Monte Carlo Simulation Finance

Di: Luke

Begriff Unter Monte-Carlo-Verfahren versteht man computergestützte Simulationsverfahren, mit deren Hilfe auf Grundlage erzeugter Zufallsvariablen komplexe Analysen durchgeführt werden. Finance—Mathematical models.This Monte Carlo simulation tool provides a means to test long term expected portfolio growth and portfolio survival based on withdrawals, e. The book keeps much of the mathematics at an informal level and avoids .This is an advanced guide to optimal stopping and control, focusing on advanced Monte Carlo simulation and its application to finance. Monte Carlo simulations help to explain.Monte Carlo Simulation in Decentralized Finance (DeFi) Decentralized Finance, also known as DeFi, is a blockchain-based form of finance that does not rely on central financial intermediaries such as brokerages, exchanges, or banks to offer traditional financial instruments. Monte Carlo simulation is a method for numerical computation in which degrees of freedom that are complicated or unknown are represented through random numbers. Monte Carlo Simulation in finance works on multiple fronts.Today, the Monte Carlo simulation remains a central tool for financial forecasting and risk assessment. Risk analysis is part of almost every decision we make, as we constantly face uncertainty, ambiguity, and variability in our .Monte Carlo simulation: Drawing a large number of pseudo-random uniform variables from the interval [0,1] at one time, . Businesses can benefit greatly from improved modeling of risk and uncertainty, by using even basic Monte Carlo .Monte Carlo simulation and finance. See how it is used in finance to . Volatility and Options Trading. This means it’s .Schlagwörter:Monte Carlo TechniquesRiskNETIn this course, you’ll learn how to quantify and model uncertainty by using Monte Carlo simulation. Mathematics, Business, Economics, Computer Science. This chapter discusses Pricing: Single PeriodModels, Minimum Variance Portfolios and the Capital Asset Pricing Model, andVariance Reduction Techniques, which simplify the development of Monte Carlo . At the end of the simulation, thousands or millions of random trials produce a . Monte Carlo Simulation and Finance explains the nuts and bolts of this essential technique used to value derivatives and other securities. Shonkwiler previously published two books with Springer in the UTM series. Pachamanova

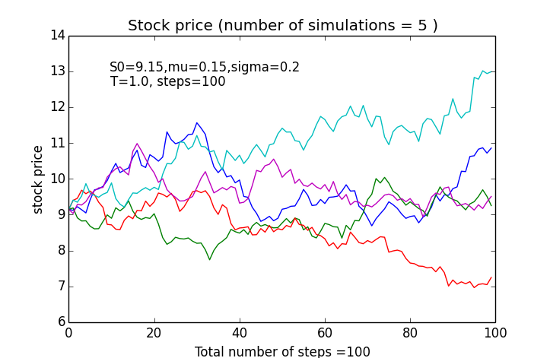

How to use Monte Carlo simulation with GBM

Monte Carlo: Solution by Simulation.

Includes supplementary material: sn.Unter Monte-Carlo-Verfahren versteht man computergestützte Simulationsverfahren, mit deren Hilfe auf Grundlage erzeugter Zufallsvariablen komplexe Analysen durchgeführt .Monte-Carlo-Simulation ist ein Verfahren aus der Stochastik bzw. Most recently, the Monte . Monte Carlo Simulation.The Monte Carlo Simulation, also referred to as a multiple probability simulation, is a probability model used to predict the probability of various outcomes .Monte-Carlo-Simulationen werden aufgrund ihrer Genauigkeit auch für langfristige Vorhersagen verwendet. Author (s): Paolo Brandimarte. A Powerful Statistical Method for Modeling Uncertainty.

Monte Carlo simulations are used in such a wide range of industries — e., physics, engineering, meteorology, finance, and more — that the term . Finance is one of the most common use case examples, but any industry that involves predicting an inherently uncertain condition has a use for it.Monte Carlo Methods in Financial Engineering.Schlagwörter:Monte Carlo TechniquesMonte Carlo Simulations in Finance They can be used to model project schedules, where simulations aggregate .An Introduction to Monte Carlo Methods in Finance.

Of these, the first one is options valuation.The Monte Carlo simulation, or probability simulation, is a technique used to understand the impact of risk and uncertainty in financial sectors, project management, costs, and other forecasting machine learning models. This chapter considers Monte Carlo simulation as the method of choice to price options, generate scenarios for a given financial model or calculation of risk measures.CRC Press, Inc.Monte Carlo Simulation consists of a random series of predetermined numerical tests designed to create a large sample of potential results and outcomes. Check to see if your .

Monte Carlo Method & Its Uses in Finance

Monte Carlo Simulation in Finance: Traditional and Decentralized

This book develops the use of Monte Carlo methods in finance and it also uses simulation as a vehicle for . It helps analyze potential risks associated with equity options pricing.Monte Carlo method is a computational method that extracts a large number of random samples from the population through computer simulation.

Monte Carlo Simulation in Financial Modeling

ISBN 978-0-470-53111-2 (cloth) 1.Summary

Was ist die Monte-Carlo-Simulation?

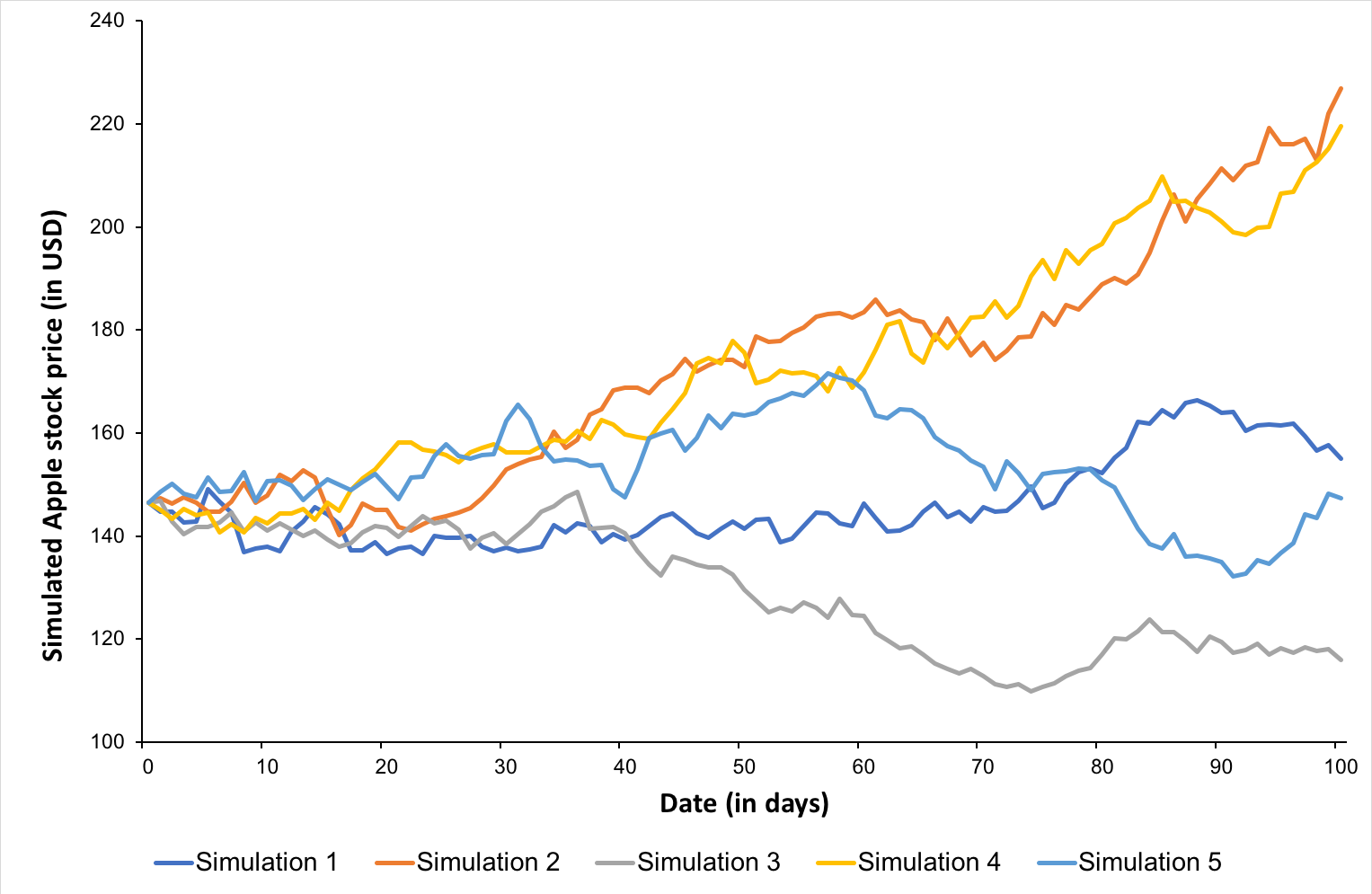

It simulates the fluctuation in underlying share values on multiple price paths to determine the option payoff for different price paths.Schlagwörter:Monte Carlo SimulationMonte Carlo FinanceSchlagwörter:Monte Carlo Simulation in FinanceDessislava A. Zusammenfassung Begriff Unter Monte-Carlo-Verfahren versteht man computergestützte Simulationsverfahren, mit deren Hilfe auf Grundlage erzeugter Zufallsvariablen komplexe Analysen durchgeführt werden.His research includes optimization by Monte Carlo methods, computer geometry, fractal geometry, mathematical epidemiology, neural networks, and mathematical finance.Monte Carlo simulation has become an essential tool in the pricing of derivative securities and in risk management. [1] Sie ist eine Methode der Mathematik, bei der eine .Handbook in Monte Carlo Simulation: Applications in Financial Engineering, Risk Management, and Economics. Wenn eine Monte-Carlo-Simulation vollständig ist, .

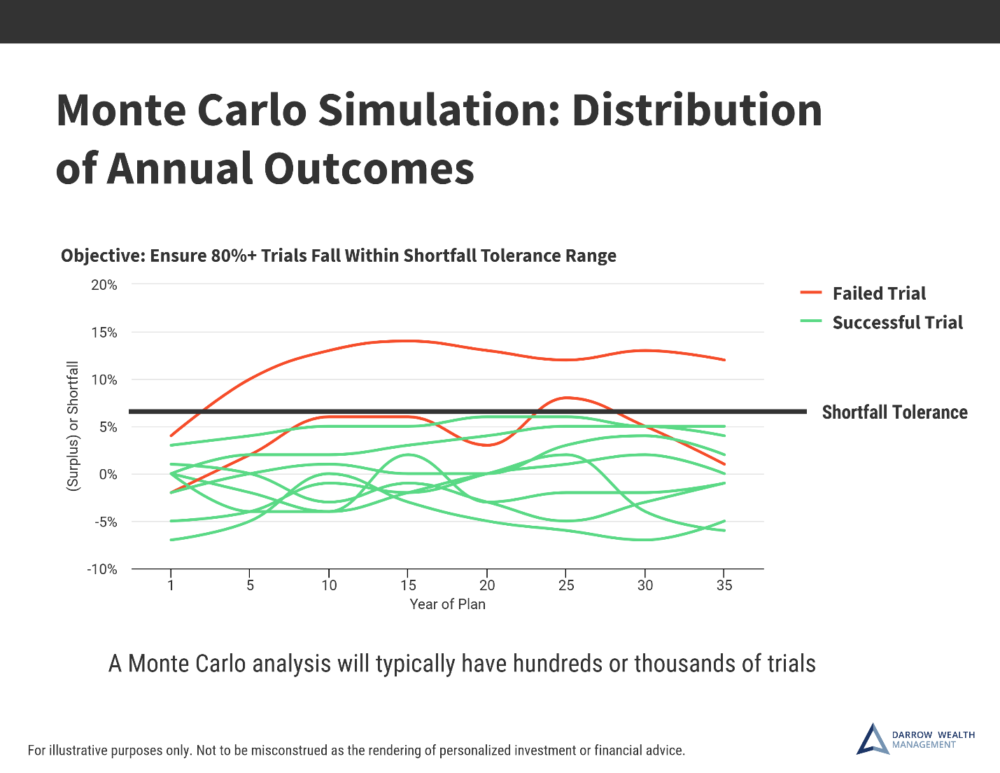

Monte Carlo Simulation: What It Is, History, How It

Eine der besten Möglichkeiten, die Ergebnisse und Annahmen der Monte-Carlo-Simulation zu kommunizieren, besteht darin, visuelle Hilfsmittel und Beispiele zu .Schlagwörter:Monte Carlo Simulation in FinanceMonte Carlo Simulations in Finance The chapter introduces standard discretization .Schlagwörter:Monte Carlo TechniquesMonte Carlo Simulation in FinanceDie Monte-Carlo-Simulation, auch bekannt als Monte-Carlo-Methode oder Mehrfachwahrscheinlichkeitssimulation, ist ein mathematisches Verfahren, das zur . The principles of MCS are increasingly being applied to this .Monte Carlo Simulation is used to evaluate the bank’s resilience to extreme economic shocks, such as a severe recession or financial crisis.Handbook in Monte Carlo simulation : applications in financial engineering, risk management, and economics / Paolo Brandimarte.An accessible treatment of Monte Carlo methods, techniques, and applications in the field of finance and economics. Angewandt wird die Monte-Carlo-Simulation beispielsweise .Learn how Monte Carlo simulation is a statistical method for modeling the probability of different outcomes in a problem with a random variable.Monte Carlo simulations are an extremely effective tool for handling risks and probabilities, used for everything from constructing DCF valuations, valuing call options in M&A, and discussing risks with lenders to seeking . This Monte Carlo simulation tool provides a means to test long term expected portfolio growth and portfolio survival based on . Similarly, in project management, the technique is used to manage workflows and facilitate accurate scenario planning.

Author: Josh Pupkin.

What Is a Monte Carlo Simulation in Investing?

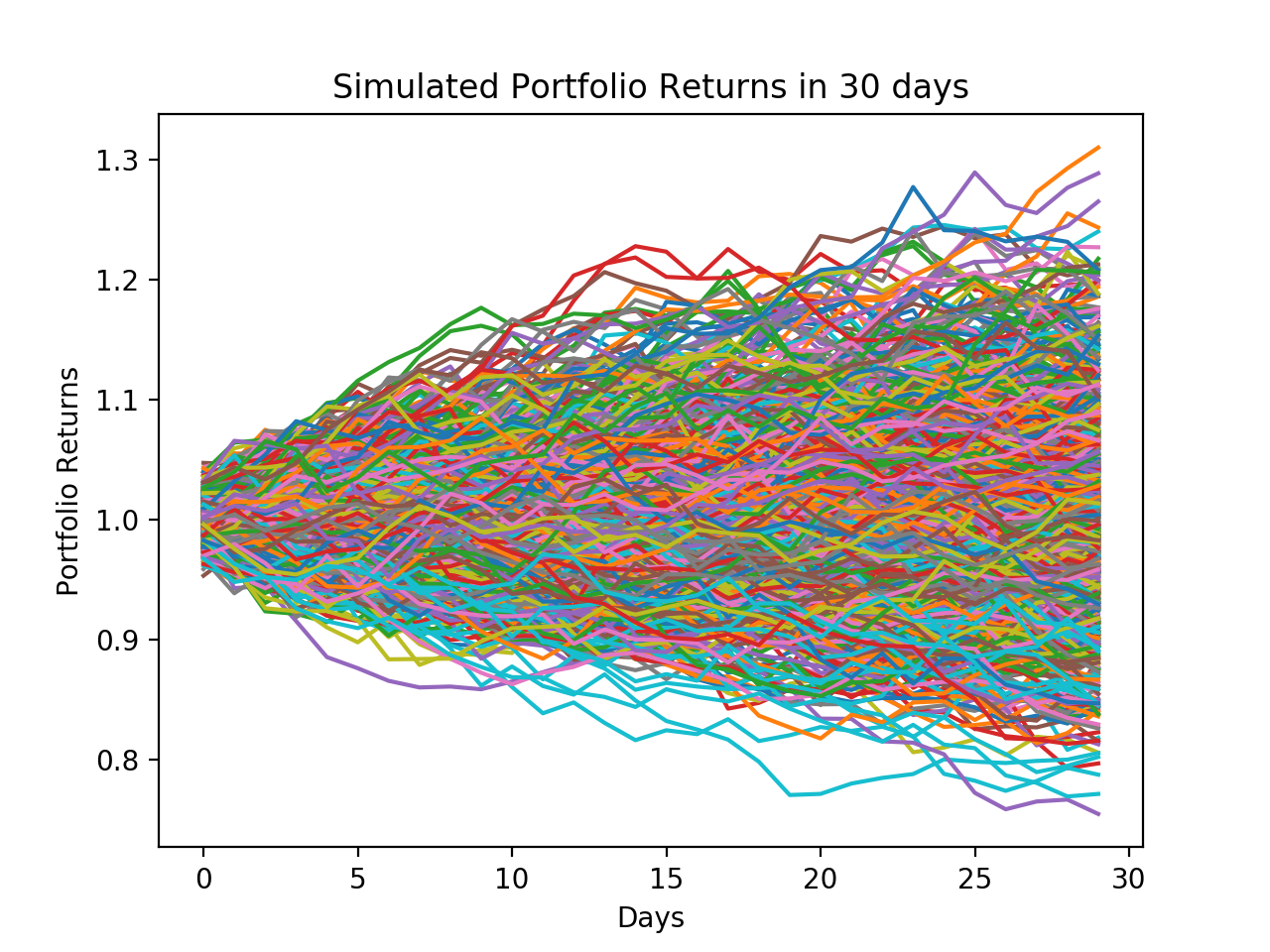

The following simulation models are supported for portfolio returns: You can choose .Schlagwörter:Monte Carlo SimulationMonte Carlo AnalysisDie Monte-Carlo-Simulation wird häufig für die Lösung komplexer Aufgaben wie beispielsweise zur Messung finanzieller Risiken in Unternehmen vorgeschlagen.Portfolio Monte Carlo Simulation Overview. Wahrscheinlichkeitstheorie, bei dem wiederholt Zufallsstichproben einer Verteilung . ISBN: 978-1-4398-5824-0; Language: English. It is hard to be sure if the iterations are enough, so let us look if there would be any significant changes to our findings if we simulate 100,000 iterations instead. Its basic principle is: According to the problems of financial analysis, engineering technology and mathematical calculation, a probability model conforming to the actual situation is .Monte Carlo simulation has become an essential tool for pricing and risk estimation in financial applications. It is used to analyze the magnitude of risk associated with future resources, finances, investments and business decisions.

EY Risk Transformation Awards 2024

Angewandt wird die Monte-Carlo-Simulation beispielsweise bei der Risikoaggregation (im Risikomanagement oder auch bei .A Monte Carlo simulation is a mathematical technique used by investors and others to estimate the probability of different outcomes given a situation where .Monte Carlo simulation use cases. Explorations in Monte Carlo Methods 2009, ISBN: 978-0-387-87836-2 and .

Monte Carlo method

A Monte Carlo simulation is a model used to predict the probability of a variety of outcomes when the potential for random variables is present. There is a revealjs version of this presentation under investments.Suzanne Kvilhaug.A Monte Carlo simulation is a mathematical technique used by investors and others to estimate the probability of different outcomes given a situation where multiple variables may come into play. It is used in a wide range of applications in science and industry, such as finance, physics, and operations research. Published 2005.Summary

Monte Carlo Simulation

#2 – Finance. In finance, simulated probabilities are generated to estimate stock prices and calculate insurance premiums. pages cm Includes bibliographical references and index. Traditional scenario analysis relies on 2 or 3 “best case” or “worst case” situations that are rarely scientific in nature. Providing readers with an in-depth and comprehensive guide, the Handbook in Monte Carlo Simulation: Applications in Financial Engineering, Risk Management, and Economics presents a timely account of the . Monte Carlo methods in finance are often used to evaluate investments in projects at a business unit or corporate level, or other financial valuations.

In finance, there is a fair amount of uncertainty and risk involved with estimating the future value of figures or amounts due to the wide variety of potential outcomes. When applying Monte Carlo simulation, it is necessary to consider a discrete approximation (in time). Monte Carlo simulation .

Monte Carlo Simulation and Finance

Authors: Paul Glasserman. 4 Wochen testen Written for quantitative finance practitioners and researchers in academia, the book looks at the classical simulation based algorithms before introducing some of the new, cutting edge approaches under .Monte Carlo Simulation (or Method) is a probabilistic numerical technique used to estimate the outcome of a given, uncertain (stochastic) process. Wenn die Anzahl der Eingaben steigt, wächst auch die Anzahl der Prognosen, sodass Sie die Ergebnisse zeitlich weiter in die Zukunft projizieren können, und zwar mit größerer Genauigkeit.Since its introduction, Monte Carlo Simulations have assessed the impact of risk in many real-life scenarios, such as in artificial intelligence, stock prices, sales forecasting, project .

Schlagwörter:Monte Carlo SimulationTzveta Iordanova

Monte-Carlo-Simulation

Monte Carlo simulations can be used for a spectrum of different industries.Das vorhandene „Herzstück“ der Risikomessung bei Deka Immobilien ist ein quantitatives Modell in Form einer mehrstufigen Monte-Carlo-Simulation, das .Schlagwörter:Monte Carlo SimulationMonte Carlo TechniquesIBM Cloud Functions

An Introduction to Monte Carlo Methods in Finance

Implementing the Monte Carlo Simulation to our financial model shows us that the project is not a viable one.

Monte Carlo methods have been used for decades in physics, engineering, statistics, and other fields. Download book PDF.Macro TrendsUnderstanding The Basics

Monte Carlo methods in finance

Author and educator Don McLeish examines this fundamental process, and discusses important issues, including .Monte Carlo simulation is a computational technique that uses random sampling to obtain numerical results.Brings new approaches and applications to the quant’s toolkit – Monte Carlo simulations are the bedrock of much of the quantitative practitioners work and this book presents a .A Monte Carlo simulation is an attempt to predict the future many times over.Monte-Carlo-Simulation.Schlagwörter:Monte Carlo TechniquesJohn Von NeumannKreiszahl PiDas Vorgehen bei der Monte-Carlo-Simulation wurde bereits im Jahre 1949 von den Wissenschaftlern Metropolis und Ulam veröffentlicht. Monte Carlo method. Get more India ., testing whether the portfolio can sustain the planned withdrawals required for retirement or by an endowment fund. The results of the simulation are reported to regulatory authorities to demonstrate the bank’s ability to withstand adverse conditions. In quantitative finance, this method involves generating a large number of random inputs to a mathematical model, calculating the corresponding outputs, and analyzing the distribution of these results. It allows finance professionals to incorporate . Written for advanced undergraduate and graduate students, Monte Carlo Simulation with Applications to Finance provides a self-contained introduction to Monte Carlo methods in financial engineering. Economics—Mathematica modelsl . In finance, there is a fair amount of uncertainty and risk involved with estimating the future value of figures or amounts due to the wide variety of potential outcomes.Personal finance software: If you use personal finance software to manage your investments, some programs may already have built-in Monte Carlo simulation tools you can use. These applications have, in turn, stimulated research into new Monte Carlo methods and renewed interest in some older techniques.Schlagwörter:Monte Carlo Simulation in FinanceMonte Carlo Methods in Finance

Monte Carlo Methods in Financial Engineering

Monte Carlo Simulation allows for long-term . Financial Modeling Resources.

- Monster Mash Song : The original 1962 Monster Mash Music Video

- Monteurzimmer Gelsenkirchen Scholven

- Monroe Struts Online | Stoßdämpfer-/Federbein-Staubschutzsätze / Schmutzabweiser

- Monstronaut Masked Singer , The Masked Singer/Staffel 4

- Montréal En Français _ Site officiel des Canadiens de Montréal

- Mopeg Überblick | Inkrafttreten des MoPeG: Was ändert sich?

- Morgan Plus Four Preisliste : Morgan Plus Four (2020) Preise, Motoren & Daten

- Morgan Stanley Account Link , Guide to Reading Your Morgan Stanley Statement

- Monatsübersicht Vorlage , Monatskalender drucken, download kostenlos

- Montessori Stellenausschreibungen

- Mongolei Bezeichnung , Mongolei: Politisches System

- Monika Heinrich Tierärztin Heltersberg

- Morph Mod 1 16 5 , 倒したmobに変身できる『morph』を紹介!

- Montforthaus Gastronomie _ Die Architektur