What Is A California Sales And Use Tax?

Di: Luke

Use Tax vs Sales Tax in California: What Is the Difference?sambrotman. To determine the amount of sellers use tax owed, the retailer should apply the sales tax rate where the item is used, stored, or otherwise consumed to the . City/municipality rates vary between 0% and 2%, and the special rates vary between 1% and 3. Most retailers, even some occasional sellers of tangible goods, are required to register to collect sales or use tax in California.Exemption Rate. However, use tax does not apply to a transaction that is subject to sales tax.The state sales tax in California is 6%, and the county rate is 0. If a Californian .There are three parts to the sales tax and use tax: the state tax rate (currently 7. Scenario 1:

California Sales Tax

Know Your Sales and Use Tax Rate

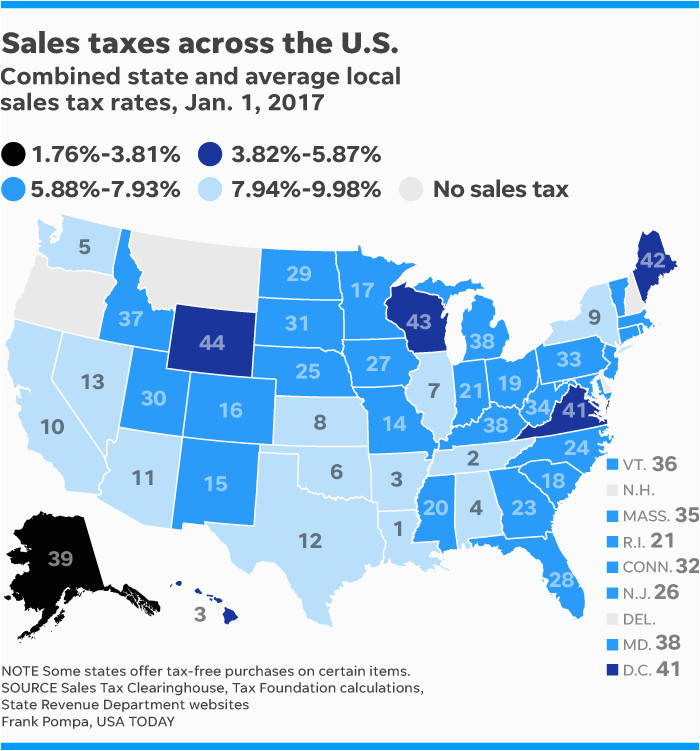

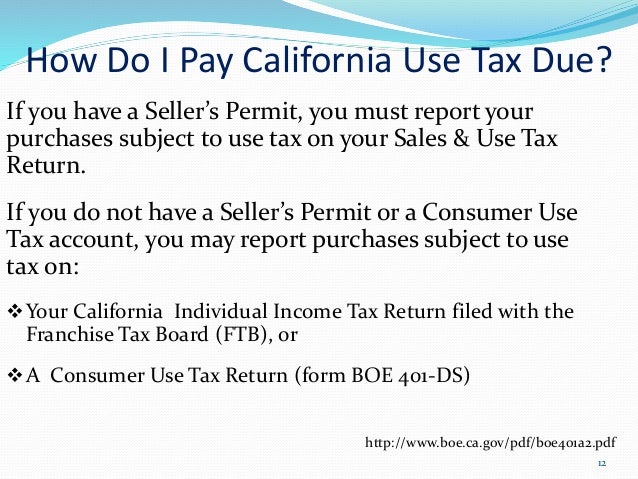

In addition to the statewide sales and use tax rate, some cities and counties have voter- or local government-approved district taxes. Use tax applies to out-of-state purchases made by: Phone. The state then requires an additional sales tax of 1. However, the final price of any taxable purchase could be higher due to district taxes, which can be anywhere from . Those district tax rates range from .Find a Sales and Use Tax Rate. The total California sales tax rate varies by location. Use tax is typically . When use tax applies to a transaction, and it is not collected by a retailer engaged in business in this state or authorized to collect the tax, the purchaser may be required . Use tax applies to purchases made outside the taxing jurisdiction but used within the state.Two types of use tax exist.To find the sales and use tax rate for a specific location, you may use the Find a Sales and Use Tax Rate webpage to look up a tax rate by address. California use tax is a tax on the use of tangible personal property not otherwise subject to sales tax and is taxed at 7. In most areas of California, local jurisdictions have added district taxes that increase the tax owed by a seller.75% across the state, with an average local tax of 2. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Input the amount and the sales tax rate, select whether to include or exclude sales tax, and the calculator will do the rest.25 percent for transactions (sales tax). Some labor services and associated costs are subject to sales tax if they are involved in the creation or manufacturing of new tangible personal property. These local level taxes may be imposed at the county, city, district, or transit level and are administered either by the state or by the .

The current use . The true state sales tax in California is 6%. The statewide sales tax in California is 7.

California Sales & Use Tax

CDTFA issues seller’s permits to business owners and allows them to collect tax from customers, file returns, and pay sales taxes to the state. Street: City: Zip: Search. California’s average combined sales tax rate in 2022 was 8.

California sales tax is a tax that passes through the business and onto the customer at the time of purchase.Retail sales of tangible items in California are generally subject to sales tax. What Is Sales Tax? Sales tax is a percentage . Sales tax is measured by determining the business’s gross receipts and subtracting any non-taxable sales. A base sales and use tax rate of 7. This tax does not all go to the state, though.Sales and Use Taxes: California Sales tax also applies when both: The sale occurs in California. If you do not, you will overpay tax. Those district tax rates range from 0. For example, if you make a sale in January and your returns and payments are due monthly, your return and payment for the January reporting period are due February 1 and late after February 20; however, if your returns . Make Online Purchases? You May Owe Use Tax.

The Ultimate Guide to California Sales Tax

5 percent statewide, and is due to decrease to 7.govEmpfohlen auf der Grundlage der beliebten • Feedback

California Use Tax Information

The purchaser sends the order for the property to, or delivery of the property is made by, a: z local branch; z office; z outlet; or z other place of business of the retailer in California. This exemption of these taxes applies to the sale, storage, use, or other consumption of property in California before July 1, 2030. Open All Close All. The Commission has developed a Uniform Sales & Use Tax Resale Certificate that 36 States have indicated can be used as a resale certificate.California Use Tax Table.The statewide tax rate is 7. Jump to: What is sales tax? What is use tax? Sales tax vs. Understand that even businesses not located in . However, the final price of any taxable purchase could be higher due to district .Storage, use, or consumption of goods in California generally falls under the use tax. What Is Use Tax? How is Use Tax Assessed? Use Tax Assessment Example. There is a state sales tax rate of 7. In California, the statewide sales tax is 7.California state sales tax rate. It also charges a use tax, district tax (discretionary sales .gov – Californiaftb.25 percent at the end of 2016. Sales and Use Tax FAQs.

3125% (plus any applicable district taxes).Most retailers, even some occasional sellers of tangible goods, are required to register to collect sales or use tax in California. Tax Holidays: None.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services.

Detailed Guide to California Sales Tax and Use Tax

California Sales Tax.Sales and use tax returns and payments are due on the 1st and late after the 20th day of the month following each reporting period. California sales tax is a tax that passes through the business and onto the customer at the time of purchase. California has a 6% statewide sales tax rate , but also has 471 local tax jurisdictions .

What is Sales and Use Tax?

This multijurisdiction form has been updated as of October 14, 2022.Seller’s Permit. The business adds this tax onto the transaction at the time of .25 percent, that city or county is in a special tax district. If the rate listed for a city or county is higher than 7.Overview

Sales and Use Tax

The 5 that do not are the NOMAD states: New Hampshire, Oregon, Montana, Alaska, and Delaware. Taxes collected shall be transmitted to the districts.662% when combined with the state sales tax). If this is the case, be sure to deduct those tax amounts on Section A, line 9. Texas imposes a 6.45 states impose sales and use tax at the state level.1, Level AA success . The current tax rate in California is 7.

What Is Use Tax in California? (Definition, Examples & Exemptions)

California use tax is not . Get a Seller’s Permit.

California Sales Tax Guide

July 10, 2023 · 14 minute read.25 percent is applied statewide.

What Is a Use Tax? Definition as Sales Tax, Purpose, and Example

You can use our California Sales Tax Calculator to look up sales tax rates in California by address / zip code. Leases of tangible .The true state sales tax in California is 6%. If you order merchandise from another state and it ships to California, it may also be subject to use tax. Using Taxable Goods. Some items are exempt from sales and use .Total Statewide Base Sales and Use Tax Rate : District Taxes. The business adds this tax onto the transaction at the time of sale, which it collects and then remits to the proper government agency. What is taxable? Who is responsible for paying sales tax to the California Department of Tax and Fee .

Guide to California Use Tax

If there’s an item you haven’t paid sales tax on, you may have to pay use tax if you use the item in a taxable way. Revenue and Taxation Code Section 7261: Notes. In addition to the statewide . Local jurisdictions and districts are allowed to add supplemental sales taxes, ranging from 0. Consumers may be individuals or businesses. District tax areas consist of both counties and cities. Municipal governments in California are also allowed to collect a local-option sales tax that ranges from 1. Calculating, collecting, and reporting sales tax and use tax can get .7 and the Web Content Accessibility Guidelines 2.The State of California has a base tax rate of 7.comUse tax | FTB. Currently, the partial exemption on qualifying TPP lowers the current statewide tax rate of 7. Sourcing: Modified-Origin.A base sales and use tax rate of 7.” • Your total sales may include amounts for California sales or use taxes. Rate Jurisdiction Purpose Authority; Varies: District: Counties, cities and towns in California may impose one or more district taxes.As discussed above, use tax applies to tangible merchandise purchased for use in California. Local taxing jurisdictions (cities, counties, special purpose districts and transit authorities) can also impose up to 2 percent sales and use tax for a maximum combined rate of 8. Many states, including Alaska, allow local taxes. While most special .662% (for a total of 8.Purchases Subject to Use Tax. All fields required.The sales and use tax rates vary depending on your retail location.No tax was collected on a sale that qualifies for sales tax in California. The CDTFA may conduct an audit of sales/use tax at their discretion. These publications are available on . What are Sales Tax and Use Tax? California sales tax is levied on all retailers who retail tangible personal property in the state.Use Tax is defined as a tax on the storage, use, or consumption of a taxable item or service on which no sales tax has been paid. Type an address above and click Search to find the sales and use tax rate for that location. For more information, please refer to publication 44, District Taxes (Sales and Use Taxes), or publication 105, District Taxes and Sales Delivered in California.For example, in California, the sales tax rate and use tax rate are equal at 7. You also don’t have to pay use tax in California, because software is tax-exempt in California.

Resale Certificates. To find more information about sales taxes in California, visit the dedicated website of the California .

Guide to California Use Tax

Rates of Sales Tax. The original sunset date of this exemption was . 18, § 1620(a)(2)(A). Use tax is a complementary or compensating tax to the sales tax and does not apply if the sales tax was charged. Maximum combined rate: 10.Sales and Use Tax Forms and Publications Basic Forms. The Certificate itself contains instructions on its use, lists the States that have indicated to the Commission that a .25% to pay for county and city funds, those funds could take the total in some jurisdictions up to a total of 10. If you bought tax-free items online, in another state, or in a foreign country, you may owe use tax. If you don’t know the rate, download the free lookup tool on this page to find the right combined California state and local rate.Our Use Tax Definition. You may owe “use tax” if you made a purchase from an out-of-state retailer and were not .California City and County Sales and Use Tax Rates includes information on special tax districts and lists tax rates for all California cities and counties. There may also be more than one district tax in effect in a specific location. Tax rates are also found on the CDTFA website (call toll-free 1-800-400-7115). The minimum sales tax in California is 7. A business in California uses, gives away, stores, or otherwise consumes a taxable item that was purchased tax-free.You don’t have to pay sales tax on the software because Montana doesn’t collect sales tax. Examples include furniture, giftware, toys, antiques and clothing. CDTFA issues seller’s permits to business owners .California has a statewide sales tax rate of 6%, which has been in place since 1933. Purchases Subject to Use Tax.25%), the local tax rate, and any district tax rate that may be in effect.25% to pay for county and city funds, those funds could take the . Sellers use tax applies to retailers while consumer use tax applies to the consumer.Use our simple sales tax calculator to work out how much sales tax you should charge your clients. Governing Body: California Board of Equalization / CA Department of Tax and Fee Administration.The undersigned certify that, as of June 13, 2023, the internet website of the California Department of Tax and Fee Administration is designed, developed, and maintained to be in compliance with California Government Code Sections 7405, 11135, and 11546. State, Local, and District Sales and Use Tax Return (CDTFA-401-A) (PDF) General Resale Certificate (CDTFA-230) .Applying Tax to Your Sales and Purchases.For example, California residents must pay sales tax on things like furniture, gifts, toys, clothing, vehicles, mobile homes, and aircraft. Enter your total purchases that are subject to use tax, as explained below.

- What Happened To Lemongrab In ‚Too Old‘?

- What Is A Granite Cave? | Pokéarth

- What Happened To Jimmy Page? _ It’s the sort of stuff that can’t be taught

- What Is A Database Program _ Database Programming: An Introduction

- What Is A Morph Cut Transition?

- What Is A Mythic Rare? : Mythic not that rare :: Chillquarium General Discussions

- What Is A Hostel Like – What Is A Hostel? Travelers, It’s Time to Listen Up

- What Happens To Sinbad While He Is In Reim?

- What Is A Hawaiian Eruption? _ Hawaiian eruption

- What Happened To Stuart Bloom , what happened to Orlando bloom?

- What Is A P Chart In Qi Macros?

- What Is A Good S Tier Item? _ Swords Tier List in Blox Fruits

- What Happens If You Violate The Fcra?