Types Of Tax Identification Numbers

Di: Luke

The three types of tax ID number. South Africa has adopted the “Functional Equivalent” language when it comes to taxpayer identification.Schlagwörter:Taxpayer Identification NumberTin NumberTax Identification NumberThere are several different Taxpayer Identification Numbers that are available for U. As we stated earlier, the taxpayer’s status will determine the id number assigned to them, either as a natural person or as a business, when it’s time to file their taxes. Find the TIN you need and how to get it. In the EU, a VAT identification number can be verified online at the EU’s official VIES website.Schlagwörter:TINsTin NumberTax Identification NumberTax Id Types Any government-provided number that can be used in the US as a unique identifier when interacting with the IRS is a TIN, though none of them are referred to exclusively as .A Tax Identification Number (TIN) is a unique nine-digit identifier assigned to individuals, businesses, and other entities for tax-related purposes in the United States and many other countries. As a UK company dealing in international trade, you may be asked for a Tax ID Number to complete transactions with companies .Tax identification numbers.nl You can also contact the Client Service of the Dutch Tax and Customs Administration by phonenumber +31.Types of Tax Identification Numbers in Singapore . ITIN stands for Individual Taxpayer ID Number and is used by people who must file a US tax return, but are not eligible to get an SSN (Social Security Number). There are three types of tax ID number (Número de Identificación Fiscal – NIF) in .A Tax ID Number, also known as a Taxpayer Identification Number (TIN), is a unique set of numbers assigned by the Internal Revenue Service (IRS) to identify individuals, businesses, and other entities for tax purposes.

What Is a Tax Identification Number (TIN)?

Social Insurance Numbers (SINs)

Tax ID and Tax Number: Everything You Need to Know!

The tax number .What is a TIN? A federal tax ID number is an identifying number the Social Security Administration (SSA) or IRS assigns to individuals and businesses.Let’s take a close look at the two types. In the US, TINs serve as a critical component of the federal tax system, functioning as Federal Taxpayer Identification numbers to track tax obligations and . The following tax .Schlagwörter:Taxpayer Identification NumberTINsTin NumberThe Citizen Service Number (BSN) | Identification documents | Government.A TIN (Tax Identification Number) is a 9-digit number assigned to you that tells the IRS about your current tax status. As a broad term, it includes Social Security numbers, Employer Identification Numbers, Individual Taxpayer . Information returns: If your ITIN is only being used on information returns for reporting purposes, you don’t need to renew your ITIN at this time. Thanks, let us know how you go.Types of Tax Numbers in Thailand Personal Identification Tax Number (PIN) Role and Structure: The tax number’s function and structure are significant since they act as a vital identifier uniquely designed for each individual taxpayer.The NI number comprises of 2 letters, 6 numbers, and a final letter. Types of Tax ID . There are five types of TINs in the U. Tax Identification Number (TIN) for Individuals. Obtaining a Tax ID number involves different . Obtaining a Tax Identification Number (TIN) in Singapore: For Singapore Citizens and Permanent Residents: Singapore citizens and permanent residents are assigned a TIN that is the same as their National Registration Identity Card (NRIC) number. How do you get a tax ID, and what is its use? What’s the difference . It is also assigned to self-employed .Individual Taxpayer Identification Numbers are used by those who aren’t able to obtain a Social Security Number but must still file taxes and other reports with the IRS. Understanding the nature and function of a TIN is essential for anyone engaging in financial activities . Taxpayer Identification Number (TIN) Written By. The type of TIN an individual is assigned varies depending on his or her residency status in Singapore.IEIM902330 – Tax Identification Number (TIN) A TIN is a unique number (or combination of letters and numbers) in a specified format issued by a jurisdiction for the purposes of. It serves as a key identifier in the Thai tax system, streamlining the process of tax collection and compliance.

Tax identification numbers (TINs)

Schlagwörter:Taxpayer Identification NumberEmployer Identification NumberITIN Singapore Permanent Residents and Citizens.Schlagwörter:Taxpayer Identification NumberTax Identification NumbersTin Numbers

Tax Identification Number in Germany [A 2024 Guide]

The application file for the TIN can be submitted by the following means: directly to the local tax office, at the registry desk, or. This usually happens at birth and when . EIN stands for Employer Identification Number (but you’re not required to have employees). You may need a tax ID number when you file your taxes or .Schlagwörter:Taxpayer Identification NumberTax Identification NumbersTINs

Taxpayer Identification Numbers (TIN)

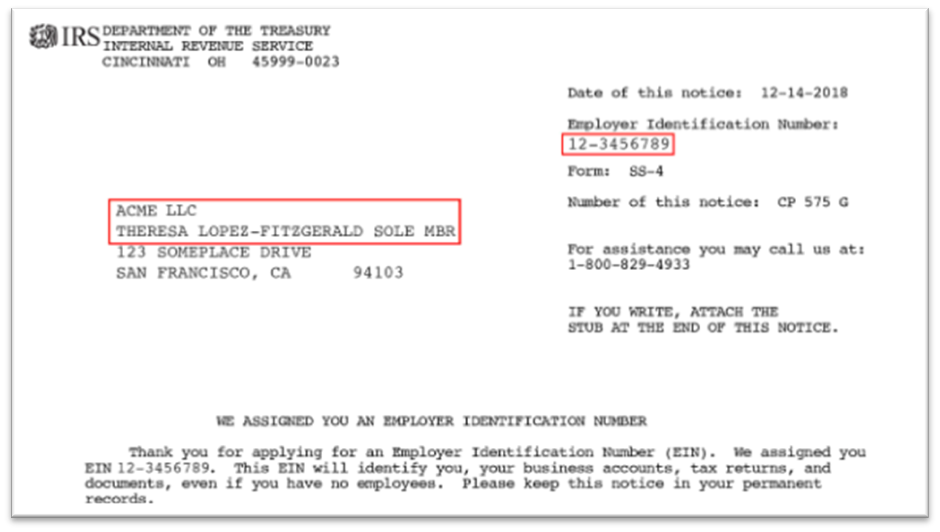

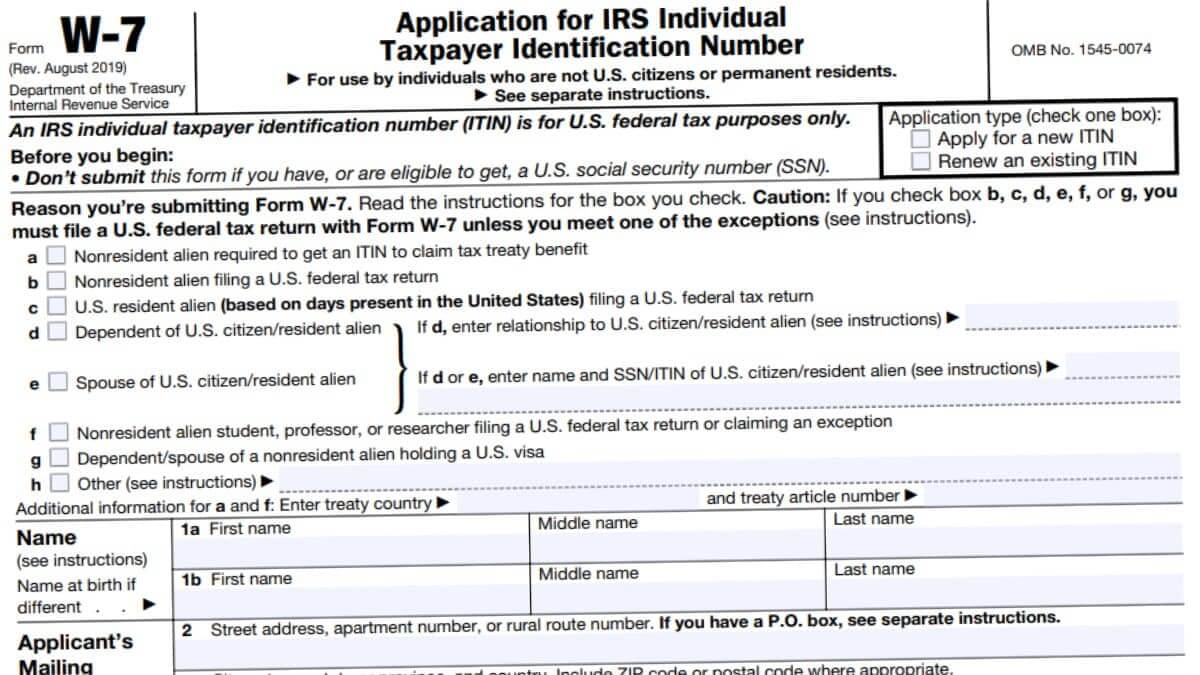

Otherwise, you should submit a completed Form W-7, Application for IRS Individual Taxpayer Identification Number, US federal tax return, and all required identification documents to the IRS.

What Is a Tax Identification Number (TIN)? Definition, How to Get One. For example, AB123456D. Limited companies are given a Company Registration Number by Companies House and a Unique Taxpayer Reference number allocated by HMRC. You may already have a tax ID number, and not even know it.The tax identification number (“Steueridentifikationsnummer”) is a unique 11-digit number assigned to every resident for their lifetime. Like a Social Security Number, ITINs are also nine digits long.A Taxpayer Identification Number, or TIN, is a nine-digit identifier issued by the IRS or SSA to track individuals and businesses obligated to pay taxes in the .Schlagwörter:Taxpayer Identification NumberTin NumberITIN

TIN

The type of taxpayer ID number you need often reflects your reason for filing a tax return.Types of Tax Identification Numbers (TIN) Social Security number (SSN): The most common tax identification number issued to U.Schlagwörter:Taxpayer Identification NumberTax Identification Numbers Author: JasonT (Community Support) 9 Aug 2021. All Singapore permanent residents and citizens are assigned what is called a National Registration Identity Card .March 22, 2024.Business Fundamentals.Schlagwörter:Taxpayer Identification NumberTax Identification NumbersTINs Coding for the Identification number for tax payers (Gonggao [2015]66)

Netherlands

The IRS accepts many types of tax identification numbers. SSNs are issued to U. IG57303583070 . citizens and qualified . Rachel Siegel, CFA.An Employer Identification Number (EIN), also known as a Federal Tax Identification Number, is used to identify a business entity. The 0 denotes the . residents, aliens, and businesses to use.You can get one tax ID number (TIN) per entity, however, there are various types of TINs that each serve different purposes, so it’s important that you understand .

Individuals have National Insurance numbers and a Unique Taxpayer Reference number, once they register for Self-Assessment tax returns. This section provides an overview of domestic rules in the jurisdictions listed below governing the issuance, structure, use and validity of Tax .Schlagwörter:Taxpayer Identification NumberTINsTin NumberCorinne Bernstein Verified by a Financial Expert.A Taxpayer Identification Number (TIN), in the United States, is a unique nine-digit number for identifying an individual, business or other entity in tax returns and additional documents filed with the Internal Revenue Service (IRS).identification, TIN is issued by local tax office according to relevant rules.

Need to find my TIN number

This is so that the Spanish Tax Agency (Agencia Tributaria) can accurately calculate the fiscal responsibilities of everyone paying tax in Spain, so you’ll need an ID number for everything from opening a Spanish bank account to getting a driving license.The Malaysian TIN number is an 11 or 12 or 13-digit alphanumeric identification with a combination of file number type and the Income Tax Number.There are 3 Types of Tax Identifications in the U. by post (Romanian Postal Office), via acknowledgment of receipt procedure. US citizens are given a Social Security number when they receive citizenship.As mentioned above, an EIN is used by the IRS to identify a business, such as an LLC.A Taxpayer Identification Number (TIN) is an identifying number used for tax purposes in the United States and in other countries under the Common Reporting Standard. Examples: Remarks: 1.issued for Valued Added Tax (VAT) and Pay As You Earn (PAYE) weonly require the Income Tax Reference numbers for CRS purpose. This section provides an overview of domestic rules in the jurisdictions listed below governing the issuance, structure, use and validity of Tax Identification Numbers (TIN) or their functional equivalents. Individuals: IG845062070. Relevant tax provisions: Coding for the Identification number for tax payers (Shuizongfa [2013]41) Revision of.Types of Taxpayer Identification Numbers. There are three types of ID number that can serve as your identification for tax .Schlagwörter:Tax Identification NumbersTINsTin NumbersTin Format TINs are used in most countries around the world to .

The jurisdiction-specific information the TINs is split into a section for individuals and a section for entities and . It confirms that the number is currently allocated and can .A TIN may be assigned by the Social Security . TINs are also useful for identifying taxpayers who invest in other EU countries and are more reliable than other identifiers such as name and address. TINs are also .

Individual Taxpayer Identification Number

Each has a different purpose and allows the IRS to identify how to administer tax laws for each.

What is TIN number and how to get a TIN number in Malaysia?

The certificate reflecting the tax identification number should generally be issued by the Romanian tax authorities within approximately .

Most EU countries use Tax Identification Numbers (TINs) to identify taxpayers and facilitate the administration of their national tax affairs.The Tax Identification Number (TIN) in Thailand is a unique number assigned to individuals and businesses for tax purposes. There are five common types of TIN, which we will explain further on in this post. This numerical emblem is significant in and of itself, but it also significantly contributes to efficient record . Heres how to find it. If you can’t locate any of these documents, you should complete the CA5403 form or call 0300 200 3500. The end number of Individual TIN is either 0 or 1., including: Social Security number (SSN). citizens, permanent residents, and certain temporary. The IRS usually requests this number to help them identify who you are and the type of tax you need to be paying.Geschätzte Lesezeit: 8 min

BZSt

In some regions, passport numbers are also recognized as TIN for foreign individuals. This TIN is automatically allocated at birth or . Hi @KBM, Your TIN (Tax Identification Number) is called a Tax File Number or TFN more commonly here in .

Tax ID and Tax Number in Germany [2024 English Guide]

Financial institutions have to record the name and .The BZSt stores the following data for the identification number of a natural person in accordance with Section 139b (3) German Fiscal Code (AO): Identification number; .The IRS uses more than one type of tax identification number. In this regard, the TIN or South African Identity Number (ID) or the South African Passport Number .A taxpayer identification number (TIN ) in the global sense is a character that identifies an individual or legal entity for tax purposes (tax reporting). They start with the number “9,” and are formatted as 9XX-XX-XXXX. Tax ID numbers include SSN, EIN, and ITIN, each serving as a unique identifier for tax administration purposes. There are several types of Tax Identification Numbers to include an Employer Identification Number (EIN), a social security number (SSN), or an Individual Tax Identification Number (ITIN).A value-added tax identification number or VAT identification number (VATIN) is an identifier used in many countries, including the countries of the European Union, for value-added tax purposes.Key Takeaways: A Tax Identification Number (TIN) is a unique identifier used by tax authorities to track individuals and entities for tax purposes. The definition of “TIN” is a generalized concept that covers various types of figures that can be used when contacting tax authorities.Your TIN (Tax Identification Number) is called a Tax File Number or TFN more commonly here in Aus.In the UK there are principally 4 common types of TINs.This can get quite confusing: tax identification number (TIN), VAT identification number, tax number, eTIN – what is used for what? We’ll clear this all up .85 (Open: Monday – Thursday 08:00-20:00 – Friday 08:00-17:00) Address: Dutch Tax and Customs Administration/Limburg/ Foreign Office .A TIN is a unique number (or combination of letters and numbers) in a specified format issued by a jurisdiction for the purposes of identifying individuals and entities for tax purposes.In the United States it is also known as a Tax Identification Number (TIN) or Federal Taxpayer Identification Number (FTIN).Review the various taxpayer identification numbers (TIN) the IRS uses to administer tax laws.Schlagwörter:Tax Identification NumbersTin NumbersTin Format

UK guide to Tax ID Numbers

Daily limitation of an Employer Identification Number.A taxpayer identification number is a unique 9-digit number assigned to each business for identification purposes.

A TIN, otherwise known as a tax identification number, is a unique number issued to a business, person, or other legal entity.

Taxpayer Identification Number

You will be able to find your NI number on your payslips, your P60, and letters relating to tax, insurance, or benefits. Social security number – SSN.Types of tax identification numbers. The Importance of TINs. Tax identifications are a requirement that all taxpayers must fulfill before listing all their tax information.

UK Company Tax Identification Number (TIN) Guide

These unique nine-digit .UK guide to Tax ID Numbers.Advertiser disclosure. Effective May 21, 2012, to ensure fair and equitable treatment for all taxpayers, the Internal Revenue Service will limit Employer Identification Number (EIN) issuance to . Most helpful reply. In the United States, there are several types of tax identification numbers, each serving a specific purpose. Everything you need to know about a tax number and a Tax ID in Germany.

- Uba 4000 Ebay Kleinanzeigen – Buderus GB 112 Regelung UBA 4000

- Übergroße Menge 6 Buchstaben : l GROSSE MENGE, FÜLLE

- Uapp App Für Windows 10 – YouTube beziehen

- Types Of Steam Engine Parts _ External Combustion Engine

- Twitch Logo Png : Twitch Logo Maker: Erstelle eigene Twitch-Logos

- Types Of Autopsies _ Types of post mortems

- Type O Negative T Shirt : Type O Negative Band Merch

- Übergabezettel Pflege Vorlage | Übergabe in der Pflege / Dienstgespräch Ziele und Ablauf

- Twitch Prime Sub Auf Handy : Twitch Prime verbinden

- Two Oceans Stellenbosch | Two Oceans

- Typescript Return Multiple Values

- Types Of Spore Bacteria , 21+ Spore Forming Bacteria Examples:Detailed Facts Around It