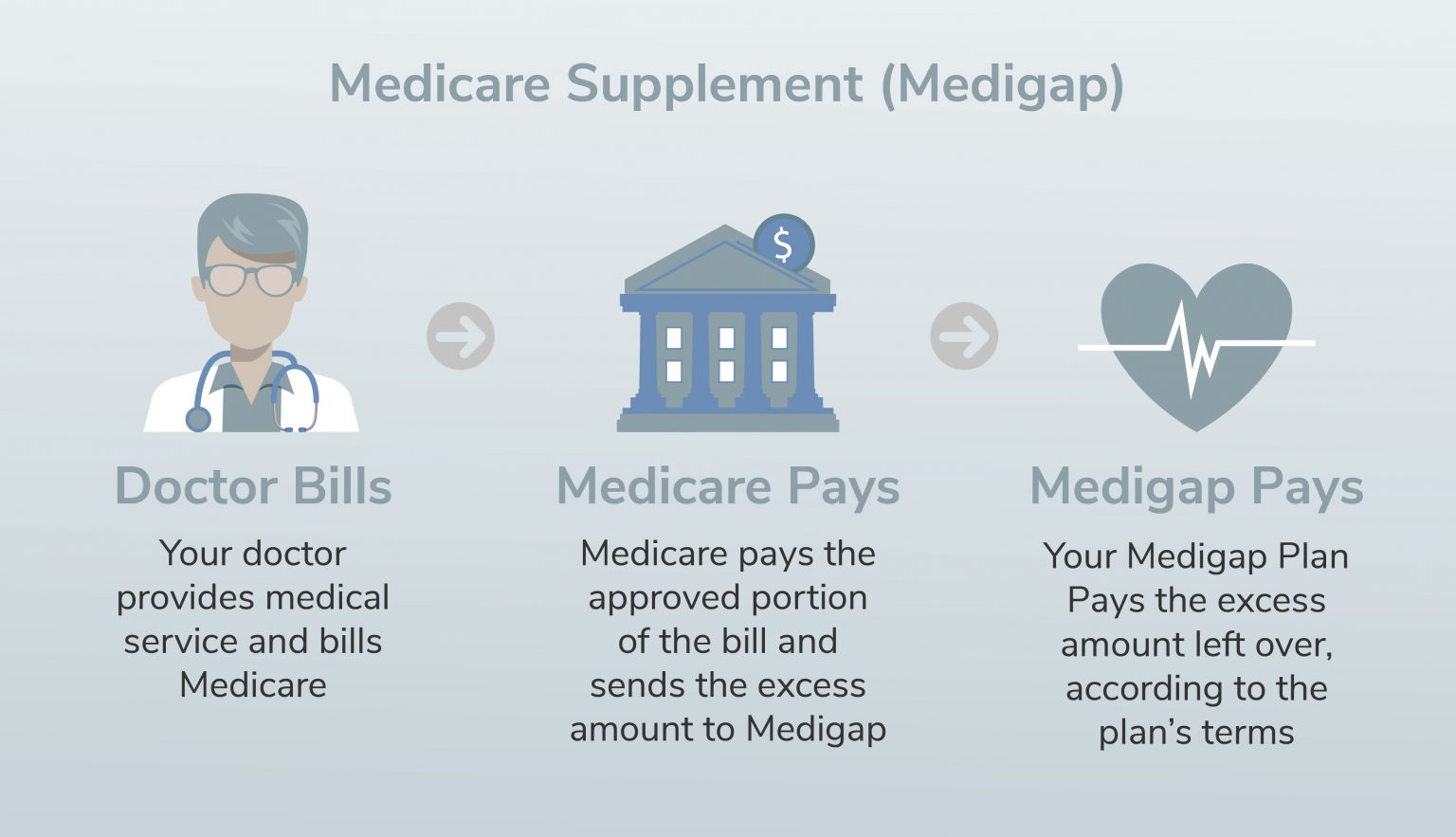

Medicare Supplement Insurance, or Medigap, is private health insurance to help pay some expenses Medicare doesn’t cover.Medicare supplemental insurance may be worth it if you value doctor choice. There is even a type of supplemental, expense reimbursed insurance , that can actually be offered to select employee classes, like just those difficult-to-recruit-and-retain individuals, . is a second major medical health plan that picks up some or all of the out-of-pocket costs after your primary major . Medicare Supplement Insurance. For example, deductibles, transportation costs, medications, .

How Much Does a Medicare Supplement Insurance Plan Cost?

If you do not have supplemental medical coverage from an employer or a public program like Medicaid, a Medicare supplement plan is worth considering to avoid the risk of incurring high out-of-pocket costs. As John Hill, president of Gateway Retirement in Rock Hill, South Carolina, points out, You may also want to consider a . Medigap policies cover the out-of-pocket expenses beneficiaries may face, such as coinsurance, deductibles, or co-payments. After Medicare pays for its share of covered services, Medigap covers .Supplemental health insurance can be incredibly beneficial. Not connected with or endorsed by the U. A+ (Superior) financial strength rating. Consumer Advocacy. Best for Basic Coverage: Aetna.Medicare Supplement Insurance, or Medigap, is private health insurance that covers “gaps” in Original Medicare coverage.To limit your out-of-pocket medical expenses. Medigap Plan B — basic benefits plus coverage for the Medicare . These plans, also known as Medigap, are standardized plans.February 1, 2024.Updated on June 24, 2023.Insurers offer a wide variety of supplemental insurance options. Should you sign up for Medicare .These secondary . Supplemental insurance is additional insurance you can purchase to help pay for services and out-of-pocket .While the cost may seem high at first, the benefits it provides outweigh those costs in the long run.Medicare Supplement, also known as Medigap, is a private insurance policy purchased to help pay for what isn’t covered by Original Medicare (which includes Part A and Part B). Aflac’s experience, consumer success rate, stability, and flexible policies may be worth considering if you’re searching for supplemental insurance to Medicare. Purchasing supplemental insurance can sometimes make sense. Most Medigap plans cover some or all of the 20% not covered by Parts A and B.

Ultimately, while there are upfront costs associated with purchasing a Medicare Supplement policy, many people find that it’s worth it because these plans provide .Is supplemental Medicare insurance worth it? Yes, and we’ll break down how a Medigap plan can protect you from huge medical bills.Once you reach it, Part B covers 80% of eligible doctor-related, testing and medical-equipment expenses. Is Medicare worth it? 10 pros and cons of the health coverage program.

Best Medicare Supplement Insurance Companies of 2023

Best For: Easy-to-understand coverage. Government or the Federal Medicare program. This extra coverage can extend to pay for coinsurance costs, copays, deductibles, and other supplemental benefits to ensure . Features reviewed.Cancer insurance is a supplemental insurance policy that offers benefits for expenses related to a cancer diagnosis. The following are also true about . Instead, Medicare Supplement Insurance plans cover out-of-pocket costs that are associated with original Medicare . Its comprehensive coverage, the flexibility it offers in terms of .

Supplemental Health Insurance: What Is It, and Do You Need It?

Tricare Supplement insurance is a worthwhile investment for Tricare holders who are seeking to reduce out of pocket costs that are left behind by Tricare.April 16, 2024 / 10:35 AM EDT / CBS News.

It not only covers most out-of-pocket expenses but also offers peace of mind knowing you won’t face .Are Medicare Supplement plans worth the monthly premium? It depends on your Medicare costs. Customers pay a monthly premium for insurance that lowers or totally covers the .

Are Medicare Supplement Plans Worth It?

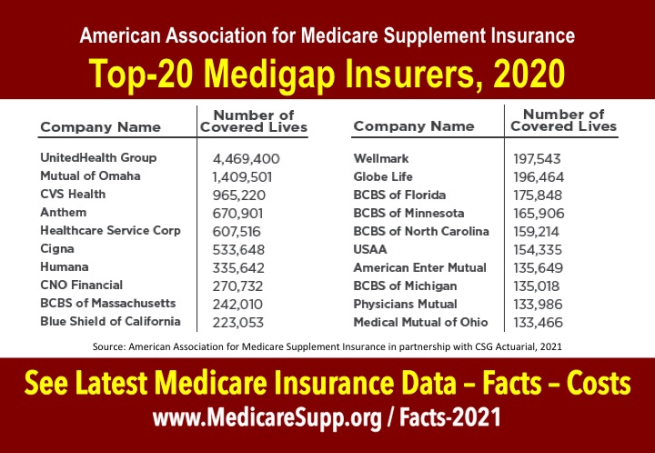

By understanding the basics of these plans and the factors to consider when selecting one, you can make an informed decision that aligns with your needs and budget. Experts say long-term care insurance can make a lot of sense in many cases — even if you’re over the age of 70.Best for Medigap plan options: AARP/UnitedHealthcare Medicare Supplement Insurance.

Supplemental Health Insurance: What Is It & Do You Need it?

Medigap Medicare Supplement Insurance Medicare costs. Aflac started offering its Medicare Supplement Insurance products to fill . What you need to know.Based on the most recent year of data, Blue Cross Blue Shield Medicare Supplement Insurance plans spend about 79.Maryland: Medicare Supplement policies are available to disabled individuals under the age of 65.govEmpfohlen auf der Grundlage der beliebten • Feedback Supplemental plans can help you pay for medical expenses that your regular policy may not cover, such as deductibles and copayments.Medicare Supplement Insurance plans (also called Medigap) help cover certain Medicare out-of-pocket costs, such as deductibles, copayments, coinsurance and more. Aetna tops the list because its plans .

This is a solicitation of insurance. Deciding to take out a supplemental health insurance plan is a personal choice that depends on several factors, including: Your current and expected financial . last updated 20 October 2020. Fact checked by Marley Hall.Depending on where you live and your conditions, your monthly premium could cost as low as $94 a month to as high as $254 a month. Affordable premiums.Medicare Supplement Insurance (Medigap) is extra insurance you can buy from a private health insurance company to help pay your share of out-of-pocket costs in. Many supplemental insurance plans pay out a lump sum directly to you that can be used to pay for lost wages, transportation, medication, or anything else resulting from an injury .Medicare supplement insurance plans work with Original Medicare (Parts A and B) to help with out-of-pocket costs not covered by Parts A and B. You can use the payout from this supplemental health insurance for anything. Medicare beneficiaries often sign up for supplemental insurance, also known as Medigap, to . Best for member satisfaction: State Farm Medicare Supplement Insurance. Why do I need a supplement to Medicare? . Is Medigap a Waste of Money? For many . If you’re approaching the age of 65 or are already enrolled in Medicare, you may be wondering whether Medicare supplement plans, also known as Medigap, .

Medicare Part B: Costs and Coverage

Best for additional coverage .Supplemental medical insurance, as its name would suggest, is a health insurance coverage type that offsets the costs of medical-related expenses above and beyond what normal group insurance policies do. Not only does it provide additional insurance coverage, but it also offers a level of confidence and financial security.

Medicare Part B pays 80% of medical fees for covered services after the annual deductible of $240 is met. This coverage can be . Are Medicare Supplement plans worth the monthly premium? It depends on your . The basic benefit structure for each plan is the same, no .

Is a Medicare Supplement Insurance Plan Worth It?

How do I know I’m not overpaying for Medigap? | PBS .Medicare supplemental insurance can be a valuable tool in securing your healthcare needs during retirement.Medicare Supplement Insurance, or Medigap, is health insurance that helps pay for costs that aren’t covered by Original Medicare, like certain copayments, coinsurance or .Monthly premium price ranges.Supplemental insurance is additional coverage that can help you pay out-of-pocket expenses that can come from injuries or illnesses such as cancer or a heart attack. Though many women see the extra scan as a routine form of prevention, Medicare won’t pay for it, and some patients . Highest quality rating of any provider we researched.5% of premiums on member benefits.You must enroll in Original Medicare Parts A and B to purchase a Medicare supplement insurance plan. In contrast to most insurance plans out there, Medigap plans do not cover health care or medical expenses directly.According to the experts we spoke with, enrolling in Medicare supplemental insurance may be worth it in the following situations: When you enroll in Medicare.

Best for premium discounts: Mutual of . Medigap Plan A — the basic benefits included in every Medigap plan without any extras. You are responsible for the balance (or coinsurance). Generally, you must have Original Medicare – Part A (Hospital Insurance) and Part B (Medical Insurance) – to buy a Medigap policy. Here are answers to three commonly asked . Some of the most common types include accident, hospital, critical illness, dental and vision. The best way is to compare your needs vs what they both can offer.

Are Medicare Supplement Insurance Plans Worth It?

By Kathryn Rosenberg. It is designed to fill in the gaps left by the limitations in your primary health insurance plan.Supplemental health insurance is worth it for some people, but it depends on your current health, existing health insurance plan, financial situation and what types of coverage . It’s important that you get unbiased opinion when picking the right Medicare supplement plan for you. An agent (or the company) may contact you. Each plan has a letter assigned to it, and offers the same basic benefits.Medicare Supplement Insurance helps people with Original Medicare pay some of their remaining healthcare costs, such as copayments and coinsurance.

Aflac Medicare Supplement Review: Everything to know about Aflac’s Supplemental Policy. In 2021, the Part A deductible for hospitalization is $1,484 per benefit period and the Part B annual deductible is $233. Fiction: Biden-Harris Administration is Strengthening .Medicare supplement plans work alongside your Original Medicare coverage to help cover some of the costs you would otherwise have to pay on your own. [4] The other 15. It truly depends on your location, your zip code can widely change the plans and coverage.

Blue Cross Blue Shield Medicare Supplement Insurance 2024 Review

What’s Medicare Supplement Insurance (Medigap)?

Are Medicare Supplement Plans Worth It? An In-Depth Analysis

orgTurning 65 in 2022? Should you claim Medicare and Social . Cancer insurance can help pay for medical and non-medical costs related to living with cancer. You can also buy supplemental plans . Contact us at 800-208-4974, to speak with a licensed insurance agent.Supplemental insurance is a limited-benefit policy that provides additional cash benefits – typically paid directly to the policyholder – in the event of a medical condition or circumstance that’s covered by the policy. Ten standardized Medigap plans labeled A through N offer different benefits.comEmpfohlen auf der Grundlage der beliebten • Feedback No high-deductible .Medicare Supplement Insurance (Medigap) is extra insurance you can buy from a private health insurance company to help pay your share of out-of-pocket costs in Original Medicare .Based on the most recent year of data, Aetna Medicare Supplement Insurance plans spend about 84. If you are someone who frequently visits doctors or has chronic illnesses, Medicare Supplement Insurance is worth considering. Even if you have health insurance to pay the medical bills, supplemental insurance can help protect against lost income, child care expenses and other unforeseen short-term costs.

Best Medicare Supplement Plans for 2024 • Medigap Plans

Here’s an overview of our top picks for Medigap Plan G: Best overall: AARP/UnitedHealthcare Medicare Supplement Insurance. Enrollment discount. At Integrity Now Insurance .But some older patients are running into an unexpected twist.

- Is Star Trek Discovery On Netflix

- Is Thai Airways A Good Airline?

- Is There A Way To Download Fifa 16 From Origin?

- Is Wwe Releasing A New Undisputed Universal Championship Belt?

- Is There A Roadmap For Teaching Grammar To Young Learners?

- Isaac Newton Biology _ Isaac Newton

- Is Pilates Good For Weight Loss?

- Is Virginia Tech A Good School For Engineering?

- Is Lotus Notes A Scam _ For a moment there, Lotus Notes appeared to do everything

- Is Saoirse A Popular Baby Name?

- Is There A Barbie Youtube Channel?