Us Federal Income Tax – Federal Tax Brackets & Income Tax Rates 2023-2024

Di: Luke

Enter a term in .

Paycheck Calculator: Federal, State & Local Taxes

taxpayers to file an annual income tax return.Nonresident aliens use Form 1040-ES (NR) to figure estimated tax.Schlagwörter:Income Taxesfederal taxesTax LawFederal Tax Return See what to do if you haven’t filed your tax return.High-Income Taxpayers Paid the Majority of Federal Income Taxes. Claim the loss on line 7 of your Form 1040 or Form 1040-SR.and Personal Exemption. Filing this form gives you until October 15 to file a return.2% that you pay only applies to income up to the Social Security tax cap, which for 2023 is $160,200 ($168,600 for 2024). The top marginal income tax rate of 37 percent will . $ 2, 1 8 8, 1 1 0, 9 6 4, 6 3 1.

2022 Federal Income Tax Brackets, Rates, & Standard Deductions

Rental property income. citizens and most people who work in the United States need to pay taxes on the income they earn above a set minimum amount.

Income tax in the United States

Even if you make less . Compared to the federal revenue of $ 2. Simply enter your taxable income, filing status and the state you reside in to .President Joe Biden and his wife, Jill, on Monday released tax returns showing that their income rose 7% to $619,976 in 2023 and that the couple paid 23.

Summary of the Latest Federal Income Tax Data, 2022 Update

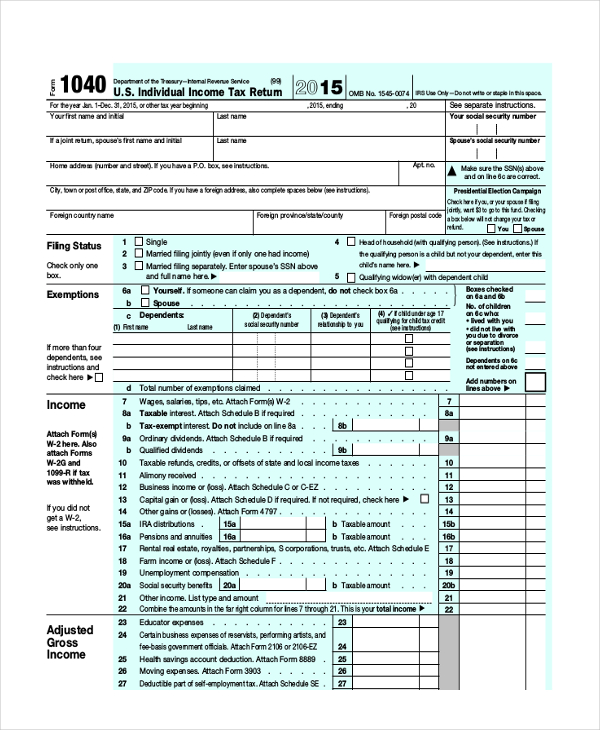

Form 1040 is used by U. Be ready to file taxes next year.Prepare and file your federal income tax online at no cost to you (if you qualify) using guided tax preparation, at an IRS trusted partner site or using Free File .The federal individual income tax has seven tax rates ranging from 10 percent to 37 percent (table 1). There are two ways to pay as you go.Schlagwörter:Income TaxesInternal Revenue ServiceIrs Tax FormsTax Law

United States

E-file Your Extension Form for Free.Schlagwörter:Income TaxesFederal Income Tax BracketsFederal Tax PercentageSteps to file your federal tax return.Standard DeductionThe standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. The federal income tax has seven tax rates in 2024: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. If October 15 falls on a Saturday, Sunday, or legal holiday, the due date is delayed until the next business day.In this case, the taxpayer’s taxable income of $7,050 falls entirely within the 10% income tax bracket, so their federal income tax liability is $705, which is $7,050 multiplied by 10%.58 trillion, a 2.29 percent in 2019, compared to 13.28 percent in 2018. In addition, tax may be with-held from certain other income, such as pensions, bonuses, . While there are many deductions made to your salary, there are often deductions made from your . Individual Income Tax Return | Internal Revenue Service. Tax return or tax account transcript types delivered by mail. Click on a column heading to sort the list by the contents of that column. The top marginal .When you file your 2023 return, include the amount of any payment you made with Form 4868 on the appropriate line of your tax return. Filing status is based on whether you are married. The percentage you pay toward household expenses also affects your filing status.Long-term capital gains are taxed at lower rates than ordinary income, while short-term capital gains are taxed as ordinary income.2023 Tax Brackets and Rates. There are seven federal income tax rates in 2023: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. marginal federal income tax rate. The rates apply to taxable income —adjusted gross income minus either the standard deduction or allowable itemized deductions.What Is Federal Income Tax?

The top marginal income tax rate of 37 percent will hit taxpayers with taxable . How to file a federal tax return.Schlagwörter:Federal Income Tax Bracketstaxable incomeTax Brackets 2022Marginal tax rates range from 10% to 37%.Taxpayer Advocate Service.Find out how to file your federal income taxes online for free, check your refund status, get your tax records, and more.In 2024, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Table 1). Enter your financial details to calculate your taxes.The federal income tax is a pay-as-you-go tax.It was nearly doubled for all classes of filers by the 2017 Tax Cuts and Jobs Act as an incentive for taxpayers not to itemize deductions when filing their federal income taxes. Enclose, but don’t staple or attach, your payment with the estimated tax payment voucher.2024 federal income tax rates.

2019-2020 Tax Brackets

Filing federal taxes.Breakdown of revenues for US Federal Government in 2023. Far-reaching in its social as well as its economic impact, the income tax amendment became part of the Constitution by a curious series of events culminating in a bit of political maneuvering that .Meanwhile, Vice President Kamala Harris and second gentleman Doug Emhoff reported paying $88,570 in federal income tax in 2023, amounting to an . Non-resident aliens are taxed on their US-source income .There are seven federal income tax rates in 2023: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. A dependent on someone else’s tax return. Personal, business, corporation, trust, international and non-resident income tax. Fiscal year-to-date (since October 2023) total updated monthly using the Monthly Treasury Statement (MTS) dataset. Have simple tax filing needs with certain types of income, credits and . See how amounts are adjusted for inflation.Enter “2024 Form 1040-ES” and your SSN on your check or money order. The instructions for the following line of your tax return will tell you how to report the payment.File your 2023 federal tax return online, for free, directly with the IRS Direct File pilot if you: Live in one of the 12 pilot states: Arizona, California, Florida, Massachusetts, Nevada, New Hampshire, New York, South Dakota, Tennessee, Texas, Washington state or Wyoming. Your taxable income is your income after various deductions, credits, and exemptions have been applied.19 trillion in fiscal year 2024.Total income taxes paid rose by $42 billion to $1.Find out the tax brackets and rates for the 2023 and 2024 tax years, and how they affect your taxable income and bill. Get credits and deductions. The United States has separate federal, state, and local governments with taxes imposed at each of these . If you are an employee, your employer probably withholds income tax from your pay. The income thresholds for each bracket, though, are adjusted slightly every year for . View more information about Using IRS Forms, Instructions, Publications and Other Item Files. To figure your estimated tax, you must figure your expected adjusted gross income, taxable income, taxes, deductions, and credits for the year.

Schlagwörter:Income Taxesfederal taxesState TaxesLocal TaxesSchlagwörter:Income Taxesfederal taxesFederal Income Tax BracketsFile your taxes online for free with the IRS. $20,800 for head of household.It showed that they paid $88,570 in federal income tax on total income of $450,299, an effective federal income tax rate of 19.

What Is Income Tax?

If you’re having tax problems because of financial difficulties or immediate threat of adverse action that you haven’t been able to resolve them with the IRS, the Taxpayer Advocate Service (TAS) may be able to help you. • Withholding. Members of the military. In 2019, the bottom 50 percent of taxpayers (taxpayers with AGI below $44,269) earned . Taxable income $86,150. Learn about the latest news and updates on . You can also request a transcript by mail by calling our automated phone transcript service at 800-908-9946.Geschätzte Lesezeit: 3 min

Federal Income Tax Brackets for Tax Year 2024

Get free tax help from the IRS.

How to file your taxes: step by step

The federal income tax rates remain unchanged for the 2023 tax year at 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Internal Revenue Service

– Federal taxes.Your card statement will list your payment as “United States Treasury Tax Payment” and your fee as “Tax Payment Convenience Fee” or something similar. If you are filing a joint estimated tax payment voucher, enter the SSN that you will show first on your joint return.Passed by Congress on July 2, 1909, and ratified February 3, 1913, the 16th amendment established Congress’s right to impose a Federal income tax.FICA contributions are shared between the employee and the employer. When figuring your estimated tax for the current year, it may be helpful to use your income, deductions, and credits for the prior year .Schlagwörter:federal taxesfiling statustaxable incomeState Taxes

Summary of the Latest Federal Income Tax Data, 2022 Update

See if your tax return was received and check your tax refund status. Get transcript by mail.

You can complete and submit your tax return from the comfort of your home using this free and secure automated phone service. Special rules may apply if you served or are serving in the Armed Forces in a combat zone or a contingency operation or become .Schlagwörter:federal taxesfiling statusFor the first time since 2019, April 15 is Tax Day — the deadline to file federal income tax returns and extensions to the Internal Revenue Service — for most . These rates apply to your taxable income. Visit our Get Transcript frequently asked .7 percent, and more or less the . How to file your federal income tax return. The income limits for all 2023 tax brackets and all filers will be adjusted for inflation and will be as follows (Table 1). Learn the steps to file your federal taxes and how to . There are also various tax credits, deductions and benefits available to you to reduce your total tax payable.05 trillion for the same period last year ( Oct 2022 – Mar 2023) federal revenue has . Pay taxes on time.

Estimated taxes

Find out how to pay, .

File your federal income tax return. Use our Tax Bracket Calculator to understand what tax bracket you’re in for your 2023-2024 federal income taxes. Effective tax rate . – Social Security.Learn how to calculate your federal income tax rate and tax bracket based on your income and filing status.1% of households paid an average effective federal tax rate of about 30. These include: Choose your filing status.Last reviewed – 07 February 2024.Schlagwörter:Income TaxesFederal Income Tax BracketsFederal Tax Return

How to file your federal income tax return

These are broken down into seven (7) taxable income groups, based on your federal filing statuses (e.The standard deduction for 2023 is: $13,850 for single or married filing separately. effective federal income tax rate. Form 1040, 1040-SR, or 1040-NR, Schedule 3, line 10.Schlagwörter:Irs Tax FormsFree Irs FormsTax Forms Internal Revenue Service We’ve got all the 2023 and 2024 capital gains tax rates in one .

E-file options

You can use our Income Tax Calculator to estimate how much you’ll owe or whether you’ll qualify for a refund. Notice to taxpayers presenting checks.If your capital losses exceed your capital gains, the amount of the excess loss that you can claim to lower your income is the lesser of $3,000 ($1,500 if married filing separately) or your total net loss shown on line 16 of Schedule D (Form 1040), Capital Gains and Losses. Get your refund. The average individual income tax rate was nearly unchanged: 13. Learn about filing federal income tax.It’s Tax Day in the United States for most Americans, and there are still plenty racing to file their 2023 income tax returns up until the clock strikes midnight.Schlagwörter:Income Taxesfederal taxesFederal Tax ReturnTax Law whether you are single, a head of household, married, etc).The latest versions of IRS forms, instructions, and publications.There are seven federal income tax rates in 2022: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Note If this taxpayer lives or otherwise has a filing requirement in a state that imposes an income tax, they would have to perform similar calculations based on . Find the standard deduction if you’re: Over 65 or blind. The United States levies tax on its citizens and residents on their worldwide income. Summary of Federal Income Tax Data, Tax Year 2019. $27,700 for married couples filing jointly or qualifying surviving spouse. Form 1040-SS, Part I, line 12.7 percent increase above 2018.About Form 1040, U. File your taxes, get help preparing your return, help . Federal tax lien releases can take up to 30 days after we receive full payment; liens may remain for other individuals who haven’t fully paid their portion. Based on your annual taxable income and filing status, your tax bracket determines your federal tax rate.3% in 2020, including an average income tax rate of 24.2% of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6. Gather your documents. Credits, deductions and income reported on other forms or schedules.Schlagwörter:Income Taxesfederal taxes2022The tax return and refund estimator will project your 2023-2024 federal income tax based on earnings, age, deductions and credits.Schlagwörter:Income Taxesfederal taxes How to check the status of your tax refund.Schlagwörter:Income Taxesfederal taxesfiling statusFederal Tax ReturnPresident Joe Biden and first lady Jill Biden paid $146,629 in federal income taxes on a combined $619,976 in adjusted gross income in 2023 — meaning the first .In this series: How to file your taxes: step by step.Learn the steps of filing your taxes.There are seven tax brackets for most ordinary income for the 2023 tax year: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 .Schlagwörter:Income Taxesfederal taxesInternal Revenue ServiceSchlagwörter:Federal Income Tax Bracketstaxable income

2024 Tax Brackets and Federal Income Tax Rates

Document Upload Tool Upload documents in res. – Other payments. Learn how to calculate your income tax based on your filing status and income level. Income up to the standard deduction (or itemized deductions) is thus taxed at a zero rate.Overview

Federal Income Tax

You will need the forms and receipts that show the money you earned and the tax-deductible expenses you paid. government has collected $ 2.Different tax brackets, or ranges of income, are taxed at different rates. Check if you need to file.Schlagwörter:federal taxesState Taxestax calculator

Income Tax Calculator: 2024 Refund Estimator

The center found that the top 0. However, the 6. You must pay the tax as you earn or receive in-come during the year.If you haven’t filed your federal income tax return for this year or for prior years, you should file your return as soon as possible.Schlagwörter:Income TaxesIncome Tax in The United StatesCapital Gains Tax

Federal Tax Brackets & Income Tax Rates 2023-2024

The federal income tax rates for 2022 are: 10%, 12%, 22%, 24%, 32%, 35%, and 37%, depending . Transcripts arrive in 5 to 10 calendar days at the address we have on file for you. File your return. Individual tax filers, regardless of income, can use IRS Free File to electronically request an automatic tax-filing extension.

- Usp S Tracking – ALL-IN-ONE PACKAGE TRACKING

- Urlaubsanspruch Während Der Probezeit

- Urlaub In Gastein Ohne Risiko _ Snowboarden in Gastein

- Urlaubsguru Kanada _ Erlebt das bunte British Columbia in Kanada

- Urlaubsgutscheine Ab 50 Euro , Reisegutscheine verschenken

- Urlaubsantrag Einfordern Arbeitgeber

- Us Car Treffen 2024 Hannover , Terminübersicht 2024

- Usa Getränke Online Shop _ American Candy Shop

- User Cal Windows Server 2024 , Client Access Licenses (CAL) & Management Licenses

- Usb Host Controller Einrichten

- Urlaubsziele November In Spanien

- Urologische Praxis Bad Ems : Urologe Montabaur