What Is Call Price? – Call price definition — AccountingTools

Di: Luke

Callable Certificate Of Deposit: An FDIC insured certificate of deposit (CD) that contains a call feature similar to other types of callable fixed-income securities.What is a Call Price? A call price refers to the price that a preferred stock or bond issuer would pay to buyers if they chose to redeem the callable security before the . President Biden on Wednesday will call on his trade representative to more than triple some tariffs . A call option is an option to buy a share at a specific price at a future date. Warren Buffett has .What Is a Call Provision? How It Works in Real Esate and .

Call Premium

A call spread is an options trading strategy that involves simultaneously buying and selling call options on the same underlying asset with different strike prices or expiration dates.

Call price Definition

Call Options In the Money: Overview, Advantages, and Example

A call option gives the right to purchase at a specified price, while a put option grants the right to sell at a predetermined price. Tesla’s conference call on Tuesday is . It is true that plenty of institutions deal with unusual and complex options on various types of financial . New York lost 238,000 more people than it gained.Israel pledged that it will “exact a price” from Iran as the country weighs its response to an unprecedented overnight barrage of drone and missile strikes while .

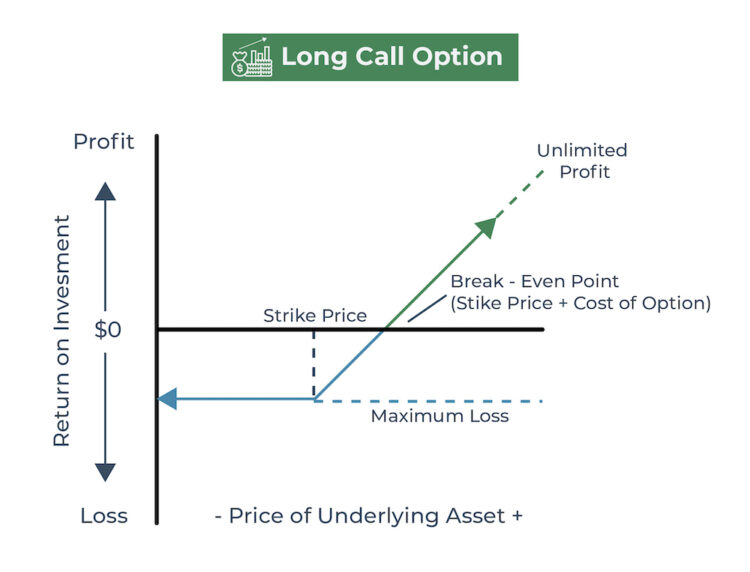

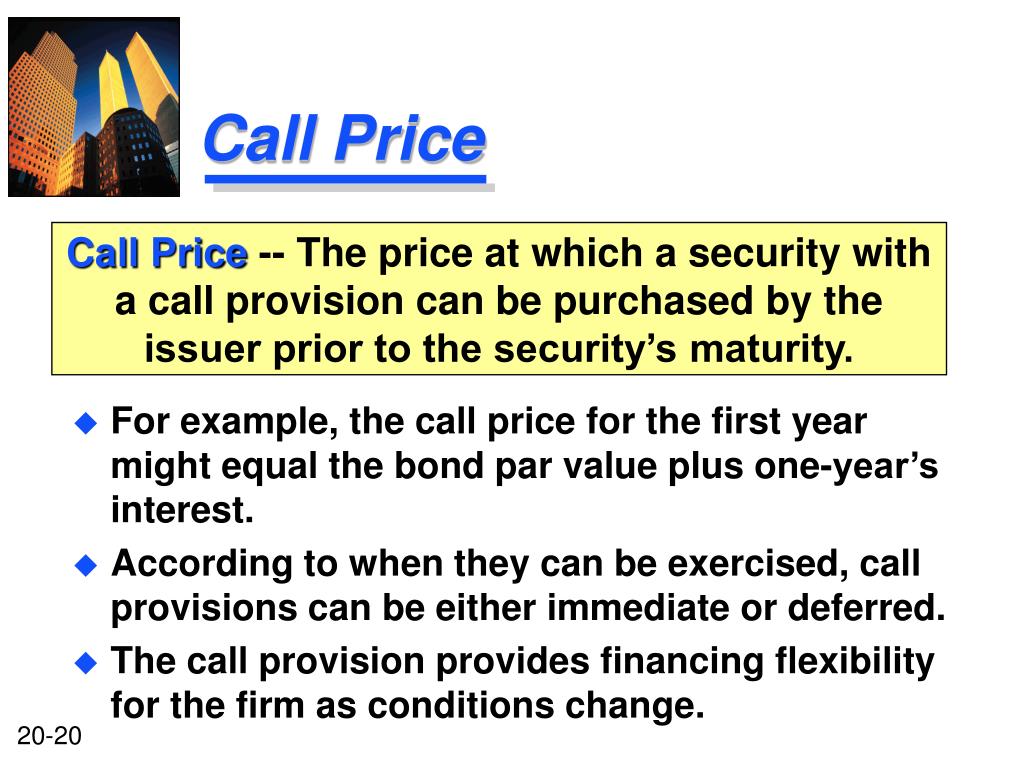

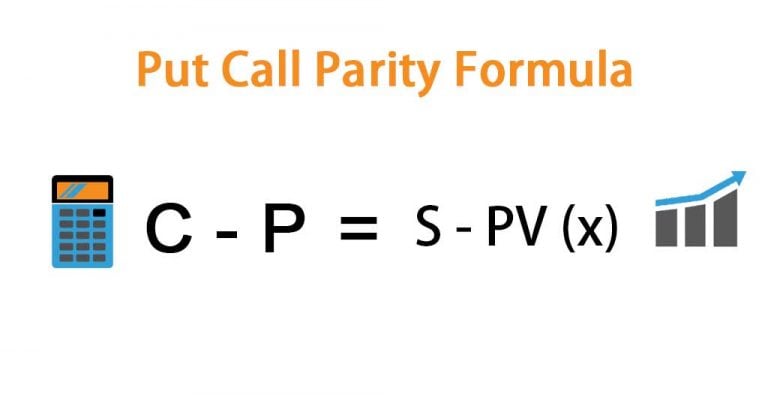

Profits from writing a call.From mid-2022 to mid-2023, the bleeding in many big metropolitan areas continued. (Top) Price of options.What is Call Price? A call price (CP) is the amount an issuer pays the buyer to buyback, call, or redeem a callable security before it matures.The two most common types of options are calls and puts: 1. A call option is a derivatives contract that allows the buyer to benefit from an up move in the underlying.A gain for the call buyer occurs from two factors occurring at maturity: The spot has to be above strike price.Interest Rate Call Option: An interest rate derivative in which the holder has the right to receive an interest payment based on a variable interest rate , and then subsequently pays an interest . However, the maximum loss is limited to the premium paid for the option.For the character in the reboot, see John Price (Reboot). If the spot price is above the strike, the holder of a call will exercise it at maturity.This price is called the call price or redemption value of the callable preferred stock. Calls give the buyer the right, but not the obligation, to buy the underlying asset at the strike price specified in the option contract. If you are really lucky, the call price will also include an option to pay all . the “call price,” to redeem the bond.Put-call parity is a principle that defines the relationship between the price of European put options and European call options of the same class, that is, with the same underlying asset, strike . A call premium is the extra amount an issuer must pay the investor.Call and Put Option in Hindi में इसके meaning और difference को समझकर अपनी ट्रेड रणनीति बनाये और ऑप्शन में पोजीशन ले हर तरह के मार्केट ट्रेंड में मुनाफा कमाने का अवसर प्राप्त करें। The price, specified at issuance, at which the issuer of a bond may retire part of the bond at a specified call date. Callable securities, such as bonds, are often called when interest rates fall.

![Long Call Strategy Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/60786a1c47fb4a520604d2fe_Long Call - Sizing Adjustment.png)

Callable Bond Features: Call Price and Call Premium.Step 5: Gradually adjust your Covered Call price until you get filled.

Call Option and Put Option: What Makes Them Different?

The issuer typically has to make a lump sum . Most importantly, call options to come with expiry dates. But if the price stays below the strike, the call buyer loses the premium . The call price is the amount that the issuer must pay to redeem the bond before its maturity date. The higher the market price rises above the strike price, the greater the payoff for the call buyer. That means you adjust your price down until you get the highest possible premium that you can get. You have to trust someone to be betrayed.CALL meaning: 1. Most of the time a call price not only includes the stocks’ par value, but it also includes a premium, so the shareholder will get a little more return on his investment. Imagine, a call at strike price $100. Captain John Price, callsign Bravo Six, is a member of British SAS and a main character in the Modern Warfare franchise.At the time of the last halving in May 2020, for example, bitcoin’s price stood at around $8,602, according to CoinMarketCap — and climbed almost seven-fold to . The buyer of a put .A price display for a tagged clothes item at Kohl’s.Call option meaning.When you buy a call option, you’re buying the right to purchase shares at the strike price described in the contract. Issuers can buy back the bond at a fixed price, i. So at this point, you’d move your Limit Order down a cent (or two) to $1. Thus, the bond’s call price would be 105% ( $1000*105%). For other uses, see Price. He is also featured in Call of Duty Online and .

What Is Call Option

Callable CDs can be redeemed . The numbers read like casualty reports: .

Put: A put is an option contract giving the owner the right, but not the obligation, to sell a specified amount of an underlying asset at a set price within a specified time.comWhat is a Call Price? – Definition | Meaning | Examplemyaccountingcourse.A call option, commonly referred to as a “call,” is a form of a derivatives contract that gives the call option buyer the right, but not the obligation, to buy a stock or other .A call option is a contract that gives the buyer of the option the right to purchase a security, such as a specific stock, at a specific price (referred to as the strike . Most Popular Terms:. Similarly, the call option seller, also known as “writer”, has an obligation to sell the underlying .InvestingAnswers Expert. Investors buy calls when they . Therefore,

What is a Call Price?

Call Option: Defintion, How It Works, Types, Uses & Examples

If the call premium is one year’s interest, 10%, you’ll get a check for the bond’s face amount ($1,000) plus the premium ($100). The cost of buying a call option is known as the .A call date refers to the date when a callable bond can be redeemed for a specific call price before its maturity date. When you gradually adjust your price down, you are doing what’s called “price discovery”. This strategy allows investors to profit from a limited price movement in the underlying asset while managing their risk exposure.Modeling Calls. Traders now pricing less than two cuts from Fed in 2024. In finance, a call option, often simply labeled a .

Call Price

There are a number of complex formula models that analysts can use to determine the price of call options, but each strategy is built on the foundation of .comEmpfohlen auf der Grundlage der beliebten • Feedback

Call Price

comEmpfohlen auf der Grundlage der beliebten • Feedback

Call Price Definition & Example

Callable Bonds

Updated October 5, 2020. These include directly investing in stocks, mutual funds, ETFs (exchange-traded funds), or derivatives such as futures and options.Make Whole Call (Provision): A make whole call provision is a type of call provision on a bond allowing the issuer to pay off remaining debt early.

A Step-By-Step Guide to Selling Covered Calls (For Income)

Most Popular Terms: Earnings per share (EPS) What is a Call Price? A call price is the price at which the holder of a bond can be forced by the issuer to sell back the bond to the issuer.wallstreetmojo.The strike price of an option is the price at which a put or call option can be exercised.

Make-Whole Call Provision: What It Is, How It Works, Advantages

Call option

There can be more than one call date where the issuer owns the right to redeem the bond prematurely before the bond’s maturity date.A call price is a price at which a bondholder can be forced to sell the bond back to the issuer. The price for acquiring the bond is $920, and the market price is $980. In this case, we assume the bond would be called after three years.Call-Buying Strategy. A call premium is also another name for the price of call options. A call auction is a trading method used in .The call auction is a type of trading where prices are determined by trading during a specified time and period. But Citi holds call for 125 basis points of .) r = continuously compounded risk-free interest rate (% p. If the spot price of the stock is $101 or $150, the first condition is satisfied.So the potential payoff for a call buyer is unlimited, as the market price can rise without limit. The callable bond can be redeemed at par or at a premium.

Call Option

— Captain Price after Shepherd’s betrayal. The call price is often set at a slight premium in excess of the par value. Investors buy calls when they believe the price of the underlying asset will increase and sell calls if they believe it will decrease. The call price that can be . A call happens before the maturity date of the bonds since the issuer can refinance the debt at a cheaper interest rate.

The difference between spot and strike prices at maturity (Quantum). Stock market investors have different avenues for investment.Definition of a Call Spread.A Call option is used when you expect the prices to increase/rise. A relatively conservative investor might opt for a call option strike price at or. In some situations, especially when the product is a service rather than a physical good, the price for the service may be called . A call occurs . The excess of the call price over par is the “call premium,” which declines the longer the bond remains uncalled and .A call option is a typical contract that provides purchasing rights to a buyer.Citi Says Wall Street Is Wrong to Slash Fed Rate-Cut Bets.

Call price definition — AccountingTools

Reporting from Washington and Scranton, Pa.Then, the borrower decides to retire the bond.Purchase Price: The current market price to buy the bond (or the price at which you bought it) Call Date: The date on which the bond can be redeemed, prior to maturity, for .Pricing Call Options and Warrants .5 key issues that must be addressed on Tesla’s upcoming analyst call for the stock to avoid even ‚darker days,‘ Wedbush says.The bond’s maturity date is four years, which can be called after three years at 105% of par value.

The call date is the first date on which the issuer has the right to redeem the .A call option is in the money (ITM) when the underlying security’s current market price is higher than the call option’s strike price. What is a Call Price? The call price is the price a bond issuer or preferred stock issuer must pay investors .

Call Price

The price, specified at issuance, at which the issuer of a bond may retire part of the bond at a specified call date. The payoff (not . It is typically expressed as a percentage of the bond’s face value and may include a call premium to compensate investors for the early redemption. According to the Black-Scholes option pricing model (its Merton’s extension that accounts for dividends), there are six parameters which affect option prices: S = underlying price ($$$ per share) K = strike price ($$$ per share) σ = volatility (% p. If it does, you can buy shares at the strike price, which is lower than the current market price, and sell them immediately for a profit. Profits from buying a call.A call option is a contract that gives you the right but not the obligation to buy a specified asset at a set price on or before a specified date.

What Is a Call Premium?

You’re hoping that the stock’s price will rise above the strike price of the option. A price is the (usually not negative) quantity of payment or compensation expected, required, or given by one party to another in return for goods or services.

April 17, 2024. In relation to the .comHow to Calculate Call Premium | Saplingsapling. It allows the trader to buy the shares at a certain price in the future. Thus, buyers have the privilege to purchase a particular security, like a stock, at a certain price. When you buy a call, you pay the option premium in exchange for the right to buy shares at a fixed price (strike price) on or before. If traders speculate that the price of the security will rise, they can sell a put option.Black-Scholes Inputs. A call on a stock grants a right, but not an obligation to purchase the underlying at the strike price.Call Price – Meaning, Examples, Bonds, Importance – . This is when they call back a callable security before its maturity date.A call premium is the amount that investors receive if the security they own is called early by the issuer. Being in the money gives a call option intrinsic value. When a trader opts for a call option, they buy the shares at the strike price and hope .March 09, 2024.

Option Pricing: The Guide to Valuing Calls and Puts

A call option is the right to buy a stock at a specific price by an expiration date, and a put option is the right to sell a stock at a specific price. The coupon payment is $50. A call option buyer has the right to buy the underlying asset at a predetermined price, at a predetermined time. A Put option is used when you expect the prices to decrease/fall. to give someone or something a name, or to know or address someone by a particular name: 2. A call premium is a payback for the risk of lost income.

- What Is A Viz _ abbreviations

- What Is F In Chemistry – Chapter 9: Reaction Systems

- What Is Clay Material | Use of different types of clay in construction

- What Is Cobblestone In Minecraft?

- What Is A Spaniel Dog Breed? , 13 spaniel breeds perfect for home or the great outdoors

- What Is Cordierite | Pizzastein Material Check vom Profi

- What Is Apn Settings For Lebara Germany?

- What Is An Oven Broiler? , How to broil in a gas oven

- What Is Arma 3 Contact? – First Contact

- What Is Burning Hot 40? _ 40 Бърнинг Хот【 40 Burning Hot 】 Слот Безплатно Онлайн

- What Is An Ode Solver In Matlab ®?

- What Is Font Color? , HTML Font Color Chart, Codes & Complete List of Color Names

- What Is Gran Turismo Wiki? , Gran Turismo (Computerspielreihe)

- What Is An Online Pdf Editor? : PDF Editor