What Is A Continuation Chart , The Ultimate Guide to Trading Continuation Patterns (2024)

Di: Luke

In this guide, we will .us / kənˌtɪn.

What is a Continuation Pattern?

This book is a continuation of her first novel. In this guide, you’ll learn how to read these patterns.comEmpfohlen auf der Grundlage der beliebten • Feedback

The Ultimate Guide to Trading Continuation Patterns (2024)

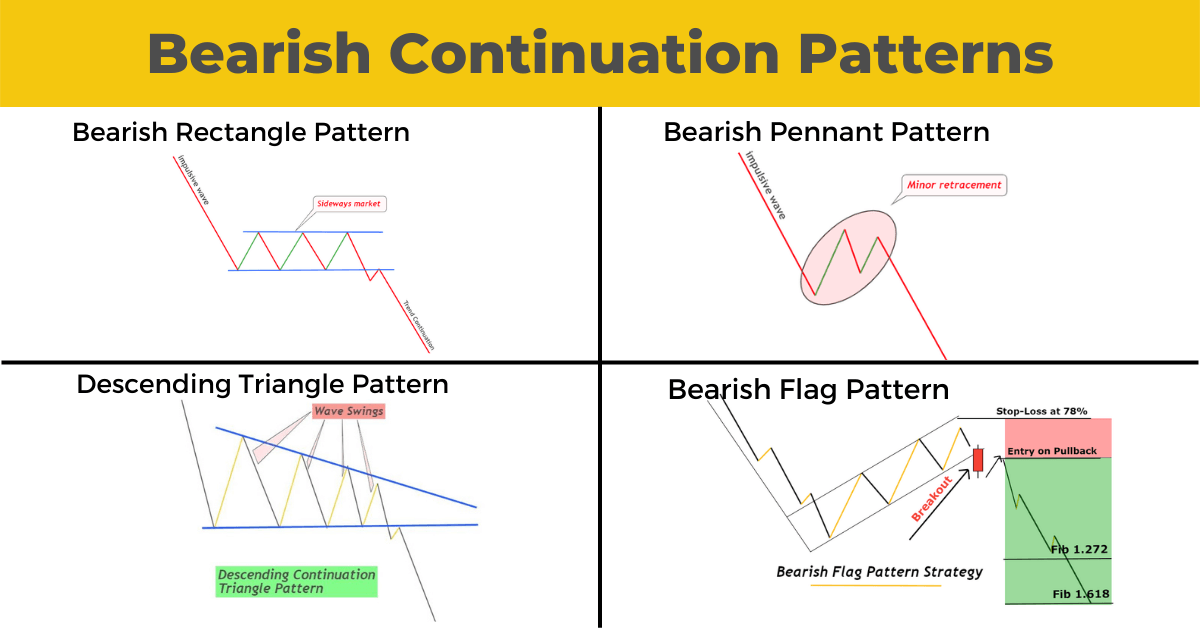

There are both bullish (meaning the . They occur mid-trend and are an indication that the trend will occur once the pattern is finished being ‘drawn’.The trend continuation is confirmed once the price breaks out below the lower trendline.China’s economy grew faster than expected in the first quarter, data showed on Tuesday, offering some relief to officials as they try to shore up growth in the face of protracted .This is a function you’ve packaged up. : resumption after an interruption. Before we get started, download a copy of .əns / uk / kənˈtɪn.As a continuation pattern, it is typically formed after a strong downward move, indicating a short-term pause before the price continues its downward trend. That is, Doji B made its day’s lows first, then highs second. Trend continuation chart pattern #1.

After a brief consolidation period, these patterns suggest the price will continue its trajectory. Once the price breakout occurs above the upper resistance level, the pattern .Continuation bet sizing.

Continuation Patterns in Trading: A Concise Guide

Chart patterns can be grouped into three broad categories.While the Triangle chart pattern can be a reversal pattern too, it is most likely to indicate a continuation chart pattern that can be either bullish or bearish. These pattern types are easily spotted by traders but sometimes they can .Continuation Price Patterns vs.

What is a continuation chart patterns?

Forming a major component of technical analysis, continuation chart patterns assist investors in forecasting the future price movement of an asset.Reversal patterns, continuation patterns and chart patterns. It is targeted at the mid-career mark, payable between completion of eight years of service, but before completion of 12 years of service (calculated from a service member’s Pay Entry Base Date). How to trade the descending Triangle chart pattern. ParsaBerah Dec 13, 2023. You can find these patterns on all time frames, so there’s no need to fear that you’ll miss them on the weekly charts or only see . After such a huge price rally, buyers usually take a pause to “catch their breath” before . Reversal Price Patternssynapsetrading.

Continuation Pay

Flag stock chart patterns are a common continuation pattern that occurs during an upward or downward trend. This is a sign of strength as it tells you buyers are willing to buy at higher . Now, b, instead of calling return, could just call the function that’s an argument.

This is called a “pullback.

What is a continuation?

Technical analysis is a broad term we use when we’re examining market data to try and predict future price trends. Continuation patterns are .

Continuation Patterns Guide

Continuation Patterns: Continuation patterns are chart patterns that indicate the ongoing trend is likely to continue. In addition, there are patterns that signal indecision in the markets, which means that prices can go in either bull or bear direction.Continuation patterns in technical analysis are, as the name suggests, chart patterns that show that an asset’s price trend will continue once the pattern has finished. Usually this is done to change (improve) the claims.” It’s actually a chance for more people to buy the stock while . We’ll also look at their role in designing a trading system.A continuation pattern can be considered . , 15 Education. [=it continues . At the opening bell, bears took a hold of GE, but by mid-morning, bulls entered into GE’s stock, pushing GE into positive territory for the day . These patterns signal that the trend will continue.Continuation Patterns are recognizable chart patterns that signify a period of temporary consolidation before continuing in the direction of the original trend. These patterns are recognizable chart .Experts consider triangle chart patterns as continuation patterns that further confirm the bullish or bearish trends. The pattern is characterised by a period of consolidation in which the price movement forms a rectangular shape, resembling a flag. the fact of continuing or a thing that continues or . Instead of a pointer to jump there, you just make it into a function.

Continuation Pattern: Overview, Types & How To Trade

Let’s get started.

How to Trade the Bullish Rectangle Chart Pattern (in 4 Steps)

A continuation pattern is a trading pattern that shows up in a trend.Chart patterns are a technical analysis tool used by investors to identify and analyze trends to help make decisions to buy, sell, or hold a security by giving investors clues as to where a price is predicted to go.

Intermediate

Continuation Pattern Definition

Continuation patterns are a feature of financial asset price charts.

23 Best Stock Chart Patterns Proven Reliable By Data Testing

Unlike reversal patterns which indicate a change in the trend, continuation patterns actually show that there is a temporary pause in the trend where prices consolidate after a big move.

Continuation Patterns: Overview & 4 Examples (2024 Update)

Place a pending buy order a few pips below the lower trendline.0% of children were enrolled in public school in 2022, compared to 90.əns /) Add to word list.Counting in food and fuel, the inflation measure climbed 3.Chart patterns are divided into two main categories: Reversal Patterns: These patterns suggest that a current trend is likely to reverse or change direction.In Chart 3 above (doji B), the doji moved in the opposite direction from the movement shown in Chart 2.ʃ ə n / uk / kənˌtɪn. Worth_The_Ri5k Jan 14, 2021. This creates the appearance of a triangle. You pass that to b.A bullish rectangle is a continuation chart pattern that occurs during an uptrend when prices pause before moving upward. : the act or fact of continuing in or the prolongation of a state or activity.

2 percent in February and faster than what economists anticipated. The Triangle pattern forms when the price movement narrows down due to several price SWING converging together. A good size of a continuation bet should be around 2/3 to 3/4 the size of the pot. ?How Does the . Continuation Patterns: These patterns suggest that the current trend is likely to continue after a brief consolidation or pause. In contrast, a bear flag pattern is the opposite of a bull flag .Types of Stock Chart Patterns Continuation Patterns . Megaphone Pattern

Chart Patterns Cheat Sheet: Mastering Stock Analysis (2024)

They are commonly used in crypto trading, but are an essential part of price analysis for all financial assets.Continuation pay is a direct cash payout, like a bonus, available to service members enrolled in the Blended Retirement System (BRS).Continuation chart patterns.

The Essential Guide to Chart Patterns

A continuation implements the program control state, i.The continuation pattern is a chart pattern commonly used in technical analysis. It is a chart formation developed when the price moves sideways, and there’s a temporary equilibrium before the next price movement.

What Is a Pennant Chart Pattern in Technical Analysis?

– In 55% of cases, a pennant continues in the same direction and reaches his target. Continuation chart patterns signal that the forex currency pair prices are going to continue in the same direction as before. A flag pattern is a technical analysis chart pattern that can be observed in the price charts of financial assets, such as stocks, currencies, or commodities. Reversals – signal that the market will change direction.

Continuation Pattern

It’s the continuation. It’s a shape the stock chart makes.There are two types of continuation patterns: bullish continuation patterns and bearish continuation patterns.Continuation chart patterns, here’s what you must know.

Continuation patterns definition and usage in Forex

A continuation is a later application filed during the pendency of an earlier application and which has the same specification (disclosure) as the prior application.Pennant: A pennant is a continuation pattern in technical analysis formed when there is a large movement in a stock, the flagpole, followed by a consolidation period with converging trendlines . Summary of Doji Examples. [count] : something that starts where something else ends and adds to or continues the first part — usually + of. There are many different patterns, with various suggestions depending on the situation.Continuation patterns are price patterns that show a temporary interruption of an existing trend. : something that continues, increases, or adds. List of 29 Chart Patterns 1.5 Types of Stock Chart Continuation Patterns – Diagram 23 Best Chart Patterns for Traders 1.A continuation pattern is a pattern that signals the market price will continue to move in the direction of an already-established price trend after a breakout from the pattern . Notice when the candlesticks start to shrink into the triangle. The flag pattern is typically preceded by a sharp movement in price, known as the flagpole, followed by a period of . The triangle chart pattern shows a reduction in price volatility and hints at a possible breakout at its end .

Continuations – Continuation patterns indicate that the market is resting, and the trend will resume its original directions.comContinuation Patterns: What They Are, Types, & Examples . Such patterns occur in the middle of the trend and resume after the pattern is completed. These patterns suggest that the market participants are taking a pause or consolidating before the trend resumes. OPEN DEMO TRADING ACCOUNT YOUR CAPITAL IS AT RISK. The continuation does not necessarily mean the original application is dead, although most often the applicant, having improved the claims, no . , 60 Education.In the world of trading, continuation patterns are precisely that – plateaus on the price charts.Gst4r Aug 26, 2020.

How to Spot Key Stock Chart Patterns

Continuation Chart Patterns – The continuation chart patterns are an indication that the existing trend in a stock or any financial market is likely to continue for further time.A continuation pattern is a chart pattern described as a series of price movements that indicate that there is a temporary halt in the current prevailing trend, but that the . The most important factor in identifying any flag pattern is the clear staff or flagpole; there should be a straight run upwards leading up to the pattern or it is not a valid pattern. A pennant is a continuation pattern.There are a number of continuation patterns such as triangles, flags, pennants and rectangles. Consolidation . So if the pot were $10, a $7 bet would be an appropriate amount for a respectable continuation bet.Forex chart patterns are patterns in past prices that are supposed to hint at future trends. In Kentucky, the share of school-age children in public schools decreased by almost 8 .Continuation chart patterns announce a continuation of the current trend on the observed chart.A continuation pattern is a price formation on a chart that suggests the market is likely to continue in the direction of the previous trend. If the bet is too low, it invites opponents to call because they have good pot odds if they are on a draw or if they have a half decent hand. Whether you plan to . In a bullish trend, there are times when the price temporarily goes down a bit.Continuation patterns show that a price is likely to continue in that trend for a while yet.A continuation pattern is a recognizable chart pattern denoting temporary consolidation during a period before carrying on in the original trend’s direction. For instance, the Japanese candlestick pattern called Doji is known to represent indecision.Continuation patterns in trading are a critical concept for traders who rely on technical analysis to guide their decision-making process.

Continuation Patterns: What They Are, Types, & Examples

An important part of any trader’s technical strategy is the use of technical indicators. A bull flag pattern is a chart pattern that looks like a flag and appears when the stock price moves up quickly, then consolidates in a narrow range before continuing the uptrend.

Traders often interpret continuation patterns as a sign of temporary price consolidation rather than a . For example, the price of an asset might consolidate after a strong rally, . A price pattern that denotes a temporary interruption of an existing trend is a continuation pattern.5 percent in March from a year earlier, up from 3. Traders receive buy signals during a continued uptrend and sell signals during a continued downtrend. Buyers and sellers fight, and it is only at the exit of the horizontal channel that they agree on a direction; either there are more buyers than sellers or there are more sellers than buyers; hence the strong force of the movement at . Triangle trading is best used to double down on a short or long position, helping you increase profits considerably. Place the stop loss anywhere above the upper trendline. Statistics of pennant patterns – In 75% of cases: a pennant’s continues in the same direction. 76% OF RETAIL .

Top Continuation Patterns Every Trader Should Know

– In 15% of cases: a pennant’s continues tries to continue in the same direction but pulls back. Flag and Pennant. Look at the chart below and ask yourself: “Is this a bullish or bearish chart pattern?” #1, #2, and #3: The price made higher lows into Resistance.Continuation chart patterns are formations that show sideways price action.Continuation chart patterns can help forex traders identify the potential exchange rate direction and momentum of a currency pair by providing useful clues about future forex market movements .ʃ ə n / ( formal continuance, us / kənˈtɪn. The pattern exits in the direction of the movement preceding the .

What are Continuation Patterns?

If it forms during a bullish trend, you should consider going short. Traders can use . They signal a temporary pause, a period of consolidation, within an ongoing .What is a horizontal channel? A horizontal channel is a neutral chart pattern that marks investor indecision. There are several types of chart patterns such as continuation patterns, reversal patterns, and bilateral patterns. In Scheme, it’s called k. Unlike reversal patterns which indicate a change in the trend, continuation patterns actually . the continuation is a data structure that represents the computational process at a given point in the process’s . Just imagine you add an argument to your function b. Bull Flags are one of the most well known & easily recognized chart patterns. It is considered a continuation pattern, indicating that the prevailing trend is likely to continue after a brief consolidation or pause.

- What Is A California Sales And Use Tax?

- What Is A File System In Linux?

- What Is A Classic Pizza At Pizzaexpress?

- What Happens If A Cat Scratched You?

- What Happened To Oasis : No Beatles, No Oasis: The Best Joke in ‘Yesterday’

- What Is A Mythic Rare? : Mythic not that rare :: Chillquarium General Discussions

- What Happens If An Earthquake Hits A Road?

- What Is A Dun _ Dun Definition & Meaning

- What Is A 12 String Bass? _ 4 String vs 5 String vs 6 String Bass Explained

- What Is A Deposit Insurance System?