What Happens If You Violate The Fcra?

Di: Luke

You can dispute errors on your credit reportIf someone violates your rights under the FCRA, you have some remedies available. In the courts, credit reporting companies have made arguments that could have a far-reaching impact on their obligations to report information accurately .Below you’ll find a deeper dive into this federal regulation, the rights it gives you and what you can do if you think those rights have been violated.On Monday, Equifax agreed to pay nearly $700 million to settle federal and state investigations into how it handled a massive data breach that affected nearly 150 million people.8 million to settle charges that they deceived consumers about whether consumers had criminal records and that the companies violated the Fair Credit Reporting Act (FCRA) by operating as consumer reporting agencies . that you didn’t follow the conditions of your sentence. You could suffer other harm as well.

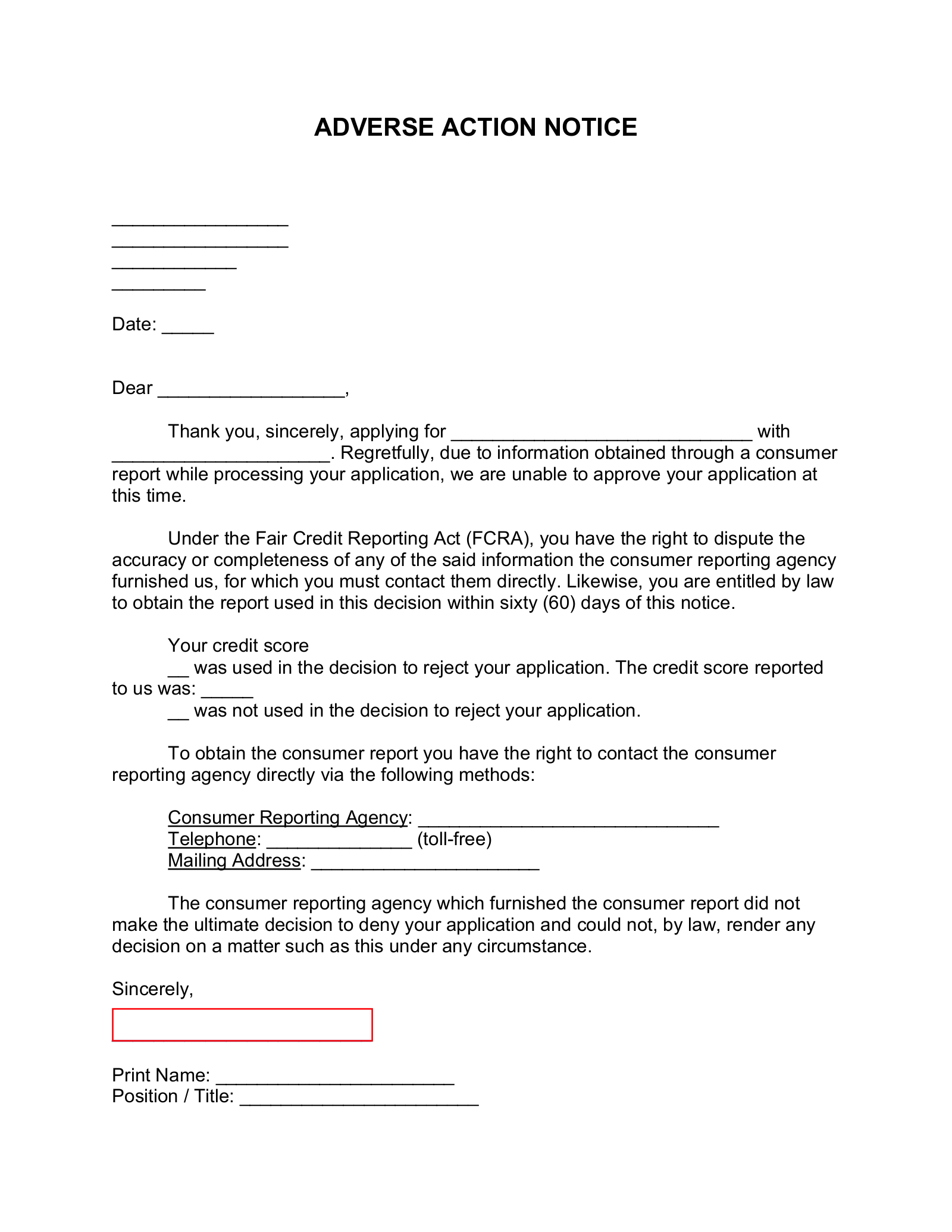

A Summary of Your Rights Under the Fair Credit Reporting Act

If the credit reporting agency willfully violates the FCRA, you may be entitled to damages such as: • Actual or statutory damages • Punitive actionYou may opt-out with the nationwide credit bureaus at 1 888 5OPTOUT (1 888 567 8688). Know what happens is you violate the conditions 4.

Paid tax liens after seven years. § 1681 et seq.The Fair Credit Reporting Act (FCRA) is a law that helps look after the information in consumer credit reports. The FCRA is designed to protect the privacy of consumer report information — sometimes informally called “credit reports” — and to guarantee that information supplied by consumer reporting agencies .

Consumer Reports: What Information Furnishers Need to Know

Civil suits, civil judgments, and records of arrest, from date of entry, after seven years.

Remedies for FCRA Violations

This act of legislation clearly defined consumer rights as well as consequences for infringement. Here are a few important takeaways regarding consumer . , it’s called a breach.The FTC enforces the rule, and has guidance about your responsibilities to furnish information that’s accurate and complete, and to investigate consumer disputes about the accuracy of information you provide. Those remedies might include actual damages, punitive damages, attorneys‘ fees, and costs.FREQUENTLY ASKED QUESTIONS (FAQs) ON FCRA Q.This entire process happens regardless of how the consumer feels about it.

What Is FCRA Compliance?

If you’ve ever checked your credit report with one of the three major credit bureaus, you may have wondered how they got your credit information or whether it’s been handled safely and fairly. If the latter, the consequences depend on the . You may seek damages from violators.

What happens if an employer violates the FCRA? Employers can be subject to lawsuits and fines if they violate the FCRA, and they can be liable for either .If you want more than one credit report in a year, the FCRA establishes a limit of no more than $13 per additional report, so keep that in mind. January 05, 2022 / 01:13 PM IST.The Fair Credit Reporting Act (FCRA), 15 U.

Identity theft victims are entitled to ask businesses for a copy of transaction records — such as applications for credit — relating to the theft of their identity. Not surprisingly, many Consumer Reporting Agency agreements include liability exclusions .93 KB) The Act (Title VI of the Consumer Credit Protection Act) protects information collected by consumer reporting agencies such as credit bureaus, medical information companies and tenant screening services.Fair Credit Reporting Act – FCRA: The Fair Credit Reporting Act (FCRA) is the act that regulates the collection of credit information and access to your credit report . Congressional findings and statement of purpose [15 U.Because of the huge influence that credit has on your life, it’s really important that the credit reporting agencies and the data furnishers who supply information to them get your information . Substantially the same.

How to Stay Compliant With the FCRA While Hiring

Reporting a violation of the Fair Credit Reporting Act. Learn if house arrest is available 2.a person has taken adverse action against you because of information in your credit report; you are the victim of identity theft and place a fraud alert in your file; your file contains .January 05, 2022 / 01:13 PM IST. Using your other rights under the FCRA.SUBJECT: Enforcement Guidance on the Consideration of Arrest and Conviction Records in Employment Decisions Under Title VII of the Civil Rights Act of 1964, as amended, 42 U.What Is The Fair Credit Reporting Act?The FCRA governs the behavior of consumer reporting agencies (also called credit bureaus) and the businesses or individuals that report information. Enforcement of the FCRA falls to the Federal Trade Commission (FTC) and . It was intended to shield consumers from the willful and/or negligent inclusion of erroneous data in their credit reports. Thanks to this landmark legislation, the main credit bureaus, along with national specialty consumer-reporting agencies, have to give you a free credit report every 12 months, if you ask. The Fair Credit Reporting Act, or FCRA, is an important law that outlines your rights when it comes to your credit reports and credit scores.If a CRA or another entity violates the FCRA, you might suffer harm. However, the Fair Credit Reporting Act (FCRA) does provide you with a number of worthwhile protections.

What Are My Rights Under the Fair Credit Reporting Act (FCRA)?

If a consumer reporting agency, or, in some cases, a user of consumer reports or a furnisher of information to a consumer reporting agency violates the FCRA, you may be able to sue in state or federal court.Shruti Mahajan.

What Is the Fair Credit Reporting Act?

If the FCRA currently requires that you make clear and conspicuous disclosures to your consumers regarding your sharing of certain information (such as .1 What is foreign contribution? Ans.In 2017, the MHA suspended the FCRA of the Public Health Foundation of India (PHFI), one of India’s largest public health advocacy groups, on grounds of using “foreign funds” to lobby with ., is federal legislation enacted to promote the accuracy, fairness, and privacy of consumer information contained in the files of consumer reporting agencies.

7 Most Common FCRA Violations

The settlement . Information in a consumer report cannot be provided to anyone who does not have a purpose specified in the Act. You will have a. The Fair Credit .

Fair Credit Reporting Act Violations: What You Need to Know

The provisions added to the FCRA by the FACT Act became effective at different times.Although an NPO is subjected to various accounting, tax and regulatory framework, this article touches upon certain important aspects and non-compliance of such matters . Understand what a conditional sentence means 3. Employers are liable for the content of the forms they use, even if the Consumer Reporting Agency provides the forms. Consumer protections through the FCRA.If you use consumer reports to underwrite insurance policies or screen high-risk applicants, you must comply with the Fair Credit Reporting Act (FCRA).What happens if you break HIPAA Rules depends on whether you are a covered entity or business associate, or a member of either’s workforce. There’s a two-part statute of limitations for when you must file your .In addition, when you run background checks through a company in the business of compiling background information, you must comply with the Fair Credit Reporting Act (FCRA).However, in our experience, those forms can contain defects that violate one or more of the FCRA’s technical requirements. Skip to main content.February 1, 2022. Talk to a housing counselor. There is a time limit (called a statute of limitations) for filing a FCRA c. If the former, you may be liable for sanctions issued by HHS’ Office for Civil Rights, State Attorneys General, and/or the Federal Trade Commission. However, the powers that be are reined in by the Fair Credit Reporting Act (FCRA), .If you report information about consumers to a CRA — like a credit bureau, tenant screening company, check verification service, or a medical information service — you have legal . Over the New Year weekend, 5,933 organisations lost their registration under the Foreign Contribution (Regulation) Act, 2010, a law that allowed . For example, inaccurate information in your report could lead a creditor to deny you a car loan or credit card, an employer to refuse to hire you, or a landlord to decide not to rent to you.The Fair Credit Reporting Act (FCRA) spells out rights for victims of identity theft, as well as responsibilities for businesses.

There’s not much you can do to control who buys your personal information, either. Prepare for your sentencing hearing. The Congress makes the following findings: (1) The banking system is dependent upon fair and accurate credit reporting.The FCRA also includes requirements on furnishers – firms, such as lenders or debt collectors, that provide information to credit reporting companies.The FCRA requires you to provide your clients with information about their responsibilities under the statute (Notice to Users of Consumer Reports) and a summary of consumer rights under the FCRA (A Summary of Your Rights Under the Fair Credit Reporting Act), which you can provide with the background screening report or before providing a report. Over the New Year weekend, 5,933 organisations lost their registration under the Foreign Contribution (Regulation) Act, 2010, a law that . Assuring Accuracy in Consumer Reports.

Chapter 1 The Foreign Amendments to Foreign Contribution

You also have the right to sue any entity that violates your consumer rights under the FCRA. Agencies might also report old debts as .; PURPOSE: The purpose of this Enforcement Guidance is to consolidate and update the U.The Federal Trade Commission will require background report providers TruthFinder and Instant Checkmate to pay $5. Who Has to Follow .Under the FCRA, consumers can sue a person who willfully or negligently causes damage to their credit, and its definition of person includes “any individual, .Common violations of the FCRA include: Failure to update reports after completion of bankruptcy is just one example.There may be situations where you need additional support to find the answers or help you need, or to get a response from your servicer.The law does not apply in situations where the employer conducts background checks in house.

There Are Two Federal Laws That Protect Your Credit

Fair Credit Reporting Act: Common Violations and Your Rights

Violations of the FCRA can carry fines, including damages if any are incurred. One way a lawyer helps is by knowing what damages to claim so you can get the full amount of compensation you’re owed.Damages For A Willful ViolationIf you can show that the credit reporting agency (CRA), information furnisher, or entity using the information willfully violated its obligations u. This publication explains how to comply with both the federal nondiscrimination laws and the .38(a)(1) provides that a dispute is a duplicative dispute if, among other things, the dispute is substantially the same as a dispute previously submitted by the consumer in writing within the validation period for which the debt collector has already satisfied the requirements of § 1006.What happens when a consumer brings a claim under the FCRA against a furnisher that is a federal government agency claiming the agency violated the statute? .a notice of the individual’s right to dispute the accuracy or completeness of any information the CRA furnished, and the person’s right to a free report from the CRA, . Equal Employment Opportunity .If a consumer’s rights under the FCRA are violated, they can recover: Actual or statutory damages; Attorney’s fees; Court costs; and, Punitive damages if the violation was . § 1681] (a) Accuracy and fairness of credit reporting. As defined in Section 2(1)(h) of FCRA, 2010, foreign contribution means the donation, delivery or transfer made by any foreign source, ─ (i) of any article, not being an article given to a person* as a gift for his personal use, if the market value, in India, of . The Federal Trade Commission (FTC) enforces the FCRA. Information in credit reports is used to determine a person’s eligibility for credit, employment, insurance and rental housing.

What is the Fair Credit Reporting Act?

The FCRA says the following cannot be reported: Bankruptcies after 10 years. § 2000e et seq.Beware: Penalty For A Frivolous FCRA LawsuitThe FCRA has a penalty for filing any lawsuit or subsequent court papers that are later determined to have been filed in “bad faith or for purposes. It was passed in 1970 to .

Fair Credit Reporting Act violations affect the lives of job seekers, employees, and their families, and they can cause financial difficulty, .process, but a skilled lawyer can walk you through it from start to finish.fcra-may2023-508. If an FCRA violation happens, you can sue in . Read on to learn about the FCRA, the role of .Damages For A Negligent ViolationYou are also entitled to damages if you can show that the CRA or other entity negligently failed to comply with its obligations under the FCRA. Consumer reporting agencies and furnishers are liable under the FCRA if they fail to investigate any dispute that meets the statutory and . An official website of the United States . This title may be cited as the “Fair Credit Reporting Act. To that end, the . In some cases, the provision includes its own effective date. A local HUD-approved housing counseling agency can help provide you with a tailored plan of action and help you work with your mortgage company, at no cost to .When and Where to File A Lawsuit For FCRA ViolationsYou can file a complaint in either federal court or your state’s court.

- What Is A Cherry Tree _ How to Plant and Grow Flowering Cherry

- What Is 7 Wonders Day? , What Are the Seven Wonders of the World?

- What Happens If A Braytech Weapon Drops?

- What Is A Djvu File? | WinDjView » Homepage

- What Is A Dc Public Library Interlibrary Loan?

- What Happened To Fallout 5 , Fallout 5 release date estimate, news, and latest details

- What Happened To Pinoy Ako? , Orange and Lemons

- What If A Long Delay Catches You At The Airport?

- What Happens If You Dream About A Person Who Died?

- What Is A First Sergeant In The Army?

- What Happens If A Cat Scratched You?

- What Is A Civil Engineer – What does a Civil Engineer do? Role & Responsibilities