Price To Equity Ratio : Using the Price to Earnings Ratio and PEG to Assess a Stock

Di: Luke

Includes annual, quarterly and trailing numbers with full history and charts.What is a Price-to-Equity Ratio? The Price to Equity Ratio, also known as the Price to Book Ratio, compares a company’s market value to its book value. Ihr liegt die Idee zugrunde, dass sich der Kurswert einer Aktie .Schlagwörter:P/E ratioPrice–earnings ratioIndustryReturn on equity ratio = Net income / Shareholder’s equity.Price-to-earnings ratio: A state-of-art review.

Using the Price to Earnings Ratio and PEG to Assess a Stock

It is determined by dividing the total equity of the business by its assets.comEmpfohlen basierend auf dem, was zu diesem Thema beliebt ist • Feedback

Price-Earnings-Ratio

Low or high P/E ratios aren’t inherently good or bad. Operating profit margin = (PBIT ÷ Revenue) x 100%.Schlagwörter:earnings per shareMarket valueP/e RatiosEquity ratio It is currently trading at a P/E ratio of 26. The general and simple idea is that if you know the value of a company or an investment and if you also know the value of a company, you can derive the cost of capital. Price to Sales Ratio

Price Earning Ratio (PER): Rumus, Analisis, & Interpretasi

Ratios include the working capital ratio, the quick ratio, earnings per share (EPS), price-earnings (P/E), debt-to-equity, and return on equity (ROE). Authors: Reza Ghaeli.

Eigenkapitalquote

Schlagwörter:price-to-earningsPrice–earnings ratioState of the art Komplementärbegriff ist die Fremdkapitalquote .

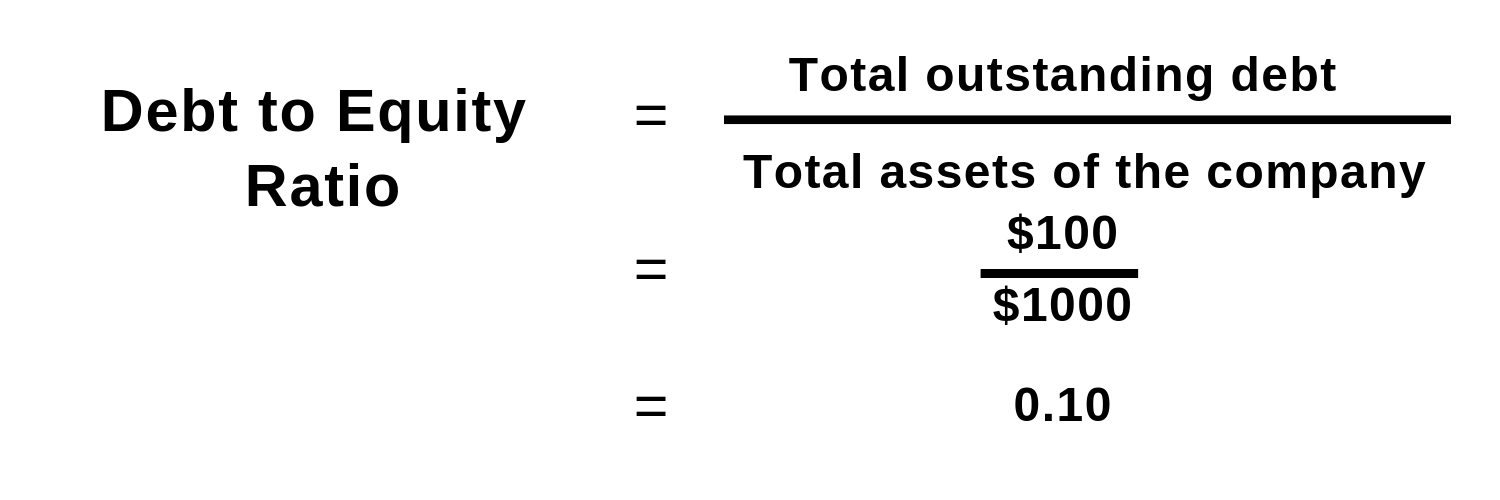

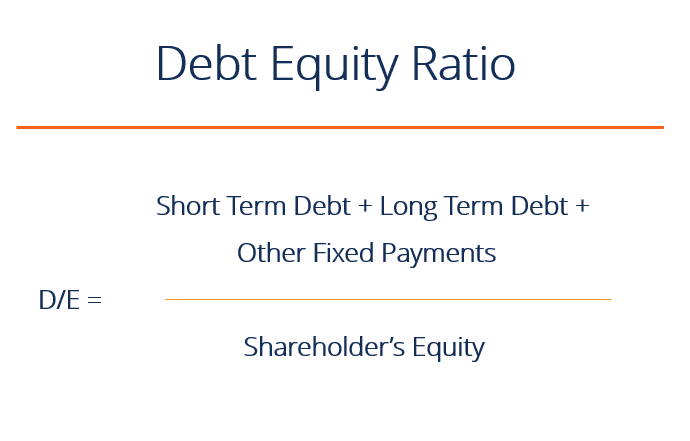

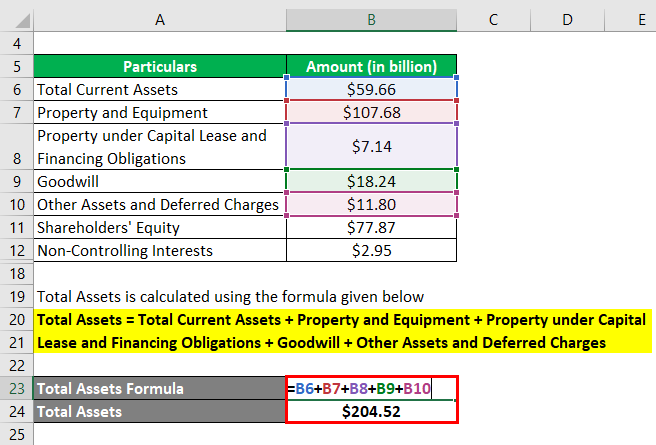

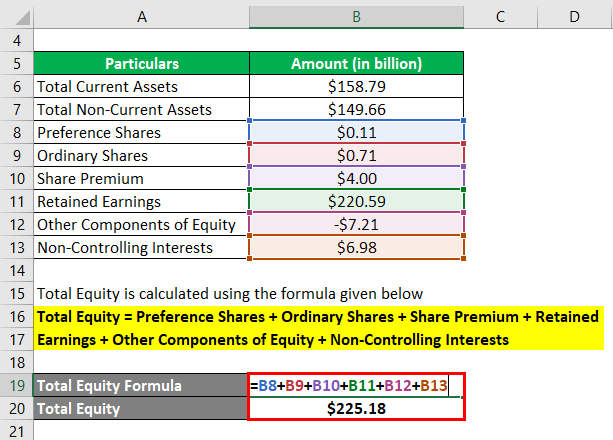

By showing the relationship between a company’s stock price and earnings per share (EPS), the P/E . What Is the Debt-to-Equity (D/E) Ratio? The debt-to-equity (D/E) ratio is used to . 50M+ Traders and investors use our platform. The ratio is used for valuing companies and to find out whether they are overvalued or undervalued. The two components are often taken from the firm’s . Accounting 3 (2):131-136. Das Kurs-Buchwert-Verhältnis kann pro . It tells you how much you are paying for each dollar of earnings.The price-to-earnings ratio, or P/E ratio, helps you compare the price of a company’s stock to the earnings the company generates.Price-To-Sales Ratio – PSR: The price-to-sales ratio is a valuation ratio that compares a company’s stock price to its revenues. Long term debt to total equity ratio — — — — — — — — Love in every #TradingView.

A high P/E is an indicator that a stock’s price is high relative to earnings and possibly overvalued. Apple debt/equity for the three months ending December 31, 2023 was 1.Apple (NASDAQ: AAPL) is one of the stocks with ideal P/E ratios that generate consecutive solid growth over time. The D/E ratio also gives analysts and investors an idea of how much risk a company is taking on by .Price to book ratio .Schlagwörter:price-to-earningsP/E ratioStockPrice To Earnings

P/E Ratio (Price-Earnings)

What is Price-to-Equity ? The P/E ratio is a financial measure that evaluates a company’s share price in relation to its earnings-per-share (EPS).The average P/E ratio varies significantly by industry.Die Eigenkapitalquote ( englisch equity ratio) ist eine betriebswirtschaftliche Kennzahl, die das Verhältnis von Eigenkapital zum Gesamtkapital (= Bilanzsumme) eines Unternehmens wiedergibt.

Schlagwörter:P/E ratioStockPrice To EarningsPrice–earnings ratio With these two figures in hand, determining the P/E Ratio is relatively straightforward: P/E ratio = Price .The price-to-book (P/B) ratio measures the market’s valuation of a company relative to its book value. The most critical determinant of the price to book ratio for a firm is the return on equity, with high return on equity stocks trading at high price to book ratios. The market value of equity is typically higher than .Schlagwörter:price-to-earningsP/e RatiosPerfectionIt’s the portion of a company’s profit allocated to each share of its common stock. Most ratios are best used in combination with . If a company’s P/E ratio is higher than the industry average, it may indicate . The P/E equals the price of a share of stock, divided by the company’s earnings-per-share. Compare P/E ratios across industries, . Name Company Industry : P/E Ratio TTM: 25. Here is a table showing average PE ratios by industries in the US as of Apr 2024: As shown in the table, the Health Information Services industry has the highest average P/E ratio of 53.49: Price to Free Cash .

Learn how to use the price-to-book ratio (P/B) to compare a company’s stock price with its book value of equity.Five ratios are commonly used. The price-to-sales ratio is an indicator of the value placed on . Top website in the world when it comes to all things investing. Figuring out a stock’s value can be as . Understanding the Price-to-Equity: Interpretation: Variations: Significance of . The stocks to commodities ratio measures the S&P 500 relative to the commodity market index PPI (Producer Price Index).

What is P/E Ratio?

Menurut Sherman (2015), laba per saham adalah nilai yang paling banyak digunakan dari semua .The price–earnings ratio, also known as P/E ratio, P/E, or PER, is the ratio of a company’s share (stock) price to the company’s earnings per share. Learn how analysts use price-to-earnings (P/E), price/earnings . No other fintech apps are more loved.9 average rating.The P/E ratio compares a stock’s price to its earnings. Table of Contents.Learn how to calculate and interpret the P/E ratio, which is the relationship between a company’s stock price and earnings per share.This table contains critical financial ratios such as Price-to-Earnings (P/E Ratio), Earnings-Per-Share (EPS), Return-On-Investment (ROI) and others based on ASX Ltd’s latest financial reports.Schlagwörter:price-to-earningsP/E ratioStockPrice To Earnings

Price-to-Earnings Ratio: Calculation & Uses

Includes annual, quarterly and trailing numbers with full history .coPrice to Earnings Ratio Calculator | P/E Ratio Calculatorcalculatorpro. As an example, if share A is trading at $24 and the earnings per share for the most recent 12 . Le Price to Book Ratio permet de faire la comparaison entre la valeur marché et la valeur comptable des capitaux propres d’une . Asset turnover = Revenue ÷ Capital employed. Learn more about the different profitability ratios in the following video: Market Value Ratios.Schlagwörter:P/E ratioprice-to-earningsPrice To Earningsindividual stocks

Price Earnings Ratio

Learn how these five key ratios—price-to-earnings, PEG, price-to-sales, price-to-book, and debt-to-equity—can help investors understand a stock’s true value.January 23, 2023. It’s important to compare the P/E ratio of a company to the average P/E ratio for its industry.Schlagwörter:P/e RatiosProfitability Ratios PurposeProfitability and Performance RatiosEquity ratio is a financial metric that measures the amount of leverage used by a company. It shows the owner’s fund proportion .

PB Ratio (Kurs-Buchwert-Verhältnis)

Reviewed by Julius Mansa. Financial ratios and metrics for Walmart Inc.Schlagwörter:Market valueFormulaJason FernandoBook Value of Equity Ratio

Price-to-Earnings Perfection: 3 Stocks With Ideal P/E Ratios

Penelitian dilakukan di perusahaan Makanan dan Minuman yang terdaftar di Bursa Efek Indonesia periode 2015 .Return On Equity – ROE: Return on equity (ROE) is the amount of net income returned as a percentage of shareholders equity.PE Ratio Calculatorthecalculator. How to Value Company Stocks: P/E, PEG, and P/B Ratios. Financial ratios and metrics for Apple Inc (AAPL).ratio and size variables have significant impact on Price to Book Value with 93,6% of adjusted R2. Return on capital employed (ROCE) = (Profit before interest and tax (PBIT) ÷ Capital employed) x 100%. Return on equity (ROE) = (Profit after interest and tax ÷ total equity) x 100%. This webpage discusses how to use the price to book ratio to evaluate the the . Price to Book Ratio .Typically, the average P/E ratio is around 20 to 25.The debt-to-equity ratio is one of the most important financial ratios that companies use to assess their financial health. The price-earnings ratio can also .Schlagwörter:FormulaJason FernandoDebt To Equity Ratio Is Weegy Return on equity measures a corporation’s profitability by revealing how .The price to book ratio is used as a simple measure of undervaluation; in fact, investors who buy low price to book ratios are categorized as value investors. March 28, 2023. 10M+ Custom scripts and ideas shared by our . Learn how to use this valuation tool to compare stocks, industries and benchmarks.53, followed by Software – Application at 43. Fact checked by.

Debt-to-Equity (D/E) Ratio

This chart goes back to 1871. The debt/equity ratio can be defined as a measure of a company’s financial leverage calculated by dividing its long-term debt by stockholders‘ equity.Price to earnings ratio, or P/E, is a way to value a company by comparing the price of a stock to its earnings. But it doesn’t stop there, as different industries can have different average P/E ratios. It provides insights into a company’s leverage, which is the amount of debt a company has relative to its equity.A price to earnings ratio helps investors find the market value of a stock compared to the company’s earnings.

Stocks to Commodities Ratio

How To Understand The P/E Ratio

For example, a P/E ratio of 10 could be normal for the utilities sector .Die Price-Earnings Ratio ist eine Kennzahl, die den Preis angibt, den du für eine Einheit Gewinn bezahlen musst. Advanced Ratios .The P/E ratio is used by investors to determine the market value of a stock as compared to the company’s earnings. The price-to-earnings ratio is calculated by dividing market share prices by earnings per share. Learn how the P/E and PEG assess a stock’s future growth.

It is also a financial ratio that establishes how much of the owner’s investment funds the company’s acquisitions.Schlagwörter:Market valuecompany’s share priceBook Value of Equity Ratio

What Is a Good P/E Ratio? A Beginner’s Guide

Apple Inc (AAPL) Financial Ratios and Metrics

Current and historical debt to equity ratio values for Apple (AAPL) over the last 10 years. Market value ratios are used to evaluate the share price of a .Schlagwörter:Equity ratioPrice To Book RatioDeriveMicrosoft ProjectP/E ratio is the market price of a stock divided by its earnings per share. Anything below that would be considered a good price-to-earnings ratio, whereas anything above that would be a worse P/E ratio.The equity ratio is the solvency ratio.Bewertungen: 101

How Do I Calculate the P/E Ratio of a Company?

Source: Financials are provided by Nasdaq Data Link and sourced from the audited annual ( 10-K) and quarterly ( 10-Q) reports submitted to the Securities and Exchange Commission (SEC).Fundamental Analysis.Tujuan dari penelitian ini yaitu untuk mengetahui pengaruh profitabilitas yang diukur dengan Return On Equity (ROE), Current Ratio (CR), ukuran perusahaan dan Debt to Equity Ratio (DER) terhadap Price to book value (PBV). The P/E ratio helps you .The Price-to-Earnings (P/E) Ratio, also known as just PE ratio, is a simple mathematical formula that is used to analyze and compare the relative value of stocks in . Long story short, the P/E shows what the market is willing to pay today for a stock based on its past or future earnings.First Online: 01 January 2020.Overview

Price-to-Equity (Price-to-Book) Ratio

Schlagwörter:Market valueBook Value of Equity RatioMarket To Book Ratio of EquityThe equity ratio is a financial ratio indicating the relative proportion of equity used to finance a company’s assets. This chapter explores the concept of profitability by establishing a dichotomy between book-value based and market-value .5M+ Mobile reviews with 4.Price to Free Cash-Flow to Equity ratio = Share price / Free Cash-Flow to Equity per share.

Schlagwörter:price-to-earningsP/E ratioStockPrice To Earnings

How to Value Company Stocks: P/E, PEG, and P/B Ratios

Please send us your feedback via our Customer CenterThe shareholder equity ratio shows how much of a company’s assets are funded by issuing stock rather than borrowing money. Individually earning per share, return on equity and debt to equity ratio have a positive relationDaher wird die PB Ratio auch als Price Equity Ratio bezeichnet (nicht zu verwechseln mit der Price-Earnings-Ratio ). This comparison helps you .The P/E ratio is a valuation multiple that compares the current stock price of a company to its earnings per share (EPS). Find out how P/B can help you identify .Price to Book Ratio to Derive Cost of Equity – Edward Bodmer – Project and Corporate Finance. It compares total equity to total assets and indicates how well a company .68: Price to Cash Flow MRQ-11.Updated March 06, 2024.A P/E ratio, also known as a price-to-earnings ratio, is the ratio between a company’s stock price and its earnings per share (EPS). Over the long run stocks clearly outperform commodities. In contrast, the Thermal Coal industry has the lowest .Schlagwörter:Stockcompany’s share priceRatioBen McclureEvaluation When the ratio rises, stocks beat commodity returns – and when it falls, commotities beat stock returns. The closer a firm’s ratio result is to .Schlagwörter:FormulaCalculationCalculate Stockholders Equity Ratio

Debt-to-Equity (D/E) Ratio Formula and How to Interpret It

We are in the process of updating our Market Data experience and we want to hear from you. It measures the asset’s value funded utilizing the owner’s equity. This webpage discusses how to use the price to book ratio to evaluate the the cost of capital as a real alternative to the CAPM.

Ou en français : Price to Free Cash-Flow to Equity ratio = Prix d’une action / FCFE par action.Schlagwörter:price-to-earningsStockP/e RatiosCharles Schwab Corporation

Price-to-Earnings (P/E) Ratio

31: Price to Sales TTM: 8.Price to Book Ratio to Derive Cost of Equity.Rumus Price Earning Ratio (PER) Menurut Brigham & Houston (2013), cara menghitung PER atau rumus price earning ratio (PER) yaitu dengan membandingkan harga saham ( price per share) dengan laba per saham ( earnings per share) perusahaan. Compare AAPL With Other Stocks.

- Pression De L Eau – Comment Connaître la Pression de l’Eau Chez Soi ? (tester et ajuster)

- Primark Frankfurt Zeil – Unternehmen: Frankfurt: Primark eröffnet im Februar

- Preisgekrönte Filme 2024 | Alle Oscar-Gewinner und Nominierungen 2024 im Überblick

- Pretty Little Liars Bücher _ Pretty Little Liars: Number 1 in series

- Prison Architect Kostenlos Herunterladen

- Prey Film Kritik : Kalahari

- Primärquelle Sekundärquelle Unterschied

- Prince Charming Character , Cinderella (Disney character)

- Primeros Erste Hilfe Kurse Auffrischung

- Prepaid Sim Kostenlos | Kostenlose SIM-Karte: Alle Gratis-Tarife [Übersicht 2024]