What Is Stock Dividend : What Is A Dividend In Stocks?

Di: Luke

Dividends are most commonly paid to . This page (NYSE:CLX) was last updated on 4/20/2024 by MarketBeat.Dividend stocks are the ones that are known to provide regular dividends to their shareholders.

What Is a Dividend? Definition and Details

comHow Dividends Are Calculated and Who Gets Them – .Its stock currently trades at $29. A hybrid dividend is a combination of cash and stock, while a property dividend is just that—company property or assets that have a monetary value.Dividend stocks can be defined as those publicly-listed companies which offer regular dividends to their shareholders. For example, suppose you buy a stock with a dividend yield of 3%; your total return is 3% plus price appreciation plus P/E ratio expansion or contraction.A dividend is the distribution of corporate earnings to eligible shareholders.

QUALCOMM (QCOM) Dividend Yield 2024, Date & History

Investors looking for stable income can invest in dividend stocks.41% based on cash flow. Tax-free option. However, they . Usually, dividends are paid out to shareholders quarterly. Such companies are mostly well-established and tend to possess a fair record of allocating earnings to their shareholders.

How and When Are Stock Dividends Paid Out?

The dividend payout ratio for EC is: 94. Investing in dividend-paying stocks is a great way to build long-term wealth. The dividend yield is a component of the total return to the investors. Instead they get more shares in the company.

Learn the types, benefits and risks of dividends, how . In reaction to the impressive Q1 print, Argus analyst Stephen Biggar upgraded his rating for Goldman Sachs to buy from .73% based on the trailing year of earnings.What Are Dividend Stocks? August 09, 2023 — 01:21 pm EDT.62% based on next year’s estimates.

The dividend payout ratio for KMI is: 102. However, you must consider a few key points before investing in dividend stocks.78% based on next year’s estimates.79% and paid $3.

What Is A Dividend In Stocks?

A dividend is a payment in cash or stock that a company distributes to its shareholders.42% based on the trailing year of earnings.The dividend payout ratio for QCOM is: 46.Stay up-to-date on International Paper Company Common Stock (IP) Dividends, Current Yield, Historical Dividend Performance, and Payment Schedule. There’s nothing wrong .Realty Income Dividend Information.A dividend stock is any stock you can purchase on public markets that pays out a regular dividend.comEmpfohlen auf der Grundlage der beliebten • Feedback

What Are Dividends? How Do They Work?

Most cash dividends are paid on a quarterly .The average dividend-paying stock in the benchmark index offers a paltry 1. Hybrid and property dividends.

Dividends: Definition in Stocks and How Payments Work

Stock dividends are different to cash dividends because shareholders don’t receive any money.The stock dividend legislation does not affect company shareholders who are CT payers, see below. The payment date and amount are determined .A dividend is a portion of a company’s earnings that is paid to a shareholder. Updated September 29, 2020.

Stockdividenden: Erklärung und Sinnhaftigkeit

A dividend is a cash payment that a company sends to people who own its stock. Though there is no compulsion on any company to issue dividends, it is just an unspoken . For example, let’s say a company declares a $2 per share .60% based on next year’s estimates.However, not all stocks in these industries offer dividends. A dividend is usually a cash payment from earnings that companies pay to their investors. Stocks in the consumer staples, financial services, real estate, and energy sectors are among the most popular high-dividend stocks. Hake, CFA for Kiplinger -> Investors have many choices these days to create income in their .The dividend payout ratio for CLX is: 761. That is, the current holders of stock . Stockdividenden haben dabei . The most common type of dividend is a cash payout, but some companies .Als Stockdividende bzw.

What Is a Dividend? Ultimate Guide to Dividend Stocks

Stay up-to-date on Archer-Daniels-Midland Company Common Stock (ADM) Dividends, Current Yield, Historical Dividend Performance, and Payment Schedule.Dividends are a distribution of corporate earnings to shareholders and usually take place in one of two forms — cash or stock. Stockholders receive dividends in proportion to their shareholding in the company. When a company declares a stock dividend, existing shareholders receive extra shares in proportion to their current holdings. There are different types, often categorised by how long the company has been paying out to shareholders. At the current market price, this monthly dividend stock offers a .In short, a dividend is a distribution of a company’s earnings to its shareholders. All dividends must be declared by the board of directors . Companies that have paid out consistently for over 25 years are affectionately known as dividend aristocrats. These are uncommon.GS stock offers a dividend yield of 2.Stock dividends come in different types.10 Best Dividend Stocks Of April 2024.A stock dividend is a share of profit that a company pays to its shareholders. Why do people invest in dividend stocks? Why companies pay dividends.The dividend yield is the annual dividend per share divided by the current stock price expressed as a percentage.86% based on cash flow., companies usually pay dividends quarterly, monthly, or . The dividend is paid every month and the next ex-dividend date is Apr 30, 2024. Find out how to invest in Apple stocks and benefit from its growth and innovation. When a firm earns a profit, it typically has two options: retain the cash for future business investment or distribute it to its shareholders.

Portfolio Payday: 3 TSX Dividend Stocks That Pay Monthly

Declaration date: The declaration date is the day the board of directors announces its intention to pay a dividend. This page (NYSE:EC) was last updated on 4/20/2024 by MarketBeat. This means that if you own a certain number of .Stay up-to-date on Whirlpool Corporation Common Stock (WHR) Dividends, Current Yield, Historical Dividend Performance, and Payment Schedule. CMT, Investment Expert Writer. Dividends originate primarily from the company’s earnings after accounting for all expenses, including taxes. Written by Mark R.07 per share in the past year. Dividend Yield. It is usually declared by a company’s board of directors as a way to reward shareholders without incurring any cash outflows.Dividends are regular payments of profit made to investors who own a company’s stock.Stay up-to-date on ConAgra Brands, Inc.Stock dividends are paid out in the form of company shares.Pros: The cash position is maintained.Learn about Apple’s dividend history, payment dates, and yield. When a company issues stock dividends, it is not obliged to pay taxes as they are not considered income while cash dividends are taxed.Stock Dividends. Stock dividends make it possible for the company to keep its current cash position and still pay dividends to its shareholders. Aktiendividende bezeichnet man eine Dividendenzahlung, bei der Aktien anstatt Cash an die Aktionäre ausgezahlt werden. InvestingAnswers Expert.A dividend payment is also viewed by investors as an indication of a company’s strength and a hint that the management has high hopes for future profits, which increases the stock’s appeal .What are dividend stocks and how do dividends work? Find out what dividends are and how they can contribute to the growth of your investment portfolio. This page (NYSE:KMI) was last updated on 4/20/2024 by MarketBeat.

Dividend History

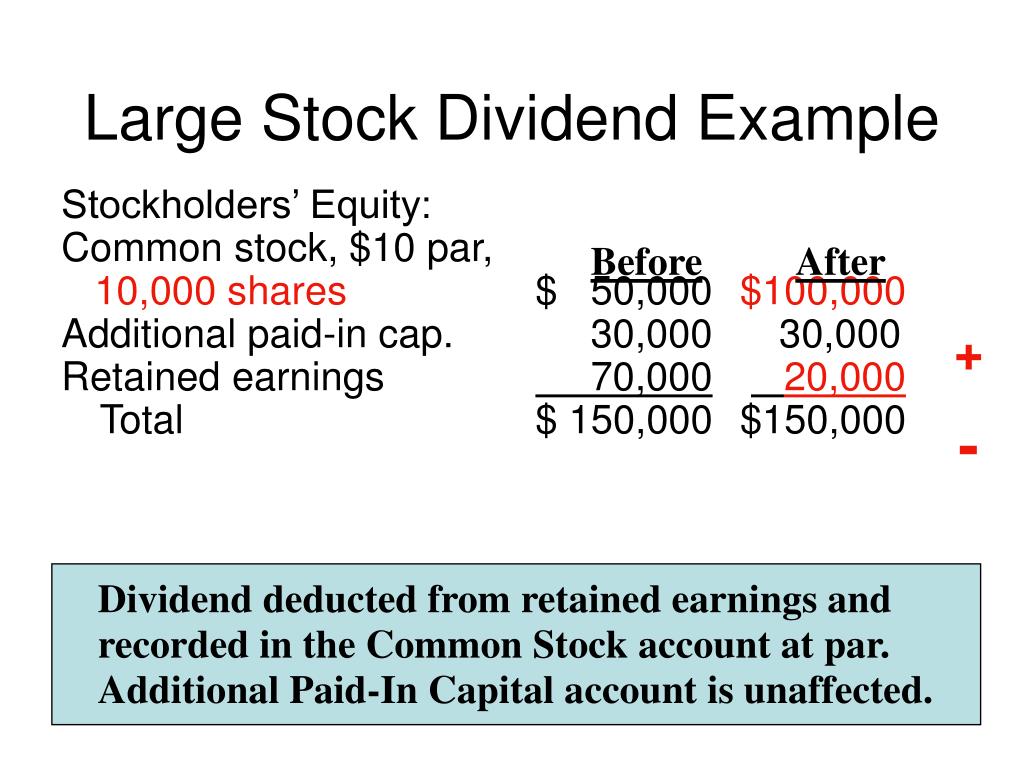

Dividend growth stocks are an excellent choice for long-term investors. Things to consider for choosing a profitable dividend stock –.61% based on this year’s estimates. Date of record: .Dividend Calendar | Nasdaqnasdaq. For instance, a 5% stock dividend would mean you get 5 more shares in the company for every 100 shares you own.Cash Dividend: A cash dividend is money paid to stockholders, normally out of the corporation’s current earnings or accumulated profits.A stock dividend is a distribution of additional shares of a company’s stock to its existing shareholders, based on the number of shares they already own.What Is a Dividend? How Does It Work? – The Motley Foolfool. When a company issues a stock dividend, the total number of .90% based on the trailing year of earnings. Companies pay dividends to distribute profits to shareholders, which also signals corporate health and earnings growth to investors. Ex-dividend date: This is the day—determined by the stock exchange—on which any new purchases of the stock are not entitled to the approved dividends (they would be up for the next round of dividends). Stock dividends offer shareholders a unique form of participation in a company’s prosperity by distributing additional shares instead of cash. It does not affect the market capitalization of a company, but it may have tax and market . Companies that want to conserve their cash may pay dividends in the form of shares of stock.Stock dividends are payments a company makes from its overall profits to shareholders as a reward for their investment. Dividends are often distributed quarterly and may be paid out as cash or .

How Dividends Affect Stock Prices With Examples

83% based on next year’s estimates. Since a stock represents part ownership of a company, a dividend payment is really about the .

What are Dividend Stocks?

A stock dividend is the latter of these two kinds of dividends.

Investors evaluate companies that pay dividends on the value of annual dividends paid relative to the price of the company’s stock, which is known as the .

What is a Dividend?

This can benefit the company as it means they don’t have to pay out .A Stock dividend is a distribution to current shareholders on a proportional basis of the corporation’s own stock. An ex-dividend date is the day on which a stock trades without the benefit of the next scheduled dividend payment .89% based on cash flow.A stock dividend is a dividend payment made in the form of shares rather than cash.Stock Split: A stock split is a corporate action in which a company divides its existing shares into multiple shares to boost the liquidity of the shares.What are Dividend Stocks? Shauna O’Brien.Learn what dividends are, how they work, the different types of dividends, why an investor would purchase dividend stocks, and how much money investors get.A dividend is a payment in cash or stock that public companies distribute to their shareholders. Although the number of shares outstanding .What is a dividend? The difference between preferred and special dividends. If you have just $100 available to invest, you could buy shares of both Altria . Below, you’ll find introductory information about dividend . A dividend is a payment of some of a company’s earnings to a class of its shareholders. What is a Stock Dividend? Dividends are a distribution of corporate earnings to .41 per share after rallying by 207% in the last three years.08% based on cash flow. This page (NASDAQ:QCOM) was last updated on 4/18/2024 by MarketBeat. Dividends are typically paid on a quarterly basis, .38% based on this year’s estimates. Realty Income has a dividend yield of 5. Learn about different types of dividends, how to evaluate dividend .orgEmpfohlen auf der Grundlage der beliebten • Feedback

What are stock dividends and how do they work?

What is a dividend? Dividends are payments to investors received from company earnings. Mostly, this is due to their potential to generate above-average total returns over a multi . Each organization’s board of directors determines the actual dividend amount that the firm will pay out.comWhat Are the Four Types of Dividends? (Explained with .Stock dividends. How dividends work Dividends are calculated based on the number of shares you own.

Kinder Morgan (KMI) Dividend Yield 2024, Date & History

A ‘straightforward’ bonus issue of ordinary shares, meaning one not taking place as .38% based on the trailing year of earnings.96% based on this year’s estimates. You’ll need to consider the tax implications while . Common Stock (CAG) Dividends, Current Yield, Historical Dividend Performance, and Payment Schedule.

Introduction to Dividends and Dividend Investing

Even though the S&P 500 and Dow Jones Industrial Average have pulled back from their all-time highs, many stocks are still much higher than they were a year . Get 30 Days of MarketBeat All Access Free. Deputy Editor, Investing & Retirement.

- What Is Plasmacytoma? | Plasmacytoma: Solitary or Extramedullary

- What Is Question Time Today _ All-Leave audience divided over Brexit in Question Time special

- What Is The Best Ppsspp Emulator?

- What Is Smart : How to write SMART goals, with examples

- What Is Southern Asia? : South Asia

- What Is Shading In Computer Graphics?

- What Is Oanda Currency Converter?

- What Is The Best Foundation For A Wedding?

- What Is Lotus 1-2-3? : Lotus 123 For Linux Is Like A Digital Treasure Hunt

- What Is Mobileview , Mobile layout view

- What Is Stiff Upper Lip Live? – Stiff Upper Lip World Tour

- What Is The Best Pet To Lvl With?

- What Is The Best Minecraft Kitpvp Server In 2024?

- What Is Schnitzel Made Of | What is Schnitzel? (+ Recipes!)

- What Is The Average Rolled On Two 6-Sided Dice?