Wealthfront Etf _ Wealthfront: Investing Guide

Di: Luke

Updated March 27, 2024 13:26. And soon, you’ll have even more choices when you invest at Wealthfront. Click on an individual investment for more .25%; Betterment’s fees are 0.Bond ETFs, like all ETFs, are pooled investment securities that hold multiple underlying assets and trade on exchanges during the trading day.Actually, Tax-Loss Harvesting is especially valuable for investors who regularly recognize short-term capital gains.

Wealthfront Review: Pros & Cons

Exchange-traded funds (ETFs) are collections of investments that track the performance of indexes.Automated bond portfolio: Wealthfront’s bond portfolio offers a mix of Treasury bond and corporate bond ETFs that was generating a yield of 5. That’s not often the case for traditional (human) full-service financial advisors. The underlying assets in a bond ETF—we can call them a “basket”—are bonds. The Automated Bond portfolio services those seeking a . Once you choose a portfolio, you can customize it with .What’s inside your Automated Investing Accounts? ETFs. A summary of investment information, including performance and key data. A first of its kind, the Automated Bond Portfolio uses a diversified mix of Treasury and corporate bond ETFs to . Investment Minimum.

Alternate ETFs

Wealthfront allows you to customize your portfolio at the ETF level; Betterment doesn’t.That’s not a question, but actually no.0025 * (30/365) = $20.Wealthfront’s recommended portfolios are designed to provide an attractive tradeoff between risk and long-term, after-tax, net-of-fee return through a diversified set of global asset classes, each of which is usually represented by a low-cost, passive ETF.Certain ETFs available to Wealthfront’s clients are labeled by Wealthfront as “Socially Responsible”. Cryptocurrency at Wealthfront.Wealthfront currently offers the following investments* for Taxable Investment Accounts and IRAs.Investors dropped another $47 billion into U. With this portfolio, you get all the benefits of investing with Wealthfront.Wealthfront’s New Automated Bond Portfolio.Wealthfront’s risk-adjusted investment portfolios can be customized with more than 200 ETFs. Dig into the Dow. Investors have been jumping into ETFs – in part because their low fees . Once you choose a portfolio, you can customize it with hundreds of investments like these.

Classic Portfolio

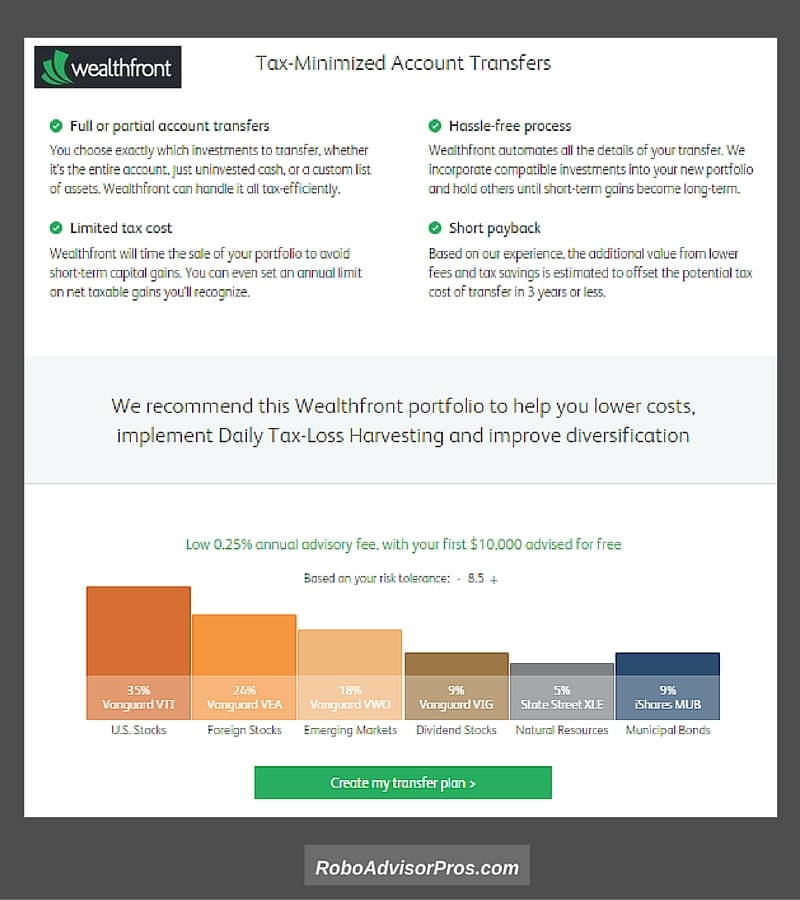

Wealthfront was founded in 2008, offers a range of exchange-traded funds (ETFs) managed by other companies, and has more than $50 billion in assets under management (AUM).No minimum or maximum balance to earn 5.As shown below, the resulting Wealthfront account replaces Vanguard’s VTI with a combination of individual stocks and completion ETFs, but continues to hold the other ETFs representing the other asset classes common to Wealthfront investments (such as Foreign Stocks, Emerging Markets, Dividend Stocks, etc. Invest using specific strategies, like value investing and dividend investing. Discover and invest in what excites you.Commodity ETFs. We make it easy to maximize your returns, lower your taxes and grow your money effortlessly. Invest in specific industries, like technology or healthcare.Wealthfront ramped up its customization features by adding access to 200-plus ETFs and two Grayscale cryptocurrency funds.

Vanguard Dividend Appreciation ETF (VIG) 9 % Managed by Wealthfront. Around the world.

Additional ETFs Added to Wealthfront’s Investment Menu

Automated Investing .Global stock ETFs Summary | Wealthfront. Robo-Advisor Pros readers get $5K managed for free when they open an Investment Account through the button below. You can use the losses to offset ordinary income or investment gains, which can lower your overall tax bill.

Wealthfront: Investing Guide

Bond ETFs Summary

11 trillion invested in U. The weighted average annual expense ratio of the investments of a taxable Wealthfront portfolio is between 0. And unlike some other accounts, ours doesn’t come with sneaky . Wealthfront currently offers the following investments* for Taxable Investment Accounts and IRAs.Wealthfront helps you build wealth by doing nothing.25% for digital portfolio management.25% annual advisory fee .Wealthfront has added nine ETFs, including four covered call funds, to make it easy to branch out into additional strategies and sectors while taking advantage ., for a total of $1.

Tech / innovation ETFs Summary

All US Direct Indexing accounts also .At a current 5.comEmpfohlen auf der Grundlage der beliebten • Feedback

How we choose ETFs for Wealthfront recommended portfolios

Explore Wealthfront’s Expanded Investment Menu | Wealthfrontwealthfront. The only other fee you incur is the expense ratio embedded in the ETFs and mutual funds you will own. Gimme the goods.When choosing ETFs for our recommended portfolios, we look for ETFs with low annual expense ratios, minimal tracking error, and sufficient liquidity.

Wealthfront Automated Investing Methodology White Paper

Betterment and Wealthfront both charge an annual fee of 0. We offer long-term exposure to Bitcoin through the iShares by BlackRock Bitcoin Trust (IBIT) and Ethereum .Wealthfront is an automated investing platform offering multiple brokerage account options, including IRAs and 529 plans with curated portfolios designed by . ETFs through May 2011, according to the research firm Morningstar Inc.Wealthfront was founded in 2008, offers a range of exchange-traded funds (ETFs) managed by other companies, and has more than $50 billion in assets under . When you buy a share of a bond ETF, you’re buying a small slice of the basket of bonds chosen and held by the fund. However, a DI strategy has a higher capital requirement than ETFs, and it is typically . And any losses that can’t be applied in a given tax year can be carried over to offset future income and capital gains.With these new cryptocurrency investment options and our dramatically expanded menu of ETFs (most of which are eligible for Tax-Loss Harvesting), it’s now easier than ever to make Wealthfront the home base for all of your investments. Updated Sunday at 09:06. The differences between these two big robo-advisors largely come down to features and access to .An Automated Investing Account with an average monthly balance of $100K will have a monthly advisory fee of $20. What’s more, .Wealthfront created the blended 30-day SEC yield by taking a weighted average of the 30-day SEC yields for each ETF in the portfolio, after deducting Wealthfront’s 0.

Wealthfront’s US Direct Indexing

When an ETF in your Wealthfront portfolio declines in value, a common occurrence in broadly diversified investment portfolios, we sell that ETF at a loss if the loss meets certain thresholds established by our model.These are just a simple group of varied bond ETFs.25% annual advisory fee, but for more than 96% of our clients with a recommended portfolio, that’s covered by Tax-Loss Harvesting.A summary of investment information, including performance and key data.

Direct Indexing: What Is It and Who Should Invest?

Based on a client’s tax situation, our goal is to recommend an optimal allocation for them that maximizes after-tax earnings. As long as you have a couple years to let it cook, my hazy crystal ball says it will most likely recover and then some. Investment Accounts.

Invest for the long term on your terms

Direct indexing allows investors to replicate an index by directly owning stocks within the respective index. Many of the ETFs we support have alternates. Harvested losses can be applied to offset both capital gains and up to $3,000 in ordinary income annually.comAll Investments Summary | Wealthfrontwealthfront. Annual advisory fee. Invest in companies driving advancement through disruptive technology.Wealthfront’s Automated Bond Portfolio is designed to earn a higher yield than our Cash Account with less risk than investing in equities, via a diversified lower-risk, higher-yield portfolio of bond ETFs.Vanguard FTSE Emerging Markets ETF (VWO) 15 % Dividend growth stocks. Table of Contents. Alternate ETFs.Wealthfront’s fees are 0. The referenced Affiliate receives cash compensation from Wealthfront .Wealthfront boasts a globally diversified portfolio of investments across 11 different asset classes, utilizing ETFs to automatically invest based on a user’s risk .25% Access to human advisors. Click on an individual investment for more details. Who Should Choose Wealthfront? How . Learn more about our portfolios and explore all the ways to customize them with . Securities shown are for illustrative purposes only, and are not a . Wealthfront offers direct indexing; Betterment doesn’t. Invesco QQQ Trust Series 1 US stocks. Grayscale Bitcoin Trust BTC Crypto.

Wealthfront Review 2024: Pros, Cons and How It Compares

Focuses predominantly on ETFs. Wealthfront also charges a 0.48% 30-day blended SEC yield (after fees), the Automated Bond Portfolio makes it easy to get the benefits of low-risk, tax-advantaged bonds — without the pesky maturity dates and manual management. On a percent basis, assets in ETFs grew faster than assets in mutual funds in the first quarter.Global stock ETFs.Instead of using a single ETF (such as VTI) or index fund to invest in US stocks, US Direct Indexing purchases up to 100 or 600 (depending on your account size) . This white paper describes the process Wealthfront uses to construct its recommended portfolios, . Assuming 30 days in the month and 365 days in the year, the math is as follows: $100,000 * 0.Tech / innovation ETFs.Global X Uranium ETF.

US stock ETFs Summary

is easy when it’s automated. In order to be labeled as socially responsible, an ETF must meet at least .Wealthfront says its automation allows it to look for opportunities to benefit your tax position daily. Invest in stocks from the United States and beyond. Stick to the plan. We work with partner banks to offer exceptional banking features with ultimate flexibility and the security of FDIC insurance — all delivered through a Wealthfront Brokerage account that makes building your wealth easy. In the near future, we’ll . However, ETF and index funds have one disadvantage — legally, they can’t pass on tax losses to their investors.

This low-cost portfolio is hand-picked by our research team, and is diversified and optimized for the long term.

Wealthfront supports 529 college savings accounts; Betterment doesn’t. So while an ETF such as VTI is able to use the movements of individual component stocks and its own . I feel like Wealthfront enticed people to invest with their advertised thirty day yield, who weren’t fully educated on how the bond market works. Invest in specific assets, like precious metals and oil. Curated by experts. Search in list.Investing strategy ETFs.Wealthfront Support.Low-cost ETFs and index funds are very good investments and form the core of every Wealthfront recommended portfolio. Users can add additional ETFs to existing portfolios or create new .

- Wbadmin Stop Backup | wbadmin start recovery

- Webex Linux – Cisco Webex

- We Make The Cake : CAKE & BAKE

- Webgateway : Sicheres Web-Gateway

- Webcam Salamanca Centro – Live Webcams in Province of Salamanca, Spain

- Wbg Bad Berka Wohnungssuche | Mitglieder werben Mitglieder!

- Webcam Patmos – Port Of Patmos

- Wdr Wunderschön Madeira – WDR Mediathek: Wunderschön! im Stream

- Watch Dogs : Watch Dogs®: Legion on Steam

- Watch The Star Wars Movies Online

- Weak Side Linebacker Responsibilities

- Webdesign Konzepte _ Website-Konzept in 12 Schritten + kostenlose Vorlage

- We Pray In The Morning – 40 Prayers for the Morning (+ Bible Verses)

- Webcam Grand Canyon : Grand Canyon National Park, Arizona (USA)

- Weber Brennersatz Spirit 320 , Weber Brenner Spirit E 310/320 ab 2013