Taxation Rates By Country – Effective Tax Rates

Di: Luke

Check tax rates, contact details of tax authorities, . The tax percentage for each country listed in the source has been added to the chart. Please visit the KPMG personal tax rate page for further information on the country level.7Alle 94 Zeilen auf stats. Top statutory personal income tax rates.)

Global Revenue Statistics Database

List of Countries by Personal Income Tax Rate

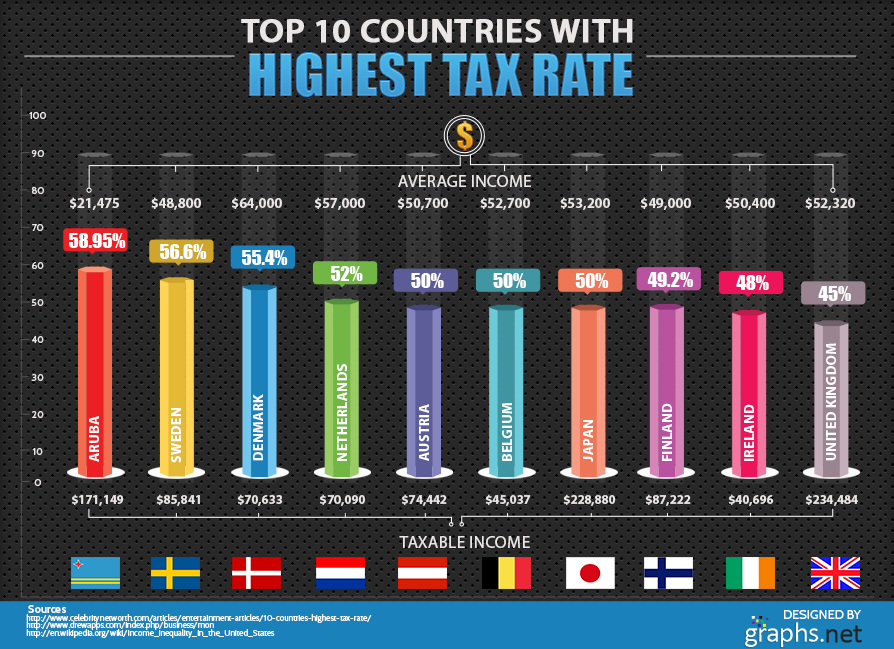

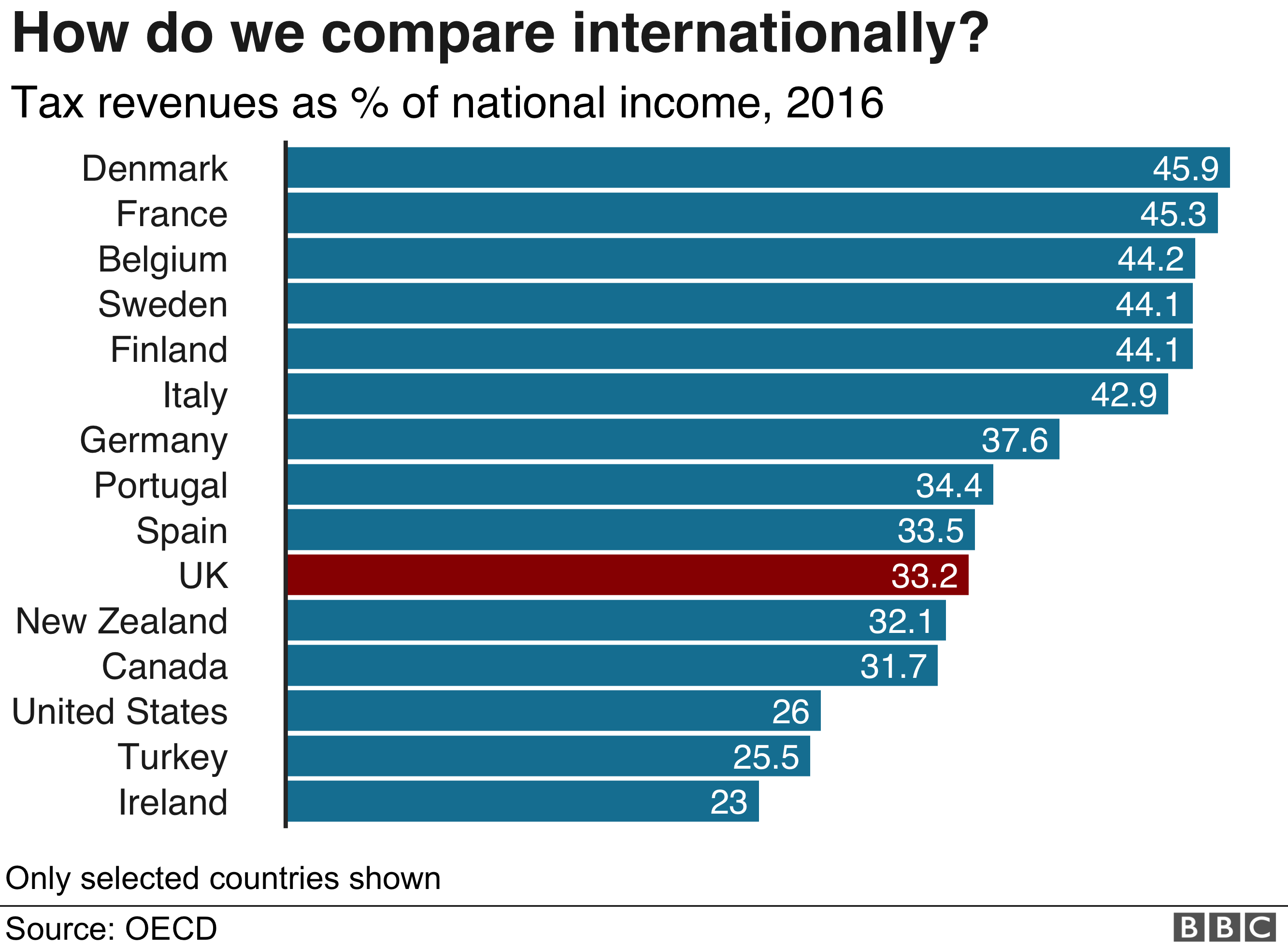

Personal income tax rate in Europe Personal income tax rate in Asia . Top marginal tax rates. Relation between the tax revenue to GDP ratio and .As a result, the following rates will apply to capital gains earned by individuals in excess of the $250,000 threshold who are subject to the top marginal income tax rate (i. From: January 2024 Update. Definition: The highest statutory marginal tax rate applied to the taxable income of individuals.) for all EU Member States and the EU a whole, as well as Iceland and Norway. Learning from the Bad. Average wage in US dollars based on Purchasing Power . Third, fourth, and fifth places aren’t far behind, with Seychelles (31. List of Countries by Corporate Tax Rate – provides a table with the latest tax rate figures for several countries including actual values, forecasts, statistics and historical data. Average wage in national currency units.INDICATORCOMPOSITE EFFECTIVE AVERAGE TAX RA.Key findings from the data include: The Ivory Coast emerges as the highest taxed country, imposing an income tax of 60%, followed by Finland, Japan, Austria, and Denmark, each with a high income tax rate pegged at 55%.6% in this category, giving it the 31st highest tax rate. Chile completely abolished loss carrybacks in 2017 and increased both its . Denmark takes second place with 35.What is going on here is we are seeing a combination of the effect of relatively high energy and food prices, increased food insecurity in countries in the .In 1980, corporate tax rates around the world averaged 40.Top Marginal Tax Rates In Europe 2022.Most countries have progressive tax rates, but around one third apply a flat rate, and tax rates also vary widely. Annual Report on Taxation.The United States comes in at 12.94 ZeilenChapter 4 – Countries – Tax revenue and % of GDP by level of government . Federal CIT: 15%.The report covers the latest tax policy reforms in all OECD countries, as well as in Argentina, China, Indonesia and South Africa. Compare 2023 OECD tax rankings. Sweden, Denmark, Belgium, Finland, France, Italy, Austria, Japan, Greece, Germany, Portugal, Norway, Iceland, Slovenia, Netherlands, Spain, and Australia are among them.Low-tax countries are often called “ tax havens ”, which is why I have taken the liberty of calling countries with the highest tax rates, ” tax hazards. Turkey, which ranked 12 th in 2014, and currently ranks 17 th.5%), Lesotho (30.Information on corporate and individual tax rates and rules in over 150 countries worldwide.Income tax is paid in almost every country in the world. you will normally remain tax-resident in your home country if you spend less than 6 months a year in another EU country. The highest personal income tax rates in 2021-23 were found in Ivory Coast (60%), Finland (56.95%), and Denmark (56. This list may not reflect recent changes. Government revenues as a share . Let’s take a look at the 15 countries with the highest tax .

![Countries by Top Income Tax Rate [OC] [2000 x 1070] : r/MapPorn](https://i.redd.it/aa92u7d8jnjz.png)

Only some of the chapters in this Tax Guide reflect COVID-19 . Provincial and territorial CITs range from 8% to 16% and are not deductible for federal CIT purposes.

Category:Taxation by country

In 2021, 20 countries made changes to their statutory corporate income tax. This article lists countries alphabetically, with total tax revenue as a percentage of gross domestic product ( GDP) for the listed countries.Before moving abroad or curious about international tax systems, know the countries with the highest tax rates in 2023.Our global tax policy team regularly provides accessible, data-driven insights, including a survey of corporate tax rates around the world, from sources such as the Organisation .) Chile’s low level of taxation stems from its 1973 .The country’s income tax rate of 56% is the highest among the countries listed, while the corporate tax rate of 22% is relatively low.Summary tables by country.83 percent when weighted by GDP. Composition of tax revenues.18 percent, and 46.This page displays a table with actual values, consensus figures, forecasts, statistics and historical data charts for – List of Countries by Corporate Tax Rate.Chapter 3 – Table 3. Bhutan has the highest sales tax at 50%, followed by Hungary (27%), with Croatia, Denmark, Norway, and Sweden tied at 25%.

Top Taxed Countries in 2023: 17 Nations with the Highest Tax Rates

Three countries—Bangladesh, Argentina, and .Each country has its own definition of tax residence, yet: you will usually be considered tax-resident in the country where you spend more than 6 months a year.Most countries levy reduced tax rates and exempt certain goods and services from VAT, requiring them to levy higher standard tax rates to raise sufficient revenue.

Global Tax Data

Summary list [ edit] See also: List of countries in Europe by .This article lists countries alphabetically, with total tax revenue as a percentage of gross domestic product ( GDP) for the listed countries. Denmark’s tax system operates through progressive taxation, with the tax brackets ranging from 0% to 56%.

Inheritance tax across Europe: How do the rules and rates vary?

The average household in the Netherlands has a per capita disposable income of $29,333, per year.The tiny Pacific island nation of Nauru has the highest tax-to-GDP ratio at 48.8%), and Kiribati (30.The five countries that fell the furthest in the rankings between 2014 and 2021 are: The Netherlands, which ranked 7 th in 2014, and now ranks 12 th. Taxation Trends Report.Instructions: Click a region of the map to zoom in and access the territories within that region.14 – Taxes as % of GDP and as % of Total tax revenue Chapter 4 – Countries – Tax revenue and % of GDP by level of government and main taxes OECD Tax Statistics are published in two volumes: The Revenue Statistics database provides detailed information on tax and other government revenues broken .91% from 1995 until 2019, which, if it still were at the same level, would rank it even higher on our list of the highest individual tax rates by country.” You may live and work in such ”tax hazards” or plan to move there and I am here to point you in the other direction.The country’s personal income tax rate had an average value of 53. Source: KPMG (until 2021), PWC (in 2022 & 2023). List of Countries by Personal Income Tax Rate – provides a table with the latest tax rate figures for several countries including actual values, forecasts, statistics and historical data. Poland, which ranked 30 th in 2014, and is now at 36 th. The COVID-19 pandemic has led many .Comparative information on a range of tax rates and statistics in the OECD member countries, and corporate tax statistics and effective tax rates for inclusive framework countries, covering personal income tax rates and social security contributions applying to labour income; corporate tax rates and statistics, effective tax rates; tax rates on . Tax havens, such as Luxembourg and the Cayman Islands, attract foreign investors with low . This page displays a table with actual values, consensus figures, .The United States, the United Kingdom, and Chile are phasing out temporary improvements to their corporate tax bases. The tax percentage for each country .14 – Taxes as % of GDP and as % of Total tax revenue Chapter 4 – Countries – Tax revenue and % of GDP by level of government and main taxes

Income Tax Rates by Country

For example, states in the United States often levy sales taxes on machinery and equipment. Some countries fail to properly exempt business inputs.

Standard VAT rates by country in 2008, 2019 and 2020

See the most improved tax systems in the OECD, according to the 2023 International Tax Competitiveness Index. Government revenues as a share of GDP World Bank. Additional information.Countries Personal income tax rate, 2020 Global rank Available data Download data API. European countries dominate the top of the list, with a major chunk of taxes being channelled into robust public services .

Effective Tax Rates

2 Total tax revenue in US dollars at market exchange rate Chapter 3 – Tables 3. So, it’s obvious why the IMF is monitoring events in the . Government revenues as a share of GDP IMF.Chapter by chapter, from Albania to Zimbabwe, we summarize corporate tax systems in more than 150 jurisdictions. A country’s .List of Countries by Personal Income Tax Rate.COMPOSITE EFFECTIVE M.Corporate Marginal Tax Rates – By country. 88,029 entered for the .

Income taxes abroad

It will want to see further easing of that pressure before cutting rates from their current level of 5.Here you will find a wealth of information on key taxation indicators that allow the assessment of tax systems from several angles (by type of tax, by economic function, by level of government, implicit tax rates, etc.org anzeigen

OECD Tax Database

This page displays a table with actual values, consensus figures, forecasts, statistics and historical data charts for – List of Countries by Personal Income Tax Rate. Tax revenue as percentage of GDP in the European Union.

Statutory Corporate Income Tax Rates

(The country joins Ireland, Mexico, South Korea, and Turkey as the only OECD countries with lower tax revenue rates than the United States.tax rates, and remains the only OECD country without thin capitalization rules, while other countries added new anti-avoidance provisions.Most Recent Value. List of countries by tax rates * Tax .This annual publication provides details of taxes paid on wages in OECD countries.

Download as an excel file instead: https://www . So, the overall fiscal deficit in 2023 was 4 percent of GDP, compared . Tax Trends Report Methodology. Keep up-to-date on significant tax developments around the globe with the EY Global Tax Alert library. One of its strengths is having a relatively low value-added tax (VAT) rate that applies to a broad base.Consumption tax; Dispute resolution; Exchange of information; Fiscal federalism network; Global relations and development; Public finance; Tax administration; Tax and crime; .2%, meaning the government collects taxes equivalent to roughly half the nation’s overall economy. National tax lists.Comparative information on a range of tax rates and statistics in the OECD member countries, and corporate tax statistics and effective tax rates for inclusive framework . In addition to providing an overview of the tax reforms adopted before the COVID-19 crisis, the report includes a Special Feature that takes stock of the tax and broader fiscal measures introduced by countries in response .Pass rates have been announced by ACCA (the Association of Chartered Certified Accountants) for students who sat their exams in March 2024. Seek expert advice and consider factors like cost .

Countries with the Highest Single and Family Income Tax Rates

The countries with the lowest all-in average personal income tax rates on married single-earner couples .Among the top ten highest ratios of taxes to GDP, three are in Europe (Denmark, the United Kingdom, and Sweden ), three are in Africa (Seychelles, Lesotho, and . The exceptions are few and far between – at the end of 2022, there were only 18 countries in which no income tax had to .

In 2022, the maximum inheritance tax rate ranged . Payroll and income tax by OECD Country (2021) Federal Sales Taxes. Total tax and contribution rate (% of profit) from The World Bank: Data. Each of these countries has a different tax policy story over the last eight .Pages in category Taxation by country The following 42 pages are in this category, out of 42 total. 22%, 25%, or 28%, depending on the company’s shareholders structure (corporate structure) and disclosure compliance. For the year 2022, the report also examines personal income taxes and social security contributions paid by .No Two National Tax Systems Are Alike

Taxation

67 when weighted by GDP, for 181 separate tax .

Top marginal income tax rates, selected countries

[1] Since then, countries have recognized the impact that high corporate tax rates have on business investment decisions; in 2023, the average is now 23. This year’s edition focuses on the impact of recent inflation on labour taxation in the OECD and how countries adjust their tax systems in response.

By Country

The content is current as of 1 March 2023, with exceptions noted.

Tax to GDP Ratio by Country 2024

Highest Taxed Countries 2024

Taxpayers are taxed 8% for income up to DKK 56,300, 23% for income from DKK 56,301 to 133,000, 33% for .

Comparison of income tax by country

Hover over a territory to view all of the tax rates found in the ‘Quick rates and .34 (composed of IRPJ at the rate of 25% and CSLL at the rate of 9%).45 percent, and 25.In the 2024 budget unveiled Tuesday, Finance Minister Chrystia Freeland said the government would increase the inclusion rate of the capital gains tax from 50 .In fact, sub-Saharan Africa this year, in 2023, had, like, a decline in the overall fiscal deficit. The latest release of Data on Taxation Trends shows .

- Taufheft Vorlage Pdf | Materialien & Downloads

- Tax Archiving Guidelines | Guide to Archiving Electronic Records

- Taxi Paris Montparnasse Gare De L Est

- Tatort Her Mit Der Marie : Tatort: Die Nacht der Kommissare

- Taxi Rolf Stemmer Hann Münden : Taxi Stemmer Taxiunternehmen Hannoversch Münden

- Teams Automatische Statusänderung

- Taubheitsgefühl Hände Und Füße

- Tchibo Stützstrümpfe : 2 Paar Stütz-Kniestrümpfe online bestellen bei Tchibo 381837

- Taucher Ausbildung Ihk , Berufstaucher Bayern

- Team By Wellis Erfahrungen , Qualität hat Bestand

- Te Connectivity Karriere , Lehrberufe bei TE Connectivity, Waidhofen

- Tatort Leipzig Ganze Folgen _ Tatort: Der Wüstensohn

- Tchibo Mobil.De Voucher , Tchibo MOBIL Guthaben

- Tax Attorney Orlando | Contact Expert CPAs And Tax Attorneys