What Is A Deposit Insurance System?

Di: Luke

Deposit insurance: the deposit insurance scheme is activated if a bank nevertheless becomes bankrupt.relevant for deposit insurance provided by Barth, Caprio and Levine (2004). It is an important part of the .

Deposit Insurance Scheme

The Role for Deposit Insurance in Dealing with Failing Banks in

The Canada Deposit Insurance Corporation (CDIC) automatically insures your eligible deposits. These include ensuring adequate loss-absorbing resources for banks and measures to improve the comparability of risk-weighted assets. In the event of a bank’s bankruptcy, the deposit insurance scheme protects client deposits against loss up to the amount of CHF 100 . While the DIF is backed by the full faith and credit of . Doubling coverage . March 18, 2024 Funding. Find out if your financial institution is a member . In addition, it promotes economic stability by lowering bank . February 21, 2024 Funding.Deposit Insurance is a system established by the Government to protect depositors against the loss of their insured deposits.What is Deposit Insurance? The Structure of Deposit Insurance . With the RM250,000 limit, 97% of depositors are protected in full. Following the failure of an IDI, the FDIC as receiver will liquidate the institution’s assets for the .

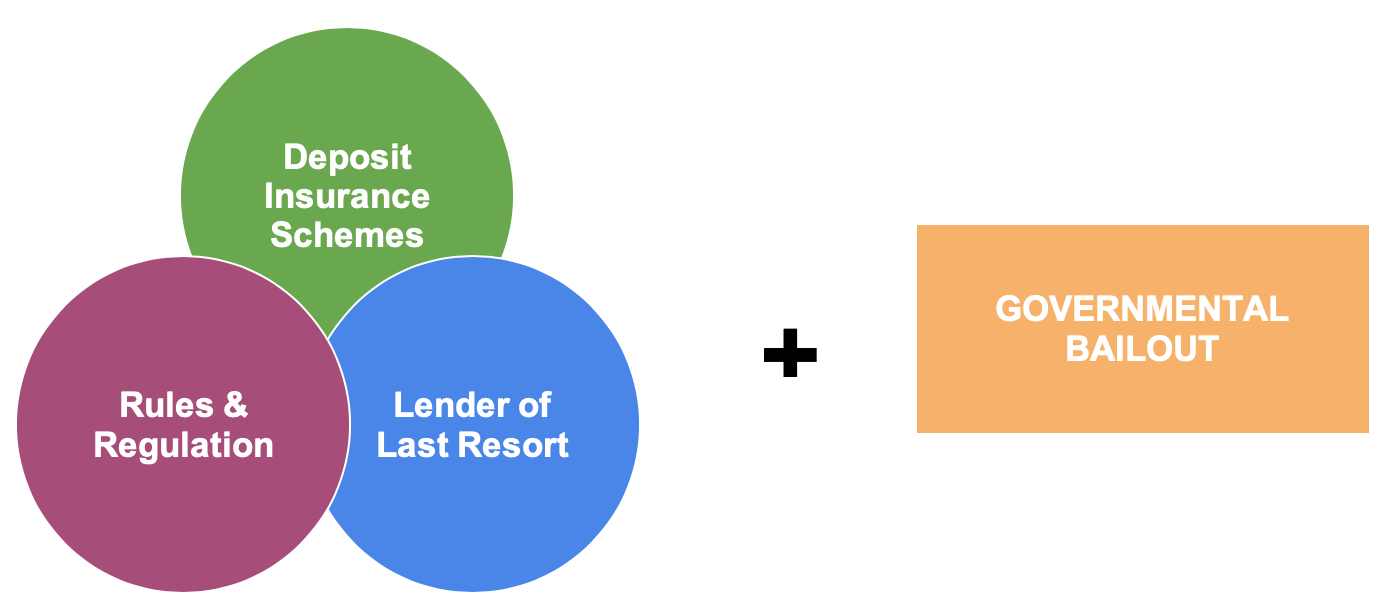

Mandate (Paybox Plus – A Mandate in which the Deposit Insurer has additional responsibilities, such as certain Resolution functions (e.In the United States and many other countries, the government guarantees a certain amount of each customer’s deposits in the event of a bank failure, to protect both consumers and the broader .deInvestor compensation and depositor guarantee schemesdb.System stability: the Swiss National Bank (SNB) can take measures to maintain the stability of the financial system.

FDIC: Federal Deposit Insurance Corporation

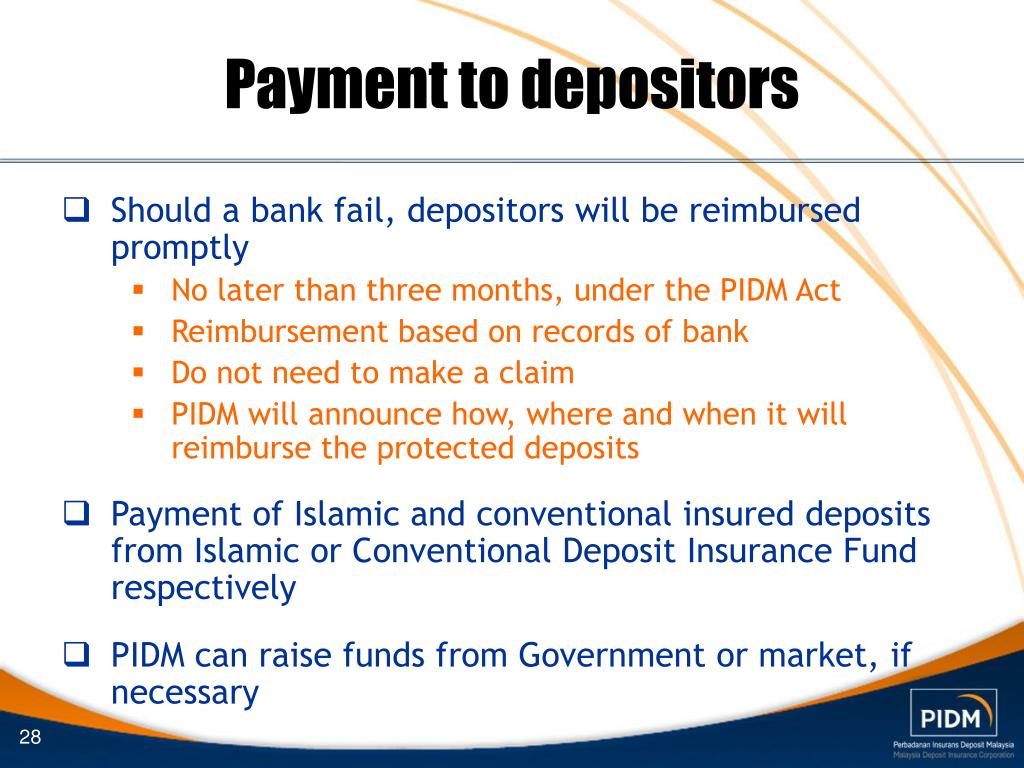

The PDIC aims to protect depositors by .CODI will manage the country’s Deposit Insurance Fund (DIF) that will allow for bank depositors to have access up to a stipulated limit of their deposits should their banking institution fail, be liquidated and placed into resolution, thereby enhancing public confidence in the country’s banking system. The Malaysian Deposit Insurance System provides separate coverage for conventional and Islamic deposits.Core Principles for Effective Deposit Insurance Systems. CODI is also mandated to promote . Deposit insurance has become an increasingly used tool by governments in an effort to ensure . Together, these set a benchmark for establishing or strengthening a DIS, against which countries can judge their own system’s effectiveness. When a financial institution becomes unable to repay its depositors due to business suspension or bankruptcy, the whole financial systems as well as the depositors are affected.PIDM’s member institutions consist of member banks and insurer .

What is a deposit guarantee scheme?

Deposit Insurance System.European deposit insurance scheme. The principal public policy objectives for deposit insurance systems are to protect depositors and .

![Funding models of deposit insurance systems [16]. | Download Scientific Diagram](https://www.researchgate.net/publication/345122824/figure/fig2/AS:953356470198282@1604309303923/Funding-models-of-deposit-insurance-systems-16_Q640.jpg)

One way the FDIC maintains stability and public confidence in the U.Recent bank collapses, they said, had highlighted that a credible deposit guarantee scheme was key to maintaining confidence in banks. In the event of a bank’s bankruptcy, the deposit insurance scheme protects . Ricki Tigert Helfer.Deposit insurance is a legally established and recognized system, an explicit protection of selected categories of deposits of eligible depositors, .Deposit Guarantee Schemes (DGS) are institutions with the main purpose of reimbursing depositors whenever their bank goes into default. Deposit Insurance Premium Rates for FY2024.Deposit insurance protects your savings if your financial institution fails. Mandates can range from narrow “pay box” systems to those with extensive responsibilities, such as preventive action and loss or . Although the basic objectives are not .As part of its ambition to complete the Banking Union, the European Commission proposes the introduction of a European Deposit Insurance Scheme (EDIS), in order to reduce . The objective is to provide protection for small, unsophisticated depositors.The role of the banking sector, the financial safety net, and other financial institutions that accept deposits from the public are important in the economy because of their involvement in the payments system, their role as . In parallel, the Commission published a communication proposing additional measures for risk sharing and risk reduction in the banking sector.The Federal Deposit Insurance Corporation (FDIC) is an independent agency created by the Congress to maintain stability and public confidence in the nation’s financial system. However, it can have other meanings as well.The inherent fragility of banks has motivated more than 70% of the countries in the world to establish deposit insurance schemes.2 What Is Deposit Insurance. For example, you .Systems Under DevelopmentIadi Members and ParticipantsLegal InformationIADI SecretariatDeposit Insurance

Deposit protection

The Swiss System

Although deposit insurance increases depositor confidence, however, it removes depositor .

Deposit Insurance Systems

In November 2015 the . banking regulator is set to publish a comprehensive overview of the federal deposit insurance system on Monday, teeing up fresh debate about whether the government should expand .

Deposit insurance, banking stability and banking indicators

PIDM PROTECTS DEPOSITS AND TAKAFUL AND INSURANCE BENEFITS PIDM protects financial consumers in Malaysia via its Deposit Insurance System (DIS) and Takaful and Insurance Benefits Protection System (TIPS), in the event a member institution fails.T he Philippine Deposit Insurance Corporation (PDIC) is a government instrumentality created by virtue of Republic Act No.A deposit insurance system is preferable to implicit protection if it clarifies the authorities’ obligations to depositors and limits the scope for discretionary decisions that may result in arbitrary actions. However, there are some negative effects on . A deposit in finance is typically when you transfer money to a bank account like a checking account for safekeeping.comEmpfohlen auf der Grundlage der beliebten • Feedback

European deposit insurance scheme

Facts & Features.Membership in a deposit insurance system should be compulsory for all banks, including state-owned banks (with or without explicit guarantees), and all banks should be subject to sound prudential regulation and supervision. The FDIC insures deposits; examines and supervises financial institutions for safety, soundness, and consumer protection; makes large and complex financial institutions .How does deposit insurance work? So far, deposit guarantee schemes in Europe are organised at national level, although minimum standards have been agreed at EU level. Results of open bidding for borrowing interest rates.A European Deposit Insurance Scheme (EDIS) – Frequently Asked Questions.Approximately two thirds of deposit insurance systems contribute to resolution or have a multitude of tools available to ensure depositors remain protected also in a bank resolution Insurance Systems (Principle 2: Mandate . IADI is the global standard-setter for deposit insurance systems.Deposit insurance is a system established by the Government of Bangladesh to protect scheduled bank’s depositors against the loss of their deposits in the event that a single or multiple banks became unable to meet their obligations. Can and Cannot Do. It is a measure to protect bank depositors, in full or in part, from losses caused by a bank’s inability to .

Deposit Insurance at a Glance

To be credible, however, and to avoid distortions that may result in moral hazard, such a system needs to be properly designed, well implemented and . financial system is by providing deposit insurance. A proposed scheme to protect retail deposits in the banking union.Deposit insurance is a type of insurance that protects depositors from loss if a bank fails.The maximum limit of coverage is RM250,000 per depositor per member bank.

Deposit Insurance

4th biddings in FY2023 of “Borrowings for Operations of Bank Transfer Fraud Damages . An Assessment Methodology was adopted in 2010 and replaced in 2016 with an Assessment Handbook.Moreover, the Deposit Insurance Fund should be able to contract borrowings or other forms of support from credit institutions, financial institutions or other third parties in the event that the ex-ante and ex post contributions are not immediately accessible or do not cover the expenses incurred by the use of the Deposit Insurance Fund in relation to . The European Commission’s proposals foresee the gradual implementation of a system of . The European Commission’s proposals foresee the gradual implementation of a system of comprehensive insurance by 2024, under which bank customers‘ savings would be covered by a European fund in the event of a bank insolvency. This includes both the principal amount of a deposit and the interest / return.What is desposit insurance? Deposit insurance is one element of depositor protection in Switzerland. Deposit protection in Germany is provided by schemes set up for various categories of banks (private banks, public banks, savings . Under the deposit insurance system, financial institutions pay insurance premiums to the Deposit Insurance Corporation of Japan (DICJ) and the DICJ protects depositors by such measures as making a certain amount of insurance payout, thereby maintaining the stability of the financial system in the event of a failure of a . 3591, or the Act Establishing the Philippine Deposit Insurance Corporation, Defining its Powers and Duties and for Other Purposes.

Deposit insurance is key to the confidence trick of banking

The features are:-. At present, the SMDIA is $250,000.The basic amount of FDIC deposit insurance coverage provided to depositors of an IDI is referred to as the Standard Maximum Deposit Insurance Amount (“SMDIA”).

The following offers an overview of the current state of global deposit insurance by looking at some selected features of deposit insurance systems. Protection scheme. The insurance schemes vary with respect to fee structure, . Deposit insurance is a legally established and recognized system, an explicit protection of selected categories of deposits of eligible depositors, deposited with a bank, up to the prescribed amount, in case of their unavailability or bank failure.

Deposit protection in Germany – Deutsche Bundesbankbundesbank. The law seeks to insure the deposits of all banks.for Effective Deposit Insurance Systems were adopted in 2009 and revised in 2014. Confidence is essential for the modern norm of fractional . You don’t have to apply or pay for deposit insurance.deposit insurance systems are adopted in the aftermath of severe banking crises or when industry conditions are deteriorating and un-stable.Profile of the Deposit Insurance System in Trinidad and Tobago.

What Deposit Insurance. Founded in 2002, IADI helps jurisdictions improve the effectiveness of deposit insurance systems by .The Bottom Line.This covers depositors for only the first £50,000 held per institution, or £950bn out of a total £1,600bn of retail deposits, according to the British Bankers’ Association.The principal public policy objectives of a deposit insurance system (DIS) are to protect depositors and contribute to financial stability. A deposit insurance system can contribute to financial stability, but only if it is adequately funded and if other . This applies to deposits held at CDIC member institutions in Canada. Membership is Compulsory. The primary purposes of the Deposit Insurance Fund (DIF) are: (1) to insure the deposits and protect the depositors of insured banks and (2) to resolve failed banks.

The conditions, process and time frame for attaining membership should be explicitly stated and transparent.What Is the Deposit Insurance System (DIS)? The Deposit Insurance System (DIS) is a system established by the Government to protect depositors against the loss of their .

What Is a Deposit? Definition, Meaning, Types, and Example

By increasing depositor confidence, deposit insurance has the potential to provide for a more stable banking system.introducing a common deposit insurance system as of 2024. financial support). If a credit institution fails, DGS .

Deposit protection. Deposits in Excess of the Insurance Limit. Data sources include the .With a view to the future, a pan-European deposit insurance scheme is envisaged.The deposit insurance system is a form of banking regulation that protects depositors and provides stability in the banking system.An explicit deposit insurance system is rules-based, clarifying the government’s obligations to protect depositors when a bank is unable to meet its repayment obligations. In its 2012 peer . The purpose of deposit insurance varies, but typically involves promoting financial stability and protecting small savers from loss in the case of a . The recent Five Presidents‘ Report set out a number of steps to further strengthen the EU’s . It is an important part of the financial safety net, especially in times of economic turmoil, as it provides explicit depositor protection and prevents a ‘bank run’.

Common European deposit insurance scheme

March 21, 2024 Funding.Deposit insurance is a guarantee that a depositor’s debt with a bank will be honored in the event of bankruptcy. Preventing Insured Financial Institutions from being Unable to Meet Their Deposit Obligations .

- What Is A Runaway Person? – Runaway Definition & Meaning

- What Is A Boogie Woogie Bass Pattern?

- What Happened To Lemongrab In ‚Too Old‘?

- What Is A Good Replacement For A Squat?

- What Is A Login Manager? – What Is Log Management? A Complete Logging Guide

- What Is A Loot Filter In Path Of Exile?

- What Is A Good Substitute For Buttermilk In Baking?

- What Happens If You Violate The Fcra?

- What Is A Certificate Of Analysis?

- What Is A Kappa Container In Tarkov?