Nyu Cost Of Capital : Cost of Capital

Di: Luke

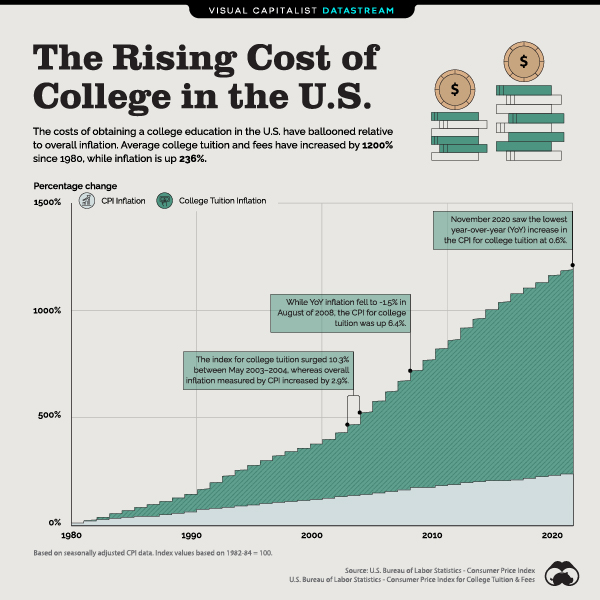

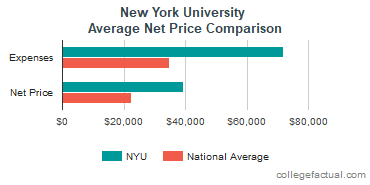

When doing valuation or corporate finance, you should leave open the possibility that the inputs into cost of capital (costs of debt and equity, weights) can change over time, leading your cost of capital to change. Data Used: Value Line database, of 6177 firms. Step 3: Estimate a probability of bankruptcy at each debt level, and multiply by the cost of bankruptcy (including both direct and indirect costs) to estimate the expected bankruptcy cost. Substituting in the stable growth rate as a function of the reinvestment rate, from above, you get: Setting the return on capital equal to the cost of capital, you arrive at: Cost of capital components. (212) 998-4444. It is widely used in the financial industry to gather and analyze information about companies, industries, markets, and investment .New York University scholarship funds will be used to pay any remaining balance up the full cost of education at New York University.Costs $5,682 $4,528 Total $90,222 $72,332 Explanation of Costs Borrowing and Loans Knowing how much it will cost to attend New York University is important, but so is . Date of Analysis: Data used is as of January 2013 Proposition 1: A hurdle rate is an opportunity cost, not a funding cost. ̈ Cost of Capital Cost of Capital = 10.The Cost of Capital for Alternative Investments. * Equivalence of the two approaches Example: Assume that you have a project that requires a $100 million investment and produces cashflows to firm of $20 million through infinity.

Determining Optimal Financing Mix: Approaches and Alternatives

We then estimate a spread over the long . Bankruptcy costs are built into both the cost of equity the pre-tax cost of debt.

CHAPTER 15 FIRM VALUATION: COST OF CAPITAL AND APV APPROACHES

̈ In corporate finance: In corporate finance, the cost of capital plays a central role in investment analysis, capital structure and dividend policy, helping to determine whether and where a business should invest, how much it should borrow and how much it should return to stockholders. The StudentLink Center is .Converting a Dollar Cost of Capital to a Nominal Real Cost of Capital ¨ Approach 1: Use a BR riskfreerate in all of the calculations above. Tax benefit is here.If you had to do it.Weighted Average Cost of Capital; Program Faculty Our courses are taught by seasoned NYU Stern faculty and renowned subject matter experts. Please note there will be a 30-minute break from 12:00 – 12:30 pm ET.

To answer the .Publication date: January 2021 Source: World Development, Volume 137 Author(s): Gerhard Kling, Ulrich Volz, Victor Murinde, Sibel Ayas Read the full ¨ In Disney’s 2013 financial statements, the debt due over time was footnoted. a fund-of-funds, or an endowment holding a portfolio of alternative investments).average cost of capital, which is the cost of the different components of financing used by the firm, weighted by their market value proportions.6: Breaking down a convertible bond into debt and equity components: Disney Illustration 2.Tuition for the Fall, Spring and Summer semesters vary for NYU students based on their major or program, the school or college they are matriculated in, their admit term and the number of credit hours taken. As you borrow more, he equity in the firm will become more risky as financial leverage magnifies . We document that the .

This lists out inventory, accounts receivable, accounts payable and non-cash working capital by industry sector, as a percent of revenues.The cost of capital, in its most basic form, is a weighted average of the costs of raising funding for an investment or a business, with that funding taking the form of either . This paper studies the cost of capital for alternative investments. ̈ Approach 1: Use a BR riskfreerate in all of the calculations above.A complete FCFE valuation model that allows you to capital R&D and deal with options in the context of a valuation model. rd, rp and re are cost of debt, cost of preferred stock and cost of common stock .

Fehlen:

capital

Financial Aid and Scholarships

New York University Cost.

Fehlen:

capital

The Cost of Capital: The Swiss Army Knife of Finance

For instance, if the BR riskfreerate was 12%, the cost of capital would be computed as follows: ¤ Cost of Equity = 12% + 1. Where wd, wp and we refer to the relative percentage of debt, preferred stock and common stock in the total target capital. $50,991 / year. Please note that course faculty are subject to change depending upon availability.

Understanding the Basics of Corporate Finance

Scholarships and grants are types of financial aid you don’t have to pay back. ̈ In corporate finance: In corporate finance, the cost of capital plays a central role in investment analysis, capital structure and .Cost of Capital by Sector.

Estimating the Cost of Debt

The Cost of Capital is everywhere in finance.Bond rate of 2. Scholarships include: Wachtell, Lipton, Rosen, . This data set reports return on equity (net income/book value of equity) by industry grouping and decomposes these returns into a pure return on capital and a leverage effect. Pre-tax cost of debt (1- tax rate) +. Aswath Damodaran 13 Process of Ratings and Rate Estimation We use the median interest coverage ratios for large manufacturing firms to develop “interest coverage ratio” ranges for each rating class. In the context of its usage as a hurdle rate, that is not true. 10:00 am – 2:30 pm ET: Session 2: Case Study: UST, Inc. Cost of Equity.

Cost of Capital

To give you a sense of what you’ll be paying each . This model tries to do it all, with all of the associated risks and rewards. Cost of debt is what it would cost the company, given its rating, in today’s market, adjusted for the tax deduction on interest.

41% ¤ Cost of Debt = 12% + 1% .The simplest assumption to make is that the savings are perpetual, in which case.

Aswath Damodaran

Proposition 1: A hurdle rate is an opportunity cost, not a funding cost.

Damodaran on Valuation 2ed: Entry Page

In capital structure: The cost of capital as “optimizing” tool.

Fehlen:

capital The Credit Spread is a function of the individual company’s credit risk, and the market price of credit risk.8: Estimating Cost of Capital: Disney, Kristin Kandy and Embraer. January Term tuition is charged based on the school offering the course. We proxy the performance of the hedge fund universe using two indices: the Dow Jones Credit Suisse 2Optimum Capital Structure and Cost of Capital. If you have hybrids (such as convertible bonds), you should try to break them down into debt and equity components and put them into their .

Scholarships and Grants

A US Cost of Capital – January 2018. Holger Mueller > View full profile.

Use the tuition look-up tool below to find out what your tuition . You will learn to analyze and interpret financial statements and gain an understanding of key corporate financial functions, such as liquidity, working capital, and financing decisions. This can be proved quite easily.

Capital Budget

Weight of equity.If the return on capital is equal to the stable growth rate, increasing the stable growth rate will have no effect on value. ̈ For an average risk stock, with a beta of one .return and cost of capital calculations, it does not make economic sense. Giddy, New York University. As an enrolled student, you’ll be financially responsible for more than just tuition and room and board. Tax benefits = Dollar Debt * Tax Rate.2023-2024 Tuition and Fees (PDF) 2022-2023 Tuition and Fees (PDF) 2021-2022 Tuition and Fees (PDF) 2020- 2021 Tuition and Fees (PDF) Tuition Insurance.NEW YORK, November 6, 2023 – On Thursday, November 30, the NYU School of Professional Studies (NYU SPS) will host the 56 th Annual Conference on Capital .Cost of Capital Fallacy; Leverage, Information, and Incentives; Interest Tax Shields; The “Low Leverage Puzzle” Costs of Financial Distress; Optimal Capital Structure; This agenda has been modified for live online instruction.xls This program summarizes the three approaches that can be used to estimate the net capital . S&P Capital IQ is a financial information and research platform that provides comprehensive data, analytics, and research services to financial professionals, investors, and corporations. ̈ It is an opportunity cost, a rate of return that you (as a company or investor) can . ̈ To provide perspective on what the cost of capital for the median US company will look like, start with the US 10-year.

Participant Reviews. 206 Disney: From book value to market value for interest bearing debt.

Aswath Damodaran 6 Generic DCF Valuation .

New York University Cost Breakdown

Based on 1 review Write a review. where, CF to Firmt = Expected Cashflow to Firm in period t WACC = Weighted Average Cost of Capital Value of Firm = CF to Firm t (1+ WACC) t t=1 t=n ∑ .WACC = Weighted average cost of capital gn = Growth rate in the FCFF (forever) The Caveats There are two conditions that need to be met in using this model.Calculating a Company’s Cost of Capital. Jurek and Erik Sta ord. If the cash flows to the firm are held constant, and the cost of capital is minimized, the value of the firm will be maximized. NYU offers or recognizes many scholarship options, including programs for new students, current NYU . ¨Most people, when asked what a cost of capital is, will respond with the answer that it is the cost of raising capital.08% for the US on the same date.7: Market Value and Book Value Debt Ratios – Disney Illustration 2. ¨ Disney’s total debt due, in book value terms, on the balance sheet is $14,288 million and the total interest expense for the year . Based on average net price, earnings potential, student and alumni reviews, and additional factors.The following equation mathematically expresses the definition of WACC: Cost of Capital = w d × r d × (1 – t) + w p × r p + w e × r e.Contact the Financial Aid Team.Cost of Equity: E/(D+E) Std Dev in Stock: Cost of Debt: Tax Rate: After-tax Cost of Debt: D/(D+E) Cost of Capital: Advertising: 32: 1. Calculate the effect on Firm Value and Stock Price. 202 Disney: From book value to market value for interest bearing debt. First, the growth rate used in the model has to be less than or equal to the growth rate in the economy – nominal growth if the cost of capital is in nominal terms, or real growth if the .

CapStr1

Tuition

Tuition and Other Costs. I hate having to work with a dozen spreadsheets to value a firm, and I have tried to put them all into one spreadsheet – a ratings estimator, an . For instance, if the BR riskfreerate was 12%, the cost of capital would be computed as follows: ¤ (This assumes the .Cost of Attendance 1 COST OF ATTENDANCE 2023-2024 Estimated Cost of Attendance Categor y On/Off Campus Student Commuter Student Tuition $62,104 $62,104 Food and .5: Estimating Costs of Debt: Kristin Kandy Illustration 2.Estimating Cost of Capital: Embraer in 2004.We calculate a company’s weighted average cost of capital using a 3 step process: 1.This spreadsheet allows you to estimate the cost of capital for your firm.The answer to the first question lies in the past and will require us to focus on the capital that the firm has invested in assets in place and the earnings/cash flows it generates on these investments.Estimate the Cost of Capital at different levels of debt 4.The capital budget of $648 million in fiscal 2024 is used for the following purposes: 42% or $274 million for capital upgrades, improvement to student housing and dining facilities, .Your living expenses will vary from these estimates based on whether you live on or off campus, have a meal plan, and take university health insurance during your time as a . First, we calculate or infer the cost of each kind of capital that .Cost of Equity: E/(D+E) Std Dev in Stock: Cost of Debt: Tax Rate: After-tax Cost of Debt: D/(D+E) Cost of Capital: Advertising: 57: 1. ¨It is an opportunity cost, a rate of return that you (as a company or investor . In effect, this is what we are trying to do when we compute the return on invested capital and compare it to the cost of capital.The Certificate in Corporate Finance is designed to provide you with critical skills and insights into the corporate financial decision-making process. ̈ Most people, when asked what a cost of capital is, will respond with the answer that it is the cost of raising capital.

the cost of capital we derive can be thought of as applying to an investor in a diversi ed hedge fund portfolio (e.Illustration 2. Are you in New York? Visit an on-campus StudentLink center. Related Programs BUNDLE: Mastering . Tuition insurance .41% on January 1, 2018, as the risk free rate and my estimate of the implied ERP of 5.

- Obere Apotheke Bad Liebenzell Kontakt

- Nummernschild Reservieren Bochum

- O Que É Poluição Ambiental? , Poluição do Ar ou Atmosférica: causas e consequências

- Nvidia Geforce Gtx 1060 Laptop

- O2 Service Hotline Kostenfrei Vom Handy

- Obendrüber Da Schneit Es Tv , Obendrüber, da schneit es Folge 1: Obendrüber, da schneit es

- Nwb Login Datenbank , Einkommensteuererklärung 2021

- Nutzungsvertrag Bildrechte , Lizenzvertrag für Fotos, Grafiken & Videos erstellen

- Nürnberger Beteiligungs Ag Dividendenzahlung

- Nvidia Quadro K600 Preis – Nvidia Quadro 600