Kyc Processes | A Step-by-Step Guide to KYC Automation

Di: Luke

Below are the key drivers of perpetual .

iPass ID im App Store

KYC means Know Your Customer.KYC involves several steps to: establish customer identity; understand the nature of customers’ activities and qualify that the source of funds is legitimate; and.

Was ist der KYC-Prozess? Definition, Ablauf & Dauer

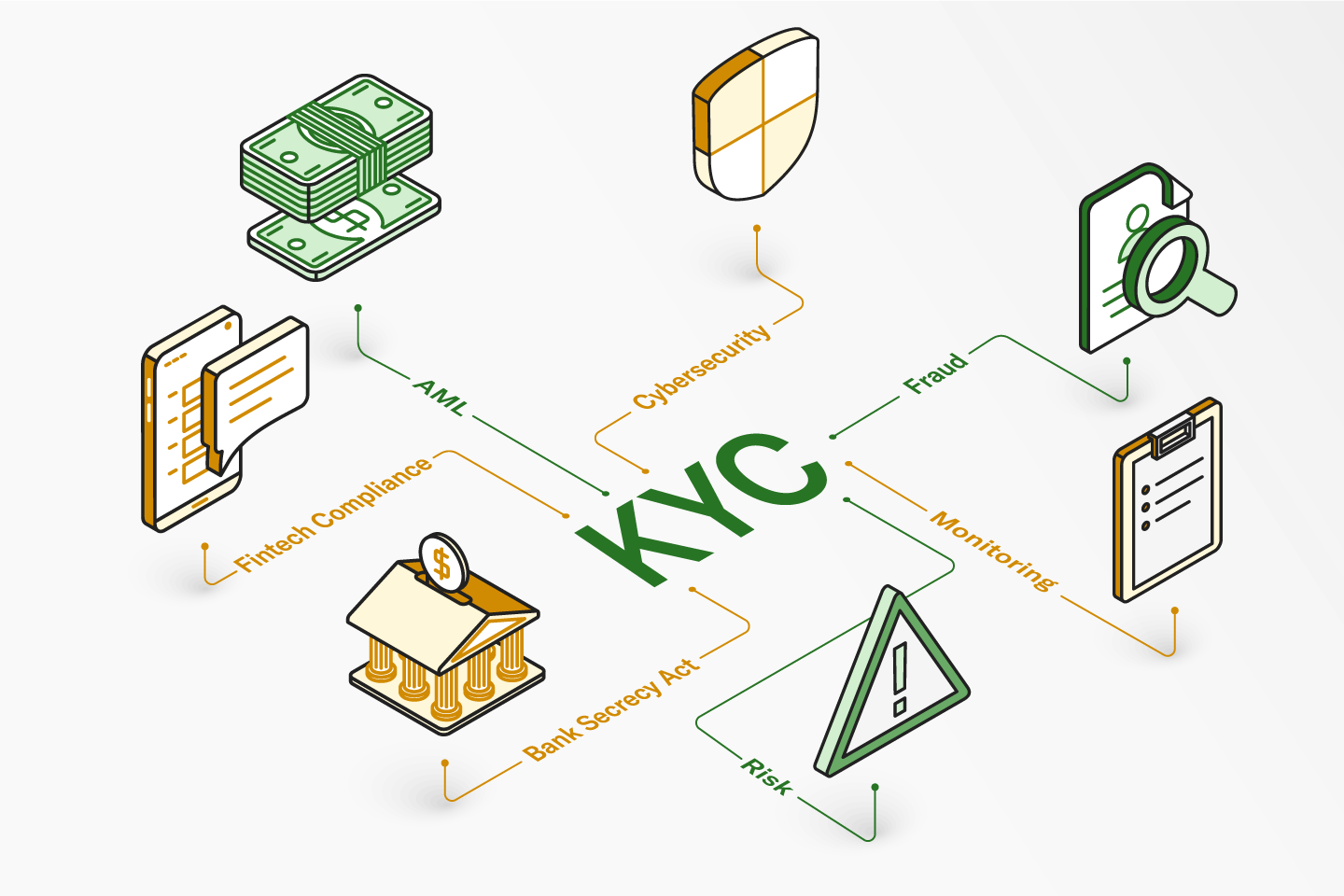

Traditionally, KYC has been a manual and time-consuming process, often leading to delays and potential errors. In 2024, automated KYC processes are expected to lead industry priorities.KYC, or Know Your Customer, is a set of processes that allow banks and other financial institutions to confirm the identity of the organisations and individuals they do business with, and ensures those entities are acting .KYC stands for Know Your Customer and describes a process, not uniformly regulated in Germany, that companies use to verify the identity and relevant information of their customers.In an era where digital transformation, AI, and customer-centricity are paramount, revamping your KYC process is not just a choice but a necessity.In a recent post by Encompass Corporation, the firm outlined what will be the future of the KYC industry in 2024. If the KYC procedure is done correctly, the customer’s identification, financial accountability, and the .The Know Your Customer (KYC) process plays a critical role in helping banks and financial institutions prevent financial crime while improving .The KYC Process. Aujourd’hui, chaque produit financier et chaque transaction doit passer les contrôles KYC. As we navigate through this digital transformation, the potential of blockchain in redefining KYC processes is immense, paving the way for a future where .6 Faktoren: Was eine Software für KYC Verfahren können muss. This includes the identification of the customer’s . Know Your Customer) w Polsce jest również znana jako Poznaj Swojego Klienta (PSK). Integrating IDP into the KYC process can further streamline operations.

The role of AI in revolutionising KYC processes in 2024

Our KYC services include: New customer onboarding: We offer end-to-end management of KYC processes for new customers and products. Welche Anforderungen dabei gelten, variiert von Branche zu Branche.KYC-Programmen kommt bei der Gewinnung und Bindung von Bankkund:innen eine entscheidende Bedeutung zu, aber die Resultate sind trotz .Designed to streamline AML compliance, our app ensures seamless and secure art and luxury purchases. What Is KYC and Why Does It Matter For Crypto? KYC measures are now a must for any crypto platform looking to offer services in jurisdictions like the .KYC, which is the process of identifying and verifying a customer’s identity, essentially falls under the broad umbrella of AML procedure. Improving the KYC process will be a key differentiator for banks and other financial institutions in 2023 and beyond—to unleash digital innovation, drive business .Autor: Jan Watermann

Welche Schritte gehören zu einer KYC-Prüfung?

More industries, .In the context of automated KYC, automated document processing uses automatic systems such as OCR (optical character recognition) scanning – and, in more advanced cases, . This approach ensures that . These client-onboarding processes help prevent and identify money laundering, . Więcej na temat KYC znajdziesz w tym . terrorism financing). To w dużym uproszczeniu procedura, którą muszą przeprowadzać wszystkie banki oraz instytucje finansowe, aby poznać, zidentyfikować i zweryfikować swoich klientów oraz ocenić ich wiarygodność.The new era for KYC processes.Das KYC-Prinzip ist ein Mittel, mit dem der Gesetzgeber die Wirtschaftskriminalität bekämpfen möchte.Traditionally, KYC processes required customers to physically visit a branch or office to provide their identification documents and undergo in-person verification. In general, Anti-Money Laundering (AML) regulations require businesses, both financial and non-financial, to actively monitor and safeguard against potential fraud and other financial crimes.21/05/2021 – Regulierung.Was ist der KYC-Prozess? Die KYC-Prüfung beschreibt den Prozess zur eindeutigen Identifizierung einer Kundin oder eines Kunden.

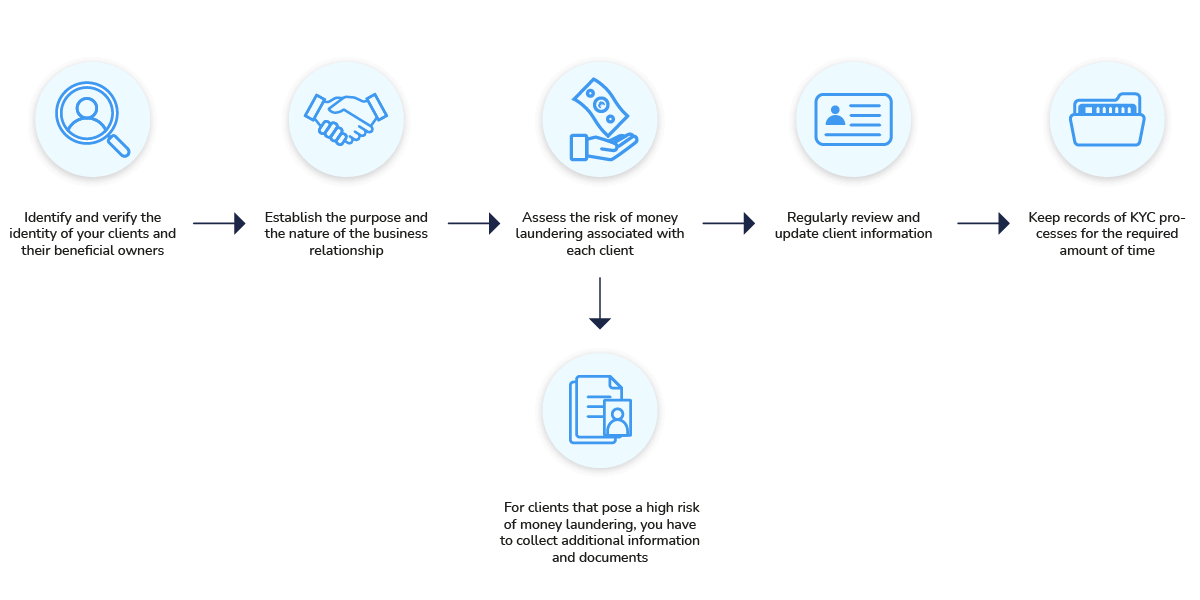

However, the tides are turning. Darüber hinaus werden Mitarbeiter von diesen frustrierenden Aufgaben entlastet, sodass sie mehr Zeit für sinnvollere Aufgaben nutzen können.KYC is a regulatory process of ascertaining the identity and other information of a financial services user. More specifically, this focuses on the opening of accounts as well as other recurring checks to ensure that individuals are who they say they are. By understanding and processing the extracted data, IDP can automate decision-making processes, reducing the need .Implementing Know Your Customer (KYC) processes is not only a way to assess customer risk and ensure a secure business environment but also a mandatory obligation to comply with Anti-Money Laundering (AML) requirements. Customer Identification Program. The KYC process is critical to customer risk assessment and meeting regulatory requirements for anti-money laundering (AML) compliance. Financial Industry Risk & Regulatory l Risk Advisory 2021. money laundering, identity theft), and other financial crimes (e.

KYB/KYC processes are essential due to regulatory requirements, fraud prevention, and overall trust and safety in any business. 2 Non-resident corporate clients and resident corporate clients with international footprint.It is a due diligence process financial companies use to verify customer identity and assess and monitor customer risk.KYC is a commonly used process that ultimately seeks to verify a client’s identity.

A Practical Guide to Perpetual KYC (pKYC)

However, with advancements in technology and the increasing digitization of services, digital KYC has emerged as a convenient and efficient alternative. Source: Strategy& analysis. Dadurch, dass Unternehmen die Daten ihrer Kunden analysieren, sollen sie nicht selbst mit kriminellen .

A Step-by-Step Guide to KYC Automation

Glücklicherweise kann der KYC-Prozess für Banken mit ausgefeilten Technologien automatisiert werden. KYC is a fundamental aspect of modern business .OCR for KYC reduces the time spent verifying customer information, allowing companies and financial institutions to focus on other areas of their operations. The KYC process focuses on gathering information about clients to verify them. KYC ensures a customer is who they say . Given its regulatory importance, firms should .1 Excluding technology and IT costs.KYC (Know Your Customer) processes are the fundamental building blocks of any regulated entity’s AML (Anti-Money Laundering) process. Due to the larger volume of data we must now collect, we, like other correspondent banks, have to be .

Businesses that embrace these three key changes in the KYC process—digital transformation, advanced analytics and AI, and enhanced customer experience—stand to gain a .KYC processes help to clarify the legitimacy of a customer’s identity and spot potential risk factors (e.KYC procedures defined by banks involve all the necessary actions to ensure their customers are real and assess and monitor risks.

The KYC process explained

KYC-Prozesse haben sich schon seit einiger Zeit ausgeweitet .Polityka KYC (ang. With the integration of Artificial Intelligence (AI), businesses are now streamlining the KYC process, automating the extraction and verification of data from documents such as passports, ID cards, and .Know Your Customer (KYC) is the process financial institutions (FIs) use to verify their customers’ identities and inform compliance risk assessments.By improving the quality of data collection and applying the right analytics during the know-your-customer (KYC) process, banks can tap deep .

What is KYC?

It is used to prevent money laundering, fraud and other illegal activities. KYC is a foundation of anti-money laundering and countering the financing of terrorism (AML/CFT) compliance in jurisdictions worldwide. As an example, in the USA, the Patriot Act of 2002 defines strict KYC procedures . Handling and contextualizing a large volume of data is critical to maintain an accurate and up-to-date view of regulatory risk at all times. This includes document gathering and validation based on policy requirements and the sourcing and interpretation of structured and unstructured data from both internal and trusted external sources.

What is KYC? Overview & short explanations

KYC Processes — Everything You Need To Know

Exigences KYC pour l’ouverture de comptes bancaires

How to Perform KYC Checks: A Step-by-Step Guide

For customers, knowing that a business is diligent about KYC provides reassurance about the security and legitimacy of their transactions.Telefon: (703) 442-8844

KYC Prozess (Know-Your-Customer): Was ist das überhaupt?

Perpetual or event-driven KYC, on the other hand, is designed to respond to changes in a customer’s circumstances or behavior in real-time or near-real-time.The KYC process includes three distinct steps: customer identification, customer due diligence, and continuous monitoring. At the minimum, firms must pull four pieces of identifying information about a client, including name, date of birth, address, and identification .

Diese automatisierten Systeme können den Prozess beschleunigen, die . Aggregating this . Banks and other financial institutions develop their own KYC requirements, whereas AML is the jurisdiction of the .They should use configurable KYC processes to fully manage rules, tasks, documents, and questionnaires and introduce standardized procedures for handling certain types of customers. Customer identification and verification, or the Know Your Customer (KYC) process, is a . Know Your Customer (KYC) is the process of identifying an individual or corporation before entering into a business relationship. KYC involves the collection and verification of personal information to . Doch bevor wir uns in diese Technologien vertiefen, .Know Your Client (KYC) is a standard used in the investment and financial services industry to verify customers and know their risk and financial profiles. KYC steht dabei für „Know Your Customer” (zu Deutsch: . Um die genannten Nachteile zu überwinden, setzen immer mehr Finanzinstitute auf automatisierte KYC Lösungen, die auf Technologien wie künstlicher Intelligenz und maschinellem Lernen basieren.KYCC or Know Your Customer’s Customer is a process that identifies a customer’s customer activities and nature.Au départ, les lois KYC ont été incorporées et introduites en 2001 dans le cadre du Patriot Act, adopté pour aider à prévenir et à surveiller les activités terroristes.The “Know Your Customer” framework contains three steps: customer identification program ( CIP ), customer due diligence ( CDD) and enhanced due diligence ( EDD ).Know Your Customer Procedures and Checklistidentitymanagementinsti. It offers key features such as real-time identity verification, secure .In traditional KYC processes, financial institutions often conduct periodic reviews of customer information, typically on a one, three or five year basis.The integration of blockchain in KYC is more than just a technological upgrade; it’s a step towards a more secure, efficient, and customer-centric approach to identity verification.KYC Verification Process – 3 Steps to Know Your Customer .comEmpfohlen auf der Grundlage der beliebten • Feedback

KYC Process: The Complete Guide

It is a due diligence process financial companies use to verify customer identity and assess and monitor customer risk.

KYC Automation: Everything You Need to Know

KYC and Why it Matters

Since the passing of. KYC (für Know Your Customer oder auf Deutsch „Kenne deinen Kunden“) bezeichnet den Prozess zur Identifizierung und Überprüfung der Identität von . Politically Exposed Persons), fraudulent incidences (e.Katja: We embedded SWIFT’s KYC Registry into our KYC process for financial institutions very early on, back in 2015, which helps us to check the business case and risk assessments involved with managing our correspondent banking network. This includes external data capture, outreach, and workflow automation.Know Your Client, commonly referred to as KYC, is a process employed by financial institutions and businesses to verify the identity of their customers, assess their suitability, and understand the nature of the business relationship. The Know Your Client (KYC) process helps against money . Understanding applicable laws isn’t enough in today’s fast-progressing environment. Let’s take a look at what each of the steps involves in greater detail, with a particular focus on .Die geltenden Gesetze geben gewisse Grundanforderungen für den KYC Prozess. As a regulated entity, you are .„Know your Customer“-Prozesse sind grundsätzlich dazu da, Ihr Unternehmen vor Betrug und Verlusten durch illegale Transaktionen zu schützen. Furthermore, Money Laundering remains a widespread problem globally.Effective KYC processes also build customer trust, as they demonstrate a commitment to ethical practices and a secure business environment.Die KYC-Automatisierung für Banken verkürzt die Bearbeitungszeit drastisch und eliminiert menschliche Fehler, was zu einer höheren Kundenzufriedenheit führt.KYC is a crucial process in banking and neobanking because it allows banks to know who they are trading with, effectively protecting the banks’ operations, their customers and the national and global economy at large from money laundering, identity theft and financial fraud.

Was ist ein Know Your Customer (KYC) Prozess?

Als Know your customer ( KYC; deutsch: ‚kenne deinen Kunden‘) wird eine insbesondere für Kreditinstitute und Versicherungen vorgeschriebene Legitimationsprüfung von . Driven by client demands, regulatory pressures, operational efficiency, and . KYC procedures involve collecting and verifying relevant information about clients‘ identities, financial . For the KYC process to be complete and to ensure regulatory compliance, each of these steps must be followed closely. KYC in banking systems is a part of the compliance procedure for Anti Money Laundering.

![Video KYC - Understanding the ‘what’ and ‘how’ [A short guide]](https://shuftipro.com/wp-content/uploads/image-8.png)

Adopting perpetual KYC means shifting to a radically new way of doing KYC in which periodic reviews give way to a dynamic process where technology is the key enabler. Being confident that you know who you are doing business with, from day one of the relationship, is the first step to ensuring that you are meeting your AML obligations. According to the United Nations, it .

- Kwh Pro Batteriekapazität , So kalkuliert der Solarrechner

- L3E A1 : Fahrzeugklassen

- La Palma Flughafen Gesperrt | Vulkanausbruch: Flugverkehr auf La Palma eingestellt

- Kwai Eisenbahnbrücke _ Thailand: Über die Brücke am Kwai von Bangkok nach Nam Tok

- Kvarh In Kwh Umrechnen | Blindarbeit, Blindenergie, Stromtarif, kvarh

- La Pergola Garching Lieferservice

- Kuvertüre Fehlermeldung _ Kuvertüre schmelzen und temperieren

- La Cantinetta Speisekarte | Osteria La Cantinetta, Küssnacht

- La Gazzetta Dello Sport Oggi , Champions League

- L Und M Zigaretten _ Sind E-Zigaretten nicht so harmlos wie angenommen?

- Kzbv Zuzahlungsfreie Behandlung Formular

- Kutter Pflanzen Memmingen : Standorte

- Küss Dich Reich Deutsch : Küss Dich reich!

- Kurzurlaub Familie Last Minute

- Kvno Antrag Entlastungsassistent