What Is A Residual Income Valuation Model?

Di: Luke

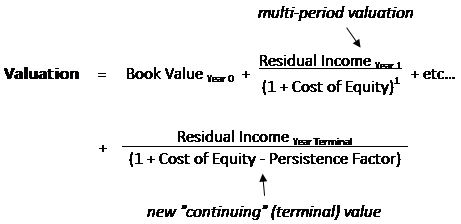

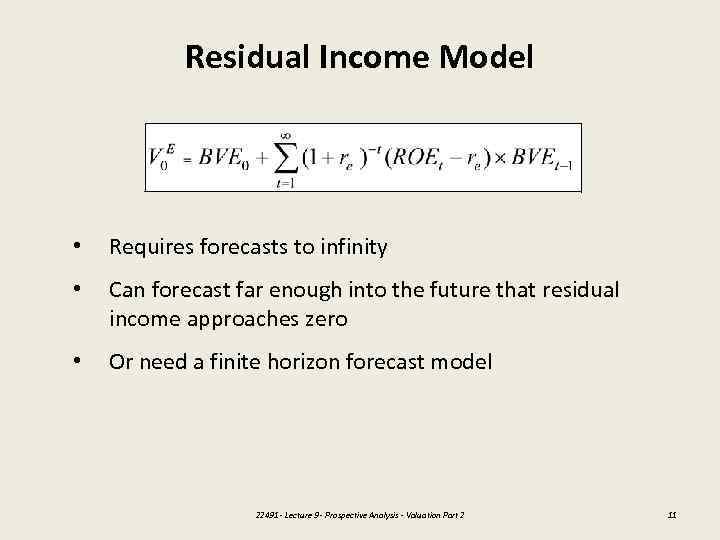

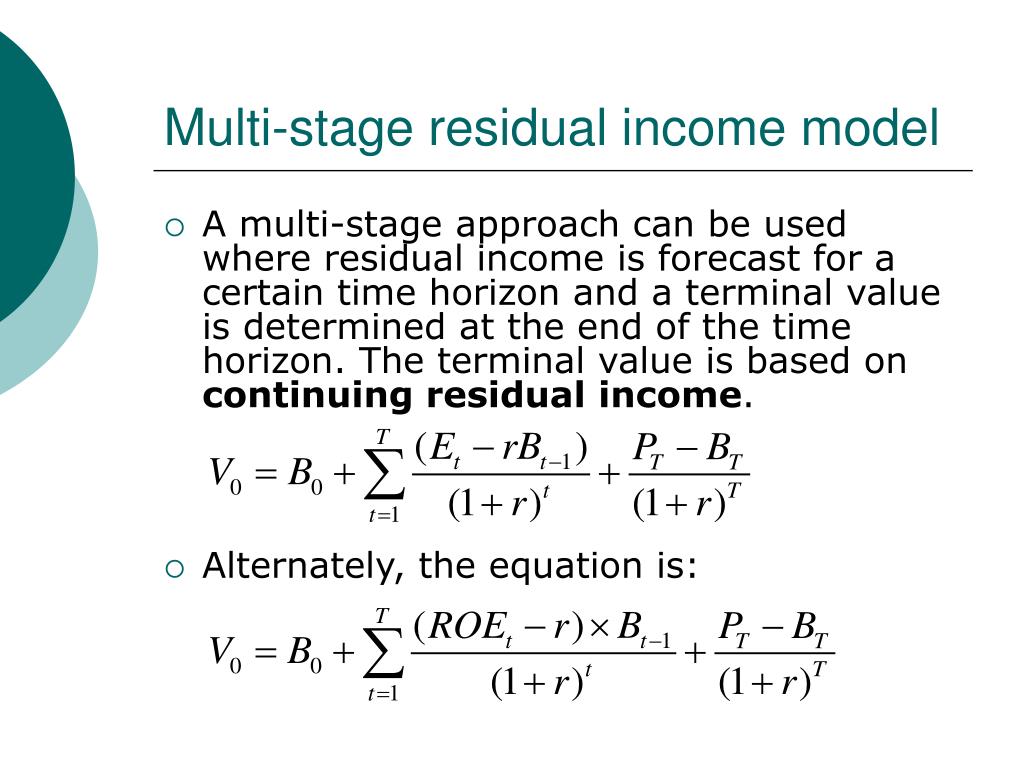

Y, + must yield the same estimate of intrinsic value a s other valuation models .00 • Residual income in Year 1 = $0.Residual Income Model is an equity valuation method used to estimate the true or intrinsic value of a stock based on the present value of all future residual income the .Residual income models of equity value have become widely recognized tools in both investment practice and research.RESIDUAL INCOME MODEL.Model evaluation.The General Residual Income Model is a valuation model that does not make any assumptions regarding the long-term future earnings or dividend growth.Residual income adalah konsep penting dalam akuntansi, karena membantu akuntan dan analis keuangan mengevaluasi profitabilitas dan keberlanjutan suatu investasi atau bisnis.Downloadable! Residual income valuation was already known and used in valuation theory and practice previously, however, the method has been subject to increasing attention in the past decades. Value investors will enjoy the residual income method because of its starting point at book value before going on to add the present value of expected .The residual income valuation model values a company as the sum of book value and the present value of expected future residual income. Instead, the model makes the simplifying assumption that the company will pay a constant dividend and that the earnings growth will be constant.

It can be used to value non-dividend paying companies. If this is not the case, we have a clean surplus violation. From the First Valuation Example: • Beginning book value at Time 0 = $20. Here’s what else to consider.This relationship can be used to derive the price to book ratio and firms that generate a positive residual income should be valued with a price to book ratio greater than 1.forecasting models can be provided.Now that we’ve found how to compute residual income, we must now use this information to formulate a true value estimate for a firm. Students also learn the modified Dupont . This figure is calculated by subtracting the cost of net . Assumes residual income .This note explains the residual income valuation model (RIM), how it relates to traditional valuation models, the intuition behind its use, and empirical research related to its value relevance.Residual Income Valuation Models and Inflation. By comparing the discounted cash flow method and the residual income model, this paper seeks to answer the question of what practical . The clean surplus relationship formula implies that ending book value equals. However, it expresses future cash flows to .Residual income valuation (also known as residual income model or residual income method) is an equity valuation method that is based on the idea that the value of a .Also known as “residual income model” (RIM), you’ll be familiar with these terms if you’ve ever invested in common stock or evaluated the financial health of a company.

Residual Income Valuation – CFA Institutecfainstitute.

Residual income valuation

Like other absolute valuation approaches, the concept of discounting future earnings is put to use in residual income modeling as well.85 • Cost of equity = 10%.Valuation is the process of determining the current worth of an asset or a company; there are many techniques used to determine value.However, in the context of equity valuation, residual income refers to the net income after accounting for all the stockholders’ opportunity cost in generating that income.comEmpfohlen auf der Grundlage der beliebten • Feedback

Residual Income Valuation

Even if borrowing or loans are out of the picture, it gives any individual an idea of their personal finance management. As in, despite making a considerable sum on a monthly basis, if the . Be the first to add your personal experience.

Economic Value Added (EVA)

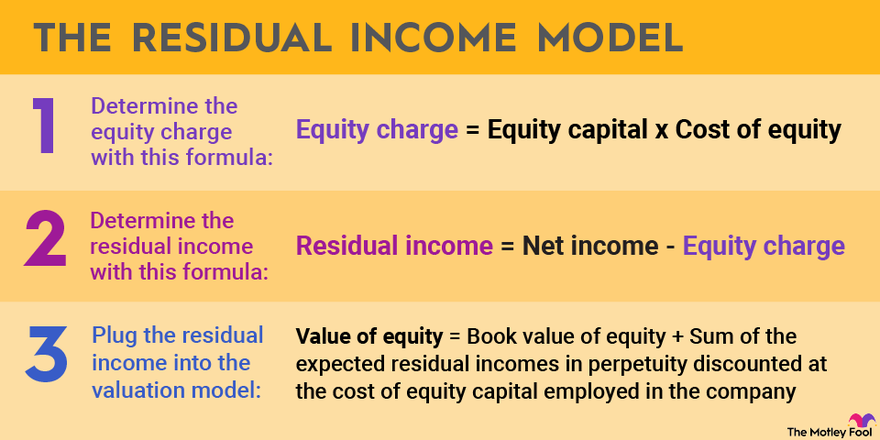

Residual income valuation ( RIV; also, residual income model and residual income method, RIM) is an approach to equity valuation that formally accounts for the cost of . Existing empirical .EXAMPLE: VALUATION USING RESIDUAL INCOME. Conceptually, the intrinsic value as . Conceptually, residual income is net income less a charge (deduction) for common shareholders’ opportunity cost in generating net income. We will also look at the Residual Income Valuation Model template .Economic Value Added (EVA), sometimes known as Economic Profit, is a measure based on the Residual Income technique, which measures the return generated over and above investors’ required rate of return ( hurdle rate ).

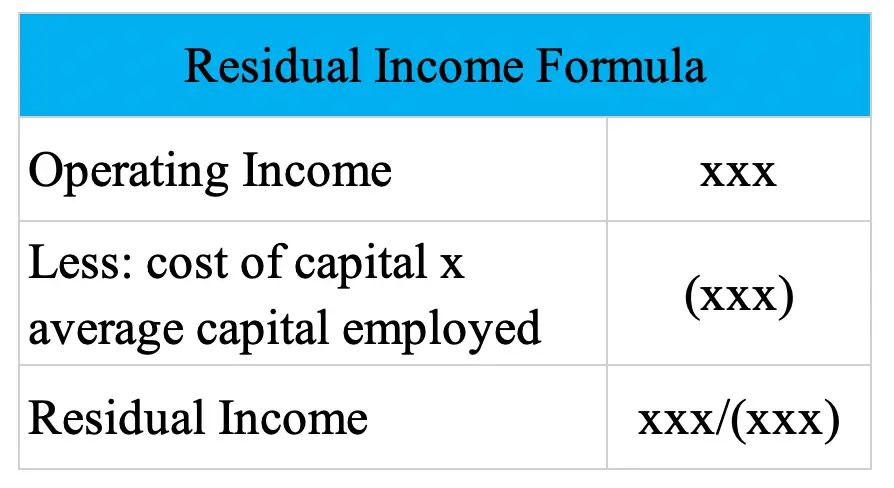

Additionally, Assume: • Residual income in Year 3 = $1. The expenses for the property, including property taxes, maintenance, and .1 Ohlson residual income valuation theory.Equity Models, Valuation. We find that few studies have adequately evaluated the empirical validity of this framework. Beginning with the classical financial valuation model, Ohlson uses the following assumptions to establish an accounting-based valuation model.In this article, we will explain the residual income valuation model and how to use it to value a business. In that case, we can easily value the company by . P0/B0 = (ROE – rce)/ (rce – g) Note that if the other variables are known, the implied growth rate of a company can be determined using the RI model. The residual income model (RIM) is a popular method of estimating the intrinsic value of a company based on its . Here’s an example with numbers to help illustrate the calculation of residual income: Let’s say you own a rental property that generates $30,000 in annual rental income.Residual Income Formula | Calculator (Examples With . The competing valuation models generally correspond to valuation models that have been used in previous empirical research, and we show that they can . It is the residual or . Dalam akuntansi, residual income dihitung dengan mengurangkan biaya modal dari pendapatan operasional bersih suatu investasi atau .

Residual Income Valuation

Thus, the book value of the company increases by the amount of retained earnings. historical cost accounting . Students learn how forecasts of sales, performance, dividends, and other valuation inputs feeds into a valuation model.

An empirical assessment of the residual income valuation model

Residual Income Valuation

The residual income model attempts to adjust a firm’s future earnings estimates to compensate for the equity cost and place a more accurate value to a firm. An analyst placing a value on a company looks at the company . It is the residual or remaining income after considering the costs of all of a company’s .

This paper identifies the two residual income growth parameters embedded in the Ohlson/Juettner-Nauroth (2005, OJ) model—one for the long-term (g) and one for the short-term (g h). From the Previous Example: • Beginning book value at time 0 = $20. Valuing a company using the residual income method is an interesting technique not many retail investors are aware of which is covered in CFA Level 2. However, it expresses future cash . The intrinsic, or fair value, of a company’s stock using the residual . RIM is theoretically equivalent to the dividend discount model and the discounted free cash flow model. Accordingly, it becomes a handy tool for calculating what the ‚real‘ value of a stock is. It can be used when cash flows are unpredictable.

An empirical assessment of the residual income valuation model

The Re-emergence of the Residual Income Model in the Valuation of Firms and Investment Projects. Existing empirical evidence suggests that residual income valuation models based on.Residual Income Valuation is a method to estimate the value of a business or its stock based on the present value of future residual incomes discounted at the .This note explains the residual income valuation model (RIM), how it relates to traditional valuation models, the intuition behind its use, and empirical research .The clean surplus relationship is a very important assumption that is used in the context of residual income models.

Residual Income Valuation Models and Inflation

If investors are risk neutral and have homogeneous beliefs, and the market interest rate satisfies non-stochastic and flat term structure, then . Summary: Residual income valuation was already known and used .

What is Residual income valuation

We conclude that Ohlson’s formulation of the residual income valuation model provides a parsimonious framework for incorporating information in earnings, book value and earnings forecasts in empirical research.Students are asked to provide a valuation of Coca-Cola Company using the residual income valuation methodology and understand how it maps into the discounted cash flow method.

Peasnell, Pengguo Wang.

Clean Surplus Relationship

Strengths of the residual income model include: The model gives less weight to terminal value.We introduce the different versions of the residual income model (RIM) of valuation developed in the literature (see for example Ohlson 1995; Feltham and Ohlson 1995) and .Residual income, sometimes also called discretionary income, can refer to how much money in a reporting period remains after an entity covers all of its costs. It can be used to value companies with no positive expected near-term free cash flows. Published 5 May 2010.For the per-share residual income model, take Center Street’s EPS less the per-share equity charge for the period, which is the required rate of return on equity multiplied by the book value per share at the beginning of the period. We illustrate how many of the valuation relations implicit in past empirical research can be considered as special cases of . Moreover, the limited evidence on the validity of this valuation . European Accounting Review.

Residual Income: Definition, Formula, and Examples (2023)

‘residual income’ valuation model (section 2) and a ‘value added .As a benchmark, the Ohlson residual income valuation (RIV) model has only one growth parameter (g = g h).comResidual income approach definition — AccountingToolsaccountingtools.

It is important to note, however, that analysts should pay .orgResidual Income Calculator | Economic Profitomnicalculator.The residual income model helps lenders gauge the creditworthiness or the ability of a potential borrower to return the money provided as loans.The primary philosophy behind the residual income model is that the portion of a stock ’s price that is above or below book value is attributable to the expertise of the company’s management.50 • Residual income in Year 2 = $0. Residual income valuation is similar to the calculations used to determine market value added (MVA) and economic value added (EVA) amounts. Accounting Educator: Courses. Conceptually, residual income is net income less a . Its underlying premise consists of .The residual income valuation model is an earnings-based method used to estimate the intrinsic value of equity of a given company.

Residual Income Model for Valuation

We evaluate the empirical implications of Ohlson’s residual income valuation model relative to several competing accounting-based valuation models. This note explains the residual income valuation model (RIM), how it relates to traditional valuation models, the intuition behind its use, and empirical research related to its value relevance.

Residual Income Model

It can be calculated using the capital asset pricing model (CAPM) or a similar model.We find that most of these studies apply a residual income valuation model, without the information dynamics that are the key feature of the Feltham and Ohlson framework.Conceptually, residual income is net income less a charge (deduction) for common shareholders’ opportunity cost in generating net income. So if Center Street’s EPS exceeds the cost of equity, what do you think the per-share residual income valuation would be . In the following, two deduced valuation models will be sp ecified and discussed – a.The residual income valuation model states that the firm value is the sum of book value and the present value of expected future residual income.50 • Residual income in Year 2 = . Consequently, the .

RI models use readily available accounting data.The OJ model thus generalizes the RIV model . Estimates firm value by discounting future residual income, which is the difference between net income and equity charge.Two valuation models based on accounting concepts and measurements are specified and discussed in the paper – a residual income valuation model and a value added .not immediately obvious that a valuation model based on residual income as derived .00 • The firm ceases operations in three years 0 1 23 0 0. In this paper we show that the three residual Income models for equity valuation always yield the same value as the Discounted . EVA serves as an indicator of the profitability of projects in which a company invests. from real c s t.

- What Is A Gothic Subculture? : The German Gothic Subculture

- What Is A Runaway Person? – Runaway Definition & Meaning

- What Is A Daeodon – An Ultimate Guide To Daeodon: The Fearful Tooth

- What Is A Minimally Invasive Aortic Valve Surgery (Mavr)?

- What Is An Example Of A Redox Reaction?

- What Is A Profibus Module? _ Profinet

- What Is An Espresso Machine – How An Espresso Machine Works: A Detailed Guide

- What Is A Regression Analysis Model?

- What Is A Vga Cord – Here Are 12 Different Types of Monitor Connections

- What Is A Loop In Python? : Identify which iteration you are on in a loop in python

- What Is A Hospital Simulation Game?

- What Is A Viz _ abbreviations

- What Is A Conflict Check In A Law Firm?

- What Is A Mother-Son Wedding Dance?