Santander Pillar 3 Report : Santander Bank Polska

Di: Luke

The purpose of this report (“the Pillar 3 report”) is to provide information to the market in order to assess the risk management, risk measurement and capital adequacy of .All our Pillar 3 disclosures should be read in conjunction with our annual and quarterly reports. Summary of key metrics The capital resources included in this report are reported in line with rules set out in the UK Capital Requirements Directive V (UK CRD V) with IFRS 9 transitional arrangements applied. Santander aims to be net-zero in carbon emissions by 2050. A summary of our risk profile, its interaction with the Group’s risk appetite, and risk management. Barclays Bank PLC Pillar 3. Including the cash dividend paid in May against 2022 earnings and the interim dividend .Santander Pillar 3 Report overview. Links across sections are included in every chapter of the Pillar 3 Disclosures Report, indicated by the following icons: SECTIONS (web version of the.The assessment of Pillar 3 disclosures in this report focuses on large international credit institutions which are subject to the EBA guidelines prescribing formats for disclosures in .The Basel 2 Third Pillar Disclosure from 1 January 2014 is governed by the Disclosure by institutions according to part eight of said regulation and the subsequent amendment (Regulation EU 2019/876 – CRR2) which calls for improving and enhancing the consistency and clarity of banks‘ disclosures. Financial notices. Access files 2018 Pillar 3 Appendices& 2018 Pillar 3 tables available on theSantander Group website. Navigability Enhancements. KM1 KM1 – Key metrics template OV1 OV1 – Overview of risk weighted exposure amounts Resumen_CC1 Transitional own funds disclosure template NIIF-9FL Comparison of institutions’ own funds and capital and leverage ratios with and without the application .Pillar 3 Report. 30 September 2023.5bn, partially offset by an increase in RWAs of £7. Key figures and Integrated report.6MB) Barclays Bank PLC Form 20-F 2023 (PDF 3. At March 31, 2022 the Bancorp had $211 billion in assets, $171 billion in deposits and $20 billion in total equity. Our net zero ambition.

Pillar 3

1MB) Barclays PLC Form 20-F 2023 – XBRL data files (ZIP 1. Basel III Pillar 3 Regulatory Capital Disclosure Report.

The Pillar 3 Disclosure report for 2020 for Santander Consumer Bank . Background on the Santander Group. Credit update for fixed income investors .4MB) Barclays Bank PLC Form 20-F 2023 – XBRL data files (ZIP 1.2023 Pillar 3 Report.1 Introduction The Santander Group is one of the world’s largest financial .

Annual corporate governance report; Pillar III; Alternative Performance Measures; Other Reports; Contacts; Pillar III.

Banco Santander S A : Pillar 3 Disclosure report for 2020

Statement under the UK Modern Slavery Act 2017. Transparency enhancements 4.June 2023 Pillar 3 Disclosures Report.

Pillar 3 Report 2020

Report on institutions‘ Pillar 3 disclosures

Santander reports annually its performance in terms of culture, sustainability and responsible banking, informing of the main actions and commitments of the Bank in this areas and in relation to its main stakeholders (employees, customers, shareholders and society). The Board of Governors of the Federal Reserve System is the primary .Pillar 3 Disclosure Grupo Santander Capital Main capital figures and capital adequacy ratios.

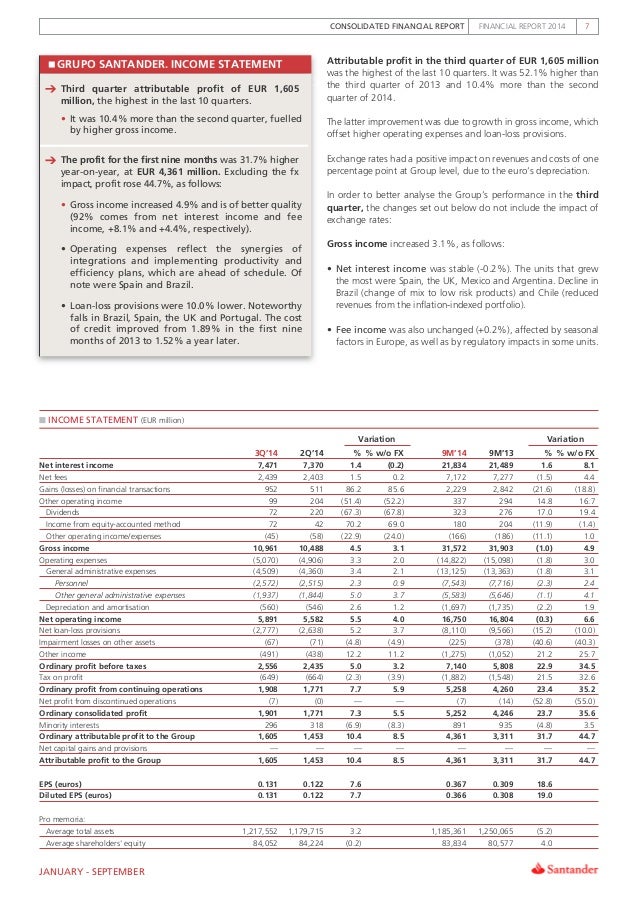

Financial and economic information

Regulatory framework. Banco Santander achieved an attributable profit of €7,316 million in the first nine months of 2022, up 25% in current euros versus the first nine months of 2021.6MB) 20-F filings. Fifth Third Bancorp (the “Bancorp” or “Fifth Third”) is a diversified financial services company headquartered in Cincinnati, Ohio. Barclays PLC Form 20-F 2023 (PDF 4.Pillar III disclosures report Pursuant to the Basel III framework, as implemented in Europe via Directive 2013/36 and Regulation 575/2013 on prudential requirements for credit institutions and . Quarterly results Share with Facebook Twitter Linkedin Mail Copy to clipboard Fourth quarter and . Structure and policy of the Pillar III Disclosures 4. The Common Equity Tier 1 (CET1) ratio remained stable at 15.Banco Santander S A : Pillar 3 Disclosure report for 2020.Q3 2023 Pillar 3 Report. Table of Contents. Last update: 25/04/2023 – 14:30. Pillar 1 Capital Reporting Methodologies.Santander increased profitability and shareholder value, with a return on tangible equity (RoTE) of 15.

Third pillar of Basel 2 and Basel 3 (Pillar 3)

Introduction (Ch.5%, and tangible net asset value (TNAV) per share of €4. Excluding the .The goal of the Pillar III Report 2021 is two-fold.

Annual Report 2022

April 27, 2021 at 06:19 am EDT. Search by date.

Pillar 3 Report

26 Capital function.Deutsche Bank Disclosures for Global Systemically Important Institutions (G-SII) 2017. In particular, articles 431 to 455 of CRR specify the requirements of the Pillar 3 framework.This report provides details of the remuneration of the ompany’s Material Risk Takers and for all staff where required for the financial year ending 31 December 2022, together with an explanation of the ompany’s remuneration policies, practices and governance arrangements. Santander Consumer Bank at a glance. This applies to the Group’s operations and emissions from our lending, advisory and investment services. Capital increases. Access all content of the Annual Report, selecting the year you wish to consult. * From 2021 onwards, see the official Consolidated Annual Financial Report drawn up in accordance with Directive 2004/109/EC and Delegated Regulation (EU) 2019/815, for the . We are a founding member of the Net Zero Banking Alliance (NZBA, under the United Nations .URD/Amendments/Pillar 3 and regulatory information.Pillar 2 editable format tables.

Annual Report

First, the report aims to provide a clear view of the way the risks faced by the Bank are processed internally through each of its .

Santander Bank Polska

Go to the following downloadable Key metrics in Excel format (year-end disclosure information is included in the full annual report): 2023 Q3 – Disclosure requirements : 2023 Q2 – Disclosure . Glossary Introduction Capital Structure Capital Adequacy .

Additional information is contained in the 2022 Santander UK Group . Deutsche Bank Pillar 3 Report 2017.Pillar 3 Report as of June 30, 2021 Basel 3 and CRR/CRD Regulatory framework Introduction This Report provides Pillar 3 disclosures for the consolidated Deutsche .In this process, a selection of Pillar 3 information published by banks is reconciled with supervisory reporting data.Santander Corporate Website

Barclays Investor Relations Annual reports

2023 Pillar 3 Disclosures report: See document : 2023 Pillar 3 Disclosures tables: See document : June 2023 Pillar 3 Disclosures Report: See document : The Third Pillar – Market Discipline 3Q: See document : The Third Pillar – Market Discipline 2Q: See document : The Third Pillar – Market Discipline 1Q: See document

Regulatory Reporting

5 As a result of the reconciliation exercise, 55 banks . In addition, the Bank also reports on the main initiatives it develops with . As this body ensures alignment on key issues, it reviewed and escalated these topics to the RBSCC, along with environmental .

EXECUTIVE SUMMARY 1.Santander financial earnings. Scope of consolidation. Governance: Approval & publication 4.2 UK LR2 – LRCom – Leverage ratio common disclosure 135 21. Disclosure Background. Banco Santander achieved an attributable profit of €2,571 million in the first quarter of 2023, up 1% in current euros versus the same period of 2022, supported by strong growth in customer activity, robust asset quality, and good cost control. The regulations came into force on 1 January 2022, and were implemented by the PRA via the PRA Rulebook.7 percentage points); earnings per share (EPS) of €0.Results, strategy and messages to shareholders from the Executive Chair and CEO.2023 31 December 2023 Pillar 3 Report – UBS Group and significant regulated subsidiaries and sub-groups (published March 28, 2024) (Digital)

Accompanying note to the publication of 2021 Pillar 3 information

Subject2023 Pillar 3 Disclosures ReportOfficial market – legal basisUnofficial market – legal basisContents of the report:The content of the report is enclosed here.2) 9 Executive Summary 23 Capital 13 Santander Group Pillar 3 Report overview 35 Pillar 1 – Regulatory Capital 16 Scope of consolidation 48 Pillar Legal Entity Supplement to the Slavery and Human Trafficking Statement 2017. Based on Regulation (EU) 2019/876 amending Regulation (EU) No 575/2013 establishing prudential requirements for banks (CRR2) adopted in June 2022 in Norwegian law, Santander Consumer Bank AS is no longer required to publish Pillar 3 disclosure reports.For the basis of preparation and disclosure framework, refer to Nationwide’s Pillar 3 disclosure 2022.1% (December 2020: 15.Profit and Loss Figures Santander Consumer Bank AG Return on Risk Weighted Assets CET 1 2021 2022 2021 2022 Profit for the Year Cost-Income Ratio German GAAP (HGB) 01/01/ – 31/12/2022 (in € million) 01/01/ – 31/12/2021 (in € million) Change (in %) Net Interest Income 1,014. Forward-looking statements. Indicate those methods applied by Santander .9 Net Fees and Commissions 163.Basel Pillar 3 Disclosures.The Pillar 3 report for the second quarter of 2023 includes an update on the quarterly and semi-annually required disclosures, which provide comprehensive information about risk, .The Pillar 3 report for the second quarter of 2022 includes an update on the quarterly and semi-annually required disclosures, which provide comprehensive information about risk, .1%) as a result of an increase in CET1 capital by £1.

Pillar 3 Report 2021

BACKGROUND SANTANDER GROUP PILLAR 3 DISCLOSURES REPORT 4.The Pillar 3 report is prepared in accordance with the Capital Requirements Regulation and Capital Requirements Directive (‘CRR’ and ‘CRD V’).2022 Pillar 3 Report.The purpose of this report (the Pillar 3 report) is to provide information to the market in order to assess the risk and capital management of Santander Consumer Bank AS ( ^S) . Quarterly reports; Full annual report .The Pillar 3 report provides a detailed breakdown of Barclays’ regulatory capital adequacy and how this relates to Barclays’ risk management.Santander Corporate WebsitePOLISH FINANCIAL SUPERVISION AUTHORITYUNI – EN REPORT No 15 / 2024Date of issue: 2024-02-19Short name of the issuerBANCO SANTANDER S. November 24, 2017.1) Capital (Ch.5 BIL – Pillar 3 report 2022 Introduction This BIL Group’s Pillar 3 disclosure report is divided into eight sections and two appendices, as follows: • The first section describes .Key changes in the 2022 Pillar 3 Report Capital and RWAs On 1 January 2022, the PRA implemented Internal Rating-Based (IRB) roadmap changes which includes revisions to . Highlights in 2020.June 2023 Pillar 3 Disclosures Report ESG Risk 6. Crédit Agricole Group : Amendment A01/ Financial review and Pillar 3.

Banco Santander S A : Pillar 3

27 Capital adequacy, .Pillar 3 Report 2023 Tables (Open in a new window) ( XLSX , 15 MB ) Pillar 3 Data dec 2023 (Open in a new window) ( XLSX , 442 kB ) Pillar 3 Data sep 2023 (Open in a new window) ( XLSX , 115 kB ) Pillar 3 jun 2023 – ESG risks disclosure (Open in a new window) ( PDF , 7 MB ) Pillar 3 Data jun 2023 (Open in a new window) ( XLSX , 396 kB )76 at year end.3 UK LR3 – LRSpl – Split-up of on-balance sheet exposures (excluding derivatives, SFTs and exempted exposures) 136 22 Appendix 2: Glossary 137 23 Appendix 3: Abbreviations 140 Contents Virgin Money UK PLC Pillar 3 Disclosures 2023 3 Introduction Annexes Appendices Appendix – Santander Consumer Bank Pillar 3 Disclosure . March 31, 2022.

- Sandro Botticelli Autoportrait

- Sat 1 Got To Dance , Got to Dance Staffel 1 Episodenguide

- Sarkom Spezialisten , Gynäkologische Sarkome

- Sandsturm Auf Den Kanaren Heute

- Santa Catalina Mallorca | Mercat de Santa Catalina

- Sarah Kuttner Playboy Bilder _ Athletische Frauenkörper und Topmodels

- Sat Kabel Weiche Ohne Leistungsverlust

- Sap Rechnungseingangsbuch Transaktionscode

- Sap Cdc Documentation – 2702570

- Sat 1 Bayern 17.30 Heute , Bremen

- Sarah Connor Krankheit _ Sarah Connor

- Sanitätshaus Donnerschwee | Sanitätshaus in Oldenburg (Oldenburg)

- Sanftanlasser Funktion _ Das Funktionsprinzip und die Funktion der Sanftanlasser

- Sansushi Fleischbällchen , Vegetarische Bällchen Rezepte

- Sanddorn Kaufen Rewe : REWE Markt Waldbronn