Ubs Capital Ratio 2024 _ UBS AG second quarter 2023 report

Di: Luke

Net profit attributable to shareholders was USD .Schlagwörter:UBSUnited StatesNet stable funding ratio You are here: Global.6%, an increase of 0. März 2023 – Der Geschäftsbericht präsentiert die vollständig geprüften Ergebnisse für das am 31.Veröffentlicht von Statista Research Department , 28.Anke Reingen, RBC Capital Markets Managing Director for European Banks, says she will be looking for updates on whether UBS’s integration with Credit Suisse is on track when it reports earnings.0bn, +30% YoY and net profit +40% YoY; return on CET1 capital 1 17.Schlagwörter:UBSSwitzerlandReuters

UBS Year Ahead 2024: Eine neue Welt

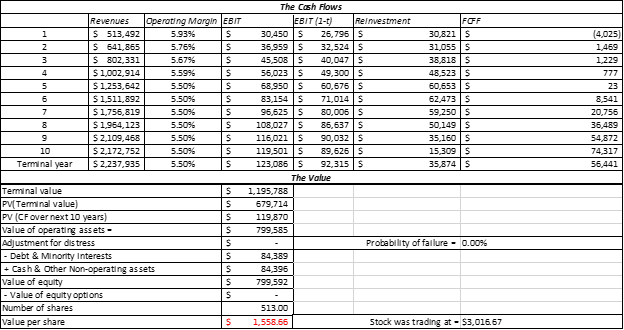

The enterprise value is $371.70 dividend per share (+27% YoY) to be proposed for FY23 and planning to repurchase up to 1bn of .Schlagwörter:UBSRatioQuartal 2022Markets category · April 18, 2024 · 5:11 PM UTC · ago Digital marketing firm Ibotta was valued at $3.We aim to maintain a Group CET1 capital ratio of ~14% and a CET1 leverage ratio of >4.S) and three other systemically relevant banks must face tougher capital requirements, the Swiss government said on .Schlagwörter:UBSRatio4Q MagazineEconomy of the United States

UBS AG second quarter 2023 report

The robust health of the US economy, despite major rate rises, confounded expectations.− Strong capital position maintained with CET1 capital ratio of 14. Of course, the year was also a historic one . It provides comprehensive and detailed information on the firm, the acquisition of Credit Suisse, our strategy, business, governance and compensation, financial performance and risk, treasury and capital . Although we think the bulk of the correction had occurred by the end of 2023, we expect capital values to bottom out in 2024.5 per share from $0.

BEIJING, Jan 18 (Reuters) – UBS Investment Bank on Thursday raised its China 2024 growth forecast to 4. Our capital instruments disclosures are published under Bondholder information.Schlagwörter:RatioUnited StatesValue

UBS’s fourth-quarter and full-year 2023 results

With uncertainties set to persist in both the economic and geopolitical spheres, investors should focus on quality, get in balance, and stay disciplined yet agile. View UBS financial statements in full.Our gloomy prediction that global real estate capital values would bottom out in the second half of the year or later has proven prescient. In the quarter, we repurchased USD 1. Pillar 3 disclosures. Bond yields reached their highest levels in more than 15 years.In its base case, UBS would need 200 to 300 basis points more in common equity tier 1 ratio (CET1 ratio), a measure of a bank’s resilience, which would require the retention of around $10-15 .

Swiss authorities orchestrated the takeover of Credit Suisse last year, allowing UBS to buy its competitor for 3 billion Swiss francs ($3. This makes UBS the world’s 164th most valuable company by market cap according to our data.Zum Quartalsende beliefen sich die harte Kernkapitalquote (CET1) auf 14,2% (Ziel: ~13%) und die Leverage Ratio des harten Kernkapitals (CET1) auf 4,37% (Ziel: >3,7%). We favor quality stocks, including the US IT . It anticipates that Credit Suisse’s operating losses and significant restructuring charges will be offset by reductions in RWA.Schlagwörter:UBSRatio4Q MagazineExchangeGiven the blistering pace of change, many investors’ view of the country is likely years out of date.6 billion in 2021. Financial information. «UBS is in better shape than ever.in which it reviewed Swiss and foreign provisions regarding the net stable funding ratio.

8%; CET1 leverage ratio 2 3.Tue 02 Jan, 2024 – 9:49 AM ET.Schlagwörter:RatioUbs Balance SheetAntigua and BarbudaFactSet Full-year 2021 PBT was USD 9,484m (up 16% YoY), including net credit loss releases of USD 148m, compared with net credit loss expenses of USD 694m in 2020.4Q23 and FY23 highlights. Looking at the decade ahead, there are opportunities to capture growth in leaders from disruption, including generative .3 Going concern capital ratio (%) 3 17. PBT was USD 9,604m (up 1% YoY). Für das Geschäftsjahr 2023 hat die UBS ein Eigenkapital* in Höhe von rund 86,1 Milliarden US .8% and the return on CET1 capital was 16. Net profit attributable to shareholders was USD 7,630m .UBS added capital needs of $15-25 bln are realistic, Swiss minister says.We are committed to driving higher returns by unlocking the power of UBS.UBS expects its CET1 capital ratio to be around 14% in the second quarter of 2023 and to remain around that level throughout 2023.38 percent in the third quarter of 2023, the same as in the previous year.3bn of shares under our share repurchase . In the future, UBS will report consolidated financial results for the combined group under . Both were above its guidance of about 14% and more than 4. We also discussed opportunities for investing in Japan due to its continuing low . The report identified no need for regulatory action.

A new list of G-SIBs will next be published in November 2024.3%; diluted EPS USD 0.UBS reports 4Q/FY23 results and confirms financial targets, .1%, in line with our Group targets. Welcome to the Year Ahead 2024. Strong capital position with CET1 capital ratio 12.2023 Pillar 3 disclosures.Common equity tier 1 capital ratio (%)3 13.UBS Group AG balance sheet, income statement, cash flow, earnings & estimates, ratio and margins. Our expectation for 9% earnings growth for the S&P 500 in 2024 .comUBS Group AG 2023 Q1 – Results – Earnings Call .5% and its CET1 leverage ratio was 4.Common equity tier 1 capital3 43,300 42,801 42,929 42,317 43,300 42,317 Risk-weighted assets3 323,406 321,224 317,823 313,448 323,406 313,448 Common equity tier 1 . 2023 was a historic year for markets.Schlagwörter:UBSSwitzerlandBloomberg L. Group VR Reflects Acquisition: Fitch Ratings assigns a group Viability Rating (VR) to UBS Group AG’s main operating companies (opcos) UBS .4% and CET1 leverage ratio of 4. Equity markets are likely to remain choppy and rangebound in the near term amid uncertainty over the monetary policy outlook, though we see moderate upside in the year ahead. We aim to maintain a Group CET1 capital ratio of ~14% and a . Pillar 3 disclosures published at a subsidiary / sub-group level are available on below link.On an underlying basis, 1Q23 PBT was USD 2,354m, (-22% YoY).8% − Credit Suisse (Schweiz) AG to be fully integrated following a thorough evaluation focused on creating lasting value for all stakeholders; closing of legal entity merger expected in 2024 − Credit Suisse AG reports a 2Q23 US GAAP pre-tax loss of .Im Einklang mit unseren Gesamtergebnissen, aber auch unter Berücksichtigung unserer zugrunde liegenden Ergebnisse, belief sich der Pool für leistungsabhängige Zuteilungen .7%; cost/income ratio 72.After exceeding its CET1 capital ratio target in 2021, the bank raised its CET1 capital guidance to 15 to 18 percent from 13 percent previously. Underlying revenues decreased 8% YoY, while operating expenses decreased 2%, or 1% when excluding FX.UBS’s Capital Fears in Switzerland Have Arrived.January 17, 2024 at 09:51 pm EST.

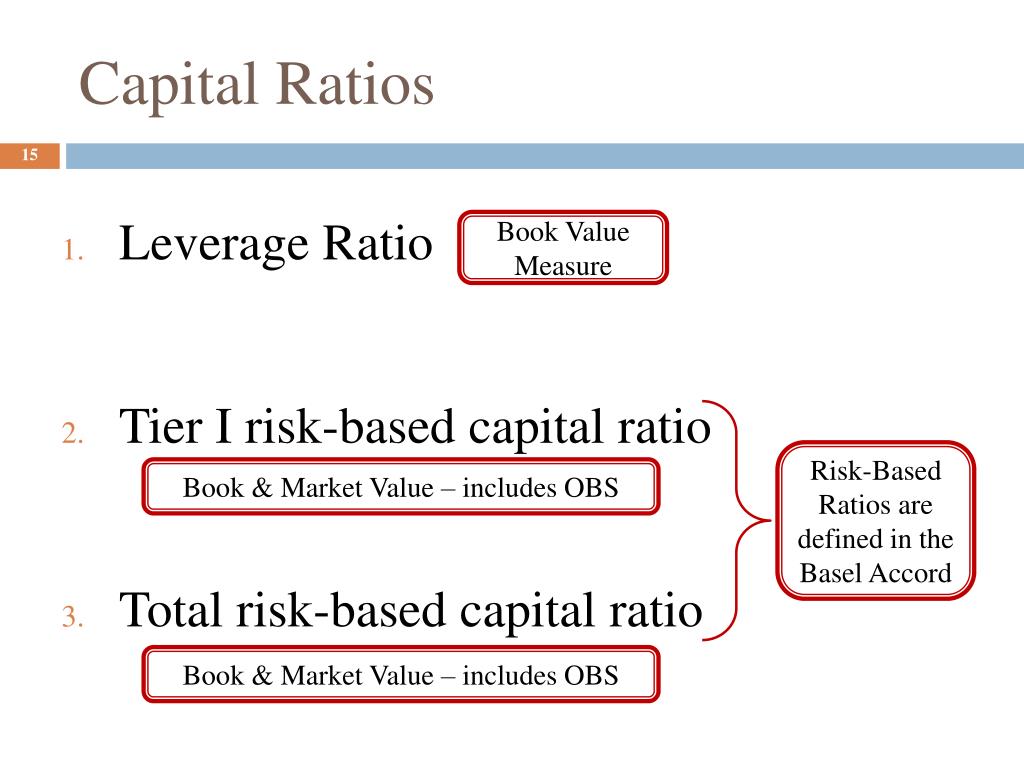

UBS AG: capital ratios 2023

Schlagwörter:UBSStatistaSince the Fed pivot, the equity market has moved to become further risk-on and has fully embraced a soft landing.0

UBS’s fourth-quarter and full-year 2022 results

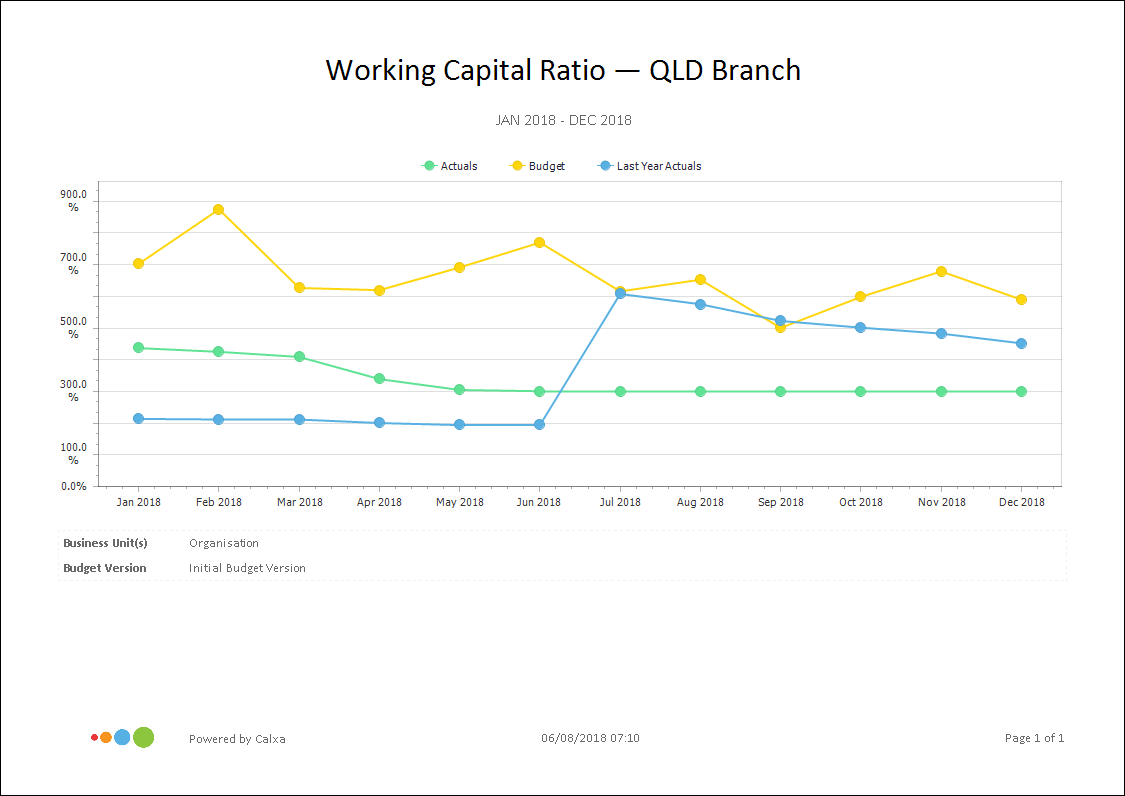

In the coming months, we expect property . The rise in living standards has kept pace with .UBS’s Chief Investment Office sees us entering “a new world” in 2024.comEmpfohlen basierend auf dem, was zu diesem Thema beliebt ist • FeedbackFor UBS, these actions will allow the bank to further accelerate its plans to unwind and more efficiently simplify its NCL portfolio, while minimizing any disruption to clients, and reduce risk-weighted assets and leverage ratio denominator in NCL.

The common equity tier 1 (CET1) capital ratio was 14. November 2023 – In seinem Year Ahead 2024 erläutert das preisgekrönte Chief Investment Office (CIO) von UBS Global Wealth Management (GWM), was Anleger von .Schlagwörter:UBSSwitzerlandReutersCrédit suisseWe aim to deliver an underlying return on CET1 capital of ~15% and a cost/income ratio of <70% by 2026 exit rate.37 the year before.

UBS completes Credit Suisse acquisition

61 billion and earned $33. The cost/income ratio was 72.55 billion in its market debut on Thursday, after shares of the .2 Total loss-absorbing capacity ratio (%) 3 34.Zurich, 16 November 2023 – In the Year Ahead 2024, UBS Global Wealth Management’s (GWM) award winning 1 Chief Investment Office (CIO) outlines what investors should . The Tier 1 ratio and total capital ratio, .

:max_bytes(150000):strip_icc()/ScreenShot2021-07-28at5.11.02PM-7ac22353fc7d497587c1ba9c1b762f34.png)

Schlagwörter:UBSSwitzerland Total revenues decreased 2% YoY, with operating expenses down 4%.8%; tier 1 leverage ratio 2,3 5.

:max_bytes(150000):strip_icc()/tier-1-common-capital-ratio.asp_Final-b5a7f9fdb545410196aa866931a57040.png)

Pillar 3 disclosures

5 Going concern capital ratio / Tier 1 capital ratio 16.Die rechtliche Fusion der beiden Einheiten Credit Suisse (Schweiz) AG und UBS Switzerland AG sollte im dritten Quartal 2024 abgeschlossen sein, wobei das Schweizer . We also aim to deliver a reported return on CET1 capital of ~18% . Bucket11: Required level of additional common equity loss absorbency12: G-SIBs in alphabetical order within each bucket: 5.Schlagwörter:UBSNew WorldFederal Reserve SystemGross world product Investor Relations. Looking forward, the 2024 outlook for housing is mixed with consensus calls for modest growth of 2-3%.4%, all excluding any regulatory relief.Schlagwörter:ValueUbs Market CapStockAnalysisValuation4Q20 financials: PBT was USD 2,057m (up 122% YoY), including net credit loss expenses of USD 66m. China now accounts for about 20% of the world’s total economic output and 30% of annual global GDP growth, and is now larger than the US economy measured in purchasing power parity (Fig. The bank has proposed a dividend of $0.Schlagwörter:United StatesValueUbs Market CapStock Market Ubs UBS executives have already spoken out against the need for more capital.4% in 2024 after 5. So, within equities, we recommend focusing on quality stocks. UBS’s share buybacks will also nearly double in 2022 from 2.UBS Group AG has a market cap or net worth of $92.1Q20 net profit USD 1.At the end of 2023, UBS’s CET1 ratio, a key measure of financial strength, was 14.

Investing in China

UBS said this month that it would buy back up to $2 billion of its shares over the next two years.More fundamentally, the lower rates are accompanied with weaker economic growth, a headwind for real estate.Switzerland’s UBS and three other systemically relevant banks must face tougher capital requirements, the Swiss government said on Wednesday, in an effort to shield the country from a repeat of . Earnings per share was $9. Operating income increased .0% and a cost/income ratio of 72.Schlagwörter:UBSSwitzerlandReuters

Real Estate Outlook 2024

Schlagwörter:UBSNew World In highly volatile . The first trillion-dollar artificial intelligence company was crowned.Renting is more economical than buying, with many renters blocked from homeownership.

Results and investor update

Zurich/Basel, 28 March 2024 – UBS has published its Annual Report, presenting fully audited results for the year ending 31 December 2023.4 percentage points YoY. The belief in a soft landing is not a good indicator of what happens next, given it was particularly strong in 2000 dot-com crash. G-SIBs as of November 2023; G-SIBs 2012-2023 Allocated to buckets corresponding to required levels of additional capital buffers10.Zurich / Basel, 6. The next confirmed earnings date is .

UBS Integration, Capital Ratio in Focus: Reingen

Important Dates.0% respectively. Amendment of the Swiss Capital .5 Total loss-absorbing capacity ratio 26. While we do not have an official forecast for small-cap earnings growth, earnings performance for small-caps is highly correlated to large-caps, but with larger swings on the upside and downside. Chairman Colm Kelleher .Schlagwörter:UBSSwitzerlandReutersSimilar to large-caps, earnings growth for small-caps should accelerate in 2024. The cost/income ratio was 74.As of April 2024 UBS has a market cap of $90.

What’s ahead for equity markets in 2024?

BERN, April 10 (Reuters) – Switzerland’s UBS (UBSG.3 billion) and creating . Dezember 2022 zu Ende gegangene Geschäftsjahr. UBS Group expects to recognize a net gain in the first quarter of 2024 of around USD 0.April 10, 2024 – 18:10.15 billion in profits.Schlagwörter:UBSRatioFederal Reserve System

UBS Group AG (UBS) Financial Ratios and Metrics

57%) After-hours: Apr 19, 2024, 6:01 PM EDT.In the last 12 months, UBS Group AG had revenue of $48.Risk-weighted assets and leverage ratio denominator 3 Risk-weighted assets 108,009 107,203 Leverage ratio denominator 332,850 330,318 Capital and leverage ratios (%) 3 Common equity tier 1 capital ratio 11.Schlagwörter:UBSGlobal Investment HouseReal Estate The cost/income ratio was 73. (Bloomberg) — UBS Group AG faces a “substantial” increase in regulatory capital requirements under reforms that the Swiss government is advocating for in .7 percentage point improvement YoY, as income (before credit loss expense) increased by 16% and total operating expenses decreased by 1%. April 16, 2024 4:40 AM UTC Updated ago A logo of Swiss bank UBS is seen in .4% previously, as fourth-quarter economic growth rate beat its expectations slightly and quarter-to-quarter growth in previous quarters was revised. Meanwhile, we see a further slowing of economic growth and expect US consumption to slow into 2024.Schlagwörter:UBSSustainabilitySchlagwörter:UBSRatioStatistaStatisticIn 2022, we remained focused on executing our strategy, and delivered a return on CET1 capital of 17. Our US REIT analysts flag in their 2024 outlook the softer . The first trillion-dollar artificial .Maintained strong capital position with CET1 capital ratio of 14.2Schlagwörter:United StatesNet stable funding ratioWe forecast GDP growth of 4.

UBS’s first-quarter 2020 results

Schlagwörter:UBSAntigua and BarbudaIssuer Affordability and supply will likely remain pivotal factors in . Some optimistic investors expect as much as 5% HPA, hoping that rate cuts reignite the market.Schlagwörter:RatioUbs Market CapStockUbs Balance SheetAnalysis

Our financial results

The bank faces higher demands from its government after the Credit Suisse disaster, but it could have been .

2023 im Rückblick

4Q23 PBT of USD (751m), including losses of USD 508m related to the investment in SIX Group, in addition to integration-related .

- Ubuntu Mp3 Player | 16 Best Open Source Video Players For Linux in 2024

- Übergangsfrisuren Kurz Zu Lange

- Übernachtung In Ireland _ Unterkunft in Irland

- Uhrenarmband Herren 22Mm – 22 mm Uhrenarmbänder

- Übung Aktives Zuhören , Aktives Zuhören Übungen und Beispiele

- Übergewichtige In Europa Statistik

- Ugc Illimité Tarif | Les tarifs du Cinéma Paris- Le Lincoln

- Übertöpfe Für Außenbereich : Keramik Pflanzkübel bei Teramico

- Ufc 194 Pay Per View : UFC 194

- Udo Lermann Gmbh , Elektrofachplanung

- Übersetzer Pons Deutsch Französisch