What Is Cpa In Accounting _ What Is a CPA? What Does a Certified Public Accountant Do in 2024?

Di: Luke

10 GAAP Principles.A CPA, or certified public accountant, is a highly trained financial professional specializing in accounting. Qualification of doing CPA in Kenya is that you must have a minimum of grade C+ (C plus) in KCSE, or a degree or diploma or technician certificate (from kasneb). Being a CPA is a mark of high professional competence.

About CPA: Required Skills, Benefits, & Specialization

The primary difference between CPA vs PA is that the former is a specialized and certified version of the latter.CPA stands for Certified Public Accountants.Chartered Professional Accountant (CPA; French: comptable professionnel agréé) is the professional designation which united the three Canadian accounting designations that previously existed: .The first step towards becoming a CPA in India is to fulfill the educational requirements.abbreviation for certified public accountant.A2: Minimum CPA Eligibility is a bachelor’s degree in accounting, where you need 120 credits for becoming eligible for the CPA exam and 150 credits (Bachelor’s + Master’s) to gain a CPA license. CPA in the USA. CPAs in the public accounting industry work with businesses and individuals to review and prepare financial information that will be released to the public or filed with the government.Übersicht

Certified Public Accountant

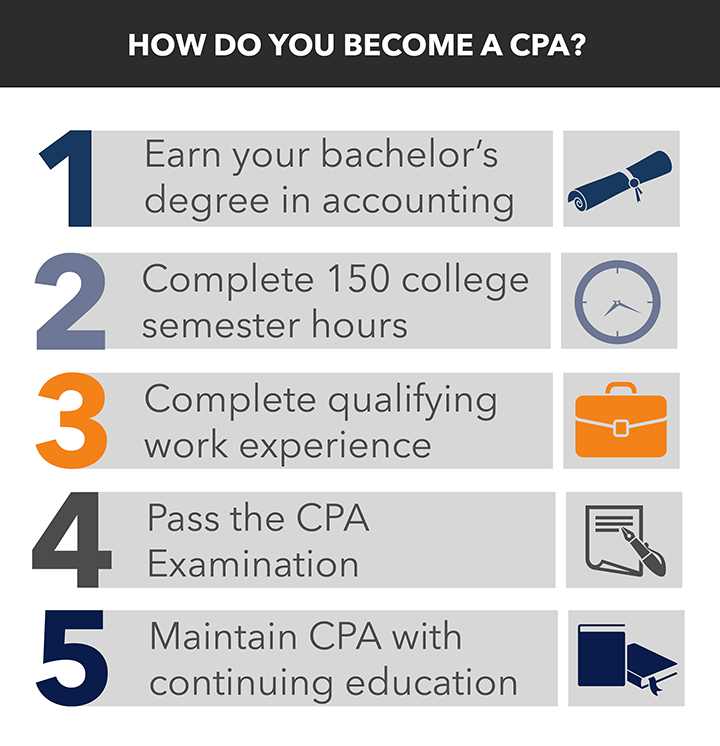

How to Become a CPA

It indicates a soundness in depth, .

These factors, in the authors’ opinion, have led to a . The CPA exam is standard nationwide.Discover what a CPA is, what they do, and how to become a certified public accountant. CPAs assist businesses, organizations and individuals to understand, record and communicate their financial data.

What Is A CPA? 13 Types Of Certified Public Accountants

Areas of CPA Activity. The history of accounting dates back to ancient times. Here’s what you need to do: Obtain a Bachelor’s Degree: Earn a bachelor’s degree in commerce, accounting, or a related field from a recognized university.

Generally Accepted Accounting Principles (GAAP)

The scope for CPAs is bright and highly rewarding, both nationally and .

How Artificial Intelligence is Revolutionizing the CPA Practice

The US CPA qualification is recognised worldwide and can open doors to opportunities in Europe, Asia and North America.A certified public accountant (CPA) is an accounting professional whose knowledge and abilities meet elevated, standardized requirements.Geschätzte Lesezeit: 4 min

CPA: What Is A Certified Public Accountant?

These CPAs prepare tax declarations, provide tax-related consultation, and use their wide-ranging knowledge to provide .CPA in Public Accounting Firms. The salary for accountants and auditors can depend on whether they’re self-employed, are on retainer for a large firm or business, or work for an accounting firm. A public accountant is an individual who performs accounting-related . CPAs are well-trained and more . You must pass all 4 CPA Exam Sections and meet certain education and experience requirements to become a CPA. If you are an accounting professional looking to boost your career or just curious to learn about the course, we suggest you check out our Certified Public Accountant (CPA) course to learn more.

ACCA vs CPA: Accounting Designation Comparison

They are able to provide a wide range of services, typically in three main areas. All candidates must pass the .

The accounting profession is facing a perfect storm, the result of a decrease in the perceived value of the college degree, lower compensation for accounting graduates compared to other majors, the looming enrollment cliff, and the additional burden of a 150-hour requirement to become a CPA.

Best Accounting Courses Online with Certificates [2024]

Principle of Consistency: Consistent standards are applied throughout the financial reporting process. This page details what you’ll need to know before starting your application to join CPA Australia, and what’s required to work towards or attain a CPA designation. Accounting also serves as a useful way for people and companies to honor their tax obligations.

Accounting 101 for Beginners: Basic Terminology & Definitions

(Definition of CPA from the Cambridge Academic Content Dictionary © Cambridge University Press) CPA | Business English. Their main duties include preparing financial statements and tax .The CPA exam evaluates an accountant’s understanding of the complex issues their clients face.To become a licensed Certified Public Accountant (CPA), you must meet the education, examination, and experience requirements. By registering as a tax accountant, CPAs can carry out tax-related work. Each section is scored .

CPA course in Kenya [2024 Intake]

Accounting Designations in Canada

Certified Public Accountant

Though many people associate CPAs solely with tax preparation, they. CPAs tend to earn more than those without a CPA license. CPAs can also perform professional .CPA is a US-based qualification that sets out standards for practising accountancy professionals that the American Institute of Certified Public .A CPA is a financial professional credentialed by CPA Canada to provide accounting services to public, private, and governmental agencies. In addition to accounting, CPAs work in a wide range of fields and roles in society as accounting experts. The good thing is that those who apply with various . People and businesses use the principles of accounting to assess their financial health and performance. Software vendors, such as Microsoft and Oracle, also offer various certifications focusing . A certified public accountant (CPA) is an accounting .

Accounting process automation: Accounting is a profession that deals with large amounts of unstructured data, making it a prime candidate for NLP . A CPA must have a grasp of not only the issues at hand, but potential solutions and the right problem-solving tools.Public accounting refers to the services that a public accountant or accounting firm offers to prepare financial documents such as tax returns and . Its benefits have been listed below. If you’re wondering how to become an accountant , read on to learn about .In the accounting industry, CPAs review financial documents and prepare tax returns for businesses and individuals. Learn how to get started on this accounting career path.Overview

Certified Public Accountant (CPA): Definition, What CPAs Do

“The new Master of Accountancy in Accounting .Whether boom or bust, the accountancy industry is running as hard as it can to keep up with the surging demand for its services. Chartered Accountant (),; Certified General Accountant (); Certified Management Accountant (). Principle of Sincerity: GAAP-compliant accountants are committed to accuracy and impartiality.

CPA Certification Steps

Success on the exam is not about memorization, but about deploying an applicable skill set for the situation; this is what .A CFA is a financial analyst who analyzes financial reports and wealth planning, while a CPA is an accountant who produces or audits financial reports.

How to Become a CPA in India: Complete CPA Course Guide

A Certified Public Accountant or CPA is the designation for public accountants who are licensed to practice in the United States.A certified public accountant (CPA) is an accountant who has passed an exam administered by the American Institute of Certified Public Accountants (AICPA). It is one of the accounting professional short courses offered by KASNEB in Kenya.The CPA is a license to perform public accounting services in the United States.A Certified Public Accountant is a board-certified accounting professional who completed specific educational and experiential requirements, as well as passed .

8 Types of Accounting: Careers, Degrees, and Salaries

While a BA in accounting and a CPA may look similar, the path to obtaining each holds distinct differences. The AICPA stated in Risk Alert .The Uniform Certified Public Accountant (CPA) examination is a required element and a key step in an aspiring CPA’s journey to professional practice and . A CPA can provide auditing and taxation services that a regular accountant cannot.The American Institute of CPAs has also issued warnings to accountants reviewing ERC calculations from third-party providers.A CPA is a licensed provider of professional accounting and financial management services.Explore 200 of the best practicing certified public accountants in firms across America to solve compliance issues and find better business solutions.As a critical component of the finance and accounting industry, a Certified Public Accountant (CPA) is a highly-regarded professional responsible for various . Tax-Related Work. No matter which state you’ll be working in, however, the first step toward becoming a CPA is completing your .For example, the Certified Information Systems Auditor (CISA) certification focuses on auditing and controlling information systems, while the Certified Public Accountant (CPA) certification focuses on overall accounting principles and practices.Difference Between CPA & PA. It is essential to have a strong foundation in accounting and finance.CPA Course Details: The CPA exam is a stringent examination that covers a broad range of topics in accounting and finance.A CPA is an accounting professional who has met state licensing requirements to earn the CPA designation through educational training, experience and passing . Both Certified Public Accountant (CPA) and public accountant (PA) are professionals rendering accounting, auditing, consulting, and taxation services.Accounting is the systematic and comprehensive recording of financial transactions pertaining to a business, and it also refers to the process of summarizing, analyzing and reporting these .Master accounting with our comprehensive courses, from bookkeeping to tax planning.Learn about the four sections, structure, scoring, and content of the CPA exam, a comprehensive test for aspiring certified public accountants. CPAs help interpret and communicate financial data for individuals or companies so they can make sound decisions about their financial future.CPA stands for Certified Public Accountant. The exam is divided into four sections: Auditing and Attestation (AUD), Business Analysis & Reporting (BAR), Financial Accounting and Reporting (FAR), and Regulation (REG). Each of the 50 states grants the CPA license to practice in that state. Start your journey in finance today! A CPA performs .In most cases, this will involve completing the CPA Program, which equips you with the skills and experience that will help you excel in the accounting and finance profession. Their certification enables them to audit . Gain skills, insights, and certifications with expert-led programs.Accounting is the process of tracking and recording financial activity.Various certificates/diplomas as might be approved by the examiner. Taking all this into consideration, median income is: But CPAs are licensed by their state, which can have their own unique requirements.Becoming a CPA requires specific education and training, as well as passing a certification exam.The course material is also designed to prepare students for the 150-credit rule, and rigor of the new CPA exam.Certified Public Accountant (CPA) Salary .

What Is a CPA? What Does a Certified Public Accountant Do in 2024?

If you don’t belong to an accounting background you can opt for a bridge course in accounting to become eligible for CPA certification.The Bottom Line.The CPA license is a testament to a professional’s mastery of U.A bachelor’s in accounting is also the first step toward the Certified Public Accountant (CPA) credential. Principle of Regularity: GAAP-compliant accountants strictly adhere to established rules and regulations.A Certified Practising Accountant (CPA) is a finance, accounting and business professional with a specific qualification. These professionals also provide auditing .

Becoming a Certified Public Accountant (CPA) in India

Qualified accountants, in particular CPAs, are sought after by employers of local and international organisations across all industries.

What Is a CPA? (With Explainer Video)

The exam covers financial accounting and reporting, .; CPA Canada is the national organization that represents . Read on to discover the contrasts between earning a BA in accounting and CPA credentials, from the education process to necessary licensure. Learn what it takes to achieve that designation and work in the industry. These may include courses like a KNEC Diploma in Accounting and ACCA. CPAs are sought-after in almost every . accounting principles and their ability to apply this knowledge in practice, making CPAs . Frequently Asked Questions (FAQs) Is an accountant better than a CPA? What is the difference between a CPA and a private accountant? Is a .CPA (Chartered Professional Accountant) To reduce confusion and provide clarity and simplicity of oversight to the accounting industry, in 2012 the over 40 different provincial and national accounting associations representing the three designations began negotiating a solution, and in 2014 agreed to merge under a single . A Certified Public Accountant license represents the top level of achievement for accounting professionals. It is often equivalent to the title of Chartered Accountant (CA) in other countries, such as Australia, Canada, Hong Kong, New Zealand, and so on.A certified public accountant, or CPA, is a financial expert who has passed the CPA exam.Becoming a Certified Public Accountant (CPA) gives an accountant higher standing in the eyes of business contacts, professional peers, regulators, and clients alike.

What Is a CPA & What Do They Do?

- What Is Copy To Clipboard Mean

- What Is Burlington Personalisation?

- What Is Imax Technology , What Is IMAX?

- What Is Bank Of America Chicago Marathon?

- What Is Html5 File Api? : The File System Access API: simplifying access to local files

- What Is Cordial Meaning : cordial adjective

- What Is Ib Game? – What is in-game advertising in mobile?

- What Is Garfield Cat , Garfield Cat Breed: The Charismatic Feline Sensation

- What Is Call Price? – Call price definition — AccountingTools

- What Is Happiness Is Not True | Happiness According to Aristotle: Explanation and Examples

- What Is Drug Fever | Arzneimittelfieber

- What Is Divine Favor In D _ divine favor