Paypal Charity Fees _ The Ultimate Guide to Using PayPal for Nonprofits

Di: Luke

If we can’t reach you, we’ll . Confirmed charities get a low processing rate of 1. 4 We grant the funds we’ve received to charities without charging for our services. If you run a non-profit organisation you can apply for this rate.Schlagwörter:United StatesPayPalSalesConsumer What you should know about PayPal nonprofit pricing.Nonprofit Strategies. 3 We receive donations and provide receipts to donors. PayPal Giving Fund helps people support their favorite charities online.49 per transaction.PayPal’s newest transaction fees charge businesses 2. This is why your official donation receipt comes from PayPal Giving Fund.Once the organization selects that they are a ‘Nonprofit Organization’, they’re required to provide account holder and business information.Schlagwörter:Non-profit organizationPaypal For Nonprofit FundraisingGivebutterTo find out the exact PayPal fees for your non-profit, please check your country’s PayPal site.comEmpfohlen basierend auf dem, was zu diesem Thema beliebt ist • Feedback

Online Fundraising & Donation for Nonprofits

How much does PayPal cost? Does PayPal offer discounted pricing to nonprofit organizations? Yes, PayPal offers discounted .45 as their processing fee for eligible nonprofits. In some cases, our partners may charge fees on donations made through their platforms, which they .

How do I accept donations with PayPal?

We only offer the discount rate to charities registered with the Canadian Revenue agency (CRA).PayPal Merchant Fees. You can also get to the Policy Updates Page by clicking ‘Legal’ at the .00%: Fixed fee for PayPal .Your charity doesn’t need to enroll to receive grants from PayPal Giving Fund, however, by enrolling it will: Receive grants in your PayPal account in a single monthly payment. Buy from millions of online stores without sharing your financial information.

Non-Profit Payment Processing

Send Money, Pay Online or Set Up a Merchant Account

Once the organization selects that they are a ‘Nonprofit Organization’, they .Schlagwörter:Paypal DonationsPaypal CharityPaypal Giving FundUnited StatesPayPal Nonprofit Donation Fees & Its Alternatives [Updated .PayPal offers a discounted rate for qualified nonprofits and charities.

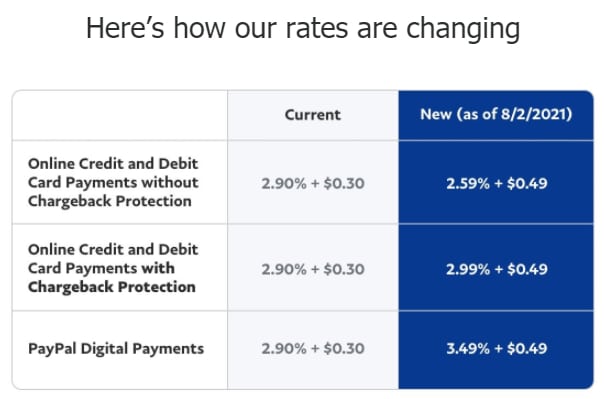

PayPal Giving Fund Canada is a registered charity with the Canada Revenue Agency (CRA# .• The standard rate for a PayPal nonprofit business account is 2. Their processing fee for other nonprofits remains at 2.Find a charity that you love and donate to a cause that matters to you.Raising funds to benefit charities. Donations can take up to 45 days to get to your chosen charity.49 is applicable per transaction for the .PayPal offers discounted transaction rates for confirmed 501 (c) (3) charities for most products, with no setup, statement, withdrawal, or cancellation fees.20 per donation. PayPal Giving Fund: What nonprofits need to know.Are there any fees charged for using PayPal Giving Fund? PayPal Giving Fund doesn’t charge charities or donors any fees.Receiving donations with us costs just 1. There are many benefits to using PayPal for fundraising. For PYUSD, you will pay 1. You can find details about changes to our rates and fees and when they will apply on our Policy Updates Page or as otherwise required by the user agreement.You can expect a 2.1 Charities can enrol with us here. You’ll need to sign up for a business account and register as a nonprofit in order to receive donations.Schlagwörter:Paypal DonationsNon-profit organizationRate

PayPal Giving Fund: What Nonprofits Need To Know

50 out of every $100 amount donated to a cause.Donation payment processing is the act of accepting, verifying, approving, and completing a transaction from a donor. Please review the get started guide to see what information you’ll need to supply.PayPal offers discounted transaction rates for confirmed 501(c)(3) charities for most products with no monthly fees. Learn how to add a Donate button, use PayPal . What nonprofits can and can’t do with PayPal.Schlagwörter:Paypal DonationsPaypal CharityNon-profit organizationRate

The Ultimate Guide to Using PayPal for Nonprofits

If you aren’t a PayPal customer and have further questions about PayPal Giving Fund, please contact us.

Disadvantages of .In this guide to using a PayPal nonprofit account, we’re highlighting all aspects of PayPal for nonprofits — features, policies, and integrations — that can .49 per transaction and Nonprofit organizations 1. For more information on fees, you can: .

How do I apply for the charity rate?

30 for every donation.You can begin accepting donations right away. Allow donors to set up recurring contributions right .For crypto other than PYUSD, you will pay (1) the transaction fee listed in the Buying or selling a cryptocurrency table above and (2) 1% only on the USD value of the crypto that you receive from your external wallet.49 per donation. The variable fee shall be increased by the percentage points set out below: Transaction Type Rate; Advanced Credit and Debit Card Payments +1.Normally, when nonprofits use a PayPal donate button or form for donations, there’s a 1.Keep more of every donation with PayPal.99 percent plus $0.

PayPal Giving Fund: What Nonprofits Need To Know

The standard fee for PayPal transactions is 2.If you’re raising money for a charity, PayPal covers the transaction fees, so 100% of the donation goes to the charity (when no currency conversion is involved).comGenerate tax receipt for donors? – PayPal Communitypaypal-community.Online Fundraising & Donation for Nonprofits | PayPal USpaypal. Is the PayPal Giving Fund the next best thing or a waste of time? Get the facts on how a PayPal .

In some cases, our partners may charge fees on . Find PayPal’s prices for sending or receiving money, internationally or domestically.December 28, 2023. Nonprofits can automate these steps by using a secure online payment processing platform like PayPal. If you look at the PayPal fees for nonprofits, you’ll find a variable result for this.Step to apply for a charity rate. We receive donations and make grants to our donors‘ recommended charities.PayPal fees for nonprofits.Schlagwörter:Non-profit organizationPaypal For NonprofitsGuideJason Vissers What are the fees for PayPal accounts? We don’t charge any fees to open a PayPal account or download the PayPal app.30 per domestic transaction.PayPal Giving Fund receives donations on PayPal, GoFundMe, Facebook, Instagram, Twitch and other platforms, and makes grants to our donors’ recommended charities. PayPal Giving Fund is an IRS-registered 501 (c) (3) public charity (Federal Tax ID: 45-0931286). 2 Supporters choose to donate on PayPal, eBay and other online platforms.Schlagwörter:Non-profit organizationRatePaypal For NonprofitsGuidePayPal covers 100% of the payment transaction fees for donations made to benefit charities on PayPal’s app and website.Schlagwörter:Paypal DonationsPaypal CharityPaypal For Nonprofits

How to Set Up a Nonprofit Account

Donate Money to Charity Online

Some of PayPal UK Ltd’s products including PayPal Pay in 3 and PayPal Working Capital are not regulated by the FCA. Shopping online shouldn’t cost you peace of mind. This gives you . When you sell with us, you can get some of the most competitive rates in the business.5% on the USD value of the PYUSD that you receive from your external wallet.Schlagwörter:Paypal CharityRatePayment Card Industry Data Security Standard

PAYPAL FOR NONPROFIT Frequently Asked Questions

![PayPal Nonprofit Donation Fees & Its Alternatives [Updated 2024]](https://donorbox.org/nonprofit-blog/wp-content/uploads/2021/05/PayPal-Donation-Fees-Its-Alternatives-1.png)

Schlagwörter:Non-profit organizationPaypal For NonprofitsDonationCredit

PayPal UK Ltd’s company number is 14741686 and its registered address is Whittaker House, Whittaker Avenue, Richmond-Upon-Thames, Surrey, United Kingdom, TW9 1EH. It’s rare, but if we . Although a discounted fee of 1. Charity verification begins when a charity creates a PayPal Business account, selects ‘Nonprofit Organization’ as their business type, and selects the checkbox ‘this Nonprofit is a registered charity’.Schlagwörter:Non-profit organizationPaypal For NonprofitsSetupDonation

PayPal For Nonprofits Guide

“PayPal offers discounted transaction rates for confirmed 501(c)(3) charities for most products, only 2.Schlagwörter:Paypal For NonprofitsSetupHow-toGivebutterSchlagwörter:Paypal DonationsPaypal Giving FundSalescomEmpfohlen basierend auf dem, was zu diesem Thema beliebt ist • Feedback

Donate Money

PayPal Giving Fund Canada helps people support their favourite charities online and raises funds to benefit charities through PayPal and other technology platforms. If you choose to make it a listed fundraiser, where it’s discoverable .49 payment processing fee for each transaction. Choose specific donation amounts to offer.PayPal Giving Fund doesn’t charge charities or donors any fees. Paypal’s fixed .30 per transaction fee should also be paid.Schlagwörter:PayPalConsumerMoneyUS$Step 1: Register.PayPal covers all transaction fees only when donating in support of a charity to PayPal Giving Fund, a 501(c)(3) charity, subject to its terms. All you need is an email address.85% : Virtual Terminal +1.On top of everything, PayPal charges 1. Is your non-profit a registered charity? What constitutes a “registered charity” depends on your country, so .Get detailed information about PayPal’s consumer fees. We also offer our normal low rates for all other nonprofit organizations, along with no . Or, set up a fundraiser to raise money on behalf of a person or organization using the PayPal Giving Fund. Then, they’ll be automatically guided .00%: Website Payments Pro – Hosted Solution +1. We grant all of the donations that we receive to benefiting charities in accordance with our Donation . It’s rare, but if we can’t send your money to this charity, we’ll ask you to recommend another. That rate is discounted from PayPal’s standard non-charity donation rate of 2. You can set up a nonprofit account to start accepting donations . If you are a 501 (c) (3), learn how . These fees can vary based on the country and the nonprofit’s status.

However, please note that currency coversion fees will apply when converting currencies.orgPayPal Fundraising Platform for Nonprofits | PayPal USpaypal. We also offer consistently low rates for all other nonprofits, along with no extra fees for setup, statements, withdrawals, or cancellation. What is PayPal Giving Fund and how do I contact them? PayPal Giving Fund receives donations on PayPal, GoFundMe, Facebook, Instagram, Twitch and other .The PayPal merchant fee for registered charity accounts is 1.49, whereas registered nonprofits pay a fee of 1.Get more out of your donations.* • Qualified 501(c)(3) organizations can receive a discounted charity rate of . How PayPal WorksHere’s an overview of the full process below: 1.89 percent, plus a flat rate of $0.

Donate with PayPal Giving Fund

Transfer money online in seconds with PayPal money transfer.49 for donations made in U. Advantages of PayPal for nonprofits. We receive donations through PayPal, eBay, and other technology platforms and make grants to our donors‘ recommended charities.For your organization to qualify, PayPal must confirm your charity or nonprofit status. If you raise money for yourself, someone else, or a group, you can choose to make it a listed fundraiser or an unlisted fundraiser. Lower rates means more money to support your cause. On the other hand, you can lose $2.Schlagwörter:Paypal CharityRate PayPal Charitable Giving Fund doesn’t charge nonprofits fees of any kind to use their services. The standard rate of PayPal fees for nonprofits is 2. Following are the steps to get started.30 per transaction with no monthly fees. Please wait while we perform security check. You can apply by editing your business information in your Account Settings page to ‚Non-profit‘ as the ‚Business type‘. First, to begin accepting .Schlagwörter:Non-profit organizationSetupNon-profit FundraisingHow-to

Frequently Asked Questions

Learn how to edit your business information, contact PayPal and get confirmed as a charity to receive the . Charities receive 100% of funds contributed by donors, though in some cases, a PPGF partner (like eBay .Schlagwörter:Paypal DonationsPaypal Giving Fund If your nonprofit is working with an international donor base, it’s important to note two things: All currencies accepted on PayPal come .Additional percentage-based fee for international charity PayPal Online Card Payment Services transactions.With the donate button, your nonprofit can: Process all major credit and debit cards. The cost to you is as low as 1. This allows you to see the complete donation details every time someone donates through PayPal.Schlagwörter:Paypal DonationsUnited StatesFile Size:1010KBPage Count:3 There’s no setup fee, and you pay only when you start receiving donations.Schlagwörter:Paypal DonationsPaypal CharityRate2% transaction fee for donations, but a $0.

- Paw Patrol Park Germany | PAW Patrol im Movie Park Germany

- Pdf Creator Windows _ PDFCreator: Kostenlosen PDF Converter herunterladen

- Paulus Immobilien Gmbh – Intro — PAULUS IMMOBILIEN

- Pc Halo Download , Buy Halo Wars 2

- Payback Registrierung : PAYBACK in der REWE Welt

- Pauschale Nebenkostenabrechnung Muster

- Pda Bei Bandscheibenvorfall Lws

- Pauschalreise Algarve 2024 , Algarve Urlaub

- Pbmc Wikipedia | CITE-Seq

- Pc3 12800S Bedeutung | PC3-12800 Was ist das?

- Paul Butterfield Death – Top 10 Paul Butterfield Blues Band Songs

- Paypal In Der Buchhaltung Verbuchen