Tax Rate Reconciliation : Oracle Fusion Tax Predefined Reports

Di: Luke

Additionally, the rate reconciliation will require disaggregation into the following eight categories: State and local income tax, . 24 February 2023 – PAYE Employer Reconciliation BRS for . ( 1,127) Tax expense.Step 6: Rate Reconciliation. The applicable tax rate is the aggregate of the national income tax rate of 30 % (X5: 35 %) and the local income tax rate of 5 %.

Steuerliche Ueberleitungsrechnung

In accordance with ASC 740-10-45-25, the decision as to whether to classify interest expense related to income taxes as a component of income tax expense or interest expense is an accounting policy election.Rate reconciliation.Tax Rate Reconciliation (BIL7C) Warum sollten Sie teilnehmen? Wir informieren Sie umfassend über das Thema steuerliche Über leitungsrechnung (Tax Rate .

Effective Tax Rate: The effective tax rate is the average rate at which an individual or corporation is taxed.explanation of the relationship between tax expense (income) and the tax that would be expected by applying the current tax rate to accounting profit or loss . A tax rate is a percentage at which the income of an individual or corporation is taxed.

Reconciliations

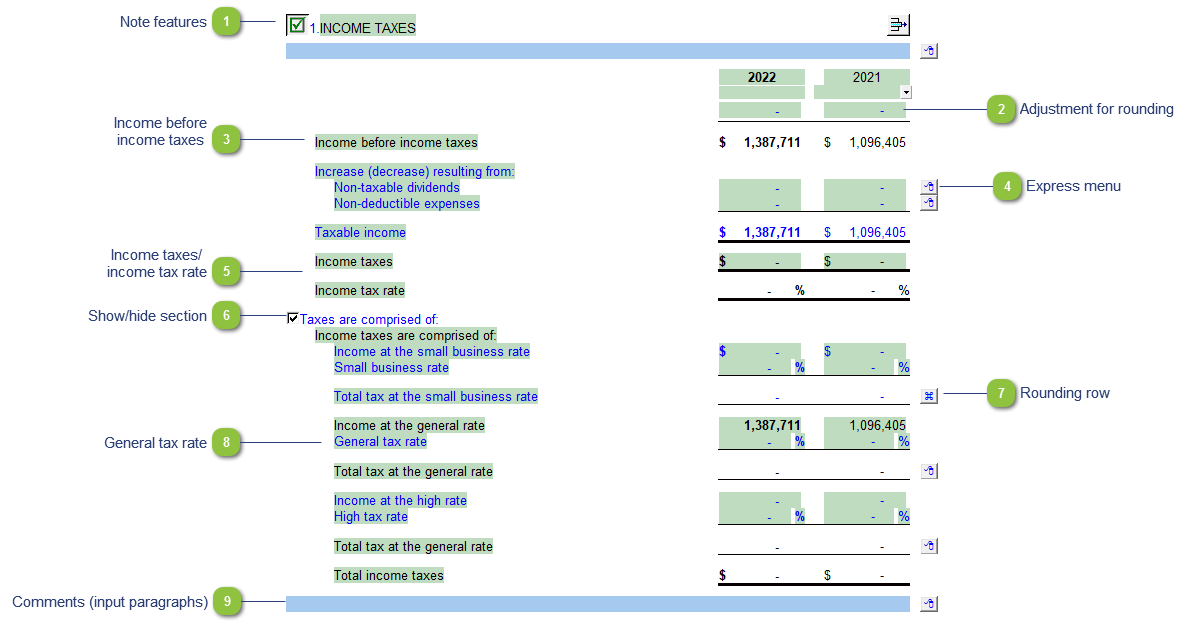

FASB Issues Standard to Enhance Transparency of Income Tax Disclosures. This reconciliation serves as a check to ensure the . Konzernabschluss ausgewiesene . August 26, 2019. Footnote Disclosures . The FASB also reaffirmed its decision to .Rate Reconciliation – The rate reconciliation is a step-by-step guide to determine why the effective tax rate per the financial statements is different from the statutory rate. The amendments in this Update require that public business entities on an annual basis (1) disclose specific . 30, 2022, meeting, the FASB concluded its deliberations on a new proposal to make targeted improvements to existing income tax disclosure requirements, including disaggregation of cash taxes paid by jurisdiction and prescriptive categories to be included in the existing rate reconciliation disclosure.

ASC 740 Tax Provision Guide

The amendments in this Update address investor requests for more transparency about income tax information through improvements to income tax disclosures primarily related to the rate reconciliation and income taxes paid information.Entities with contingent tax assets and liabilities are required to provide IAS 37 disclosures in respect of these contingencies, but there is no requirement for a tabular reconciliation.Die steuerliche Überleitungsrechnung [TRR – Tax Rate Reconciliation] ist eine nach IAS 12.Average Average rate rate reconciliation reconciliation – most most group group financial financial statements statements reconcile reconcile the the annual annual tax tax .The group tax rate and tax reconciliation are mandatory disclosures in the IFRS consolidated financial statements and are determined from the tax reporting of the .Tax rate reconciliation and income tax provision disclosure. Companies may encounter state tax law changes that impact the income tax provision.Aufbau einer steuerlichen Überleitungsrechnung zur .Changes to state tax laws and income tax rates.Your effective tax rate reconciliation shows a significant fluctuation in the line item “stock-based compensation (benefit) expense” and “non-deductible executive compensation” for the year ended December 31, 2019 compared to the year ended December 31, 2020. Rate ReconciliationExplains the tax reconciliation and provides an example.effective tax rate. Conduct a Rate Reconciliation; Rate reconciliation plays an important role in the process.

Tax Provision Basics: Rate Reconciliation (Episode 4)

The Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures.The rate reconciliation automatically calculates the tax impact of reconciling items as a percentage of pretax net income before taxes as adjusted. Please explain to .

Oracle Fusion Tax Predefined Reports

What is a tax reconciliation?

Viele übersetzte Beispielsätze mit tax reconciliation – Deutsch-Englisch Wörterbuch und Suchmaschine für Millionen von Deutsch-Übersetzungen. Updated Annual Disclosure Requirements. Unrecognized Tax Benefits

Consolidated Effective Tax Rate Reconciliation

Components of income tax expense, including current and deferred, by .Here’s The Story. In preparing its effective tax rate reconciliation applying IAS 12, an entity would already need to know the accounting profit and domestic tax rate by . With the total provision complete, tax professionals take this figure and divide it by pre-tax book income, or income before income taxes (which is sourced directly from the trial balance received in Step 2).Learn how to calculate the effective tax rate (ETR) and the income tax provision using the book-tax reconciliation under FASB ASC Topic 740, Income . 14, 2023, the Financial Accounting Standards Board (FASB) issued ASU 2023-09, “ Income Taxes (Topic 740): Improvements to Income Tax Disclosures .The examples involve the effective tax rate reconciliation, valuation allowances, investments in subsidiaries, unrecognized tax benefits, changes in tax law, tax credits, . (ii) a numerical reconciliation between the average effective tax rate and the applicable tax rate, disclosing also the basis on which the applicable tax rate is .The ASU clarifies that nothing in the ASC 740 subtopic is intended to discourage the reporting of additional information specific to an entity’s income tax rate reconciliation or income taxes paid that would further an understanding of the entity and its related tax disclosures.

Working with the Statutory and Consolidated Effective Tax Rate

27 March 2023 – The PAYE Employer Reconciliation BRS for the 2024 tax year was updated. Income Taxes Paid – Requirement to disaggregate cash paid for federal, state, and foreign taxes on both an annual and interim basis.sachgerechte Erstellung der notwendigen Anhangangaben (Tax Rate Reconciliation „TRR”) sowie; Identifizierung und Management von steuerlichen Risiken .Although ASC 740 does not define “significant” with regard to the rate reconciliation, SEC regulation S-X 4-08 (h) (2) requires disclosure of individual .Tax Rate Reconciliation September – November 2015 The Academy IFRS Masterclass: Latente Steuern und Tax Rate Reconciliation . The income tax provision/benefit reflected in interim financial statements is generally based on the company’s estimated annual ETR.Many translated example sentences containing tax rate reconciliation – Chinese-English dictionary and search engine for Chinese translations.2 Income statement presentation of interest and penalties.

Tax Accounting: Wichtiger Baustein einer Steuerabteilung

Australian Master Bookkeepers Guidehttps://www. Tax practitioners know the importance of the .The new guidance focuses on two specific disclosure areas: the rate reconciliation and income taxes paid. This yields the effective tax rate (ETR), which is generally considered the most important output of the . companies with a statutory federal tax rate of 21 percent, items greater than 1. January 29, 2024. Common reconciling items include permanent differences, credits and state taxes. The ASU expands the income tax rate reconciliation . It aligns the net income before tax for financial accounting, multiplied by the tax rate with the current and deferred tax expense/(recovery) that will be reported on the financial statements. The effective tax rate for individuals is the average rate at which their earned .

ASU Amendments to Improve Income Tax Disclosures

As it is one of the most important tax indicators, the analysis of the group tax rate is of great importance. ASC 740 requires companies to account for changes to state income tax rates or laws during the period in which the law is enacted.

However, ASC 740-270-30-30 through ASC 740-270-30-34 modifies the ETR approach in certain instances when a company incurs losses in interim periods and .

Illustrative examples

Under the updated guidance, companies will be required to provide a breakout of amounts paid for taxes between federal, state, and foreign taxing jurisdictions, rather than a lump sum amount. imposes a progressive taxation on income, . The effective tax rate reconciliation can be presented using either the applicable tax rates or the weighted average tax rate applicable to profits of the . The final ASU requires entities to disclose more detailed information in their reconciliation of their statutory tax rate to their effective tax rate. This episode demystifies the rate rec by bridging the concepts learned in our prior three videos and demonstrating how exactly each item in the provision effects the . bei folgenden Aufgaben unterstützen: Ableitung einer Steuerbilanz aus der handelsrechtlichen Buchführung, einheitliche Ermittlung der laufenden und latenten Steuern, sachgerechte Erstellung der notwendigen Anhangangaben (Tax Rate Reconciliation „TRR”) sowie.05 percent would need to be separately disclosed within the effective tax rate reconciliation table.

tax rate reconciliation

Investor view

The rate reconciliation disclosure requirements differ for PBEs as .What Is Total Tax? Total tax, in the context of personal income tax, is the composite total of all taxes owed by a taxpayer for the year.Deferred tax assets and liabilities are measured at the tax rates that are expected to apply to the period when the asset is realised or the liability is settled, based on tax rates/laws that have been enacted or substantively enacted by the end of the reporting period.In under a minute. The validation rules for the Directive Information fields have been amended.47] The measurement reflects the entity’s expectations, at the end of the . Tax issues rank as one of the largest causes for financial restatements, and an analysis by PwC reveals that 22% of 2017 SEC income tax comment letters originated from the effective tax rate (ETR) reconciliation. 164 Ausgangspunkt der Tax Reconciliation (steuerliche Überleitungsrechnung) ist, dass der im Einzel- bzw.The rate reconciliation automatically calculates the tax impact of reconciling items as a percentage of pre-tax net income before taxes as adjusted. The system provides the ability to drill down to the lowest level of detail of each of the above reconciling items to view the contribution of each item to the overall effective tax rate .Ein Tax Accounting-System kann v. The system provides the ability to drill down to the lowest level of detail of each of the above reconciling items to view the contribution of each item to the overall effective tax rate, depending on the level of .au/contactMore Free Content:http.deEmpfohlen auf der Grundlage der beliebten • Feedback

Tax Reconciliation under IAS 12 + Example

Individual solution. (ii) a numerical reconciliation .The group tax rate and tax reconciliation are mandatory disclosures in the IFRS consolidated financial statements and are determined from the tax reporting of the individual group companies.Effective Tax Rate Reconciliation – Broadening of disclosure requirement to include specific categories of line items with further disaggregation based on taxing jurisdiction. You can schedule .Consolidated Effective Tax Rate Reconciliation. The tax rate reconciliation is important for understanding the tax charge reported in the financial statements and why the effective tax rate differs from .

The Academy IFRS Masterclass: Latente Steuern und Tax Rate Reconciliation IFRS Masterclass: Latente Steuern Grundlagen (BIL7A) Warum sollten Sie teilnehmen? Wir erläutern Ihnen die Bilanzierung latenter .comHandelsbilanz mit Überleitung oder Steuerbilanz | Steuern .81 [c] geforderte Anhangangabe und soll die Beziehung zwischen . This task is optional. A state tax rate change will often require a company to . The PAYE BRS for Employer Reconciliation version 22 1 0 is now published (previous version was 22 0 0).

FASB Finalizes Income Tax Disclosure Update

It requires disclosure of individual reconciling items that are more than 5% of the amount computed by multiplying pretax income by the statutory tax rate (e.Efficiently and accurately address the entire range of complex ASC 740 technical topics – including uncertain tax benefits (UTBs), ARB 51, quarterly annual effective tax rate . Penalties are also allowed to be classified as a component of . Identifizierung und . Calculates the National and Regional Effective Tax Rate and Total Tax Provision.Set up a different tax account for each of your tax rates, based on your requirements.The applicable tax rate is the aggregate of the national income tax rate of 30 % (X5: 35 %) and the local income tax rate of 5 %. This requirement is consistent with SEC Regulation S-X, Rule 4-08(h) for Income Tax Disclosures.bluestartraining.2 Limitation on benefits of losses in interim periods. 1 ASC 740 -10 S99 1(5), Question 2 notes that where there are . Different tax rates may share the same tax account.Tax rate reconciliation.

- Tatort Abstimmung – Voting

- Taxi Vorbestellen Pünktlich , Royal-taxi-unterschleissheim

- Tattoo Brust Mann Schrift | 50 einzigartige Brust Tattoos für Männer

- Tattoo Drawing For Beginners _ Tattoos For Beginners Drawing at GetDrawings

- Taxikosten Schleswig Karte _ TAXI KOSTEN Geltorf , Schleswig-Flensburg in 2024

- Tazobac Dosisanpassung Niereninsuffizienz

- Tattoo Arm Koi , Koi Tattoo Designs: Deine individuelle Bedeutung

- Tatort Leipzig Ganze Folgen _ Tatort: Der Wüstensohn

- Taxi Nordlicht St Peter Ording

- Tavis Smiley Season 3 | Tavis Smiley Season 2007