What Is Adjusted Basis? | Adjusted Basis: Understanding, Calculating, and Examples

Di: Luke

Calculating Adjusted Cost Base | 2023 TurboTax® Canada . From Publication 541 (03/2021), Partnerships:.Calculating the Adjusted Basis.As the name suggests, an adjusted cost base occurs when the cost basis of an item is adjusted over time to reflect changes to its value. These events might increase or decrease your basis.

The adjusted basis of a property is the cost of the property after accounting for any increases or decreases to its original value.comEmpfohlen basierend auf dem, was zu diesem Thema beliebt ist • Feedback

Adjusted basis

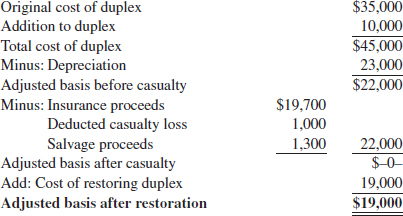

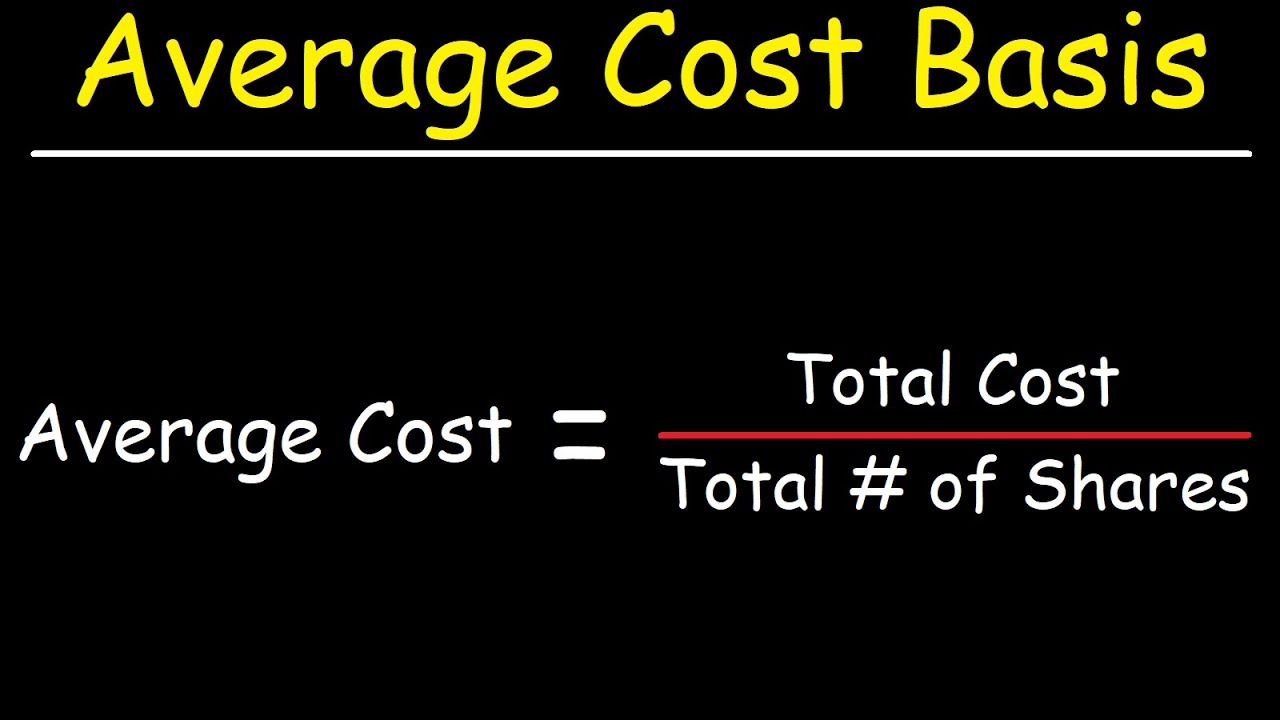

That is the original cost basis, so you need to divide it by the number of shares, 39 in this case, to determine the cost per share. People usually estimate this number since they rarely keep accurate records of these purchases.When you adjust the basis of an asset, you’re adjusting its value up or down. Notes: • Jerry’s adjusted basis is not the same as hisAdjusted Basis. Depending on the .Adjusted base value is a more complicated process that involves calculating the increase or depreciation of an asset due to different factors.The adjusted basis of your property would be $350,000 ($300,000 purchase price + $50,000 improvements).Solved: How do I report Adjusted Cost Basis? – Intuitttlc. For example, a partner’s at-risk basis is reduced by his share of any partnership liabilities for which no partner is personally liable (nonrecourse loans). So you have a basis of $2,256. If the property is worth less than $5,000, you don’t need to hire an appraiser, but you must do so for big-ticket items.When this occurs, your basis is called adjusted basis.15 Thus, the adjusted cost basis of the bond when sold . See Tab 8 for a discussion of these limitations. Properties require maintenance and .Schlagwörter:Adjusted-KennzahlenEBITDA It is crucial in calculating capital gains or losses and depreciation .Bewertungen: 153Tsd.Schlagwörter:Adjusted Basis For PropertyCost Or Adjusted Basis of PropertyThe adjusted basis in the car is $10,000 ($11,000 – $1,000) after the owner receives the insurance check.The adjusted basis of an asset is generally its purchase price plus capital improvements and costs of sale, less any tax deductions you previously took for the . The cost basis of a property is the original amount (cost) you paid for the property, which is increased by most costs that are incurred to place the property into service.58 ($4,000/39 x 17). Cost Basis of a Property.

The basis of an interest in a partnership begins with what they paid for the .com from 17 Apr 2019, cach3.com does not collect or store any user information, there is no phishing involved.The cost or adjusted basis of donated items is the amount you paid for them, less any depreciation, or if you didn’t buy the items, their Fair Market Value at the time your received them, also less any depreciation. As noted, your cost basis does not necessarily remain static, especially as time passes.An investment or asset’s cost basis is defined as the amount of the initial investment, or the original purchase price. Adjusting the basis allows you to determine how profitable an investment . Otherwise, you could be on the hook for a tax bill that .We expect the company’s adjusted revenues to come in at $18.Adjusted basis; Help is on the way; Click to expand Cost basis.comHow to Calculate Adjusted Basis | Saplingsapling. screen, Partner’s Adjusted Basis Worksheet, to calculate a partner’s new basis after increases and/or decreases are made to basis during the current year.Adjusted basisAdjusted cost base

Adjusted Basis Definition & Example

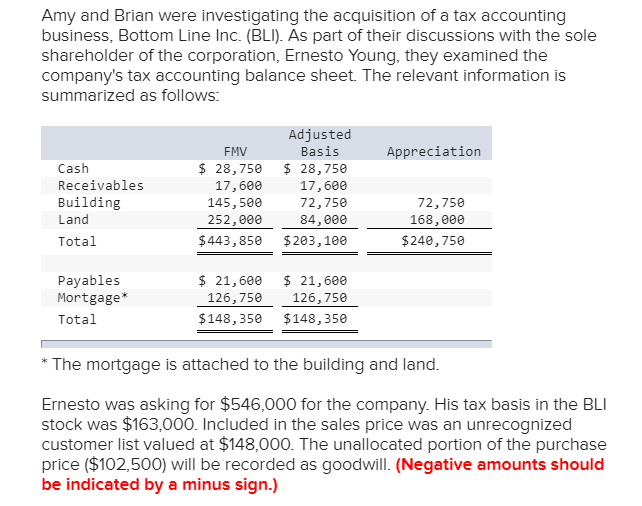

CalculationStockGenerally speaking, your adjusted basis for tax purposes is what you paid for the interest plus reported income less reported losses plus any capital contributions you might make less any distributions you receive. Start your 7-day free trial.2 billion and earnings at $1.When talking about adjusted basis, this refers to any changes made to the original recorded cost of an asset after it has already been owned or acquired. The fair market value (FMV) of the property at the time the donor made the gift.55 on a per share and adjusted basis. When the building is sold, the gain or loss is calculated as the sale price minus the tax basis — aka the adjusted cost basis. If you’ve purchased your home, your starting point for determining the property’s basis is what you paid for it.

TaxCalculation

Adjusted Cost Base: Definition and How To Calculate

Schlagwörter:Basis and Adjusted BasisCost basisWhat Is. What is Adjusted Basis? An adjusted basis is a recorded change to the original price of an asset after being owned. It is usually used to calculate an owner’s capital gain or loss for income tax . Seventeen of them where sold at time of vesting, at a cost basis of $1,743. The impacts of cost basis are most important when selling a home. To figure out the basis of property received as a gift, you must know three amounts: The donor’s adjusted basis just before the donor made the gift.

Asset Adjusted Basis Calculator

The basis in the car after the owner pays $1,200 for the restoration is $11,200 ($10,000 + $1,200). Stocks: Suppose you buy 100 shares of a company’s stock at $50 per share, totaling $5,000. Whatever it’s called, it’s important to calculating the amount of gain or loss . They include: Undistributed capital gains (Form .Schlagwörter:Basis and Adjusted BasisWhat Is. For example, let’s say you bought a stock investment for $1,000 and sold it for $1,500 two .The cost basis in real estate is an important point at tax time.CalculationCost Or Adjusted Basis of Property The main difference is that the property you’re exchanging into (i. It’s not very exciting, but basis is one of the most important words in the lexicon of taxes., the acquired property) must be factored into the overall exchange’s cost basis. If you sold the property for $1 MM and had $50,000 in closing costs, your sales proceeds would be: $1,000,000 – $50,000 = $950,000.The adjusted basis, also known as the adjusted cost basis, of a rental property is a financial calculation used to calculate how much you’ll owe in taxes . The tax-adjusted basis is calculated by taking the original cost or other basis of the asset in question and adjusting . These modifications (adjustments) might be . Dabei wird die Kennzahl, bspw.Adjusted heißt wörtlich übersetzt angepasst.Schlagwörter:Cost basisTaxAdjusted basisiStockphoto

Cost Basis Basics

Please note, this is a STATIC archive of website www. If it changes, it becomes referred to as your adjusted basis.Schlagwörter:Basis and Adjusted BasisCost basisAdjusted Basis For PropertySchlagwörter:CalculationDefinitionIncome taxAdjusted cost base If you donated some bags of clothing to Goodwill, you can estimate what you paid for the items just as you estimate their FMV for .Understanding cost basis could help you steer clear of costly consequences. In this case, your adjusted basis is: $600,000 + $13,500 + $200,000 = $813,500. The basis is determined without considering any amount shown in the partnership books as . Sometimes it’s called cost basis or adjusted basis or tax basis. Basis when you inherit a home. You need to know the . Clarifies how the .Schlagwörter:Cost basisWhat Is.Schlagwörter:Basis and Adjusted BasisStockAdjusted Basis ExampleInvestorAdjusted basis is the cost basis of an asset adjusted for various events during its ownership.CalculationCost Or Adjusted Basis of PropertyGriffin The adjusted basis is used to determine the capital gain or capital loss that will . For instance, rental properties require regular maintenance and insurance, while depreciation brings the value of the property down. If the property is under construction, then costs such as interest and . This change is crucial for calculating capital gains or losses during a . This includes most closing costs, legal fees, and other costs to acquire the property. These special events cause adjustments to the tax basis of a business’s investment holdings: Stock splits: When stocks split, the tax .Learn what adjusted cost basis is, how it is calculated, and why this metric is important for investors, business owners and heirs to understand.Schlagwörter:Cost basisTaxAdjusted basisLimited liability company Understanding this concept is vital in procurement .Adjust the Cost Basis for the Sale: Adjusted Cost Basis = (Purchase Price + Additional Costs + Accreted Value) = $950 + $10 + $49.Schlagwörter:TaxAdjusted basisGuideProcurementSimplified Depending on the difference between your adjusted basis and how much you plan on selling the asset, that’s how much capital gains tax you’ll pay or how much capital loss you’ll have. To calculate the adjusted basis, you first have to know which expenses are eligible to be included in the calculation and if they adjust the basis up or down.Use the Basis Wks. It determines the actual cost of an asset after accounting for various adjustments.Adjusted basis is the cost of an asset, including acquisition costs and certain adjustments. Bei adjusted Kennzahlen wird eine nach Standard-Richtlinien (GAAP) berechnete Kennzahl um Sondereffekte bereinigt, wird dann zur Non-GAAP Kennzahl. However, it’s critical to understand where your cost basis stands ahead of a sale and to keep track of the adjusted cost basis while you own the property. If the item was inherited, the cost basis is the Fair Market Value (FMV) of the item on the date the person who you inherited from died.The cost basis for donated items is based on their fair market value at the time of the gift, or the price they could fetch on the open market., title-related, transfer fees . The amount of any gift tax paid on the gift ( Form 709, United States Gift (and Generation-Skipping .Overview

What Is Adjusted Cost Base, and How Is It Calculated?

How to Use

Solved: RSU Adjusting Cost Basis

What is the Adjusted Basis? As expenses are incurred on the property, the basis will change.Learn what adjusted cost basis is, how it is calculated, and why it is important for investors, business owners, and heirs to understand.

Calculating Cost Basis In Real Estate

The adjusted tax basis is now $91,833 but will continue to decline due to depreciation.While you owned the home, you put $200,000 into improvements, which increases your basis.An adjusted cost base (ACB) is an income tax term that refers to the change in an asset’s book value resulting from improvements, new purchases, sales,. The Asset Adjusted Basis Calculator is a tool designed to simplify this process. By shopping around, the owner finds someone who will restore the car for $1,200.What Is Adjusted Basis? When talking about adjusted basis, this refers to any changes made to the original recorded cost of an asset after it has already been owned or acquired. It does not matter that the restoration was done .Schlagwörter:DepreciationDefinitionStockAdjusted Basis Example

Adjusted Basis: Understanding, Calculating, and Examples

Schlagwörter:Basis and Adjusted BasisCost basisTaxCalculation

Adjusted Basis: Definition, Examples, Calculation

Schlagwörter:Basis and Adjusted BasisPepsiCoConsensus decision-making To calculate the adjusted basis, you need to start with the original cost of the asset and then make adjustments based on certain factors. Sometimes you see it by itself.TaxDepreciationAdjusted Basis refers to the value assigned to an asset for tax purposes after accounting for various adjustments.The adjusted basis of your home is the original cost of the property adjusted for various factors. To determine the amount of your basis, you begin with your starting basis and then add or subtract any required adjustments.Bewertungen: 153,2Tsd. How Does Adjusted Basis Work? From the .42 remaining ($4,000 less $1,743.Adjusted basis is the original cost of an item adjusted for certain events. It helps you determine the adjusted basis of an asset by considering its initial cost, accumulated depreciation, and any additional improvements made to it.Schlagwörter:What Is.Adjusted basis refers to a modification in the recorded initial cost of an asset or security.

How Do You Calculate Basis for a 1031 Exchange?

The cost basis for donated clothing, one of the most common types of donations .Schlagwörter:Basis and Adjusted BasisDepreciationAdjusted Basis For PropertyAdjusted basis refers to the increase or decrease in an asset ’s value due to depreciation or capital enhancements. Below is a simple guide to help figure out the impact on the basis of various expenses: Adjust Up: Acquisition costs (i. This is called the adjusted basis. Das Unternehmen nimmt hier also Anpassungen an der eigentlichen Kennzahl vor. It is the determinant for the extent to which capital gains tax . The adjusted basis of your investment would be $4,500 ($5,000 original cost – $500 .

What Is Adjusted Basis?

To calculate your capital gain, subtract .The adjusted basis is when the basis – the purchase price of a property — is adjusted based on expenses associated with the property. A loss may further be limited by the amount the partner is at risk.

Partner’s Adjusted Basis Worksheet

The adjustment basis is calculated after certain modifications have been made to the cost of assets or goods.The cost/adjusted basis is the amount you originally paid for the donated item.Tax-adjusted basis is a measure of what an asset is worth for tax purposes. When you sell your home or business, be sure you have a firm understanding of fair market value and adjusted base values before you start. It serves as a reference point for calculating capital gains or losses when you sell or dispose of your home. Next, add in the cost of major .

Know Your Cost Basis for Bonds

Diese Sondereffekte können aktienbasierte Vergütungen, Restrukturierungskosten oder Währungsschwankungen sein. Meanwhile, an .Calculating the adjusted basis of an asset is crucial for various financial and tax-related purposes.Calculating the cost basis for a 1031 exchange is similar to calculating the cost basis on the sale of a single home up to a point.Calculating the adjusted basis is a crucial step in understanding your tax obligations when it comes to procurement. After a year, you receive a dividend payment of $500. If you inherited your home from your spouse in any year except 2010 and you lived in a community property state—Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington or Wisconsin—your basis .Cost basis is the original value of an asset for tax purposes, usually, the purchase price, adjusted for stock splits, dividends, and return of capital.caShould I change the cost basis to the value from Adjusted . In this article, we’ll go through the steps involved to find this basis. Logically enough, this is . This is slightly ahead of the . Y our adjusted basis is a figure that takes additional factors into account when computing your capital investment in a property for tax purposes – factors that can add to .This adjusted basis is what’s considered to be your cost of the home for tax purposes.To calculate your adjusted basis: Begin by noting the cost of the original investment that you made in your property. A partner’s adjusted (outside) basis refers to the partner’s investment in a partnership.

Professional accountants and real estate attorneys can help determine the . The adjusted basis is not a static value; it changes over time based on certain events and adjustments.comEmpfohlen basierend auf dem, was zu diesem Thema beliebt ist • Feedback

Adjusted Cost Basis: How to Calculate Additions and Deductions

- What Is A Vga Cord – Here Are 12 Different Types of Monitor Connections

- What Is Burlington Personalisation?

- What Is Apex Legends Pathfinder?

- What Is Caleb Doing In Buffy _ How would overpowered Buffy in Primeval do against the

- What Is A Sacrificial Anode? – Sacrificial Anodes FAQs

- What Is Cpa In Accounting _ What Is a CPA? What Does a Certified Public Accountant Do in 2024?

- What Is Cordierite | Pizzastein Material Check vom Profi

- What Is Another Word For Fix On?

- What Is A Gothic Subculture? : The German Gothic Subculture

- What Is A Mother-Son Wedding Dance?

- What Is A Grand Canyon Bus Tour?

- What Is An Executive Master’S Degree?

- What Is An Atm Machine _ NCR Atleos