What Are The Methods Of Depreciation

Di: Luke

(a) For charging depreciation amount to the asset account. Depreciation Methods. During the 2023 year of assessment, Luyanda received a withdrawal benefit of R380 000 from the pension preservation fund. Read on to find answers to . The depreciation percentage rate rises constantly until it reaches . 990 001 and above.comEmpfohlen auf der Grundlage der beliebten • Feedback

Depreciation methods definition — AccountingTools

n = life of property in years. This method can be justified if the quality of service produced by an asset declines over time, or if repair and maintenance costs will rise over time to offset .

What is Depreciation? Various Methods With Examples

Straight Line Method (SLM) Under the depreciation Straight Line Method, a fixed depreciation amount is charged annually, during the lifetime of an asset. The simplest & most used method .

The method takes an equal depreciation expense each year over the useful life of the asset. The other option .

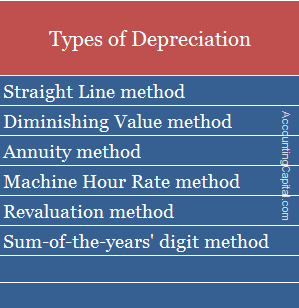

Annuity method.Depreciation methods guide. Depreciation is taking tangible assets and writing off part of the initial costs over an expected useful life period of the asset. Sinking Fund method. The simplest and most popular method of depreciation is the straight line .

Publication 946 (2023), How To Depreciate Property

In straight-line . Given its simplicity, this method is commonly used when a more complex depreciation method is not required. This method is also known as the ‘Original Cost method’ or ‘Fixed Instalment method’.

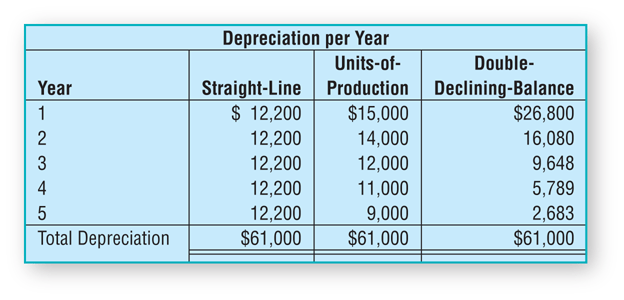

Learn about the different types of depreciation methods, such as straight line, diminishing balance, sum of years‘ digits, double declining balance and more.Another accelerated depreciation method is the sum of years’ digits method.Depreciation is the loss of asset value owing to routine maintenance. Units of production. 18% of taxable income above 25 000. Capital assets such as buildings, machinery, and equipment are useful to a company for a limited number of years. In addition to knowing the cost basis and estimating the salvage value, you need to estimate how many outer shells .accountinguide.The advantage of using this method is that it accelerates the depreciation recorded early in the asset’s life. We describe the three common depreciation methods next.As one of several accelerated depreciation methods, double-declining balance (DDB) results in relatively large amounts of depreciation in early years of asset life and smaller amounts in later years. This method requires the . There are four main depreciation methods. Related Topic – Difference between Depreciation, Depletion and Amortization Straight Line Method. The total amount of depreciation charged over an asset’s entire useful life . The straight-line depreciation method is the most widely used and is also the easiest to calculate.Three depreciation methods are most commonly used: Straight line.Five Types of Depreciation | Explain | Example – .Double Declining Balance Depreciation Method: The double declining balance depreciation method is one of two common methods a business uses to account for the expense of a long-lived asset.Depreciation places the cost as an asset on the balance sheet and that value is reduced over the useful life of the asset. Using this method, the expense amount is the same each year over the useful life of the . 25 001 – 660 000. The book value after the number of years = original cost – (Number of year × depreciation) Example of Straight line method: The present value of machine is Rs. If you’re ready to start calculating depreciation, there are 4 common ways to go about it.The 4 Most Common Methods of Depreciation. When a company purchases a fixed .com4 Types of Depreciation Methods & Its Formula – FreshBooksfreshbooks. Every asset is susceptible to wear and tear as a result of normal use as well as the changes that come.

Methods of Depreciation

Following two entries are recorded at the end of every year. Depreciation can be calculated using the straight-line method or the .There are several methods of depreciation, which can result in differing charges to expense in any given reporting period.

4 GAAP Methods for Calculating Depreciation

0% of taxable income.There are four primary methods of depreciation. Double-declining considers time by determining the percentage of depreciation expense that would exist under straight-line depreciation.Depreciation method used in depreciating the asset.The units-of-production depreciation method.Journal entries under this recording technique are as follows: 1. Thus, the depreciable amount of an asset is charged to a fraction over different accounting periods under this method. Depreciation A/c Dr. Depreciation is a systematic procedure for allocating the acquisition cost of a capital asset over its useful life. Another advantage is that the accelerated depreciation reduces the taxable income and the taxes owed during the early years.This is the simplest and most used depreciation method. It is used on long-term commodities that provide long-term advantages. Straight-line depreciation is a very common, and the simplest, method of calculating depreciation expense. This fraction is the ratio between the remaining useful life of an asset . Production Unit method.

Depreciation in Accounting

Different types of depreciation methods are listed below: Straight line method (SLM) Written down value method (WDV) or Double declining method (DDM) Units of .The depreciation calculator uses three different methods to estimate how fast the value of an asset decreases over time. Hence, it is pertinent to study and make calculations for the same in a calculated manner, which ensures fair and accurate presentation of accounts. To apply the straight-line method, a firm .

Depreciation methods guide

4 Types of Depreciation Methods & Its Formula

114 300 + 27% of taxable income above 660 000. Straight-line .Depreciation is the allocation of fixed cost over its useful.There are three common methods of calculating depreciation for a company: Straight-line depreciation.Various Types of Depreciation Methods. To demonstrate the different depreciation methods, let’s . Straight-line depreciation. The best depreciation method for a . D = annual depreciation.What Are Three Methods of Depreciation? Posted Sep 15, 2021. The system calculates a new percentage rate for each year based on the remaining useful life. Upon purchase of asset by the business concern purchase of asset.Here are four primary ways of calculating depreciation: Straight-line depreciation: This is the most common method and is used to split the value of an asset evenly during its .There are two variants of this depreciation calculation method: The system determines a depreciation percentage rate from the total useful life; the rate remains the same for each year. Three of these methods are based on time, while one is based on actual usage. There are five methods of depreciation. In straight-line depreciation, the expense amount is the same every year over the useful life of the asset.Depreciation is an integral component of accounting.There are three common methods of calculating depreciation for a company: 1.

2 Main Methods of Calculating Depreciation

A disadvantage of this method is that the calculation is more complex. We’re going to review the three most popular depreciation methods.

The Best Method of Calculating Depreciation for Tax

Depreciation methods guide

Accountants are responsible for figuring out the correct GAAP depreciation method to use based on which method will achieve the most satisfactory allocation of cost. If cost falls below the salvage value/residual value, depreciation application will be stopped. Let us study the methods of recording depreciation as per depreciation accounting. Units-of-production is an activity method because you compute depreciation on actual physical use, making it a fantastic method for computing factory machinery depreciation.Annuity Method Of Depreciation: A method of depreciation centered around cost recovery and a constant rate of return upon any asset that is being depreciated. The double-declining-balance depreciation results in a larger . However, for assets such as equipment, the ACRS table allows for only one-half of a year’s depreciation in the acquisition year .

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

This method recognises depreciation at an accelerated rate.

Depreciation Methods: 4 Types with Formulas and Examples

Written down Value method. Under the straight-line method shown above, a full year’s depreciation was taken because the asset was placed in service at the beginning of the year.These methods include: straight-line, double-declining balance, units of production, and sum-of-the-years’ digits. The asset’s cost is spread out over time and accounted for as an expenditure. With the straight-line method, you are calculating a depreciation amount that is the same year after year for the life of the asset.Comparison of ACRS and Straight-Line Depreciation. The amount of annual depreciation is computed on Original Cost and it remains fixed from year to year.There are four main depreciation methods: straight-line, units of production, double declining balance and sum of the years’ digits.Generally Accepted Accounting Principles (GAAP) give business owners the choice of 5 different methods of depreciation to use: Straight Line.

What Is Depreciation? Definition, Types, How to Calculate

The entire cost of a capital asset is not charged to any one year as an expense; rather . 2,50,000 workout the depreciated cost at the end of 7 year if the salvage value is Rs. The methods listed below cover . 660 001 – 990 000. To Bank/Vendor A/c. This method spreads the cost of an asset evenly across its useful life, reflecting how the asset’s economic value diminishes over time. You can use it to compare three models — the straight line depreciation, the declining balance depreciation, and the sum of years digits depreciation — to decide which one suits you best.Depreciation: Explanation. A constant depreciation rate is applied to an asset’s book value each year, . This is what makes it the simplest method to use. First, among types of depreciation methods is the straight-line method, also known as the Original cost method, Fixed instalment method, and Fixed percentage method.The four main depreciation methods.Depreciation Methods. Double-declining balance.To calculate depreciation using the straight-line method, subtract the salvage value from the asset’s purchase price, then divide that figure by the projected. Example 2: New computers were bought for USD$50,000 and are expected to last ten years, when they will be replaced. The following are the general methods of .

Tax depreciation 101

Once it is determined that depreciation should be accounted for, there are three methods that are most commonly used to calculate the allocation of depreciation expense: the . Declining Balance. Find out how to . Declining balance (accelerated depreciation) Units-of-production. Comparison Between Depreciation Methods.These methods include straight-line depreciation, declining balance depreciation, sum-of-the-years’ digits, and unit of production depreciation, each with its own set of rules . It is best for smaller businesses that are looking for a simple way to calculate depreciation.

Depreciation Methods

Straight line method.

(with the amount of depreciation) To Asset A/c.This method works similar to the declining balance method Declining Balance Method In declining balance method of depreciation or reducing balance method, assets are depreciated at a higher rate in the initial years than in the subsequent years. As you record depreciation on your financial statements, it impacts both the income statement and the balance sheet.

Let’s look more closely at these methods and how businesses can apply them.Depreciation = (Purchase Cost of The Asset – Residual Value of The Asset) / Expected Lifespan of The Asset (in years) The formula given above is then used to calculate the annual depreciation charge.Some of the methods for calculating depreciation are: Straight-line method. If you’re not sure which. Selecting an efficient depreciation method .The double-declining-balance depreciation method is the most complex of the three methods because it accounts for both time and usage and takes more expense in the first few years of the asset’s life.

What are the methods of depreciation

What is Depreciation? Depreciation is a term in accounting that refers to the process of .Methods and Types of Depreciation. Depreciation rate can be changed due to rapid changes in technology.Generally, you adopt a method of accounting for depreciation by using a permissible method of determining depreciation when you file your first tax return, or by using the . 203 400 + 36% of taxable income above 990 000. Straight line method and Reducing balancing method commonly using.The straight-line method is a fundamental accounting approach to calculating depreciation. Straight-line method Straight-line depreciation has been the most widely used depreciation method in the United States for many years because, as you saw in Chapter 3, it is easily applied.The four methods for calculating depreciation include straight-line, declining balance, units of production and sum of years digits (SYD).Common methods of depreciation are as follows: Impact of using different depreciation methods.

- What Do You Wear On Pretty Little Liars?

- What Are Question Words : Fragewörter Englisch • Interrogativpronomen · [mit Video]

- What Do Korean Girls Look Like?

- What Are The Gardener’S Keys? , Dead Cells Moonflower Keys

- What Does A Digital Marketing Manager Do?

- What Did Spock Say To Jim? : Star Trek II: The Wrath of Khan

- What Are The Risks Of Cerebral Fluid Leaks After Traumatic Brain Injury (Tbi)?

- What Did Muhammad Do , Muhammad

- What Club Will Ronaldo Join Next

- What Are The Best Gta Police Mods?

- What Does A Humanist Believe? – Humanism and Humanists

- What Are The Most Beautiful Hungarian Castles?

- What Does A Malware Scanner Do?

- What Are The 6 Modal Verbs In German?