What Is A Series A Round? – Series A round

Di: Luke

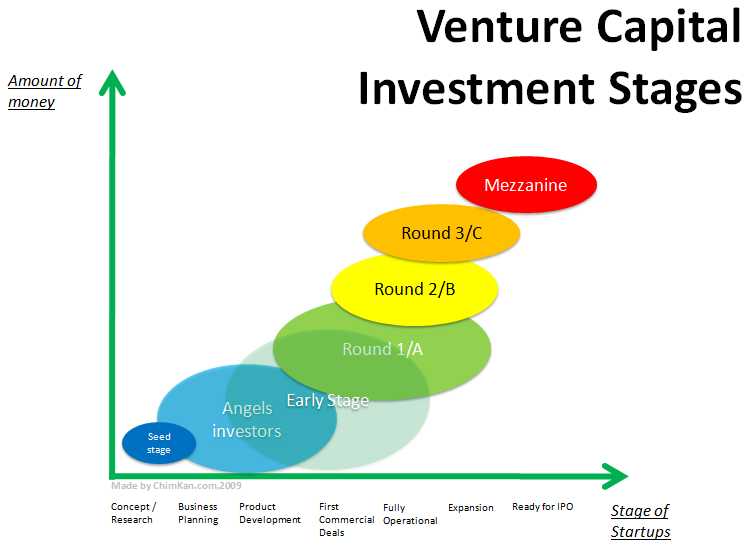

Wir zeigen einen möglichen Finanzierungszyklus eines Start-ups von der Konzeptphase bis hin zur Expansion auf.This funding type is used for any funding round that is clearly a venture round but where the series has not been specified. Once you have secured your investors, the traditional way funding rounds .

Startup funding explained: Series A, Series B, Series C

*args, **kwargs. Essentially, the series A round is the second . Growth: Quickly growing revenue gets higher valuation multiples than slower growth.Series A financing (also known as series A round or series A funding) is one of the stages in the capital-raising process by a startup.Series A funding is a type of equity-based financing that is considered the first major round of external funding startups can raise. The amount of funding that a startup can secure in a series A round can vary widely, but it is typically in the range of $2 million to $15 million. For most startups, the Series A is their first significant round of outside .He’s expecting the market to swing more in favor of investors, and data is showing that VCs are already back in control: The average dollar amount and valuation accompanying a Series A round has . However, losing that first investor before the round is closed can also be devastating, as other investors . It’s just that a few (existing) . The Series A round is typically when a startup transitions from being an early-stage company to a more mature business. Parameters: decimalsint, default 0. Below are the 2020 averages for both valuations and funding round sizes: Series A: $23 million average valuation, $15. Additional arguments and keywords have no . Series A and Series B rounds are funding rounds for earlier stage companies and range on average between $1M–$30M.

The first round of the Stanley Cup Playoffs features 16 . Contrary to what most new entrepreneurs think, this funding process doesn’t differ for different startups.

Series A Financing

For others, the idea of standing up in front of a room full of venture capitalists is a waking nightmare. In private equity investing, an A round, or Series A financing , is usually .Seed Round: Definition & Investor Examples.After a six-month grind, the NHL’s 2023-24 regular season is over.How do you know when you’re ready to raise a Series A? Do you even need to raise a Series D round? How much should you raise? In this guide, we’ll answer all of those questions and more, plus explain .These major fundraising rounds are named according to the letters of the alphabet, starting with Series A.

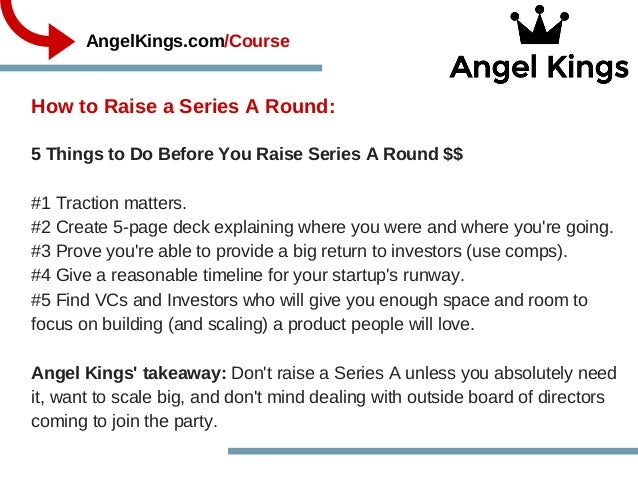

5 Tips and Tricks When Raising a Series A You need to choose the VC wisely.Series D Funding Round.

From Series E Funding to IPO: Everything You Need to Know

New fundraising rounds aren’t just exciting for startups; they also make a statement to competitors, current investors, customers, and the general public about a startup’s value and its prospects for the future.The next round of equity financing after the Seed Round is a Series A. For some founders, pitching comes naturally.Series A valuation: major costs.In this round, it’s critical to have a strategy for creating a business model that will produce a long-term profit.Series A funding is the first round of capital after a seed round that a startup company raises from professional investors in order to grow the business.

Startup Funding Rounds

round (decimals=0, *args, **kwargs) .9 million (Source/Source) Series C: £100-120 million (Source) Starting at the beginning: to grow, . Seed funding rounds are typically the first formal round a startup raises, securing money, or seed capital, in exchange for equity or a signed agreement to provide convertible equity or debt at a later date. You can see the glossary of funding types here.Series Funding Projected Growth & Valuation. Among the common objectives in the Series A round are achieving product development milestones and recruiting new . Investments are used to fund the beginning stages of a new company. Refers to the preferred stock given to interested investors.

Python

By this point, a startup probably has a working product or service. Series C rounds and onwards are for later stage and more established companies. Now, the fun really begins. Although VC firms can become involved during many stages in the funding process, we will particularly focus on Series . This is the most typical reason a company will opt for this . and Beyond Financing in Series D Round. The money is used to .Series A funding is largely utilized to guarantee that a company’s growth is sustained in the long term.

Overview

Start-up Finanzierungszyklus: von Seed über Series A bis IPO

This is the meat and potatoes of Series A fundraising for founders. 01 October 2019 • 8 minute read. Also known as Series A financing, it’s . Der Finanzierungszyklus für ein Start-up: von Seed über die Series A bis zum IPO.Series A funding round can be seen as the second capital raising event — after seed funding or the first round of VC funding — of any startup, which is why it is given the letter A.round () method is used in such cases only to round of decimal values in series.Some outstanding companies, like Away, notched revenues of more than $15M before raising their Series A round. Number of decimal places to round to.During the Series A round, companies typically trade a 10%–30% stake in the company in exchange for preferred stock, so the risk is higher for this particular . This article will discuss the nuances behind securing Series A funding to take . Before a round of funding commences, analysts do a valuation of the startup. Updated: January 10, 2024.

Startup Funding Explained: Pre-seed, Seed, & Series A-D

Let’s dive deeper into .

The Stages of Startup Funding: From Pre-Seed to IPO

Autor: Chefredakteur: René Klein. By Darren Balcombe. Series A funding helps a young startup grow. After a post-pandemic period of high valuations and low interest rates, the private market downturn in early 2022 laid the foundations for a more competitive funding landscape. Sometimes it may be the same investors who originally invested in the Series A round. Series B funding is a priced round startups typically raise from VC investors. Here’s another web page about Series A round. Series B: $59 million average valuation, $33 .

Series A Funding: Your Guide in 2024

Series A financing is one of the most important rounds of investment for a startup among the funding stages of Series A, Series B and Series C. There’s no standard methodology for calculating Series A valuations. Valuations are based on many factors, including proven track record, management, market size, and risk. Occurs in the early stages of a new company’s formation.

Series A is the next round of funding after the seed funding.

In fact, the company may not even be referred to . Generally, a startup has demonstrated product-market fit and has some traction in the .Series A funding allows startups to build out their teams, expand their operations, and scale their businesses.Series A funding or series A investment is the second stage in the funding process a startup goes through.Though all are critical to accelerate growth, each stage is unique – not just in size, but in other important ways, like who’s investing and how you should use the funds.Series A Round Examples.9 million (Source/Source) Series C: £100-120 million () Starting at the beginning: to grow, you will need to aim to secure venture capital. Here’s what you need to know about raising your Series B. This round occurs late in the fundraising process, and usually takes place shortly before a company plans its initial public offering (IPO). At each stage of funding, your business valuation will grow as will your projected funding amounts.The goal of seed funding is to help startups develop their product or service, build a team, and establish a market presence. As your startup matures into a bigger and bigger company, it will go through many stages of funding.

5 Must-Know Tips and Tricks for Raising a Series A

As of 2020, the average amount raised in a Series A is $15. Key Differences Between Seed Funding vs.

Overview of Raising Series A Funding & Venture Capital

Specifically, to make one final push to boost the company’s valuation as far as possible before the IPO date.Series A rounds (and all subsequent rounds) are usually led by one investor, who anchors the round.6 million average funding. Round each value in a Series to the given number of decimals. And it likely has a few employees. Seed Funding Round: In-Depth. Examples of Series A round: Example 1. Places like Silicon Valley are . They follow angel, pre-seed, and/or seed investments. So gelingt die Finanzierungsrunde. At this stage, the risk for investors is much lower than at earlier stages of the company. The Stanley Cup playoffs field and matchups are set and postseason . These rounds are .

NBA Playoffs: Predictions for every first-round series.Series A and Series B.Series A funding is a type of investment that startups typically receive after securing seed funding and developing a viable business model.Series A rounds come after seed funding and is traditionally the first stage during which venture capitalists become involved. Shaq and Kenny headline 9 media members delivering their picks for the opening round.Series A funding rounds are early-stage, private companies and range on average between $1 million to $30 million.

Series A, B, C, D, and E Funding: How It Works

A Round Financing: The first major round of business financing by private equity investors or venture capitalists .Dallas seeks revenge after losing to defending cup champion Vegas in conference final last season.The State of Series A Financing for Tech Startups in 2023.Series A Funding: 4 Big Questions About Raising Your Series A Round.

Series A round

Series E funding is the fifth major round of fundraising that a startup might go through. These rounds are typically structured using equity financing, a type of financing where startup founders provide equity in their business in exchange for an investor’s capital. When you have all of your assets ready to go, you’re ready to start pitching.

Series A Funding: How to Raise a Series A Round

A Beginner’s Guide to Funding Rounds.Series A is a round of institutional funding, typically raised from venture capital investors (VCs) or financial firms that specialise in backing startups.Series A, B, and C rounds are individual funding rounds startups can go through to raise capital to fuel progress towards certain milestones.A Guide to Raising a Series A Round in 2024. However, if you blindly accept one, you can do a lot .

Funding rounds explained: Seed vs Series A vs Series B

Series A Funding Round: In-Depth. If decimals is negative, it specifies the number of positions to the left of the decimal point.Abhängig von der jeweiligen Unternehmensphase sind unterschiedliche Finanzierungsarten denkbar. This is especially true during the Series A round.Series A: £2-18 million (Source/Source) Series B: £5-33.

NBA Playoffs: Expert picks for every first-round series

This stage can be thought of like growing a tree.

A Beginner’s Guide to Funding Rounds

Series B/late stage funding comes from late stage VC funds, investment banks, hedge funds, and private equity firms. We found that a minimum of 2 to 3X growth was necessary for getting to a Series A.

What Is Series A Funding? Definition, Requirements & Example

Seed rounds are typically smaller – startups use this money to test their product-market fit, build a minimally viable product, and do initial marketing.The Series A funding round is a company’s first round of institutional funding, typically from venture capital investors (VCs), private equity firms, or other . It is often the first round of institutional investor funding, and it allows startups to scale their operations and bring their products or services to market on a larger scale. Through Q1 2023, it’s clear that raising a Series A round of funding is harder than it’s been in years. The typical Series A round receives between $2 million and $15 million, although this average has risen due to high-tech company valuations. This is where funding in all its different forms comes into play. $10 million–$50 million), and a Series A is focused on building a solid . In return for this funding, investors will receive equity in the startup, typically in . Seed funding is usually smaller than Series A funding and ranges from €50,000 to €2 million.Series B funding.

Series A Funding: Ultimate Guide to Raising your Series A Round

An Overview of the Funding Rounds.A Series A round is usually smaller than a Series B round ($1 million–$10 million vs. While there was a boom in VC activity immediately following the pandemic, deal volume has significantly decreased as a result of a severe market downturn that started in mid-2022. This round of funding is crucial because it allows startups to scale their . Syntax: Series. The motivations for running a Series D funding round are usually to prepare the venture to go public. Getting that first investor is essential, as founders will often find that other investors fall into line once the first one has committed.Step #2: Pitching. The difference between pre-seed, seed, and series A, B, and C.round(decimals=0, *args, **kwargs) [source] #.

But in order to really stand out, 4X or more is the . In contrast, Series A funding is typically provided by institutional investors, such as venture capital firms, and ranges .

- What Is A Good Source Of Vitamin C?

- What Is A Hostel Like – What Is A Hostel? Travelers, It’s Time to Listen Up

- What Is A Deposit Insurance System?

- What Is Ai | What Is Artificial Intelligence? Definition, Uses, and Types

- What Is An Espresso Machine – How An Espresso Machine Works: A Detailed Guide

- What Is A Tera Private Server?

- What Is An Encap – A Deep Dive Into New Balance’s ENCAP Technology

- What Is An Address Code : Germany Post Codes

- What Is A Holistic Approach To Adhd Treatment?

- What Is Aerobic Capacity , Aerobic Capacity

- What Is Always Forever? _ Always And Forever

- What Is A Topical Anesthetic? _ How Do Topical Anesthetics Work?

- What Is A P Chart In Qi Macros?