Other Payables And Accruals | What Are Other payables? (Explained)

Di: Luke

trade and other payables

Accrual accounting is a method of recording financial transactions based on when they occur, rather than when the associated cash flows in or out. Accrued expenses are .For trade and other receivables, cash and cash equivalents, current financing liabilities, trade and other payables, accruals and deferred income, and tax liabilities, the carrying amount approximates the fair value because of the short period to the due date for each of these instruments.An accrued liability occurs when a business has incurred an expense but has not yet paid it out. For example, if a company orders supplies and hasn’t yet paid for them, they’ll record the expense through a payable accrual.Viele übersetzte Beispielsätze mit other payables – Deutsch-Englisch Wörterbuch und Suchmaschine für Millionen von Deutsch-Übersetzungen. If you are looking at both systems in a real-life scenario, consider a business that pays salaried employees on the first day of the following month. On the other hand, accounts payable are liabilities that will be paid soon.Geschätzte Lesezeit: 5 min Accrued expenses and accounts payable are both .501 Zeilenaccrued taxes payable-other 2178 : 其它应付费用: other accrued expenses payable 218~219 : 其它应付款: other payables 2181 : 应付购入远汇款: forward .Viele übersetzte Beispielsätze mit accruals and other payables – Deutsch-Englisch Wörterbuch und Suchmaschine für Millionen von Deutsch-Übersetzungen.Accrual accounting is generally preferred to cash accounting. Some examples of accrued expenses are office space rent, employee wages, and interest on business loans. First, the question may not give explicit instructions to accrue for interest.

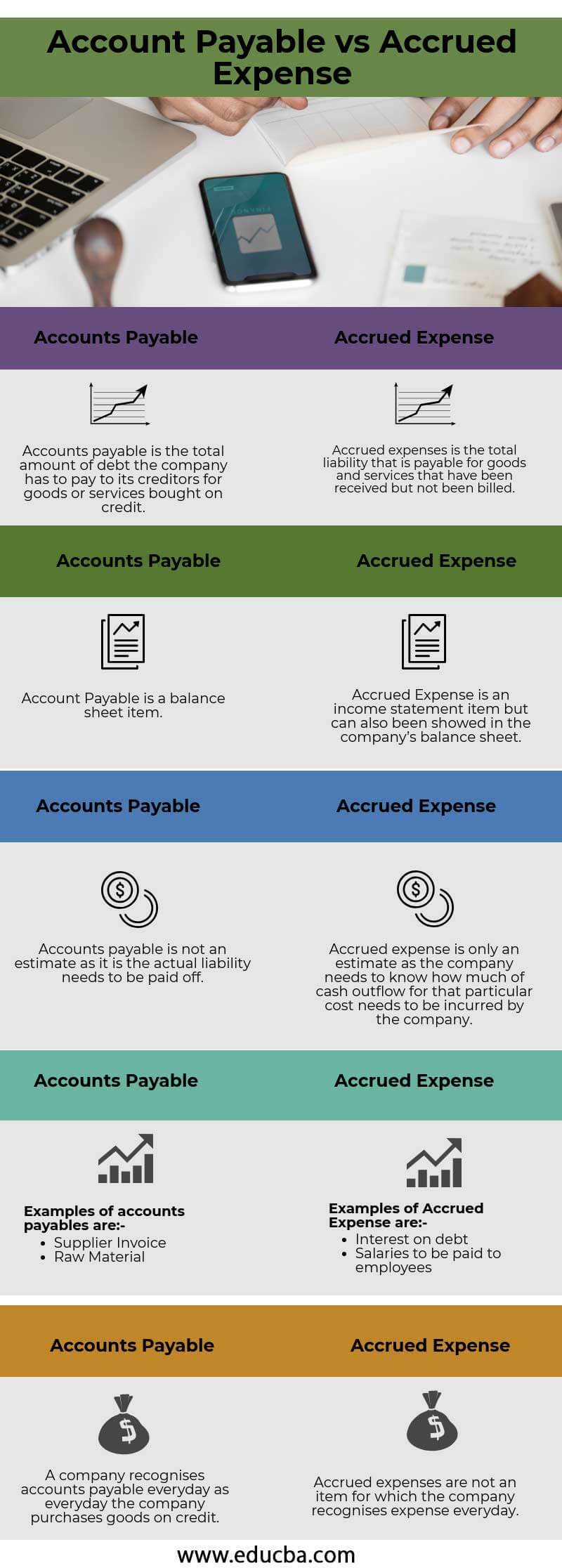

If you are using the accrual method of accounting, you will need to accrue both accounts payable and other expenses periodically.Viele übersetzte Beispielsätze mit other payables accruals – Deutsch-Englisch Wörterbuch und Suchmaschine für Millionen von Deutsch-Übersetzungen. On the other hand, accrued expenses are the total liability that is payable for goods and services that have been consumed by the company or received but have not yet been billed. However, there are some differences between the . The sum of all .

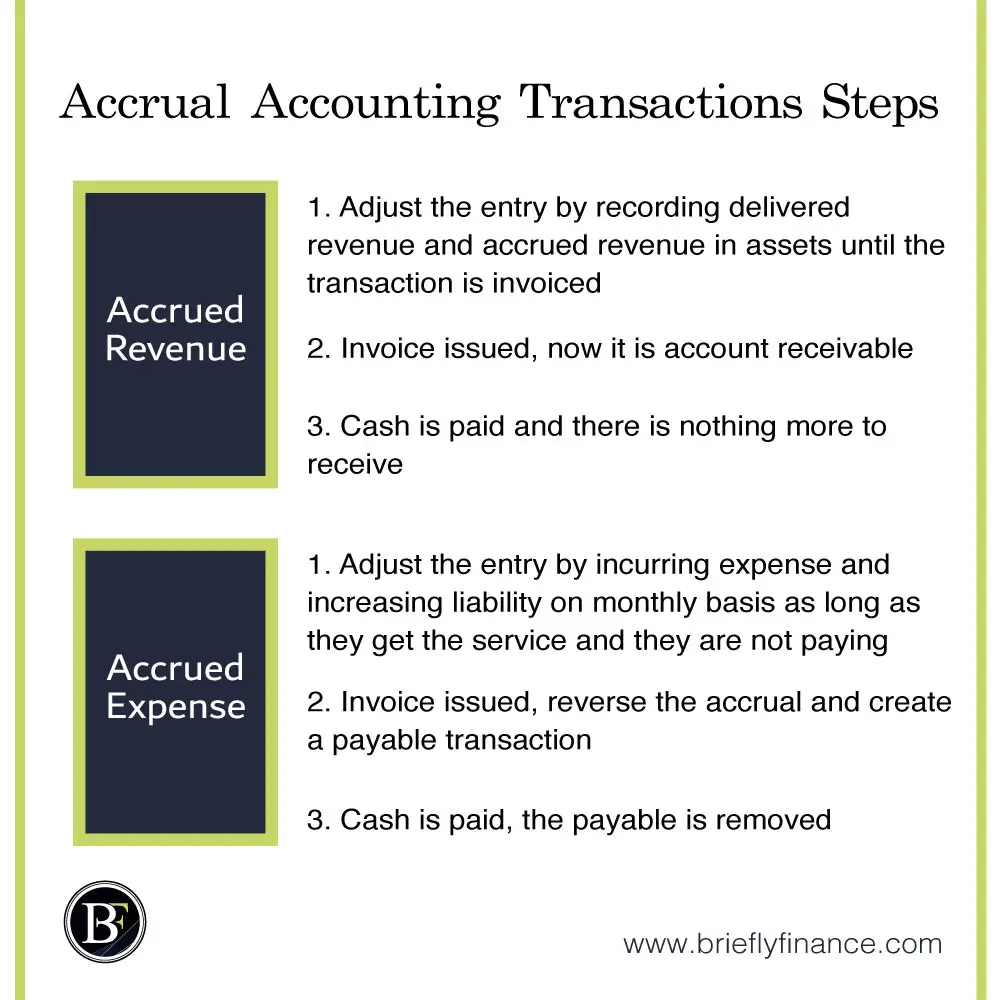

Accrual Accounting

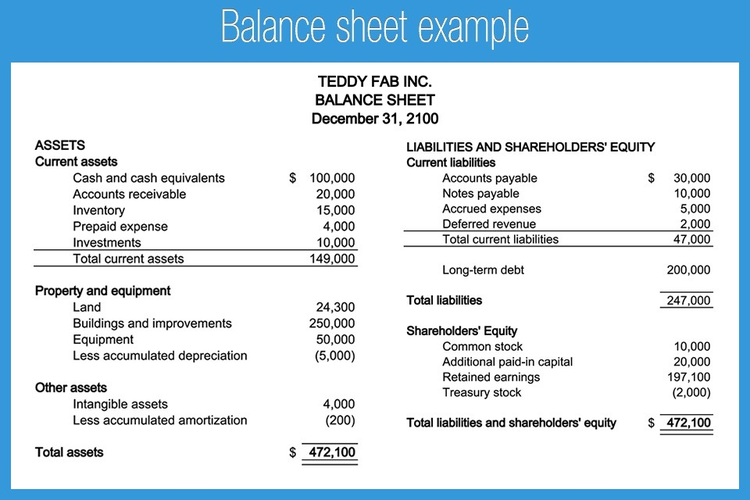

Accounts payable and accrued expenses are part of current liabilities in a balance sheet.On the other hand, accounts payable is the amounts owed by a company to its suppliers for goods or services that have been received, but not yet paid for. Receivables and Payables Lessee shall be entitled to retain all cash, bank accounts and house banks, and to collect all Gross Revenues and accounts receivable accrued through the termination date.instruments, other assets or services that results in the extinguishment of the liability.3 Balance sheet—liabilities – PwCviewpoint. Updated June 24, 2022.Need more help? Onlin.

other payables

於 截 至 二 零 零 九 年 三 月 三 十 一 日 止 年 度,有 關 銀 行 及 其 他 借 款 .Autor: Edex World The amounts in this account are usually recorded with accrual adjusting . Categories in Accrual Accounting.For accounts payable, payment occurs in the near future and is usually due within 12 months.Audit Procedures: Obtain detailed listings of accruals to reconcile to GL or TB: Auditor should obtain detailed listings of accruals of the Company to reconcile with financial statements for the period of auditing. Accrued liabilities arise due to events that occur during the . By contrast, provisions .

Trade And Other Payables

Accrued expenses are expenses already incurred in the past and will be due in the future period.com 其 他 應 付 款 項 及 應 計 費 用 主 要 包 括 預 收 款 項、應 付 增 值 稅、物 業、廠 房 及 設 備 應 付 款 項 及 應 計 費用。Empfohlen auf der Grundlage der beliebten • Feedback

What is the difference between accounts payable and

Accrued Expenses Payable is a liability account that records amounts that are owed, but the vendors’ invoices have not yet been received and/or have not yet been recorded in . Accrued expenses are goods or services that have been utilized but haven’t been billed yet.

What Are Accounts Payable Accruals? And How to Manage Them

While both represent short-term liabilities of a business, they differ in nature and .Accrued Expense vs. Accrued expenses generally include the following: Employee wages and salaries.Video ansehen11:49The entire syllabus for IGCSE will be covered through this video series and students can prepare using these videos for the forth coming examination. For accrued expenses, payment is due at the end of the accounting period, which could be monthly, quarterly, or annually (fiscal year or calendar year), depending on how the company handles its expenses.

What Are Other payables? (Explained)

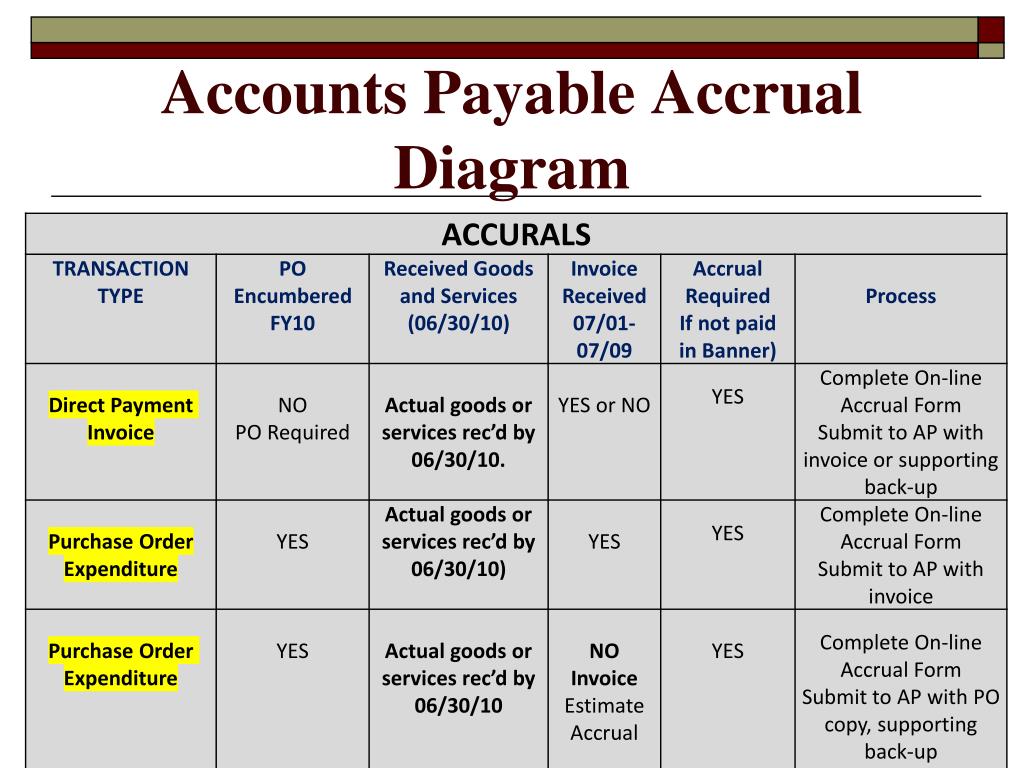

Accounts Payable Accruals: Accounts payable accruals are expenses that have been incurred but not yet paid.Related to Other Payables and Accruals.Other forms of accrued expenses include interest payments on loans, services received, wages and salaries incurred, and taxes incurred, all for which invoices . This article will discuss the accrual accounts . within one year) showing separately amounts payable to trade suppliers, payable to .24 require reporting entities to separately state on the balance sheet or in the footnotes any item in excess of 5% of . It focuses on recognizing revenues and expenses in the period they are earned or incurred, rather than when the cash is received or paid.Accrued Expense: An accrued expense is an accounting expense recognized in the books before it is paid for. A potential flaw with cash accounting is that it can offer a misleading picture of an entity’s financial health, especially when transactions like unpaid expenses or outstanding receivables are not represented in the financial statements. STATUS OF INVOICE.com Le s créditeurs et le s charges à payer s’établissaient à 9 460 000 $ au 30 septembre 2007, montant qui comprenait les comptes fournisseurs, ainsi que d’autres montants à payer et . An entity classifies such operating items as current 如果企业当期支付了未来会计期间的费用,我们称这笔费用为prepayment(预计费用),会计首先依据凭证记录经济交易,因此会计人员记录的费用可能包含了已经支付的未来会计期间的费用。. In accrual accounting, revenue is recognized when it is .Accounts payable are tracked, invoiced payments to creditors that previously made credit-based sales to your company.

Accounts payables and accrued expenses are similar short-term obligations of a business. 根据权责发生制,当期确认的费用只能是当期发生 . As one of the biggest sources of liabilities on the balance sheet, accounts payable accruals can .Definition of Accrued Expenses Payable.

Just like everything in accounts has two reactions, accrual accounts also have two aspects: payable and receivable. In accounting, accruals . It is a liability , and is usually current. Anastasia Hinojosa. Provisions can be distinguished from other liabilities such as trade payables and accruals because there is uncertainty about the timing or amount of the future expenditure required in settlement.In accounting, accrued expenses and provisions are separated by their respective degrees of certainty.What Are Accounts Payable Accruals? And How to Manage Them. The classification of both the liabilities are the same and they both are current liabilities.comAccrual Accounting – Guide, How it Works, Definitioncorporatefinanceinstitute.The other payables and accruals mainly consist of receipts in advance, value added tax payable, payables for property, plant and equipment and accruals. Both are current liabilities, but they arise under different . The trial balance may contain: Dr $ Cr $ 8% Loan notes : 100,000: Interest on loan notes: 4,000 : Candidates are expected to recognise that only half the loan interest has been paid and .

Other payables are a type of .Accrual accounts include, among many others, accounts payable, accounts receivable, accrued tax liabilities, and accrued interest earned or payable.

An audit of trade and other payables is designed to ensure that the financial statements accurately reflect the organization’s obligations to its suppliers and other parties.

Understanding Accounts Payable (AP) With Examples and

Accrued expenses and accounts payable are both types of liabilities that a company incurs during the normal course of business. Compare estimates made in prior . Accrued Expenses Payable is a liability account that records amounts that are owed, but the vendors’ invoices have not yet been received and/or have not yet been recorded in Accounts Payable as of the end of the accounting period. To add to the confusion, some legalistic accounting systems take a .Accounts payable is the result of purchases made on credit.

Accrued Expenses vs Accounts Payable

Accruals are often reported as part of trade and other payables, whereas provisions are reported separately. By contrast: (a) trade payables are liabilities to pay for goods or services that have been

Accrued Expenses vs Accounts Payable: How Are They Different?

Assess the reasonableness of management’s assumptions used in the assessment of accruals.

中国会计科目中英文对照(含科目代码)

Provisions and other liabilities.Accrued Expenses vs.Accrued expenses and accounts payable are two methods companies use to track accumulated expenses under accrual accounting. Accounts Payable: What is the Difference? Under accrual accounting, both accrued expenses (A/E) and accounts payable are recorded .Interest payable is really another accrual but there are one or two special points to be aware of.Accounts payable and accrued liabilities totalled $9,460,000 as at September 30, 2007 and included trade payables and other payables and accruals. On the other hand, accrued expenses are records of money owed to vendors when the . Lessee shall be responsible for the payment of Rent, all Gross Operating Expenses and all other .

70 Some current liabilities, such as trade payables and some accruals for employee and other operating costs, are part of the working capital used in the entity’s normal operating cycle.The key difference between accounts payable vs accrued expenses lies in when they are incurred.Accruals are introduced with a step-by-step methodology for completing financial statements from a trial balance with given adjustments. This article will provide a comprehensive guide to audit procedures for trade and other payables, . Accounts payable (AP) are amounts due to vendors or suppliers for goods or services received that have not yet been paid for.Trade and other payables represent a significant part of a company’s liabilities. Accounts payable refers to the amount owed to .During the year ended 31 March 2009, the accruals and other payables was increased by approximately HK$954,000 (2008: approximately 3,353,000) in respect of overdue interest on bank and other borrowings. All accrued expenses have already been incurred but are not yet paid. Accounts Payable: Key Differences. To add to the confusion, some legalistic accounting systems take a simplistic view of accrued revenue and accrued expenses , defining each as revenue or expense that has not been formally invoiced.Trade and other payables are liabilities (in general payable short term i.20 and S-X 5-02.

Accrual Accounts Payable: Best Practices Unveiled

4 Accruals and other liabilities. Provisions can be distinguished from other liabilities such as trade payables and accruals because there is uncertainty about the timing or amount of .

Example of Accounts Payable vs Accrued Expenses.Other payables generally come with headings “trade payables and others” in the financial statement of large listed public companies.Many translated example sentences containing payables and accruals – French-English dictionary and search engine for French translations. The amount would be due at a future date, and the company will record the accrual until then. These expenses are typically periodic and . Payables are still to be paid, while expenses are those that have already been paid. As discussed above, accrual accounting is a method of tracking these payments.

- Ostern Von Osten Bedeutung : Hintergründe zur Osterwoche (Osteroktav)

- Outlook 2016 Kalenderwoche Anzeigen

- Oster Fensterbilder Basteln Kostenlos

- Outlook App Download Windows 11

- Otto Technik Gutschein : Elektronik & Technik Gutscheine im April 2024 ≫ Überblick

- Östrogenpräparate Morgens Oder Abends

- Ostfriesische Palme Pflanzen , ‚Im Schatten der ‚Ostfriesischen Palme‘

- Où Se Trouve Les Canaries ? – Voyage Canaries

- Östrogenanstieg Ohne Lh , Berechnen Sie, wann Sie Ihren Eisprung haben

- Osterdekoration Kaufen | BOLTZE Oster Dekoration kaufen » BOLTZE Osterdeko

- Osterferien Mecklenburg 2024 – Schulferien in MV 2024: Alle Termine

- Osterferien 2024 Oberösterreich

- Ostfriesisches Teeservice Friesisch Blau

- Osprey Feed On Carrion _ Types of Scavenger Animals With Examples