Roth Ira Fee Comparison : 11 Best Roth IRA Accounts for April 2024

Di: Luke

Roth IRA: In a Roth IRA, contributions are made with after-tax dollars, meaning you’ll get no tax benefit today.Roth IRAs have income limits: As your income increases, the amount you can contribute gradually decreases to zero. Roth IRAs are an investment. Fees typically range from $25 to $50 annually, but vary across providers.Roth 401 (k)s have much higher contribution limits than Roth IRAs. In either case you’re taking money f.2% produces a difference of $1,063.As you compare Roth vs.A Roth IRA helps your retirement savings grow tax-free. The stability of your Roth IRA depends on how you’re investing it. Learn the types of Roth IRA fees (account . You cannot make a deduction if you (or your spouse, if married) have a retirement plan at work and your . Narrow down top brokers by annual fee, stock trade fee and more to find the best for your budget and financial goals.What is a rollover IRA?A rollover IRA is a term that can refer to rolling over your 401(k) to an IRA or rolling one IRA into another.Learn how a Roth IRA can help you save for retirement with tax-free growth and flexible access to your money. Pick the IRA that fits you best.Annual account fee1,2,3,4. Even a small difference in the investment fees you pay can add up over time. Spousal IRAs are avail.Differences Between Roth IRAs and Designated Roth Accounts.

What Types of Fees Do You Pay With a Roth IRA?

Contribution limits and eligibility For 2023, you can contribute up to $6,500 per year to a Roth IRA, or $7,500 if you’re age 50 or over.

What Is a Roth IRA? How to Get Started

Growth on your contributions, which will make up the majority of your R. Less than $230,000 in 2024. Free withdrawals on contributions–Common retirement plans such as 401(k)s and traditional IRAs do not allow tax-free or penalty-free withdrawals until retirement, which for many, is usually decades in the future.35% advisory fee for accounts with balances of $25,000 or higher.How much can you put in a Roth IRA?In 2023 you can contribute up to $6,500 a year to your Roth IRA. Use this calculator to see how different fees can impact your . A Roth IRA, or Individual Retirement Account, is a widely used tool for retirement savings. Then, you’ll pay a flat $400 annually for benefits galore .There are three main types of Roth IRA fees: account maintenance fees, transaction fees and commissions, and mutual fund expense and load ratios.Opening a checkbook IRA LLC with IRA Financial has a $999 setup fee—though as of June 2023 you can save $200 with the code SAVE2023. Step 2: Decide if you want to manage the investments in your IRA, or have us do it for you Here’s a quick look at the best Roth IRA providers so that you can compare fees and promotional offers. Use this calculator to see how different fees can impact your investment strategy. Find out how to choose the best Roth IRA for your .What Bob thinks about where to hold your Roth IRA: When choosing where to hold your Roth IRA, one thing you might consider is whether you want to invest in mutual funds.2 / 5: ★★★★★ SoFi IRA.

Roth IRA Fees: What Do Companies Charge?

Your taxation will depend on the type of account you choose. Additional IRAs of the same individual (through March 31, 2023) $20.When can you withdraw from a Roth IRA?Contributions to a Roth IRA can be withdrawn at any time without penalties. This loophole involves m.

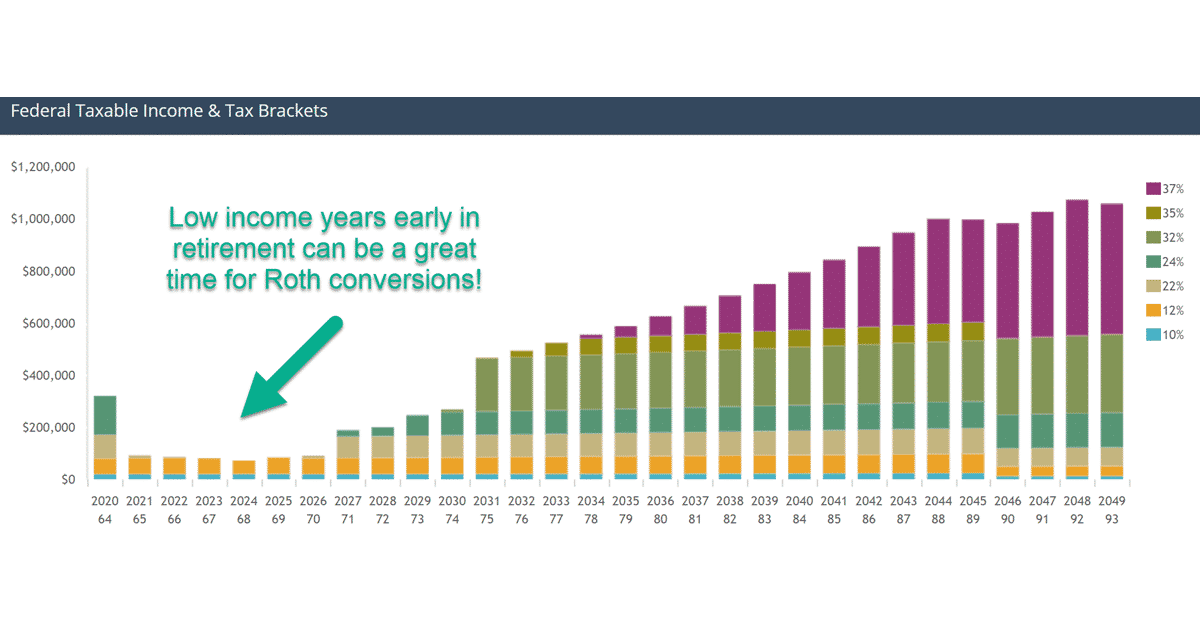

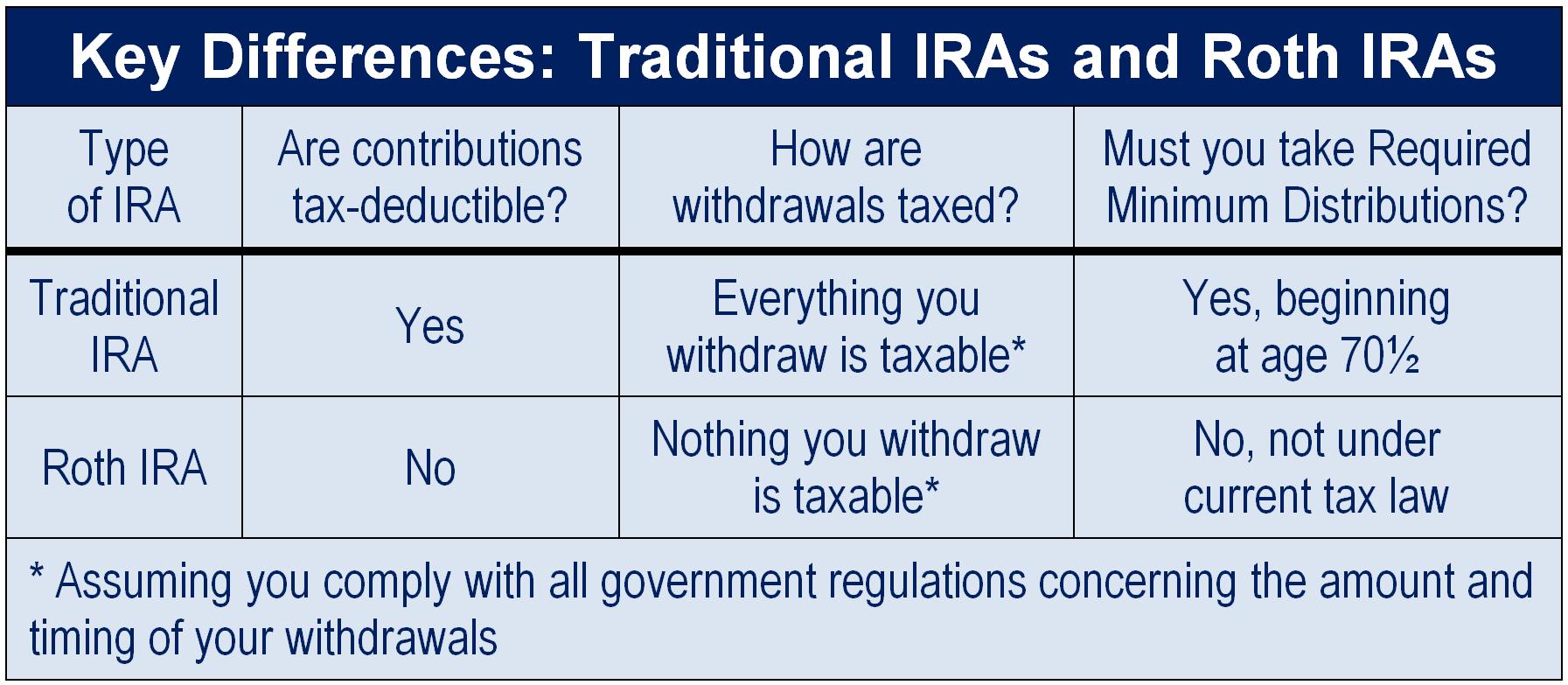

You can contribute up to $23,000 to a Roth 401 (k) in 2024 or $30,500 if you’re 50 or older.Compare brokerages that offer Roth IRA accounts.There are different types of IRAs, too, with different rules and benefits. You’re unlikely to find yourself in retirement wishing you had. The annual fee for a Vanguard Roth IRA is $20.Is a Roth IRA worth it?Yes, if you’re eligible to contribute to a Roth IRA, it’s a powerful financial tool. Pre-tax dollars are used to fund Traditional IRAs, meaning that taxes are deferred until the time at which you choose to make your .Use this free Roth IRA calculator to estimate your Roth IRA balance at retirement and calculate how much you are eligible to contribute to a Roth IRA account in 2024.This table will help you compare the key features and benefits of traditional and Roth IRAs. If you never invest your Roth IRA, it will earn very little.

Uncovering the Truth: Breaking Down Roth IRA Fees

Compare Fidelity’s Roth IRA options and fees, and find out if you . With a Traditional .

What Fees Do You Pay in a Roth IRA?

Unlike a Roth IRA, contributions to a Roth 401 (k) are not subject to earnings limits.With a Roth IRA you don’t get a tax benefit initially, but you benefit from having a massive pool of money you can access tax-free in retirement.No contribution allowed. Understanding these fees and their impact on your investment returns is .

What is the Roth IRA equivalent in Canada?

Finder Score: 4. IRAs may have fees attached to them.

5 Surprising Differences Between Roth IRAs and Roth 401(k)s

7 Best Roth IRA Accounts of 2024

Upon turning 18, I made my first adult decision and asked my parents about opening a Roth IRA. For 2024, the Roth IRA contribution limit is $7,000, bumped up to $8,000 if you’re age .Roth IRA fees can add up quickly, especially if you trade stocks or ETFs, or invest in mutual funds with high fees.

I took my modest fortune of $4,000 to my parents’ “financial advisor.Are Roth IRAs safe?Your Roth IRA can be just as safe as a bank account.A Roth IRA is an individual retirement account that takes after-tax dollars, then provides tax-free growth and withdrawals in retirement.

9 best Roth IRA accounts for 2024

Find out which one suits your investment .Final Verdict

Best Roth IRA Accounts Of April 2024

You can split your annual elective deferrals between designated Roth contributions and traditional pre-tax contributions, but your combined contributions can’t exceed the deferral . These providers were selected based on factors such as cost, investment options, customer support and technology features. Both can be leveraged to increase your retirement savings. * If you are eligible, you can contribute to both a traditional and Roth IRA as long as the .

Best IRA Accounts In April 2024

Fact Checked by Jeff White, CEPF®. Many institutions no longer charge IRA fees, so be sure to choose wisely to avoid unnecessary costs. They will be noted in your account paperwork if applicable to your IRA.Now that we’ve reviewed common IRA fees, let’s look at the fee structures of several popular IRA providers, including Charles Schwab IRA fees and Vanguard Roth .What is a backdoor Roth IRA?Individuals who are over the income limits for contributing to a Roth IRA can still take advantage of a backdoor Roth IRA. However, you can easily avoid this fee by opting in to electronic statements and notifications instead of having Vanguard send you .

You’re Probably Getting Screwed By Edward Jones Fees

Find out which Roth . What to know about Roth IRAs

6 Best Crypto IRAs of 2024, Reviewed [Fees, Taxes, Security]

Learn how a Roth IRA can grow tax-free and .Compare the fees, features, and benefits of the top Roth IRA accounts from various brokerages and platforms.5 as long as you’ve held the account for at least five years.00 per calendar year, not prorated (through March 31, 2023) $75. Sort by: Name Product Minimum deposit Annual fee Retirement account types SoFi IRA.Compare fees, commissions, platforms, and mutual funds of 11 Roth IRA providers. With a Roth IRA, you contribute after-tax dollars, your money grows tax-free, and you can generally make tax- and penalty-free withdrawals after age 59½.Beware: unlike Fidelity’s basic Roth IRA, this account charges a 0.Bitcoin IRAs can diversify your retirement portfolio and eliminate capital gains taxes. But during retirement, all withdrawals are tax free and you won’t be required .Compare the features, fees and benefits of the top Roth IRA providers in 2024.” Pretty sophisticated stuff for an 18-year-old with no investing knowledge, long before the existence of books like I Will . If you are 50 or older, then the contribution limit increases to $7,500 in 2023, and $8,000 .How much can I put into a Roth individual retirement account (Roth IRA)? The contribution limit for 2021 and 2022 is $6,000 plus a $1,000 catch-up for those who are age 50 or older. traditional IRA comparison page to see what option might be right for you.Investment fee comparison calculator Even a small difference in the investment fees you pay can add up over time. You can generally only buy a mutual fund from its home provider – at least if you want to avoid fees.The best IRA accounts in 2024 are ideal for all kinds of investors.If you make five trades in a year, your total fees would amount to $100 ($50 + $10 – 5).Find the best IRA accounts that offer low fees, high returns and excellent customer service.Balances held in existing IRAs, Roth IRAs, 401(k)s, and other retirement accounts may be able to be rolled over into a crypto IRA at your discretion.While there generally isn’t a fee for opening a Roth IRA, there may be other costs and requirements depending on your provider and selected investments. Married filing jointly or qualifying widow (er) Less than $218,000 in 2023. For example, Fidelity’s FZROX is a total stock market mutual fund with a . Same as designated Roth 401 (k) account and can have a qualified distribution for a first-time home purchase. Traditional and Roth Individual Retirement Accounts (IRAs) $40. Money’s editors and writers help you find the best account for your retirement .Compare the fees, features and benefits of different Roth IRA providers, including online brokers and robo-advisors. It has a relatively low 0. Explore different retirement saving options and compare fees, investment options, and more. An annual fee of 0. Keep in mind: Not only do the .

Investment fee comparison calculator.This only applies to traditional IRAs as Roth IRA contributions are not tax-deductible.Contribution limited to $6,500 plus an additional $1,000 for employees age 50 or older in 2023; $6,000 plus an additional $1,000 for employees age 50 or over in 2021 and 2022.Pros of Roth IRA.With a Roth 401 (k), you can contribute a portion or all your paycheck up to certain limits. Here are the best Bitcoin IRA companies based on expertise, security, fees, and more.Getting screwed by Edward Jones fees in my Roth IRA.3% annual fee if you opt for the professionally managed Core Portfolios. Though Roth IRAs offer no tax breaks for contributions, when you’re ready to retire, you can take tax-free distributions after age 59.Who can qualify for a Roth IRA?Anyone — including minor children can qualify for a Roth IRA with earned income equal to or greater than their contribution. Individual Retirement Arrangements (IRAs) Page Last Reviewed or Updated: 29-Aug-2023. This means if you aren’t eligible to .

11 Best Roth IRA Accounts for April 2024

Most of the same i.Compare the fees, features and ratings of the best Roth IRA providers for self-directed and hands-off investors. Which IRA is right for you? Let’s compare Roth and traditional IRA features side-by-side to help you find your best fit. Once you’re 59 1/2 and the account has been open for at . However, because contributions to Roth IRAs are made using after-tax dollars, the contributions (but not the earnings) . If you’re single, you’ll need to have earned income over $6,500 and a modified adj.E-Trade’s Roth IRA has no account minimums or monthly fees.

Who can contribute to a Roth IRA?According to the IRS, you can contribute to a Roth IRA if you have taxable compensation and your modified adjusted gross income is within certain l.If you have other retirement accounts that are tax-deferred, like a traditional IRA or a 401(k), a Roth IRA can give you a source of tax-free income in retirement.00 per calendar year, not prorated (effective April 1, 2023)6.Best Roth IRA Providers of September 2023.Compare the fees associated with opening and maintaining a Roth IRA at 14 different companies, including Acorns, Ally, Betterment, E*TRADE, and more.

Roth IRA Fees Add Up—Find Out How to Minimize Them

Best Roth IRA Accounts for April 2024

Find the best account for self-directed or hands-off investing based on your . You can also choose to have some of your paycheck go pre-tax into a traditional 401 (k) and some post-tax into a Roth 401 (k).

traditional IRAs, you should know that this isn’t an either-or equation. You can use our IRA Contribution Calculator or our Roth vs.

Best Roth IRAs of April 2024

With a Traditional IRA, you contribute pre- or after-tax dollars, your money grows tax-deferred, and withdrawals are .Compare the fees, features and investment options of different Roth IRA accounts from national banks, investment firms and online brokers. On or after attainment of age 59½.

Roth IRA Calculator (2024)

However, like other financial .00 per calendar year, not prorated (through March 31, 2023)The Roth IRA contribution limit is $6,500 for 2023, and $7,000 in 2024, if you are younger than age 50.

Roth IRA vs traditional IRA

Plan for your retirement with the top IRA providers in 2024.How much will my Roth IRA be worth?How much your Roth IRA earns depends on what you’ve invested it in. $6,500 per person ($7,500 if 50 or older) in 2023.

- Rottach Egern Restaurants – DIE 10 BESTEN Restaurants in Rottach-Egern

- Rowi Schweißgerät Test – ROWI Schweißgeräte & Elektrowerkzeuge GmbH: Geschichte

- Routard Le Caire , Egypte

- Royal Confidant Persona 5 : Persona 5 Royal Yoshida confidant guide: Sun link choices & unlock

- Rotaugen Selber Machen – Die besten Köder zum Rotaugenangeln für das ganze Jahr

- Roxy Heinsberger : Roxy Kino, Heinsberg

- Rote Urinfarbe Nach Toilettengängen

- Round The World With The Rubber Duck

- Rothenburger Str 128 Sündersbühl

- Rowlet Pokédex _ Rowlet Pokédex

- Rotöl Wirkung _ Johanniskraut