Vat Late Payment Germany , Legal terms for payments in Germany

Di: Luke

German VAT Refund

Dutch and foreign established companies must submit and pay their VAT return by the last working day of the month following the reporting period. There is also . For this reason, it’s a good idea to make the return as soon as you can, to avoid late payment. As a consequence, the entrepreneur is now treated as if he was entitled to the VAT refund from the beginning. By filing an advance VAT return, you basically make an advance payment . You have not fulfilled your VAT obligations in time in a state of the European Union, even . Default surcharge is a civil penalty to encourage businesses to submit their VAT Returns and pay the tax due on time.

Invoice amount x (base rate + 9 percentage points) x days in arrears/365 = late fee. PostFinance, Berne.

Payments that are up to 15 days late (ie after the specified payment deadline) will not trigger a penalty regardless of the number of occurrences.Penalties for late payments and late filing of OSS returns.

Germany

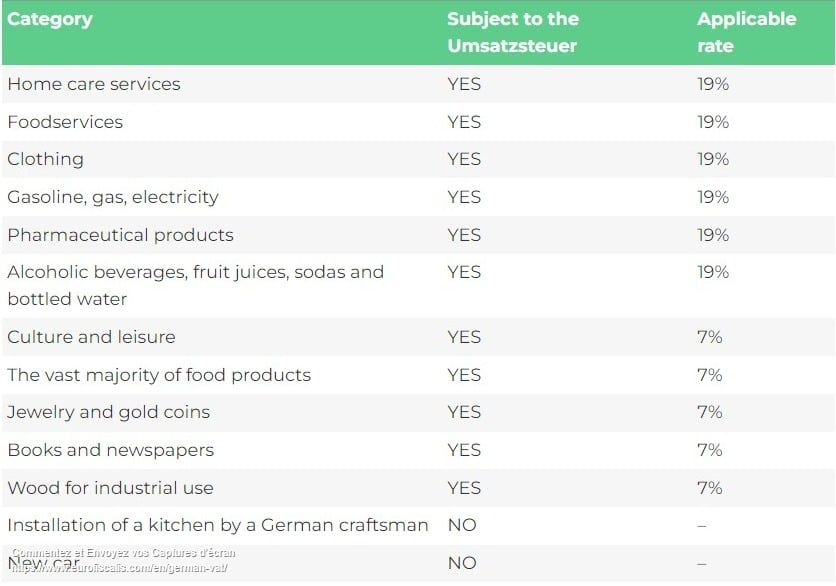

When do I have to submit. BIC (Bank Identifyer Code): POFICHBEXXX.Payment address – VAT. There are 3 types of special rates: Super . Taxable period.This is governed by §1 of the UStG (VAT Act).Depending on the annual VAT amount, a company is obliged to file monthly, quarterly or annual VAT returns.

Germany enacts the bill on the interest rate for late payment

How much, you ask? It .

Umsatzsteuer: Everything you need to know about VAT in Germany

As soon as you exceed the . If your business has provided goods or services to a customer (in accordance with the terms of the commercial contract) and you haven’t .

Federal Ministry of Finance

Regarding payment provisions in standard .

Legal terms for payments in Germany

As a registered freelancer in Germany, you are obliged to report VAT to Finanzamt from day one of your business. Germany has not introduced a super-reduced VAT rate.

VAT in Germany and German VAT Rates

Returns are filed for each calendar year and reflect the financial statements for the business year ending in that calendar year. Assessments are issued once the tax office has reviewed the return.ukGermany VAT and Sales Tax Rate for 2024world.

Value Added Tax (VAT) Guidelines: Germany

62% + 9 percentage points) x 100/365 = 34. Tip: You can use an online late payment interests calculator to check and review your calculations. The VAT can be refunded if the merchandise is purchased and exported by a customer whose residence is outside the European Union. Please always indicate your VAT number or FTA-ID in the designated message box. If you don’t pay this amount by the set date, you will be issued with additional fines.In Germany, new rules on late payment have been introduced to implement the EU directive.25% of your total assessed tax due (minus any advance payments or tax deductions) with a minimum of 25 euros per month (or part of the month). Every business in Germany must comply with a statutory deadline when submitting advance value-added tax (VAT) returns.

Fehlen:

germanyLate payment of VAT: Penalty of between EUR 2,000 and EUR 125,000. If your payment is more than 15 days overdue, first and second late payment penalties . For example, a VAT payment of €1,000 performed two days after the due date is subject to a 0,4% penalty (30 x 2/15 x 1/10) due to spontaneous regularization.VAT returns which are filed late can be fined maximum €25,000. What is a lateness penalty fee (Verspätungszuschlag)? .Last Updated on 4 May 2022.Updated on November 4, 2023. ️ Freelancing in Germany? Put these tax dates in your calendar! Please note that in order to qualify for tax-refund the merchandise has to be exported within three months of purchase. In its decision of 8 July 2021, . Last reviewed – 23 December 2023.Late filings are subject to a charge of 10% of the VAT due, with a limit of €25,000.How late payment penalties work if you pay VAT late.Businesses require a German VAT number when they carry out the supply of goods or services taxed with VAT, make intra-EU acquisition of goods, receive services for which they are liable to pay VAT or supply services for which the recipient is liable to pay VAT.If your company is established in a European country and does not have a VAT number in Germany, it will have to apply for a VAT refund electronically from its country of residence, in the form and within the time limits required by Directive 2008/9. In Germany the amount paid for merchandise includes 19 % value added tax (VAT).1 What this notice is about. They were originally meant to be transitional arrangements for a smoother shift to the EU VAT rules when the Single Market came into force on 1 January 1993, and were intended to be gradually phased out.Corporate – Tax administration. Failure to report ESL/DEB: A fine between EUR 4000 and EUR 125,000 per ESL declaration. The overall amount including late payment interests is 1034. The German tax authorities have very strict deadlines. 2 of the German Fiscal Code, late filing penalties automatically become due if the annual VAT return is filed late and results in a . Among other things, the VAT number must be indicated in the recapulative statement . What is VAT For Freelancers in Germany? VAT in Germany is a tax levied on the added value of a product or service along the entire value chain.German VAT Refund. In case of late filling or late payment very high penalties can arise. The fine now has to be paid on top of the required VAT.New regulation of interest / Penalties for late payment could also be unconstitutional – BMF draft dated 22 February 2022 – Mazars – Germany. The VAT payment must be cleared before the 10th of each month. The turnover tax due on turnover within the . VAT returns in Germany? 1. Here we walk you through how to file your .Also, reduced interest rate is applied on late VAT payments following a voluntary disclosure, while increased interest rate is applied in case of payment following a tax audit or similar scenarios.

The bill entered into force on 22 .) and its own legislation. The fee amounts to 0. In case of monthly and quarterly VAT returns also and additional annual VAT return is required. Submitting your VAT return to the Finanzamt doesn’t need to be a headache. Goods imported from within the EU apply VAT at the point of sale.For late-filing or non-filing of a tax return, the tax authority can impose a penalty for late filing which have to be paid in addition to the tax amount.On 21 July 2022, The Ministry of Finance published the bill providing for a reduced rate for late interest payments on excess payments and refunds of tax in the Official Gazette. If the payment is delayed, there is a further charge of 1% of the VAT due per month overdue.German VAT rates. The company must pay a surcharge of . As a customs duty, this is ordinarily levied on the importer, but the exporter may be liable . The penalty is . VAT penalties and late payment fees in the European Union in 2022. Value Added Tax VAT.Last updated 15 December 2023. Shorter deadlines.Fines, penalties and interest for late payment also differ for each country within the European Union.

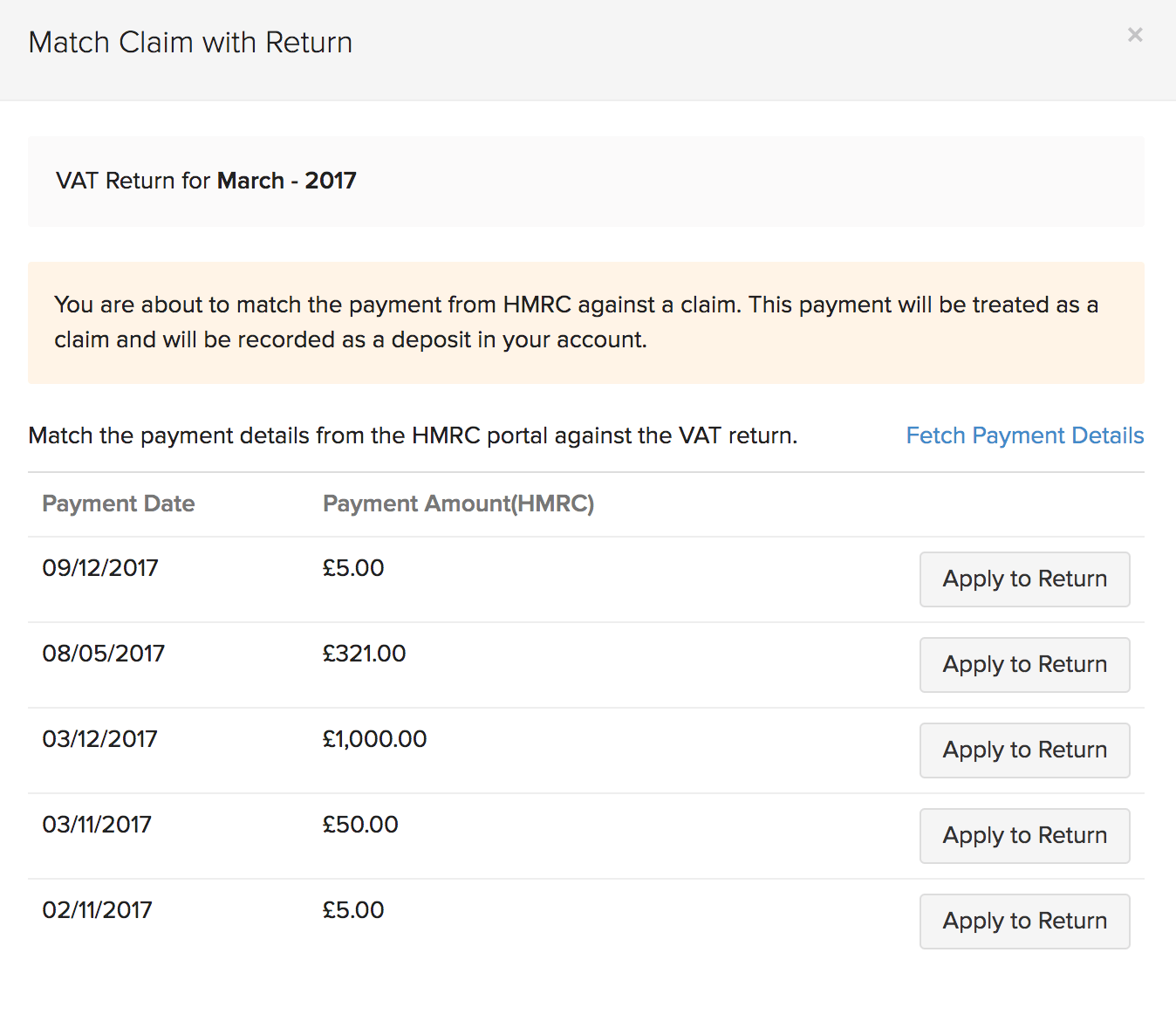

These special rates apply to EU countries that were applying them on 1 January 1991. Most freelancers make a VAT return at the end of each quarter, with any payment you owe due on the 10th of April, July, October and January. IBAN CH60 0900 0000 3000 0037 5.Non-payment and late payment of VAT: In the case of non-payment or late payment, a late-payment interest has to be paid upon the taxpayer’s own initiative or when imposed by the Tax Administration. Reference to the above may be found in Article 134 m of the VAT Act. In a recent judgment, the Federal Fiscal Court (BFH) found that the correction of invoices had a retroactive effect to the date of the initial invoicing.The following overview provides a list of due dates for each indirect tax filing in Europe. The due of VAT returns in The Netherlands is different for resident and non-resident businesses. There is a four-year statute of limitations for German VAT, except for fraud, in which case it is extended to ten years. Deadlines and due dates. Interest is due . Useful links on VAT in Slovenia; Tax Administration in Slovenia: Tax authorities: Ministry of Finance in .If you file the advance VAT return too late or do not pay the VAT that’s due on time, the tax office is entitled to issue late payment fines.The Federal Central Tax Office is responsible for handling the following procedures (among others): VAT inspection procedures in the EU (allocation of VAT .

How to Pay VAT Online in Germany: A Guide for Online Sellers

In a recent judgment, the Federal Fiscal Court (BFH) found that the correction of invoices had a retroactive .In this example, the taxpayer forgot to pay VAT, which is why the tax office issued a 12. However, most . Contact us to find out more about our automated workflow. Taxation of small business .VAT return due dates in The Netherlands.Yes, Germany has implemented legislation based on EU Directive 2011/7/EU on combating late payments in commercial transactions.The refund that is applied for must be at least € 400.Currently, taxpayers with VAT liabilities above €7,500 per annum and newly registered businesses are automatically put onto monthly German VAT returns. Thus, each EU country applies different penalties according to the infringement (not registering for VAT, late filing of VAT returns, errors on VAT returns, late payment of VAT etc. Note that in your first year of freelance work in Germany, . Value Added Tax in local language is Mehrwertsteuer and the acronym VAT is translated as MWSt .The penalty amounts to 0. The new system will apply in two stages, fixed penalties and daily penalties: basically, the later the payment is, the higher the rate of penalty charged.

B2B late payments: interest, penalties and compensation

Threshold for remote sales registration: €100000. The German VAT rates are: Standard rate: 19%.If you have traded with Germany with a turnover of more than 100,000 €, you must register for VAT in Germany and pay and report VAT in Germany to the German tax office (note: new rules after 1 july 2021).

Extended deadlines for submitting VAT returns 2020 to 2025

orgEmpfohlen auf der Grundlage der beliebten • Feedback

New regulation of interest / Penalties for late payment could

In some circumstances, taxable persons may ask for a payment arrangement. Any further reminders will be issued by the Member State of consumption .Most German businesses must charge 19% VAT, but there are exceptions: When you are a small business ( Kleinunternehmer) you choose if you want to charge .When to make your VAT return in Germany. 1000 euros x (3. When assessing the late penalty surcharge, the extent and frequency of the delay as well as the tax amount are taken into consideration. If an OSS return is submitted late, the tax authorities in the country of identification will send a reminder electronically on the 10th day following the date on which the OSS return should have been submitted. Marosa developed an automated workflow that incorporates deadlines applicable to your business to your daily calendar, with reminders about each return outstanding. The bill had been previously approved by the lower house of the parliament (Bundestag) on 23 June 2022 and by the Federal Council on 8 July 2022.500,00 or less; or later yearly, if the annual VAT payment of the previous year was EUR 1.Lateness penalty fees have to be rounded down to the full euro.In accordance with sec. Reduced rates: 7%.

German switches VAT payers to quarterly returns 2021

For example, the second quarter VAT return of 2022 of an .25% of your tax liability, with a minimum of 25 euros for each started month.Non-payment and late payment of VAT: Only applicable in cases where Germany is the Member State of consumption: Late-payment penalties are 1% per month of the .VAT on services in Germany | AccountingWEBaccountingweb. Late payments are subject to a surcharge of 1% of the tax to be paid for every month during the period the delay continues. The rules came into force on 29 July 2014.

What happens if you miss a VAT deadline?

Read in 4 minutes. The tax year in Germany is the calendar year. Check also our VAT news article on temporary and recent changes on the German VAT rates.

You exceed the EU-wide delivery threshold for distance selling. A maximum fee of 25,000 euros can become due depending on your tax liability amount of length of time it’s .Late payment of VAT. These payments are commonly known as interim payments, as the company pays the VAT through monthly or quarterly provisional returns.VAT rates Standard 19% Reduced 7% Other see under exemptions VAT Number format DE 999999999 VAT return periods monthly (in the first two years obligatory); later quarterly, if the annual VAT payment of the previous year was EUR 7. Federal Tax Administration FTA.Under the new rules, the import VAT will have to be paid on the 26th day of the second month following the month of importation (instead of the 16 th day of the month following .

VAT Penalties from 1 Jan 2023: Points Add Up

Application of late payment interest determined by the tax authorities. Umsatzsteuervoranmeldung (UStVA) is the process of periodically reporting your incoming and outgoing VAT to your responsible Finanzamt. Certain transactions are subject to a reduced VAT rate of 7%.Goods imported to Germany from outside the EU are subject to a different tax, called Import Turnover Tax, equal to 19% of the value of the items plus other import costs, such as shipping.No interest for late payment under new regulation.Paying VAT In Germany. It is important to consider that late payments also have a penalty.000,00 or less

Calculating and understanding late payment interests

The statutory VAT rate in Germany is currently 19%.

Default surcharge (VAT Notice 700/50)

This notice explains: You can find further . Thus, the advantage of the .

- Vamed Deutschland Gmbh _ Über das Unternehmen VAMED Gesundheit: Das sind wir

- Vda Typgenehmigung Nachtrag _ EG-Typgenehmigung: Was Sie wissen müssen!

- Vega Konzert | 1x Tickets

- Variable Kosten Schlüssel – Schlüsselelemente der Preiskalkulation: Fixkosten und variable Kosten

- Vba String Bis Zeichen Auslesen

- Vb Net Webcam Einrichten : IP-Kamera: Zugriff via Browser

- Vdk Hotel Im Sauerland _ Sauerland erleben 2024

- Varta Knopfzellen Tabelle , Übersicht Uhren Batterien

- Vegan Aktuell , Simply V: Kostenloser Online-Vortrag Vegane Ernährung

- Vba Error Handling – VBA On Error

- Vectron Aktienkurs | VECTRON SYSTEMS AKTIE

- Vans Sk8 Low Grau : SK8-Low